What Is A Lending Curve and How To Use It

A yield curve shows interest rates associated with different contract lengths for a particular interest rate instrument. With recent interest rate volatility, the yield curve is changing shape daily, and there is much discussion about how the shape of the yield curve predicts the future strength of the economy. While economists may use the shape of the yield curve to gauge future economic strength, bankers should be paying particular attention to the lending curve. The lending curve shows borrowers’ loan coupons for different terms. The lending curve is currently strongly determining borrowers’ demand for loan structures. Banks that understand how the lending curve drives borrowers’ motivation can gain an advantage relative to the competition.

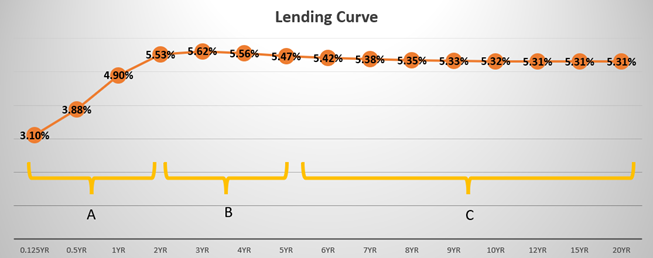

The Lending Curve

We feel that too many factors influence the shape of the yield curve to conclude that an inversion is portending a recession – although a recession is coming, we do not know when but they always come. When pundits try to predict a recession beyond a year, it is like saying, “I don’t know what’s around this corner, but I can predict what’s around the second corner.” However, the lending curve is a fundamental driver of borrower behavior, and bankers should be cognisant of how the shape of the yield curve is driving loan demand and loan structuring.

The graph below shows the lending curve from one month out to 20 years. It shows the average commercial loan rates for different terms. While individual commercial loans are priced non-uniformly depending on credit quality, loan size, cross-sell opportunity, and overall relationship, the curve below assumes a $1mm, bankable credit, with a RAROC of 15%.

Three segments of the lending curve require a banker’s attention. Segment A is out to two years and demonstrates substantial steepness (2.43%, to be exact). This segment is steep because the market believes that the Federal Reserve will aggressively raise interest rates over the next couple of years. Segment B of the lending curve is two to five years and is flat. This is where most banks lend on commercial loans. Segment C is five to twenty years and is inverted by 0.16%. This is where most banks currently do not want to lend on-balance sheet because of interest rate risk.

There are a few essential takeaways for bankers looking to retain existing commercial borrowers and generate new business:

- Making loans in segment A of the lending curve is not particularly profitable for banks at this point of the business cycle for several reasons. Loans originated with less than two or three years of contractual maturity (or repricing) are temporary credits that tend to refinance. Loans are expensive to source, underwrite and book, and shorter credits are generally less profitable. At the average community bank, approximately half of the loan portfolio matures every year – that means that half of the portfolio must be defended each year just to maintain the same loan size. Further, because short-term interest rates are going up, credits with shorter repricing result in strain on debt service coverage ratios. Therefore, these loans should only be utilized for the strongest cash-flowing obligors.

- Making loans in segment B of the lending curve puts banks in an undifferentiated competitive position. Also, this segment has the double drawback of exposing both the borrower to repricing risk in two to five years (a possible credit event) and straining the bank’s balance sheet to interest rate risk with a hawkish Fed.

- Segment C of the lending curve has several advantages for community banks. The ability to make loans out to 20 years without a repricing trigger can differentiate a bank, enhance credit quality, lengthen and deepen the relationship, and make that particular customer more profitable for the bank. Most importantly, because the lending curve is inverted in this segment, the borrower can pay less (or the bank can earn more) than when lending in segments A or B. If you are not seeing loan demand, it may be that your bank is not lending in the segment currently most attractive to borrowers – the long end of the lending curve.

Conclusion

There is a substantial discussion about what the yield curve may or may not be portending for the economy. While that debate continues, bankers should pay attention to the lending curve because its shape is driving borrower demand for longer fixed-rate loans. Banks that have lending products that can satisfy borrowers’ needs for 10 to 20-year fixed-rate loans will have a competitive advantage and will be able to generate higher profits.