The Future For Banks on Returning To Work

After more than 12 months working from home during the pandemic, many banks have yet to formulate a consistent plan on returning to work. While some banks are returning to their pre-Covid-19 state, others take the view that the future of work isn’t so important as the future of living. By taking advantage of this once-in-a-lifetime opportunity, banks can architect a dramatic change that benefits all parties, but most importantly, their employees. After talking to more than 100 banks and conducting/reviewing various surveys, we present our topmost important findings, lessons learned, and thoughts on what the future of office work looks like for banks.

The Objective

If we are not to squander the recent remote work trend, then on the surface, a clear win for banks in a post-pandemic world would look like the following (in order of priority):

- Increase the quality of talent

- Increase employee satisfaction and engagement

- Enhance employee training

- Decrease lease/ownership expense

- Reduce travel expense

To meet the above objectives, banks must proactively figure out if they are going to be a majority “office-first culture,” a majority remote-first culture, or somewhere in between, such as deciding based on job function or team desires. Banks shouldn’t underestimate the weight of this decision as there is likely no other decision that you currently face that will have such a large impact on culture. If culture is important to your bank, and almost every bank says it is, then it pays to get this one decision right above all else.

For the sake of this article, we will take it as a stipulation that remote work has been successful this past year. Support for this position comes from a January 2021 PwC survey of workers, largely composed of financial services firms, where PwC found that 83% of employers deemed remote work successful, as did 71% of employees, with 11% and 23% reporting “mixed results,” respectively.

The Challenge

The challenge revolves around the famous H.R. Haldeman quote that said, “Once the toothpaste is out of the tube, it is awfully hard to get it back in.” Now that bank employees have successfully experienced working from home, it’s hard to get them back into the office.

A recent community bank CEO gave an interview where he was quoted as saying, “I think our employees want to return to the office – to get back to normal.” A subsequent survey of this bank’s employees revealed that 86% of his employees, in fact, want to primarily continue working from home.

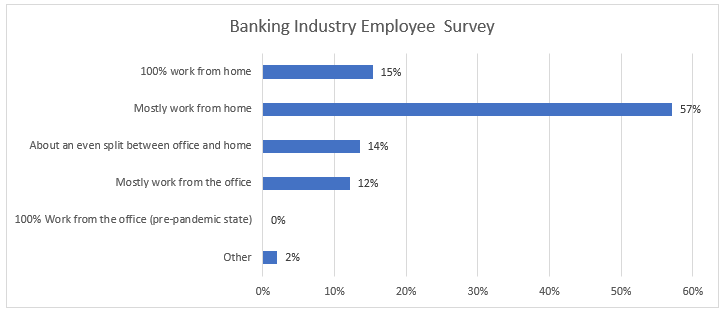

These findings concur with a recent survey we did of bank employees:

The Strategic Implications of Permanent Remote Working

One material consideration is the strategic implications of moving to a majority of work from home culture. Banks that have more flexible work from home policies will be able to attract a wider and less expensive range of talent. They will also be able to do this at a lower cost. The more a bank requires its workers to be in the office, the smaller the geographical area it can draw from. Workers that have to be at work every day will likely come from an area within 15 to 50 miles of the office. If you only have to be in the office one week a month, then that range is likely to expand to 90 miles.

However, for banks that only require occasional team meetings, then workers can be drawn from across the U.S. and perhaps the world. That bank that can source better talent will have a greater competitive advantage against a bank that sources from a 50-mile radius. As specialty skills increase in demand for functions such as technology, cybersecurity, fraud prevention, payments, A.I., and similar, sourcing the best talent will become ever more important.

Have a lower cost structure is also a major competitive advantage. Banks pay an average of $20,000 per worker per year to house and physically support that worker. This compares to an average cost of just under $3,500 per worker per year to support remote workers.

The result of these two factors presents a major competitive advantage, even vying for workers in the same geographical area. Given a choice between two employers, employees have stated a preference to those that give them the most incredible work-from-home flexibility.

The Future Changes of Work

The essential question is this – What is the purpose of an office?

The PwC survey asked this question, and the answers were revealing (below).

The results beg the question – how can we better support the stated objectives of each party in the office and with remote work?

Keeping our strategic conclusion in mind and given the above, we collected some of the answers below of what the future foretells:

Office Space Structure

Square footage: For banking, the average bank executive thinking about remote work sees a 30% reduction in office square footage. No banker we spoke with agreed to get rid of their office space entirely in the next five years.

Layout: Less permanent desk space, more temporary desk space, more collaboration areas, and larger areas/conference rooms for full-team meetings.

Remote Offsite Meetings: Look for more remote offsite meetings. Instead of bringing everyone to an office, more meetings for remote workers will take place locations that can be leveraged to promote employee wellness (e.g., resorts), to build a culture (e.g., amusement parks, team building events, glamping, etc.), or before industry events (e.g., conferences, training, etc.)

Shared Office Space: Some bankers are considering establishing WeWork-type shared or co-working office space for their employees in areas where they live. These satellite offices will function as a hybrid space, either giving work-from-home bankers a place to go for a change or as a hybrid model to create a permanent workplace in cases where a previous office or branch space is given up. The difference here is that instead of a costly central office, multiple “micro-office” can be established for a fraction of the cost. The added benefit is that it gets bankers interacting with their hyper-local communities daily.

Work-From-Home Structure

Rural Banks: As more workers across corporate America choose to work from home, smaller, rural communities will see a resurgence reversing a multi-decade trend. Customer attrition in rural community banks will slow.

Injury Prevention: Look for banks to invest more in their remote workers and to help with injury prevention. Budgets for items like standing desks, ergonomic chairs, exercise equipment, and multiple monitors will increase in order to better support the home office.

Experimentation: Some of the more forward-thinking banks talked with us about making the back half of 2021 an experiment where different work-from-office formats would be tried with employees given a vote. Recent surveys revealed the following preferences to start:

What is Lost Working From Home: Many bankers acknowledged that they are not concerned over the quality of work produced at home but the intangible items that are difficult to measure. The quality of communication, the loss of mentorship and training quality, the serendipitous brainstorming of ideas, internal networking, and leadership development. These remain problems to solve and make an attempt at measuring in the future.

Culture: One of the biggest risks of working from home is the loss of company culture. Bank managers are now rethinking how to strengthen bank culture remotely. More check-ins, more in-person team building, and more communication are the three baseline initiatives that many banks are taking around this point. Team cohesion and company culture aren’t impossible remotely – but it’s different.

Productivity

The majority of bankers agreed that in almost every area, productivity improved over the course of the pandemic. While the start was rocky getting employees equipped to work from home and difficult for the staff to adapt to their new work area and workday, the majority of bankers we spoke with said things quickly got better and improved over time. More than 60% of both bankers and bank managers said they were equally or more productive at home. PwC’s findings support this (below):

Productivity Coaching: As banks restructure the workplace, there is now a need to create a new channel to promote productivity best practices. Before you can walk by Sally’s desk and see that she has a monitor in portrait mode (instead of the traditional landscape) to allow her to view loan documents more efficiently, with remote work, you lose out on some of this cross-pollination of good ideas. This deficit will give further rise to the productivity coach that will be able to teach a variety of “time hacks” from how to layout your office, using advanced features in Microsoft Office, and using various forms of technology such as bots and automation to reduce the more menial tasks.

Skill and Function Allocation: One huge plus that has come about during this past year is the more efficient allocation of skills and resources. Before, customers might have to wait to be contacted by a wealth manager or mortgage banker assigned to their geographic area. With more remote tools like video conferencing, many banks have or will turn the model on its head to permit better load balancing of human capital.

Meetings: The ease of which to conduct video conferencing has increased the attendance and invites to meetings. Banks are taking another look at how effective these meetings are and guidelines of when you can eliminate and reduce meetings. One bank, for example, allowed meetings on Monday only by exception, using the logic that Mondays are potentially the most productive time, having thought about the organization of the upcoming workload over the weekend. Another bank has made the 30-minute meeting the default for all meetings, and managers had to justify why a 60 or 90-minute meeting was required. The result was more than 55% off one-hour meetings were able to fit into 30 minutes. This $1B-sized community bank saved over 2,100 hours in meeting time this past year with an increase in productivity.

Organizational Structure

Incentives: More cities are offering tax credits and incentives to move both for the company and now for individuals. Savannah, GA, for example, offered tech workers up to $2,000 to cover moving expenses to relocate. The George Kaiser Family Foundation pays $10,000 to relocate to Tulsa. Banks are taking these incentive programs into account.

Less Bureaucracy: This past year has highlighted the advantages of a flatter organization. Without an office structure and leveraging technology, bank leaders can manage more employees. Teams, Slack, video conferencing, mobile polling, and more human resources tech, in general, has allowed managers to engage with employees at a far greater rate than the traditional work-from-office structure. What used to be a 1:8 targeted ratio, the new leader-to-report ratio is now thought to be closer to 1:15. While this ratio will depend on function, look for banks to take another look at bottlenecks caused by an additional middle management layer.

Product Channels and Customer Segments: Look for banks to restructure how they deploy product and customer segment resources more efficiently. Many banks have had their organizations structured around geography with “East” and “West” regions. In the future, look for banks to move away from geographical regions and organize more around customer segments or functional specialties. More banks will be able to start up smaller customer specialties such as ESOP lending, education banking, and wealth.

Flex Time & Gig Workers: The organizational restructuring of banks will lead to greater use of part-time bankers. Some of these will be on set schedules, and some will be on-demand workers. For banks, the flexible workforce will be better match projects with human capital. Part-time workers in product design, project management, A.I., robotics, coaching, business process automation, data management, profitability, branch management, and similar are expected to be in high demand. For workers, part-time work can provide a better work-life balance, particularly appealing to quasi-retirees and stay-at-home parents.

Head of Remote Work: Many banks have or are considering naming a “head of remote work” to help represent and coordinate remote work efforts.

Policy and Human Resources

Performance Metrics: Time at work will start to be replaced as the primary key performance indicator for bankers, and more emphasis is placed on productivity and output.

Policy Rewrite: Many banks are in the process of rewriting their H.R. policies to reflect a more flexible workforce. Who is eligible for remote work, what minimum technological requirements must be present to enable productive remote work, what accommodations will be made for disabled workers, approval of remote work environments to achieve a minimum level of safety, communication/monitoring requirements, and how to deal with injuries at home while at work are just some of the many gaps in existing policies.

Applicable Laws: Speaking of policies, most banks have left the required physical location of the employee unsaid in current policies and procedures. If your employee only has to show up for some meetings, is it acceptable to work out of state? Out of the country? If they are not within the bank’s traditional jurisdiction, what does that mean for overtime laws, worker compensation laws, health laws, and local ordinances?

Compensation: Some banks have run into the issue of if they originally hired the banker at big city compensation and then they move to a rural area, should they still be eligible for that higher salary level? Do compensation ranges need to be adjusted to take into account the hiring in expanded areas?

Benefits: With increased cost savings, banks will come to realize that they are not spending enough on each employee to ensure that they are in a productive work environment. The purchasing of chairs, desks, lighting, broadband upgrades will become more common.

Time off: The lack of boundaries and the absence of commute bookends have increased burnout and anxiety levels for a portion of every bank’s workforce. Employee wellness will continue to be at the forefront of H.R. procedures. Many banks are talking about implementing wellness days where teams get an extra day off once per quarter. Forced vacations were the next most popular tactic, followed by wellness days that take the form of offsite team meetings where a couple of half days or “fun days” are built in to provide downtime and team building. Examples include cooking classes, bike rides, and similar.

Time off: On the flip side, as employees have more flexibility, the past year has shown us less time off may be required. Banks may consider adjustments in the definition of “sick days” or the number of hours that constitute a full working day.

Diversity: Reducing geographical restrictions will give a boost to banks looking to be more diverse and inclusive. The greater diversity should result in a wider range of ideas to solve problems and more attentive customer service as employees with different backgrounds, skill levels, experiences, and language capabilities can be better allocated for customer problem resolution.

Workday: As productivity replaces time-at-work, look for banks to help workers reorganize their day to maximize productivity. The traditional “workday” will get redefined. Greater remote work freedom may mean the conventional workday gets restructured to allow for mid-day errands, afternoon workouts, or morning time with kids in exchange for working more evenings and weekends.

Hobbies & Physical Activity: Part of many bank wellness programs include more support of hobbies, sports activities, and community events. These range from an additional annual stipend to support gym memberships, trainer expense, sports leagues, etc., to pre-established infrastructure such as company-supported sports leagues or corporate gym memberships.

Promotions: With more focus on effectiveness and lee reliance on physical presence, look for hiring and promotions to be more democratized with more focus on work quality and less on “face time” with the boss.

Education: Remote work can allow banks to have the flexibility to send workers to a wider array of educational locations. For example, banks can send workers for longer-term programs such as going back to finish their degree at night or achieve their MBA at a higher quality school away from headquarters.

Training: A restructured workforce will require a host of new training. Remote selling, for example, is now mandatory and dramatically different enough than in-person selling to warrant specialty training. More coaching of employees for wellness, productivity, workload management, and technology are all now mandatory. Since remote work prioritizes written communication over verbal, banks recognize that increased training is needed in written communication. In addition, management likely needs training and support to better lead teams in a remote environment.

Sustainability Initiative

ESG: Some of the larger banks are hoping to increase their environmental, social, and governance standing by playing up the remote office investment while touting the reduced pollution and carbon emissions from reduced commute times.

Required Technology

The hybrid office has given rise to a host of additional technology that banks are now contemplating providing their workers. Video conferencing, of course, but there are a host of other areas that banks have had success with to include some of the below.

Voice Transcription: Since bankers can speak more than five times faster than they can type and we can read twice as fast as we can listen, getting workers more tools around talk-to-type, automated meeting notes

Writing: Tools that enable collaboration such as Box, Google Docs, and similar will expand, as will tools that assist with writing such as Copy.ai, Grammarly, and similar.

No Code: The rise of “no-code” programming will take off. Banks should be actively looking for these types of applications that enable line workers to prototype and develop products to support both employees and customers.

RPA: Robotic process automation will see an even greater increase in investment as knowledge of how these bots work and even how to build them will be a required banking skill in order to enhance productivity both in the office and when working from home.

Productivity: There are a host of tools that banks will consider implementing enterprise-wide outside of Zoom/WebEx & Office 365 – Slack, Notion.so, Zapier, Firstbase, Salesforce, Basecamp, Krisp, Otter.ai, Teamwork, Kickidler, and Wooboard are just some of the more popular remote work tools that have become popular.

Putting This Into Action

The allowance of remote work will become a bank’s competitive advantage. Not only will they be able to attract better talent with greater worker efficiency, but the ability to enable remote work and productivity will be a differentiator among banks. Quality employees will gravitate to banks that not only allow remote work but have built quality infrastructure to support it. Great banks will be those that can consistently deliver on the promise of employee development while working remotely.

Banks that take the lessons from the past year and restructure their organization to attract higher quality talent at a lower per employee cost will find their efficiency ratio will drop and their revenue per employee increase. Further, a bank that has more remote workers will find a greater percentage of their expenses are variable as they jettison the fixed cost of real estate and companion infrastructure.

On top of all that, look for shareholders to pay greater attention to a bank’s remote work percentage. Over time, banks that can successfully execute to a higher percentage of their workers remote-first will find that they will attract cheaper capital and will have more options for M&A.

Banks are at an inflection point as they call their workers back into the office. Innovative banks will take the next month to brainstorm how to take advantage of these lessons that have been learned over the past year. Every bank, in our opinion, should at least consider the possibility of what a more remote-first workforce might look like. We are just coming off one of the most paradigm-shifting experiments corporate America has ever seen. It would be a shame to squander this knowledge.