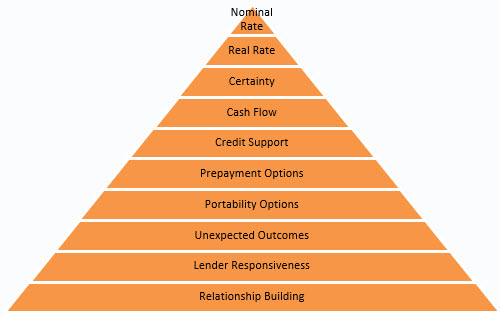

Use Our 10-Layer Pyramid to Educate and Advise Borrowers

Most customers are borrowing neophytes. We estimate that the majority of community bank borrowers have a rudimentary financial and accounting understanding, and these borrowers may focus solely on the interest rate on a loan when comparing their options. Even “sophisticated” and seasoned borrowers do not know how to compare their borrowing options to optimize outcomes. “Sophisticated” borrowers may close less than one loan per year (plenty of time to forget past lessons), and these borrowers may only consider the interest rate, commitment term, and monthly P&I payment when comparing their options. Good bankers should educate their customers (as best they can) because there are at least ten attributes that borrowers must address in making an informed financing decision. We will describe the ten attributes that successful commercial lenders should understand when helping borrowers make a financing decision.

The Ten Layers of Borrower Analysis

The pyramid below outlines the ten levels of analysis that borrowers should consider when making a financing decision.

- Nominal Interest Rate. We speak with hundreds of commercial borrowers across the country. From small business owners to real estate investors to municipal and public corporations, and borrowers are demanding more from their banking relationship. However, surprisingly, the lowest pricing and the most aggressive credit structure are not at the top of the list of most borrowers. Borrowers do want a fair price and do want market-driven terms, but small business owners do not specifically look for the lowest rate or the highest advance rate without recourse. Nonetheless, it’s easy for a borrower to compare interest rates, and the stated loan rate is the nominal interest rate that the borrower pays for borrowed funds. Every borrower factors this attribute in the decision-making process.

- Real Interest Rate. Borrowers pay back their loan over several years and in nominal dollars, and they pay back the same nominal dollar amount they borrowed, but that dollar is worth less in the future than it is today. The real interest rate that the borrower pays is more important than the nominal interest rate. Therefore, borrowers should understand the market’s inflation expectation and calculate a loan’s real interest rate. The real rate may be very different depending on the term. Currently, the average nominal interest paid on a 5-year fixed-rate commercial term loan is approximately 2.77%, which is a real rate (after expected inflation for the next five years 2.58%) of 0.19%. Borrowers must understand the importance of expected inflation when considering financing options.

- Certainty. The certainty of a loan is not lost on most borrowers. A loan commitment for two years is very different than a commitment for ten years. Further, a loan that reprices in five years has less certainty for the borrower than a loan with a fixed rate for ten years, as an example. Locking in certainty is always valuable for borrowers, but especially during a period when both credit spreads and benchmark rates are at historic lows (the present lending environment).

- Cash Flow. Most novice borrowers do not consider cash flow. Borrowers do not pay the loan with interest rates but with dollars. Different amortization periods create different cash flow needs. Further, borrowers can deduct interest payments from taxes owed, and borrowers can depreciate certain assets financed by the loan. Therefore, borrowers should understand their after-tax, after-depreciation cost of financing in real dollar terms. In today’s market, solid borrowers can finance their business with a negative cost of borrowing (after inflation, after-tax, and after depreciation expenses) – that means borrowers are getting paid to borrow funds, and this is the intended consequence of monetary stimulus.

- Credit Support. Many community banks prioritize sound credit decisions. Lenders will require acceptable cash flow, leverage (advance rate or debt-to-EBITDA), and personal guarantees to give borrowers aggressive pricing and other valuable borrower options. Borrowers need to be educated that aggressive credit structures will leave lenders little leeway for working with borrowers in times of stress. A loan that is aggressive at inception is already a credit loss to the bank during a downturn, and banks will have a little runway to work out an accommodative solution for both parties. It is not in the borrower’s interest to seek the most aggressive credit structure that some banks may accept.

- Prepayment Options. Borrowers will likely have the best view of their business and personal life and understand the value of terminating the loan and the cost/benefit of a changing business and economic environment. While the borrower holds the option of prepaying a loan, that option is not always free. There are transaction costs to every refinancing, and, more importantly, there can be a very high cost when borrowers are required (because of financial performance or poor banking relationship) to change their credit provider in a different lending environment when interest rates may be higher, liquidity tighter or banks do not want to lend to a particular sector or in a geographic region. Therefore, borrowers should understand the cost and consequences of prepayment – either voluntary or not.

- Portability Options. Most borrowers view a loan as financing on collateral. Borrowers have developed that view because some banks have, unfortunately, fell into the mistaken belief that lenders finance projects or pieces of collateral. But good lenders finance balance sheets or businesses. The collateral used to secure a loan is very different from financing a balance sheet that may grow, where pieces of collateral may be bought and sold frequently. Borrowers should insist that their banker take a balance sheet view of their business. For example, attractive financing can be maintained even if borrowers sell and substitute collateral multiple times. This is a feature that is very desirable to many borrowers. Furthermore, viewing the borrower’s balance sheet needs can create better financing options and is a more holistic understanding of the borrower’s business.

- Unexpected Outcomes. Borrowers do well with their banking relationships when times are good, but borrowers should plan for the possibility of financial problems. Borrowers must consider the possibility that in the future, they must rely on their banking relationship when their business is struggling. Borrowers will favor strong banks that can be flexible when working with the borrower in an economic slowdown or business downturn. Community banks that survive based on the strength of their local community are more likely to understand the borrower’s needs during difficult times and be motivated to work with existing clients to help them make it through a challenging economic environment.

- Lender Responsiveness. Response time is critical in today’s fast-paced business environment. Responsiveness is the time a bank takes to accomplish an action that has an impact on the customer. That action can be the time to underwrite a credit, to produce a term sheet, to draft closing documents, or make an amendment to a loan, provide cash-out, waive a breach or extend additional credit when the borrower’s liquidity is tight. Community banks that are quick and agile offer borrowers faster reaction time and faster decision-making.

- Relationship Building. Borrowers not only consider their company’s immediate needs but are looking to find a partner that can address and cater to their business as it grows and evolves. The right lender will have the ability to serve the borrower as revenues grow, geographic footprint expands, and business processes become more complex. The right lender will also structure immediate financing that will not hamper future business needs so that the solution provided today will be forward-looking and provide the right financing with sufficient flexibility for the borrower’s evolving needs.

Conclusion

We hear from bankers that borrowers are demanding the lowest price and loosest credit terms. But the evidence does not support this assertion. Our discussions with borrowers lead to a different conclusion. Borrowers are looking for certain criteria in determining their preferred lenders. In situations where the borrower’s criteria are poorly met (the ten criteria above are not presented), then the borrower will resort to demanding the lowest price and most aggressive terms. The many borrowers that we work with are rarely driven by the lowest interest rates or highest leverage.