How To Use Account Analysis Effectively (Part 1)

Data analytics combined with artificial intelligence is changing the strategy and tactics around account analysis and the analyzed checking account (which we will call a “transaction account”). In this two-part series, we want to explore the history, structure, and role of account analysis in Part 1 and then some insights and tactics on increasing bank profitability while benefiting the commercial customer.

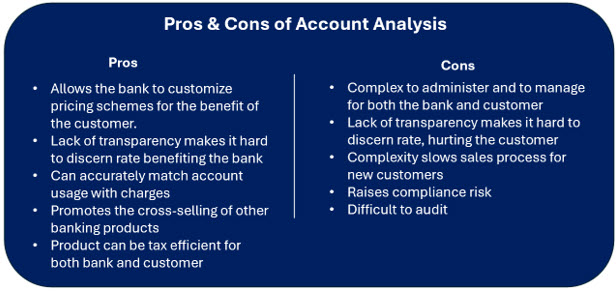

Why not pay your commercial account interest income and let them use it to offset account fees? Why go through the cost and hassle of tracking “hard” and “soft” earnings? The question is interesting given that almost every bank is going after the high-balance commercial customer, and most do that by highlighting their analyzed transaction account product within treasury management.

Background on Account Analysis

After the 2008 financial crisis, the Dodd-Frank Act was passed in 2010. One of the many provisions of the Act included lifting the ban on banks offering interest on corporate customer demand deposit accounts (DDAs), a restriction previously enforced by Federal Reserve Regulation Q. This shift put in question whether the “Earnings Credit” (EC), a prevalent characteristic of treasury management in the US, would survive. Earnings Credit is equivalent to interest but isn’t directly paid into the customer’s account. Instead, it helps reduce various service fees customers incur. This method calculates the monthly average balances and uses them to help counterbalance service charges such as monthly fees, transaction or service charges. An account with an EC is also referred to as the process of “Account Analysis” (AA) or an “analyzed transaction account.”

The structure is complicated and might have gone away. Still, as we were all debating the issue and the role of EC in bank profitability, the Federal Reserve lowered the Fed Funds target rate to nearly zero, rendering discussions about hard interest (actual paid interest) and earnings credit inconsequential.

However, now that deposit rates are as high as 6%, the question is back on the table. Why go through the complexity of account analysis instead of just paying and accounting a straightforward interest rate on balances?

The Complexity of Analyzed Transaction Accounts

We have complicated the commercial analyzed transaction account sales process. We now have to sell an interest rate and an earnings credit when that EC is earned and which account qualifies for an EC. Usually, the sales process entails getting three months of statements, either manually or digitally, and then producing a comparison with the client.

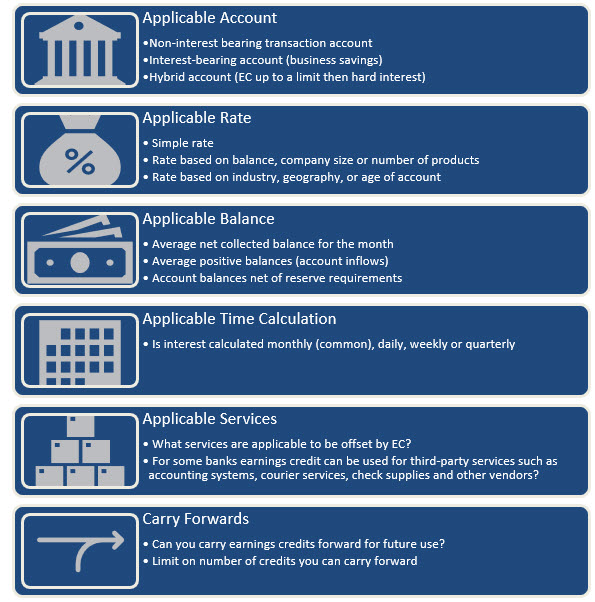

The computation of earnings credit or hard interest on accounts generally involves a straightforward calculation. We consider the average daily balance for the month, the applicable EC rate, and the day count of the month. However, this can become complex with the various potential scenarios depending on the corporate client.

To decide on an appropriate credit rate, the bank considers its pricing strategy (HERE), the size of the account, customer loyalty, and the overall value of the customer relationship. To size the offering correctly, most banks have a tiered system for clients. Varied criteria are set for each tier. Every month, customers use a unique mix of banking services that shift as their business needs grow and transform.

Bank-specific growth strategies and governance or risk management needs, as well as competitor behaviors and regulatory modifications, may necessitate tailored policy adjustments. In this age of personalization, it has become essential for banks to have the capacity to instantly modify earnings credit and hard interest calculations for each corporate account on a client-by-client basis.

Reserve Requirements, Carry Forwards, and Methodology

To compensate banks for a minimum level of profitability, banks often exclude a certain level of balances from both hard interest and earnings credit. Making matters more complicated, banks often allow their customers to carry forward excess credits that are not used into the next period up to a point. Here, banks need to track the level of carried credits and the expiration of such credits.

Sample Calculation

Let’s assume a bank has a large non-profit organization with $10 million in balances in a transaction account. The organization earns an EC of 2% and a hard interest charge of 1% for 30 days of the month.

Thus, the calculations look like $10,000,000 x 2% x 30/360 = $16,667.

If there are $5,000 in account charges and instant payment charges, then the “excess credit” is $16,667-$5,000, or $11,667.

We then calculate the balance available for a hard interest charge at $11,667/2% EC Rate/(30/360), or $7,097,425. The customer then gets this balance times 1% a month, or $5,915 in interest.

In selling the account, it is a little murky what the customer is getting, so a bank can play up the 2% EC rate or talk about an “effective rate of 1.31%,” which is the blended rate of the two given the balance and charges. Banks can use an analyzed balance to drive more banking services as the credit might be in excess of what a bank can use, thereby providing a catalyst to use products such as business savings, instant payments, lockbox, armored services, or other products that can generate fees and/or extend the customer’s lifetime value.

Note that this is before a reserve amount, which we would deduct from the original $10mm in deposit balances and conduct the same calculation, thus lowering the effective rate the bank pays.

The example illustrates that banks must adjust the interest rate, applicable balance, and duration of interest payment to calculate earnings credit and interest accrual. These variables are influenced by numerous factors. Adjustments might also be required halfway through a cycle based on specific customer agreements or the bank’s risk and governance strategies.

Coming Up Next

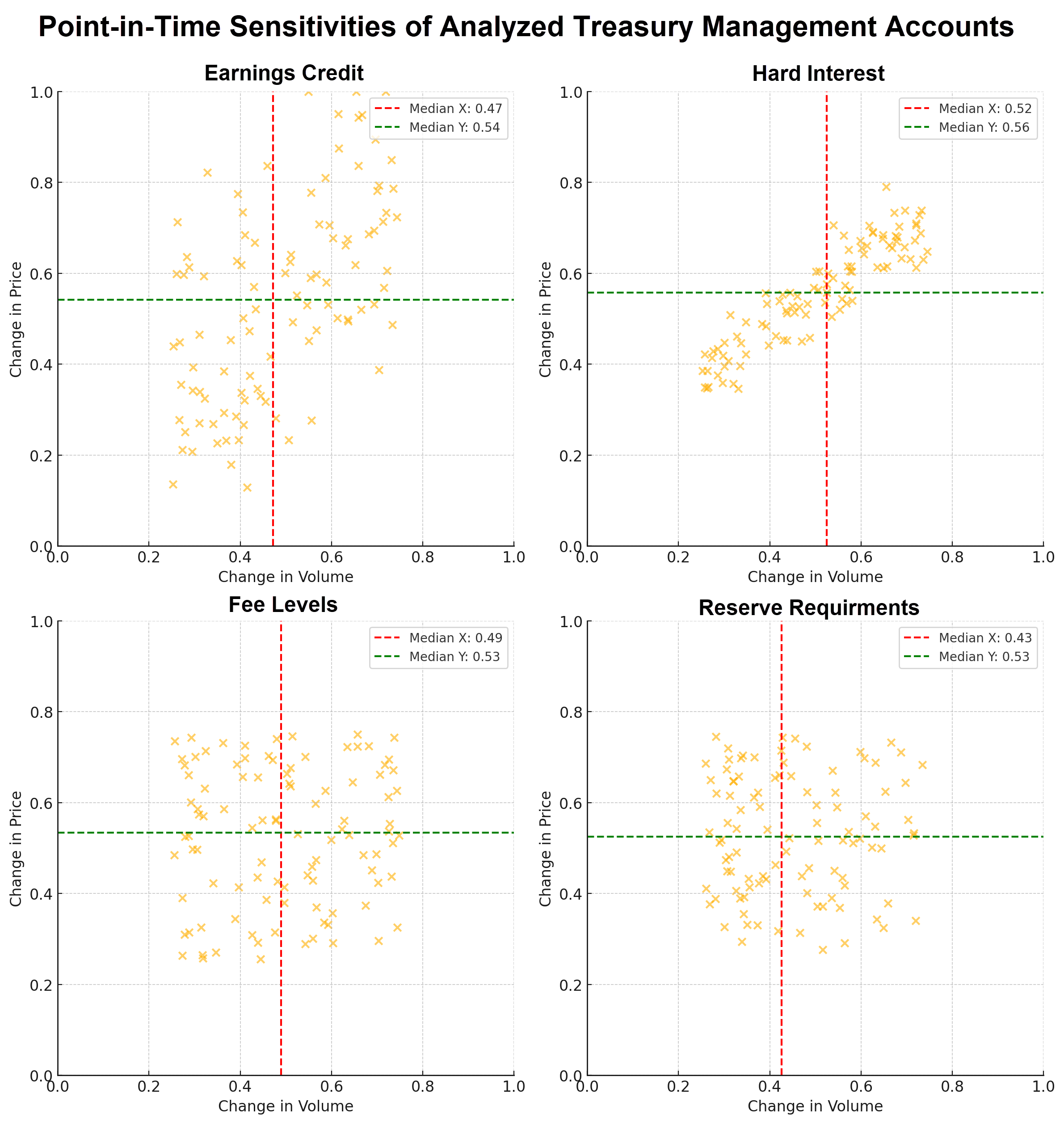

In Part 2, we will explore how AI is changing banks’ strategies and tactics for managing their products. We will underscore best practices and discuss how AI is helping banks price and manage products more effectively. We will also look at the chart below for insight into how the sensitivites of EC, hard interest, fee levels and reserve requirements impact treasury management account profitability.

It is questionable whether a bank should even have an analyzed transaction account anymore versus just paying a hard interest charge to offset fees. In this article, we laid the groundwork for how account analysis works. We highlighted the complications of managing, selling, servicing, and maintaining the product for a bank’s treasury management and transaction account customers. To gain more industry knowledge about account analysis, click on the graphics below to learn about the account analysis use case and what vendors leading banks are choosing the help manage billing, offers and account analysis, plus see the upcoming conferences that focus on treasury management.