The Next Step For Banks In Moving To SOFR

In the next twelve months, the transition from LIBOR to alternative Risk-free Rates (SOFR in the US) will take an important course. Banks with products tied to LIBOR need to understand the implications of ISDA Fallback Protocol and how to manage possible risks with this critical industry transition. Shortly, ISDA (International Swaps and Derivatives Association) will be publishing LIBOR Fallback Protocol. Firms that sign up for the LIBOR Fallback Protocol agree to the spread adjustment and the fallback rates if LIBOR becomes unavailable in the future. Some community banks have loans and deposits tied to LIBOR, and many community banks have used LIBOR hedges to help borrowers manage interest rate risk. These community banks need to understand the implications of the ISDA Fallback Protocol on the economics, documentation, and cash flow processing for these LIBOR-based products.

LIBOR Fallback Protocol

Firms that designate their desire to adhere to the ISDA Libor Protocol agree to various LIBOR transition steps as follows:

- LIBOR will be substituted with SOFR.

- SOFR will be adjusted to make it economically equivalent to LIBOR. ISDA will take the median difference between SOFR and the specific term LIBOR over a five year period from the trigger event (defined below).

- The spread adjustment will take into account both compounding differences (SOFR is a daily rate, while LIBOR represents different tenors), and the credit adjustment (SOFR is a risk-free rate, and LIBOR includes a credit component).

- The trigger to substitute SOFR for LIBOR will be one of two forms; first, pre-cessation trigger will occur if LIBOR is deemed unrepresentative by regulators, despite it being published, and, second, permanent cessation trigger will occur if LIBOR ceases to exist.

- Firms that agree to the ISDA Fallback Protocol will have the protocol apply to non-ISDA documents.

- Entities that agree to ISDA Fallback Protocol agree to the adjustments, triggers and definitions published by ISDA firm-wide, and will not need to negotiate these terms bilaterally. The intention is to save time and resources in renegotiating existing contracts and avoid disputes and possible litigation.

It is anticipated that nearly all dealers and swap providers will adhere to ISDA Fallback Protocol, but most end-users of LIBOR products will not. It is expected that community banks that have common commercial fallback language in their cash products (loans and deposits) and hedges will accept the ISDA definition of triggers, and the published adjustments for LIBOR. The benefit of accepting ISDA Protocol Fallback definitions and adjustments is to align the economics of LIBOR trades to avoid economic redistribution between counterparties.

For example, let us examine a sample existing LIBOR-based loan, priced at 1-month LIBOR plus 2.50%, which was fixed with a swap to provide the borrower a 3.00% rate. In this example, the lender is earning 1-month LIBOR (currently 0.18%) plus 2.50% (2.68% adjustable yield), the borrower is paying 3.00% fixed, and the hedge provider is receiving 0.50% and paying LIBOR. It is anticipated that almost all hedge providers will choose to accept ISDA Fallback Protocol, and such adherence will cover all LIBOR based hedges at that firm (even if the LIBOR contract is not an ISDA agreement). If all three parties accept the economics of the ISDA Fallback Protocol, upon a trigger event, the above example loan will change as follows: the lender will earn SOFR (currently 0.12%) plus the 1-month LIBOR adjustment anticipated to be approximately 15 basis points (the 5-year median difference between the two indices) plus 2.50% credit spread (2.77% adjustable yield to the lender), the borrower will still pay 3.00% fixed, and the hedge provider is receiving 0.50% and paying SOFR plus 0.15%. The hedge providers upstream counterparty (central exchange) will convert its mirrored swap from 1-month LIBOR vs. 0.50% fixed to SOFR plus 0.15% vs. 0.50% fixed. By adhering to the ISDA Fallback Protocol, all three parties are economically neutral.

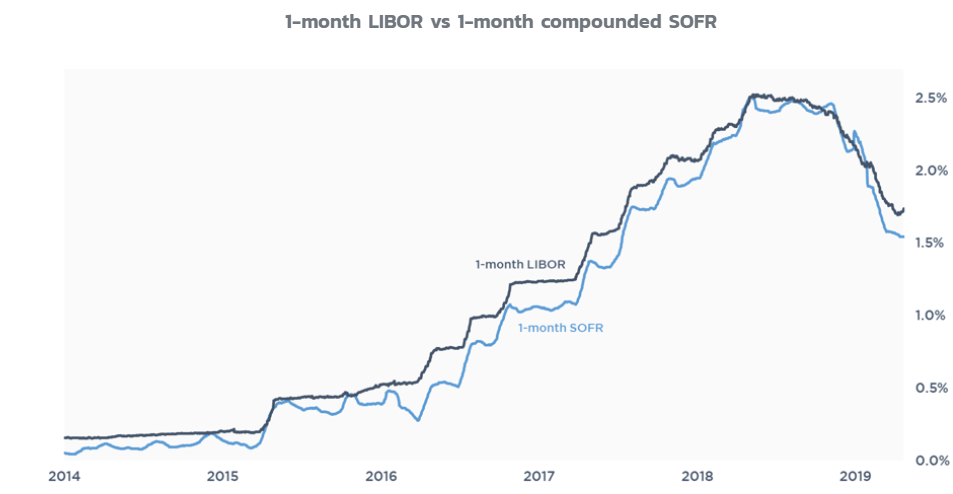

Practically, the hedge provider is forced to adhere to the ISDA Fallback Protocol because central exchanges that trade derivatives (LCH and CME) will be adhering to the same protocol, and hedge providers will want to retain a net neutral position with these central exchanges. In the example above, the borrower is naturally motivated to keep their fixed rate constant. The lender takes comfort that the correlation between LIBOR and SOFR is very high with an adjustment that compensates the lender for the absolute difference in the two rates (as shown in the graph below).

We do not view the transition from LIBOR to SOFR as an economic risk for community banks. However, we see the potential for some operational risk. There are some important differences between how LIBOR and SOFR are calculated, stored in core systems, and used for cash flow settlements. First, currently, SOFR is an overnight rate, and there no tenors for this index. Unlike LIBOR, which could be contracted for overnight, 1-week, 1-month, 3-month, etc., SOFR is currently only an overnight rate. Regulators and dealers are working to create a term structure for SOFR, and we anticipate that this will happen in early 2021. Until then, any entity that uses SOFR will need to update the rate daily. Second, by convention, SOFR is a compounding index, and monthly cash payments are calculated based on daily interest-on-interest. Some community bank core systems do not allow daily compounding. SOFR can be used as a simple (non-compounding) index, but that convention cannot be cleared at central exchanges – not an issue for most banks, but this operational quirk must be understood at each instrument level.

Regulators and industry groups have taken large strides in facilitating the transition from LIBOR to SOFR and have mitigated the majority of economic risks in that transition. It is not guaranteed that a trigger for LIBOR will occur in 2022, but if it does, community banks must be ready to move to SOFR quickly. Furthermore, for community banks, certain latent operational risks remain that must be well understood and worked out at the instrument level to ensure a smooth transition to SOFR.