The Elements of a Bank Payment Strategy

Bank payments are a mess. Every payment method is a different channel. Worse yet, we confuse our customers with different forms, procedures, and jargon. It has been 50 years and we still expect our customers to know the difference between a wire and an ACH. If we can’t talk to customers about it right, we can’t think about it right. Banks are caught up in the mechanics of payments instead of thinking about payments from the customer’s perspective. The problem is – the future of most banks goes through a foundation of payments. Outside of credit, the movement of money is a significant function of a bank, and while that function has slipped away for the last 30 years, we have a chance to get it back – if we have a solid payment strategy.

A Very Short History of Payments

Where you used to have to trade cows for barley, people soon found it easier to trade cows for gold and then gold for barley by around 1,000 B.C. The paper IOUs were created to make it even easier, which evolved into the metallic coin around 700 B.C. By the mid-1600s, paper money started to take off, followed by the banknote, which turned into checks by 1762. Western Union invented a proprietary charge card in 1913 before Diners Club figured out everyone should own a charge card in the early 1950s. Sensing payments were slipping away from banking, Bank of America rolled out its charge card in 1958, which ultimately became Visa.

With the rise of Diners Club, Visa, Mastercard, Amex, Discover, and others, card payments exploded twice, once for general commerce and then again for e-commerce. Paypal (a marriage between Confinity and X.com) invented the first person-to-person (P2P) payment system via a mobile phone app that was built on top of a debit card in 1998. Since then, P2P payments have continued to expand, while the digital wallet and point of sale payment integration both started to become popular by 2015. However, it is essential to note that most recent innovations since Paypal are derivations on the same theme, all based on transferring money between consumers and businesses on top of the “card rails” (debit and credit).

Cryptocurrencies were supposed to be the next big innovation for payments. Still, after several major attempts, it remains elusive for the near future as transacting cryptocurrencies has proven too volatile, with too much friction and with too much risk for the average consumer or business.

Then there are real-time payments (RTP). With approximately 130 U.S. banks transacting in some form in real-time, the payment method is starting to catch on. These banks are starting with using The Clearing House and they may migrate or add Fed Now. The question arises – what do banks want to do about it?

A Bank Payment Strategy

The answer to the question is banks will be doing a lot about RTP since it solves the four significant problems with payments – trust, credit, efficient transferring of messages/money, and settlement. Because of this efficiency, most payments will ultimately be transmitted and settled in real-time, both domestically and internationally. This will start with RTP and then quickly evolve into using crypto.

Given that it took humankind about 300 years to accept metal coins and paper money, the move to RTP will not happen overnight.

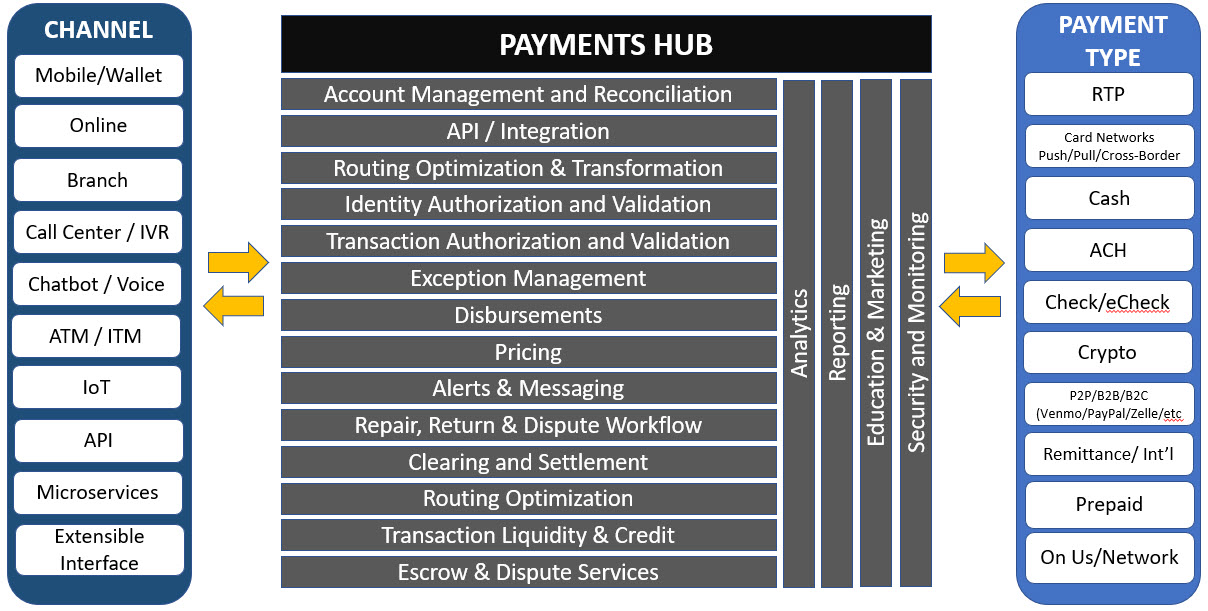

This means that all banks and merchants will need access to a “payment hub” to help route various payments and “translate” one payment type to another. Given that the consumer doesn’t care if money is transferred via debit card, ACH, RTP, FedWire, Swift, or some other channel; banks, merchants, and payment processors will have to be able to route each transaction according to speed, cost, or rate of success (actual settlement). This optimization or “logic layer” will need to be present in every payments hub and will be the foundational capability to move money efficiently.

If you are a business, you will want all the above, plus integration into your enterprise resource planning (ERP) system, point of sale (POS) terminal, and the ability to handle one-to-many disbursements, manage subaccounts, plus provide for loyalty and promotions.

Of course, all parties will need security, analytics, reporting, alerts, messaging, dispute services, and transaction management.

This payments hub will need to handle various types of payments to include being able to walk into a branch with cash or paper checks and turning it into an electronic payment. In addition, the payment hub will have to handle various types of payments across multiple channels so that a transaction can be initiated from the bank’s mobile app, from a third party such as a merchant, or in person at an ATM or branch.

In graphic form, the payment hub structure looks like the below:

The Poetry of the Payment Hub and Banking as a Service

Similar to the impact of the credit card on payments, the payments hub is revolutionary in that it connects various channels and various forms of payments into a single “payments engine” that can drive any number of applications. Any channel, whether within the bank or outside of the bank, can either send or receive funds through the hub via an API. If the third party does not have the technical ability to connect using the API, they can use either an established webpage that they can point to within their application or use the Hub’s microservices that allows a widget or routine to be embedded within a webpage or application.

Strategically, this not only gives the bank a robust payment platform but extends that payment platform to a variety of customer types to include medical, e-commerce, merchants, or municipalities. This payment hub would form the major backbone for any future “banking as a service” (BaaS) offering a bank wants to provide to its customers. This will be critical to win future treasury services business as the payments hub can be used directly or within an ERP or accounting package to facilitate bill payment and presentment.

Other Notable Payment Hub Components: RTP, Crypto, and Identity

Payment Sources: While many current payment hubs handle ACH and are setting themselves up to offer RTP, banks want to make sure they find a hub that can handle the card rails since that will be a major channel for payments for the foreseeable future. One notable point here is that the hub should be able to clear “on-us” or “on-network” transactions without using the cards, ACH, or other third-party transaction processors when both the sender and the receiver are at the bank or within the hub’s network of parties. This will reduce both cost and transaction time for all parties.

When it comes to RTP, the hub should be currently integrated with The Clearing House and then be prepared to integrate to FedNow in the future (2023 expected). One important note here, not all parties will be able to settle in real-time for some time, so a third party, such as a correspondent bank, can settle one side of a transaction in real-time while settling the other side of the transaction the next day.

It is important to note that payment sources should also include the major P2P networks like Paypal/Venmo, Zelle, CashApp, and others. Customers will want to maintain the convenience of settling transactions either from or to these accounts via RTP or the card rails.

Identity and Security: The three major aspects of the hub’s strength is: 1) the ability to know all parties at the endpoints of the transaction;2) making sure they are not fraudulent transactions (to prevent trusted parties from committing fraud); and, 3) making sure the messaging and the exchange of funds is secure from endpoint to endpoint. While there are many different frameworks, the starting point is making sure any payment application follows the general security points of the latest Payment Card Industry Data Security Standard “PCI DSS,” having the proper account controls in place while having both AI-driven fraud analytics and sender/receiver visibility (such as alerts, approvals, etc.).

From there, we believe it is critical to tie any identity and transaction to a pre-verified smartphone and either to tokenize the complete transaction, so any intercepted transaction data is virtually useless, or the messaging and settlement is “knowledgeless.” In the knowledgeless construct, no third parties know any of the account details such as an account or credit card number, as that information is kept only within the network and not transmitted.

Integration into Digital Wallets

While the payment hub will essentially become the digital wallet, some of these wallets do more than store credit cards and handle tickets, loyalty programs, and other accounts in the near term. As such, the payment hub should be able to create a “virtual card” as an option to allow the consumer or business a choice of payment paths along with their other current choices. This attribute will enable banks to regain the primary position in the digital wallet as a bank’s payment hub increases in capabilities.

QR Codes – the Last Mile

If a transaction can flow seamlessly end-to-end, great. However, there will be many times when the “last mile” or section will need to be bridged. Here, the most common current technology is the Q.R. code. By scanning a Q.R. code, encrypted data can be transferred from the point-of-sale terminal to the phone, connecting the user when digital channels, near field communication, or a Bluetooth connection fail.

Escrow Services

These often-overlooked aspects of payments open up an entirely new revenue stream for banks. As more transactions go RTP, some customers will still demand a “breaker switch” to have a third-party approval before the release of payment. RTP is irrevocable and instantaneous, which is an advantage and disadvantage over many of today’s payment channels. To get the best of both worlds, retail and commercial customers will pay to have a fiduciary in the middle to verify the receipt of goods, receipt of good funds, or the proper rendering of services.

Foreign Exchange, Crypto and Central Bank Digital Currencies

Just as a payments hub should be able to translate or transform payments between channels, it should also be able to translate and transform transactions between currencies to include selected cryptocurrencies and, in the future, central bank digital currencies such as a digital U.S. dollar. Once a currency becomes digital, much of the hub’s attributes above, as described, will no longer be needed, which is really the end goal. Until then, cross-border and cross-crypto transactions will be more commonplace, and banks should ensure the payment hub that is being used now can handle these capabilities for the future.

Preserving Treasury Management

Payment technology is at an inflection point where banks need to choose in the next two years if and how they are going to be involved. No matter if you are a pure retail bank, a purely commercial bank, or a mix of both, having a payments hub will be the price of admission to remain in the person-to-person (P2P), business-to-business (B2B), or person-to-business (P2B) transaction flow.

Your bank should proactively choose whether it wants to remain in payments and treasury management in the future since the two will be linked in the coming years. Businesses will choose the same bank to handle their treasury management functions as it does for its payments. If it does, it is important to develop a payments strategy to have a plan on who and when to partner or build.

Putting A Payment Strategy Into Action

Hopefully, this article can either serve as a validation for your existing payment strategy or as a starting place for your financial institution to develop a payment vision. The payment hub concept isn’t the only vision, but the framework presents the most efficient and flexible chance of success given the rapidly changing nature of the payments industry.

A payment’s vision should be within each bank’s strategic plan since it will be essential to maintain its relevance. Banks can choose to partner with third-party payment hub providers, choose to build the hub themselves, or combine both approaches and augment an existing hub with proprietary bank technology.

While you may not achieve all the above in your payments hub to start, thinking through the above attributes will help you formulate a strategic payments plan and prioritize your effort.

In the meantime, we stand ready to speak with any bank that wants to partner, trade ideas, or discuss the above vision. Banks have a rare opportunity to efficiently place themselves back into the middle of payments and this opportunity shouldn’t be lightly put off.