This Will Happen To Banking When The Fed Moves to a Central Bank Digital Currency

As a banker, you undoubtedly keep an eye on the trends of Bitcoin, Ethereum, and other cryptocurrencies. Their huge popularity must have you thinking about the future of money. Like JP Morgan Chase CEO Jamie Dimon, you were probably against these currencies to start and now have come around to being more open to them, even acknowledging their place as a store-of-value and possibly a medium of exchange. The Federal Reserve has, and it is by no accident, that recent moves are sending a strong signal to bankers everywhere. The question is, what are you doing to prepare for this future? In this article, we explore that possibility and what it means for the future of banking.

The Central Bank Problem

If you are the central bank, cryptocurrencies present a significant problem for you. The lack of control over the velocity of money, the lack of transparency, and the lack of control of supply all erode your power to influence money supply as well as present material policing risks. It becomes harder to understand the amount of usable currency in circulation, harder to inject liquidity into the system, pull liquidity out, or freeze someone’s bank account. The more ominous dimension to this problem is that the harder you push to maintain control of the current monetary framework, the more friction you create around the U.S. Dollar and the faster the money supply moves into crypto.

The Fed’s Control of the Narrative

However, suppose a central bank creates its own “Central Bank Digital Currency,” or “CBDC,” not only do you stop many of the before mentioned problems from happening, but you also place the central bank in a much better position than having traditional paper currency. The creation of a CBDC gives the central bank highly accurate tools to monitor the money supply, control its supply and dramatically reduce USD-denominated crime.

By turning the U.S. Dollar into a token-based digital currency on a blockchain, the Fed now knows where every dollar is and how it is used. By holding non-transactional accounts at the Central Bank, the Fed merely has to change its overnight rate to move money on and off its balance sheet. This control and sensitivity, if used correctly, has the ability alone to bring more stability to the U.S. economy and greater strength to the U.S. Dollar.

If you think this is a long way off, consider that in the last six months, the Fed has published more whitepapers, articles, research, speeches, and YouTube postings on the concept of a U.S. digital currency than any time in its history. There is a charm offensive going on, and we believe it will culminate in a U.S. Dollar CBDC in five years’ time.

If you doubt this, consider the Bahamas already use the fun-sounding “Sand Dollar” on the islands of Exuma and Abacos for the past year, Sweden has been testing the e-Krona, as has Singapore and South Korea, Japan, Canada, the U.K., and the EU have all publicly declared that a CBDC is being considered.

Then there is China. China has been studying CBDC since 2014 under its “Digital Currency and Electronic Payments” initiative and went into trials late last year for a digital Renminbi. China will likely be the first major central bank to make this move and when it does, look for the country to not only crackdown on the use of other cryptocurrencies like Bitcoin but also start a major push touting the benefits of a CBDC optimized for stability.

The result will be more global liquidity to the Renminbi at the expense of both other cryptocurrencies and the U.S. dollar. The EU/UK will follow suit, and the U.S. will be forced to move sooner than currently planned in order to maintain its dominant position as the default global currency.

Cryptocurrencies like Bitcoin and Ethereum, because of their volatility and lack of liquidity, have evolved into largely a store of wealth and alternative asset class without the benefit of being a practical transactional currency. Because of the price volatility, the transaction fees, small block sizes, and the fact that you cannot currently net out transactions in cryptocurrency, makes any crypto difficult to use at scale.

CBDCs will have many of the advantages of 24/7 transactions, reduced fraud, and a real-time gross settlement system that will allow for cheaper and faster payments, plus the advantage of being a sanctioned fiat currency backed by considerable monetary reserves. Reduced transaction friction combined with currency stability and a simultaneous devaluation of non-CBDC cryptocurrencies will dramatically alter the current monetary landscape.

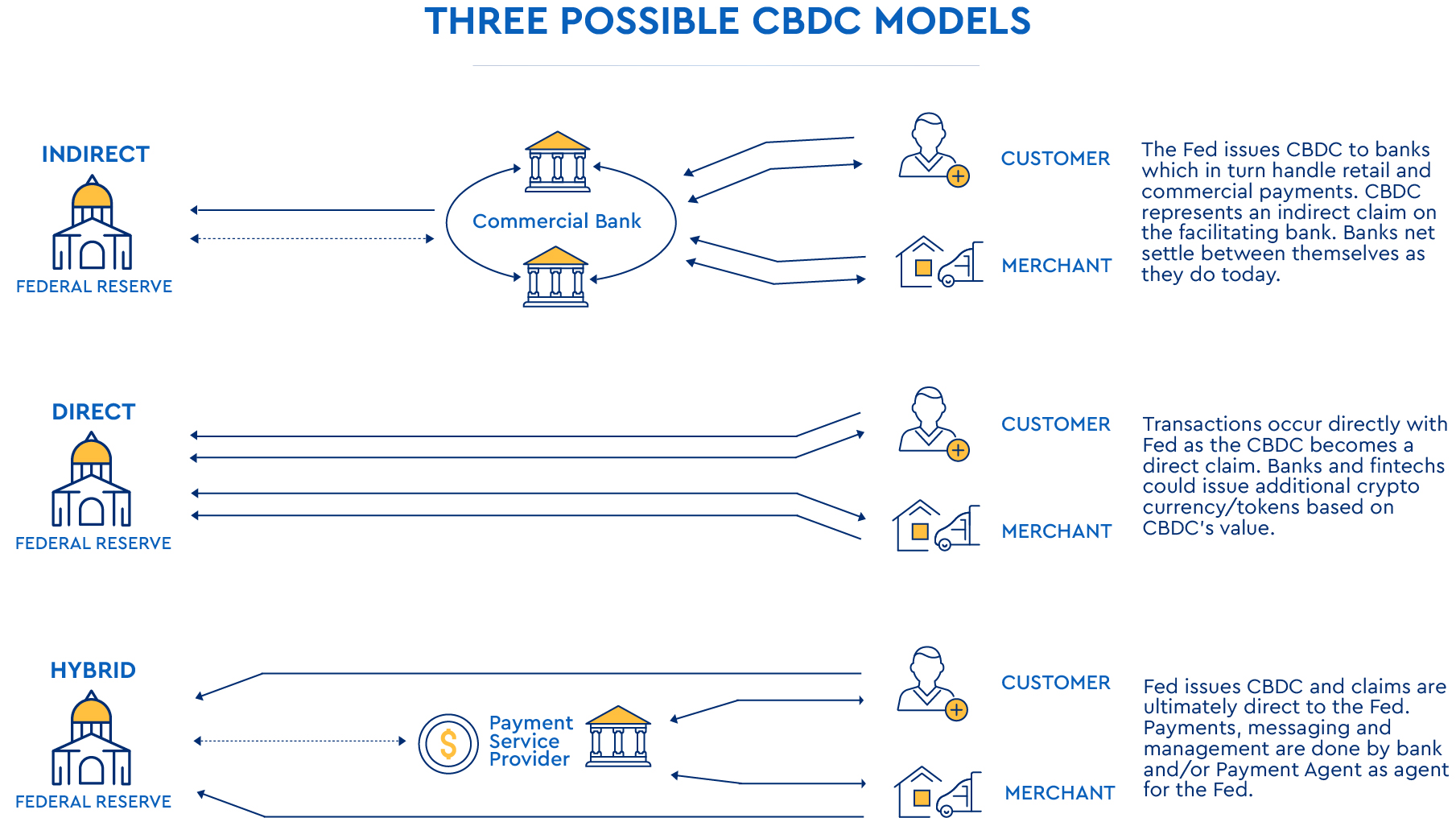

Integration Into The Banking Industry

While it remains to be seen how a CBDC will be integrated into the banking industry, our bet is that the Fed stops short of a supernational payments network and opts for the holding of accounts of regulated banks much as it does now. We also could see where the Fed would also agree to house non-transactional commercial and even retail accounts.

Our guess is that banks will still handle daily transactional settlement on behalf of its customers via a real-time clearing network such as The Clearing House, FedNow, or correspondent bank, but every bank will have to be tied into the Fed’s network in order to access a customer’s non-transactional funds.

The Fed would set an overnight rate like it does today, that it would pay on this depository account. The rate could be positive or negative depending on the objectives of the Fed. The lower the rate, the more money gets driven into banks and leveraged. Banks, on the other hand, would need to set a rate high enough to attract funds into their own transactional or savings accounts.

Similar to the e-Krona model, should this scenario play out, banks will have to increase their cost of funds to attract deposits held on account at the Fed. Further, banks will likely have to dramatically increase their payment capabilities in order to be more relevant to retail and commercial customers. Payment banks, driven by the likes of Square, Paypal, and others, will spring up doing nothing more than driving transaction fees. To compete and be able to capture transactional account balances, banks will have to be able to play a role in these transaction streams, be able to facilitate a digital wallet, be able to validate digital identity, and be required to clear funds in real-time optimized by both speed AND cost.

While it will take time to move away from paper currency and imaged checks, the move to a CBDC will cause its demise much sooner than pundits expect. The evolution will be that once the bulk of the market starts clearing in real-time, banks that have customers that still traffic in paper currency and next-day items will find themselves with additional internal expenses and external charges in order to turn real-time transactions back into a batch world. These banks will find it harder to compete and will face a rapidly shrinking customer base. Customers will move to banks with real-time core systems that can handle real-time settlements, which will enable cheaper and faster movement of the digital dollar.

The end result will likely be that 60% or more of our community banks get driven to an acquirer with a platform that can handle digital currency or get driven out of business.

Putting This Into Action

While a CBDC isn’t the same as traditional cryptocurrencies like Bitcoin, it does have many of the same advantages while not having some of the disadvantages. For users that are willing to give up some of their monetary freedom in exchange for greater transactional safety, value stability, more liquidity, and lower transaction cost, a CBDC will make sense for the vast majority of our customer base.

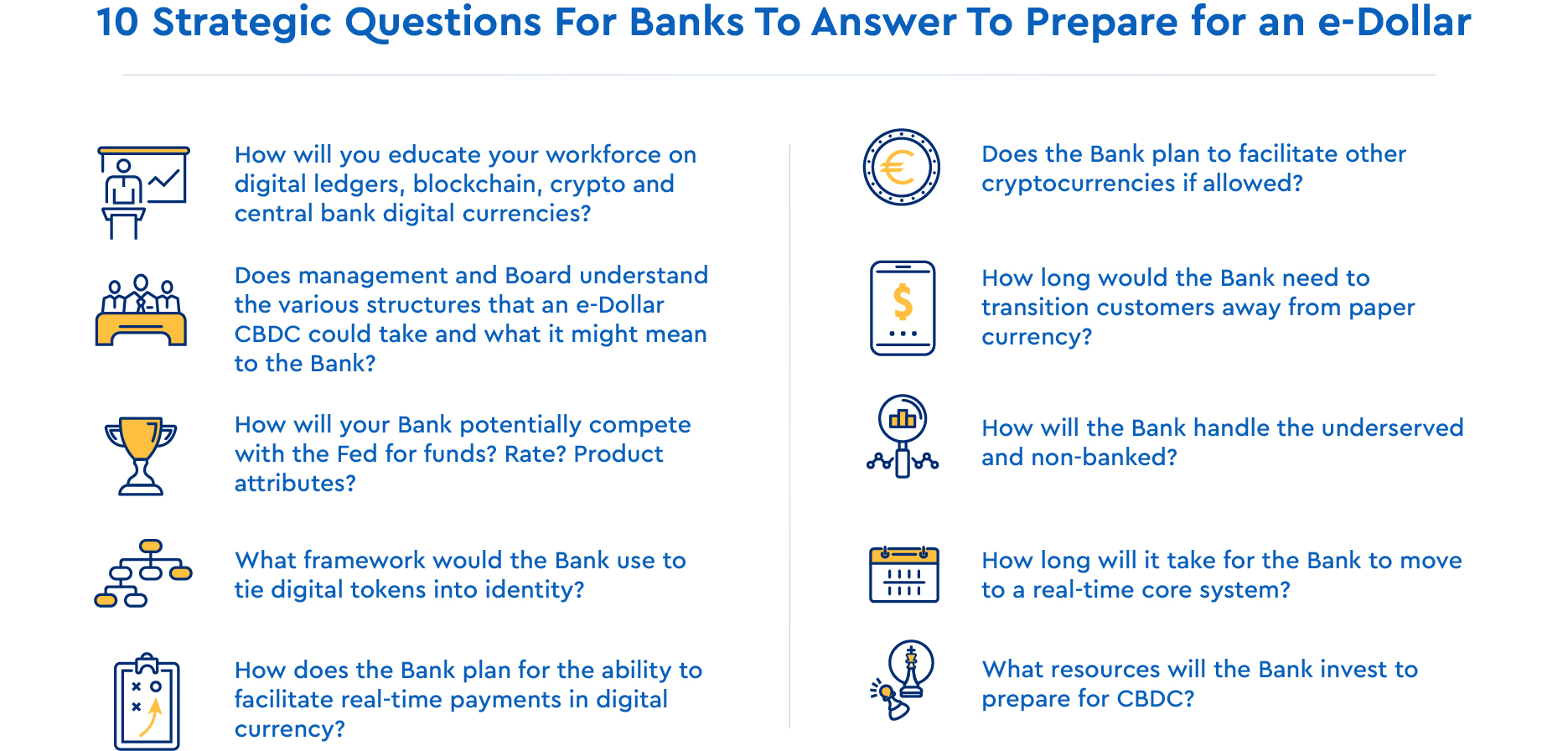

The first step is to start thinking about and planning for working a CBDC into your strategic plan. It takes a long-time to change to a real-time core, and if you wait until we already have a CBDC, it will likely be too late. Banks need to start to put the building blocks in place now.

The Fed’s recent YouTube release on CBDC should be required watching for all senior bank managers and their boards:

From there, it is worth a discussion and a plan to come up with a plan on how to address this threat/opportunity.