The Use and Usability of Ratings in Banking

In the online world, customer reviews and ratings are ubiquitous. Consumers have come to expect them, yet few banks use them. Ironically, sites that rate banks, such as NerdWallet, BankRate, and others, maintain detailed reviews on banks with great success as well as places like Yelp. If your bank is not offering rates, chances are your potential customers are getting their information from elsewhere. In this article, we cover the pros and cons, look at the data on various rating formats, look at how many ratings you need, and the best practices for using ratings to drive more sales.

What Happens If I Get A Negative Rating?

The most common concern over putting ratings on your site is, are you prepared to manage them, and what happens if your reviews are mostly negative? The easy strategic answer to this is don’t collect reviews if you don’t care what your customers think, are not willing to improve, or have no control over your product. We will grant you that there is a certain head-in-the-sand calm of not knowing what your customers are saying.

However, we take the position that truth is power, and you will be much slower to change your marketing or products if you don’t see your reviews. Reviews allow valuable feedback that forces organizations to improve. Allow for ratings on your bank or product, and focus is almost guaranteed. Few bankers doubt the importance of customer satisfaction, so while employees can complain all they want about a product (often driven by verbal customer feedback), there is something motivating about seeing quantitative evidence.

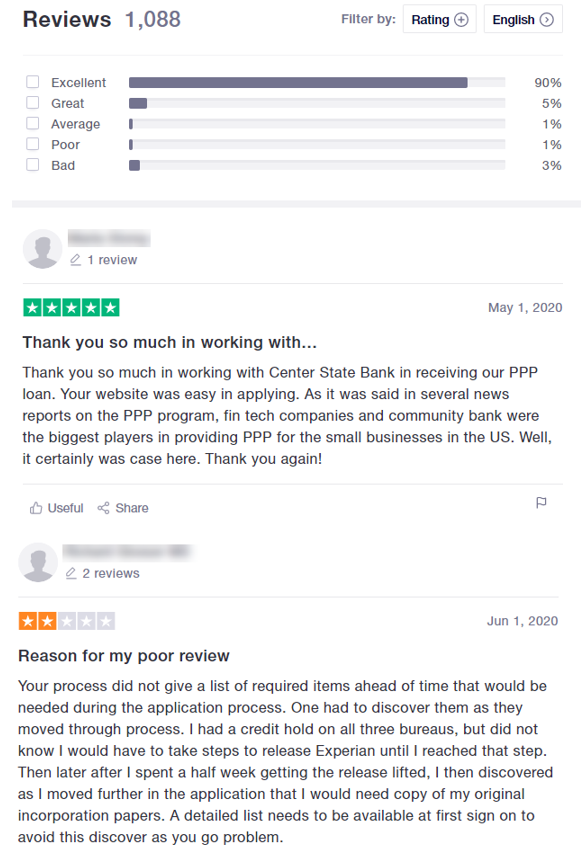

Below is a sample review structure, and while we get many positive reviews, it is the negative reviews that hold more value. Like the review below, most negative comments are fair. While often we get negative reviews for items outside of our control, such as security protocols, regulation adherence, or product limitations, more times than not, the negative review is within our control. The one below, for example, highlighted the fact that we needed to do a better job of improving our marketing communication and our website communication. It was that very review that helped us improve the process and make our product better for all customers. This is feedback that we would not have garnered had a review process not been in place.

The Data on Bank Reviews

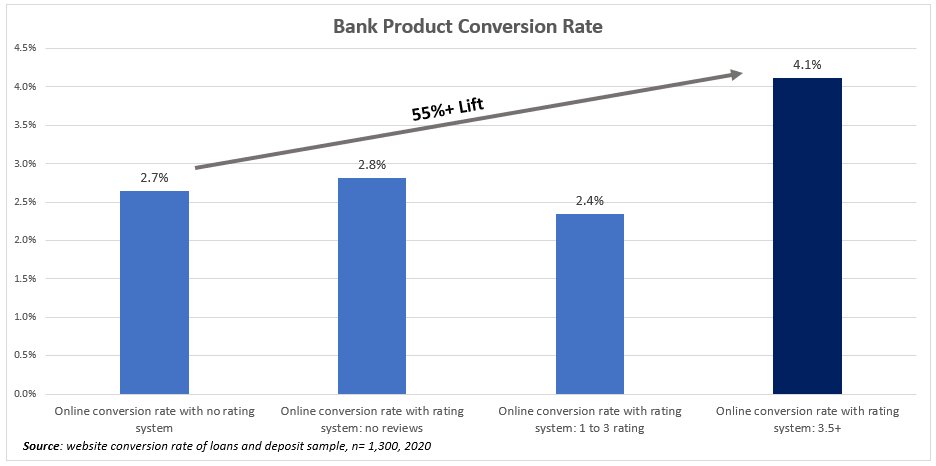

As our data below shows, just having rating capabilities, even with no rating help. While negative ratings do hurt, ratings above 3.5 on a scale of 5 tend to help giving banks an average of a 55% increase in onsite conversions. While this statistic will vary depending on the product, rating, number of reviews, and commitment risk, it will likely be higher for your bank. For your average e-commerce site, for comparison, the impact of having positive ratings is usually more than 250%.

Our data also indicates that the more expensive or complicated the product, the more reviews matter. We have also found that when you have a low number of five star or numbered reviews, the less reliance potential customers place on those reviews. In terms of the number of reviews, while the more, the merrier and higher numbers add to trust, the positive effect tends to level out past 12 reviews. That is to say that the more reviews you have, the more customers say they “trust” the reviews, once you get above 12, have a lot of reviews do not tend to materially impact conversion rates.

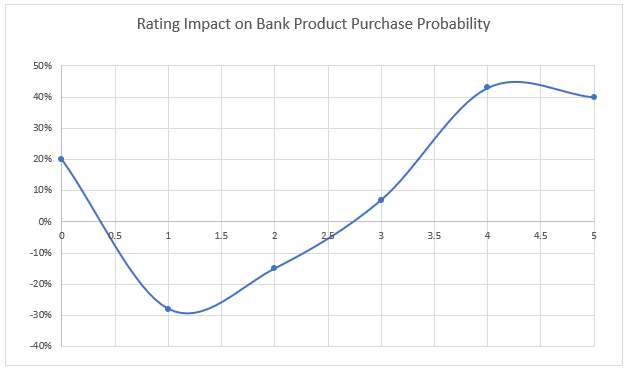

In terms of ratings, as most bankers would suspect, a low rating and negative review hurt conversion, as can be seen in the chart below. The “sweet spot” of rating reviews, tends to be in the 4.2 to 4.4 range. Having all “5s” tends to be discounted, and customers seem to have less trust in those reviews, which presumably does have an impact on conversions.

Of interesting note, when it comes to trust, it is common for bank customers to seek out and click on negative reviews. To the extent the customer can see the bank’s response, credibility tends to be improved as the trust rating tends to go up. When a rating is above a “4” AND negative reviews are present, AND the bank has responded to those negative reviews and offered some corrective action or mitigating information, conversion rates improve compared to not having any reviews on the site by more than 66%.

This should inform functionality and process as banks should establish the technology and process to respond to negative reviews and low ratings.

Usability – Are Numbers or Stars Better?

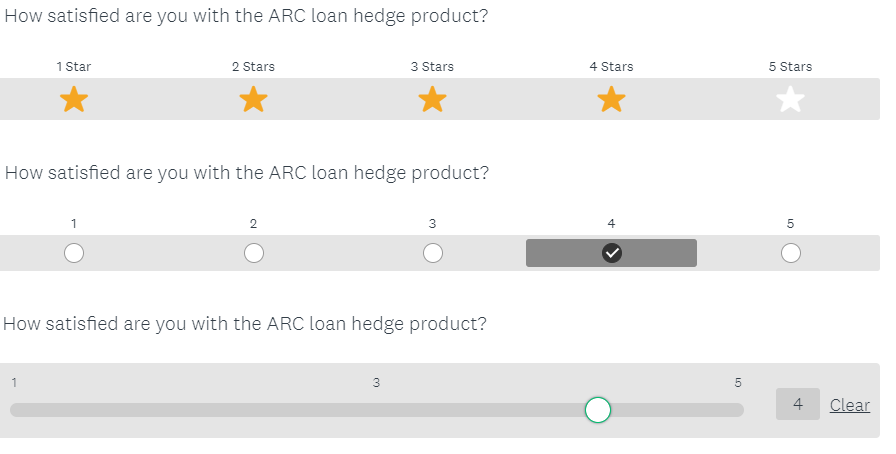

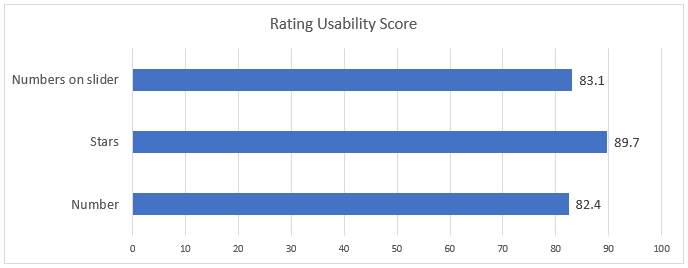

Finally, in terms of usability, we asked the question, what format is the optimal format to collect ratings? Here, we tested three methods (below) and combined them with some variations. We looked at using stars, numbers, and numbers with a slider. The data is below.

As can be seen above, all three variations tested well. We observed a small, but significant difference in usability scores amongst bank customers for using stars as a preference above the three options. Sliders, while our thesis was more fun and interactive, tested just slightly worse than numbers alone, which was surprising.

All that said, we are quick to point out that statistical significance does not mean practical significance, and we conjecture that our observed data may be highly influenced by how many questions are being asked, the type of product, the order of questions, and even the manner presented.

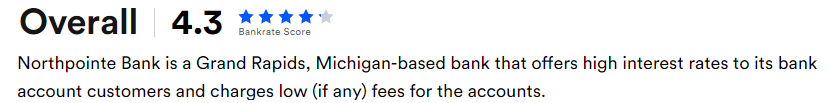

For example, when we labeled the scale as in “1” equals “very unsatisfied” and “5” equals extremely satisfied, scores tended to be lower by about 15%. Thus, our conclusion is all three methods are usable, are practically materially the same, and should be considered. The question about which presentation is the best likely has to do with how and where it is used. All things being equal, we would recommend utilizing stars on a five-point scale to collect the information. For display, use the numerical average first and then include the star rating after like the below.

Displaying numbers first had a usability score of 87 compared to putting the stars first and then the numbers, which had a usability score of 83. This is different than how Amazon and Netflix do it, both of which probably know a thing or two about ratings and usability, so take our findings for what they are worth.

Putting This Into Action

Banks can benefit from ratings on their products, branches, events, and even bankers. Not only does it provide information to your customer base that will most likely improve conversions, but it will give you a valuable feedback loop in which to improve. In addition, the use of ratings alone creates more of an ownership culture and more of a clear path to holding your product managers, bankers, and customer service staff accountable.