The impact of coronavirus on community banks will be widespread, and, with some borrowers, the restructuring efforts may take a long time and will sap substantial bank resources. Even as bankers are exerting time and effort to help some borrowers stay in business and continue to service their bank debt, other borrowers are looking for new funding, and existing customers, who are creditworthy, are being solicited by competitors. The question for community bankers is how to retain existing strong customers and appropriate ways to structure new debt given the current challenges. One structure that we have seen successfully deployed by community banks in this environment is a forward starting floater. We would like to explain how this loan is structured and why banks should consider it in the current credit and interest rate environment.

How it Works

Most bankers are concerned about the short-term economic challenges because of the business disruption caused by the coronavirus. The concern is how to overcome the uncertainty over the next one or two years since pandemics are temporary events, by definition. On the other hand, if a banker believes that credit conditions will not recover in the short-term future, but rather that the economy will take many years to recover, then now is not the time to take credit risk and commercial loans are not the right place to invest capital at this stage. For those that believe that the downturn may be deep but temporary, the forward starting floater is a viable strategy to price relationship customers that work best when interest rates may be temporarily low. This strategy allows banks to avoid downward pressure on margin for one or two years as interest rates are depressed, but still mitigates long-term interest rate risk with the expectation that the pandemic passes and interest rates return to more normal levels. The strategy also creates an appealing liability profile for many borrowers with long-term financing needs.

The idea behind a forward starting floater is to divide the life of a term loan into two different phases and, in each phase, structure a payment stream that is most appealing for the lender. Many conservative borrowers still desire fixed-rate certainty on term loans, and lenders want a fair yield on a loan without taking interest rate risk. The forward starting floater achieves all of those objectives by dividing the loan into two phases as follows:

Phase 1: This is a one to two year period during which the lender is earning a fixed rate yield. If interest rates decline, the bank’s yield remains steady (it is a natural floor at the starting loan rate).

Phase 2: This is a five to 18-year period during which the lender is earning an adjustable yield. During this phase, if interest rates fluctuate, the lender’s NIM is stabilized, and if interest rates increase substantially, NIM will expand.

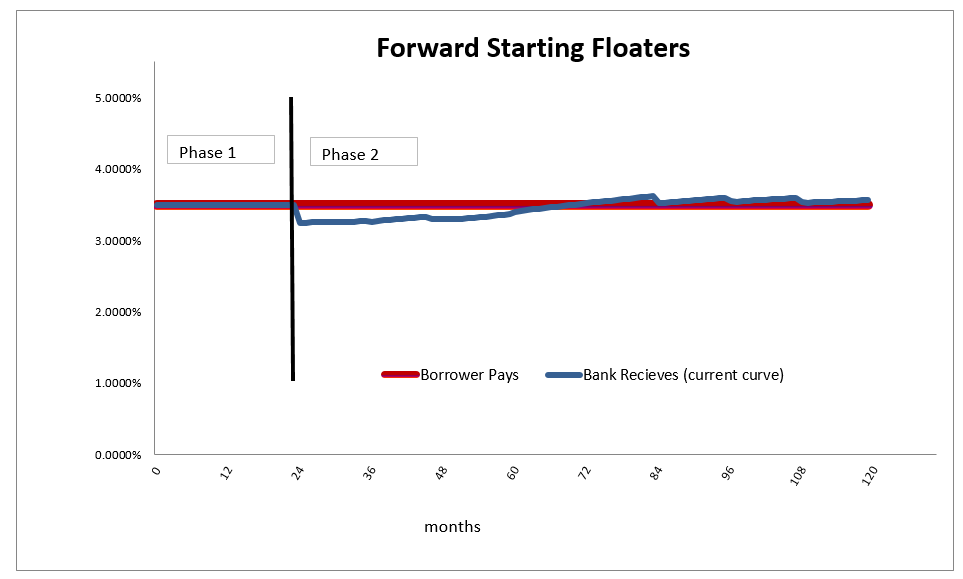

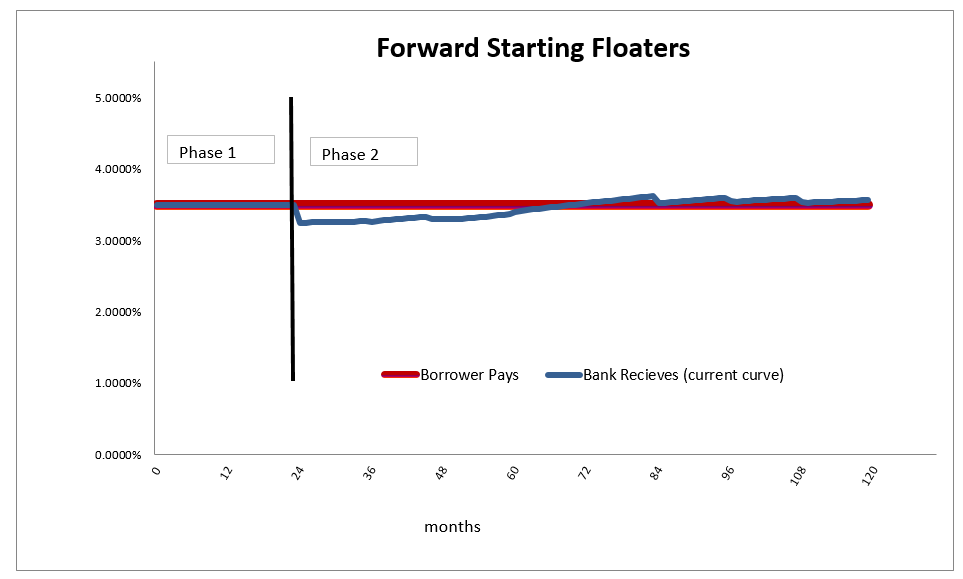

What is novel about this structure is that during Phase 1 and Phase 2 the borrower’s fixed rate of interest is the same, and the two phases are only apparent to the lender. We have used the ARC program to convert the adjustable-rate during Phase 2 from floating to fixed for the borrower (without using a derivative for the bank or the borrower). The graph below demonstrates the phases and borrower payment versus lender yield for current interest rates.

Why The Forward Starting Floater Today

The above graph shows that the borrower is paying 3.50% fixed for the entire 10-year life of the loan, while the bank receives 3.50% fixed for two years, followed by an adjustable-rate that is determined by the then prevailing short-term interest rates. While short-term rates are low today, those rates, based on the current forward curve, are expected to be about the same level over the 10-year period (thus the flat shape of the yield curve). The forward starting floater makes sense today for the following reasons:

Low Rates: Rates are low, and many borrowers want to lock in the cost of funding their business for more extended periods.

Yield Curve: Because the yield curve is flat, the borrower does not pay a premium for longer-term fixed rates.

Margin Preservation: The lender eliminates any risk associated with decreasing interest rates during Phase 1 of the loan. This structure is appealing for bankers because of the extremely negative view of the economy in the next one to two years.

Risk Reduction: Again, because of the flat yield curve, the lender is expected to recognize the same adjustable yield for five to 18 years as the borrower pays from day one. However, interest rate risk is eliminated during Phase 2 because the adjustable yield will move closely with the bank’s cost of funding. If interest rates move to a more normal level in Phase 2 of the loan, the bank’s margin is protected.

Cost Efficient: The difference between converting the entire loan term from floating to fixed versus the last five to 18 years from floating to fixed has almost no premium or additional costs for the borrower.

Increased Lifetime Value: Perhaps the most significant advantage to the community bank is that the borrower agrees to a prepayment provision creating a deterrence to refinancing with a competitor if rates fall any further (as unlikely as this may be).

Conclusion

We are competing in a unique and credit-challenged environment. Bankers need to take care of problem credits and retain customers who have ample cash flow, which are now prime poachable clients. For lenders that believe that current credit environment is temporary, the forward starting floater may be the right solution, because it creates a fixed yield in the short term but interest rate protection over a longer period, and credit enhancement for the borrower.

Tags:

Published: 03/23/20 by Chris Nichols