The Formula For Brand Affinity Marketing To Make Your Bank Go Viral

Back in 2015, Brazil led the world in fan football-related injuries. Passions ran so high that there would be 25 deaths and about 300 serious injuries from fan-on-fan violence in a typical year. More private security was brought in and fights increased. A more significant police presence was tried, and altercations increased more. It was a badge of honor to be arrested for defending your club. Then, in a twist of innovative thinking, Ogilvy, the famous ad firm, was brought in. The public laughed. What ensued was an out-of-the-box brand affinity marketing tactic that banks can use to promote their brand today.

Creating a Brand Affinity Marketing Solution

After talking to fans and brainstorming, Ogilvy Brazil, smartly asked the question – who can we align ourselves with that would have a vested interest in helping us meet our objective – reducing fighting? The answer they came up with – Your Mom. A program was devised that invited the moms of football fans to come and be trained in exchange for free tickets. During games, the moms walked around giving that “mom look” and saying, “mom things.” Violence dropped to near-zero.

The biggest thing the tactic did was to shift the vibe. Even the hardest core football hooligan was softened by the elder female presence. Instead of going to a game to fight, fans started to go there to love and respect the Brazilian family. Even if it wasn’t your mom working security, you didn’t want to disrespect the maternal position. Some fans didn’t want to risk a mom getting hurt, while many others wouldn’t fight because their mom was literally watching them.

What started as a joke turned into a movement, and suddenly it was cool to share a game with your mom. The power of moms ended up trumping the need to fight.

The bank marketing lesson – figure out the persona of your customer base, who can influence them, and how to activate them.

This is why influencers work in social media. However, your bank doesn’t need an influencer, just someone that has credence.

Who Can You Align Yourself With?

Parties vested in your bank’s success abound in your community. This is the easy part for banks and is already a well-worn tactic. Chamber of Commences, small business groups, financial literacy movements, municipalities, non-profits, or complementary businesses such as wealth management, lawyers, accountants, or insurance agents.

Banks need to take these relationships to the next level and invest in them more. While this is often a true affinity compensation structure that pays the partner for referrals, that tactic will usually not generate the passion needed to reach influencer escape velocity.

It is far better to make a marketing investment in a shared cause that can raise the bank’s profile while promoting a cause that stirs passion and support. Citizens Bank of Edmonds does this ridiculously well with their Heard on Hurd support and leadership. The bank sponsors a street festival that gets a variety of influencers, community leaders, and aligned businesses supporting the effort.

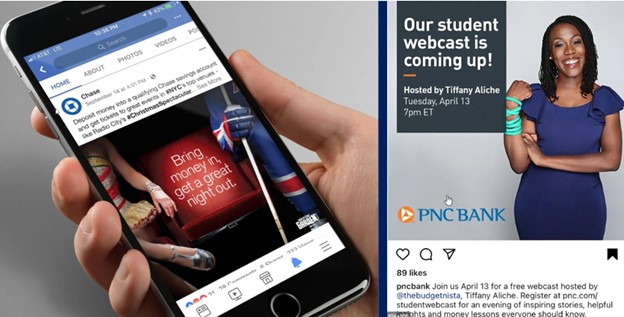

JPM Chase does it in conjunction with Madison Square Garden, Union Bank & Trust partnered with Emanate Consulting for church loans, PNC does it with various Instagram celebrities, and many banks partner with community groups, non-profits, and local leaders.

The goal is to find the peanut butter to your jelly. Who has the most to benefit from your bank’s success? Who can provide your bank reach and credence to achieve your goals?

This tactic works because, according to Nielsen, their data shows that your bank customers will trust the people they know or the organizations they support 92% of the time – the next closest trust transference mechanisms are online reviews with a 70% trust factor.

Who had the most to gain when ESPN wanted to roll out their new Fantasy Football League in 2015? Yes, the NFL. ESPN commercialized fantasy football and helped create an $11B industry out of nothing, while the NFL increased viewership by 30%.

Opportunities Abound But, How Can The Movement Go Viral?

After ten years of testing bank marketing, there is now a pretty good formula for brand affinity marketing that is driven by the data. It comes down to picking the suitable theme, the right partner, and promoting the appropriate product.

Bank affinity marketing is about aligning your bank with other partners and influencers within a community. A bank will not always be able to make its affinity action go viral, but it can exploit the market conditions to increase the probability.

For starters, it means picking a partner that meets the following conditions:

- The more impartial, the better – A bank and a governmental entity teaming up is usually more potent than a bank and a trade association.

- Expertise – An organization with proven expertise can give your bank credibility.

- Proximity – The more robust the ties are to your customer, the more successful the partnership will likely be. This is why partnerships with university alumni associations usually result in above-average success.

- Status – The higher the position in your target’s social hierarchy, the better.

Next, pick a theme to invest in. This means looking for partners and situations that have statistically proven to attract attention and support. From years of testing, here are the top five themes (in order of profitability) that can attract attention that banks should consider building a partnership or creating a campaign around to attract engagement:

- Real-life Value Help: Any time you can show how your bank can save time or money in a real-life situation that has the highest probability of attracting customers. One bank partnered with a multifamily association to help renters apply for loans and to provide guarantees faster. The product was a huge hit.

- Humor: A bank that partners around a good humorous situation usually attracts engagement and attention. While it is hard to get this right, a clever campaign with a partner has the most significant chance of going viral.

- Health-related: Health issues scare customers, so any time your bank can create a partnership that provides safety, security, and peace of mind, that is a win. Saving for long-term care, potential medical expense reserves, or help around the Pandemic all have proven successful. This is especially true when trying to catch the attention of those 50 years old and above.

- High-energy Aspirational Experiences: A partnership that promotes a high-energy aspirational experience such as a festival, sporting event, adventurous vacation, concert, or unique occasion is sure to grab attention. This is especially true if you are trying to attract the attention of those 34 and younger.

- Family/Pets/Kids: When in doubt, promoting family, parent, or pet-orientated themes is usually a surefire engagement idea for bank affinity marketing partnerships.

FOMO – The Perceived Ubiquity of Brand Affinity Marketing

The final piece to the viral brand affinity marketing tactic is the creation of demand. Demand begets demand.

For a bank marketing idea to take off, it not only has to be the right product with the right partnership, in the right environment with the right theme, but it also has the PERCEPTION that everyone is talking about it. That is, there must be an apparent ubiquity of the idea.

Banks don’t need global virality to succeed; they need a small percentage of their prospect base. Banks have to appear to go viral, and that is enough to make a product take off.

Indeed, you can never tell what will take off, but you can be prepared. When brands want to make their ideas go viral, they introduce new content and stand at the ready to provide a catalyst to popularity. What looks like organic virility is not.

Go Pro and Red Bull, for example, teamed up to execute on theme number four above in 2014. After a series of extreme events, they staged the “Stratos” jump, where Felix Baumgartner set multiple world records jumping from the edge of space 24 miles down to earth.

The event was set up with plenty of social media, earned media, organic content, and paid digital advertising. Paid celebrities and influencers were there to stoke the conversational fires as the topic started to trend. During the four-minute freefall, the team broadcasted Felix’s vital signs, supported the event with a pre-planned tweet storm, and the content spread.

That stunt cost more than $30mm, of which several million was used just for social media amplification. The brands created the perception that the event was everywhere. While the stunt was good, the marketing was even better. Instead of a niche following that day, the brands went global. Viewership increased 44x, interactions were close to a million, and sales for both companies jumped 7% to generate more than $1B each of new revenue.

Putting Brand Affinity Marketing Into Action

UNICEF/Target, BMW/Louis Vuitton, Pottery Barn/Sherwin-Williams, Uber/Spotify, Nike/Apple, and Buzzfeed/Best Friends Animal Society are all other examples of successful partnerships that followed the above path. While your bank may not have the partnership clout like a Go Pro, Nike, or Apple, it can take a lesson from their playbook and execute a mini version.

All these brands started with zero fans and became famous because of their products and marketing. They have billion-dollar budgets because of their creativity, not the other way around. Banks must get creative first. None of this is about your bank’s budget or social media reach; it is about finding ways to adapt the prescribed product or behavior.

To start down this path, the first step is to believe that you can increase the likelihood of your product or campaign taking off. If you change your perspective of how you see the world so that you know you can achieve viral success, you will start seeing opportunities to create viral success.