What The Election Means For Credit

It is around this time before a presidential election that bankers start to ponder how the results of the election will affect credit, interest rates, and the general business environment. The stock and the acceptable answer is that presidents get too much credit when the economy does well and too much blame when it slumps. The complex and intertwined US capitalist economy goes through boom-and-bust cycles independent of any president’s actions. During normal times, when normal fluctuations ripple around the economy, the president’s actions have a limited impact on stability and magnitude of economic growth. However, we are not currently living in normal times. We argue that at the time of this pandemic, an administration has more opportunity to influence the safeguarding of the lives and the livelihoods of its citizens. In this election, a president’s strategy on Covid-19 may make a fundamental difference to our economy and the banking industry.

Election Scorecard

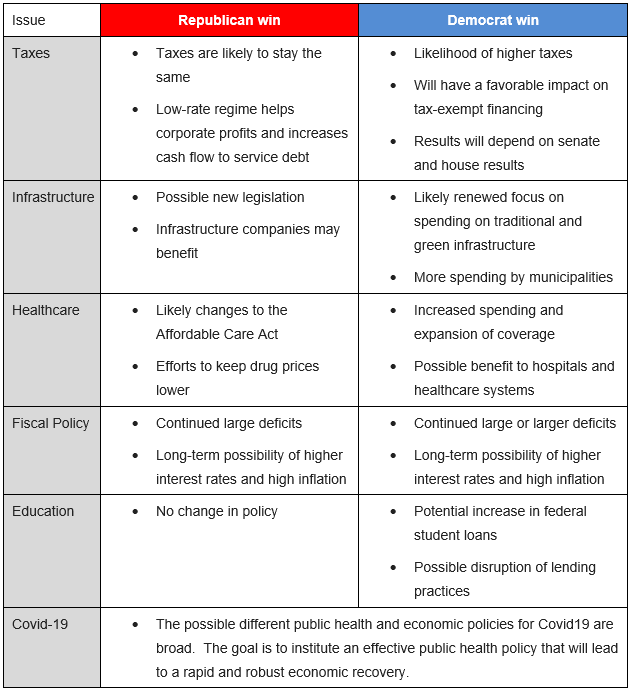

For bankers, the potential impact of the 2020 election on various business lines is demonstrated below.

Covid-19 Policies

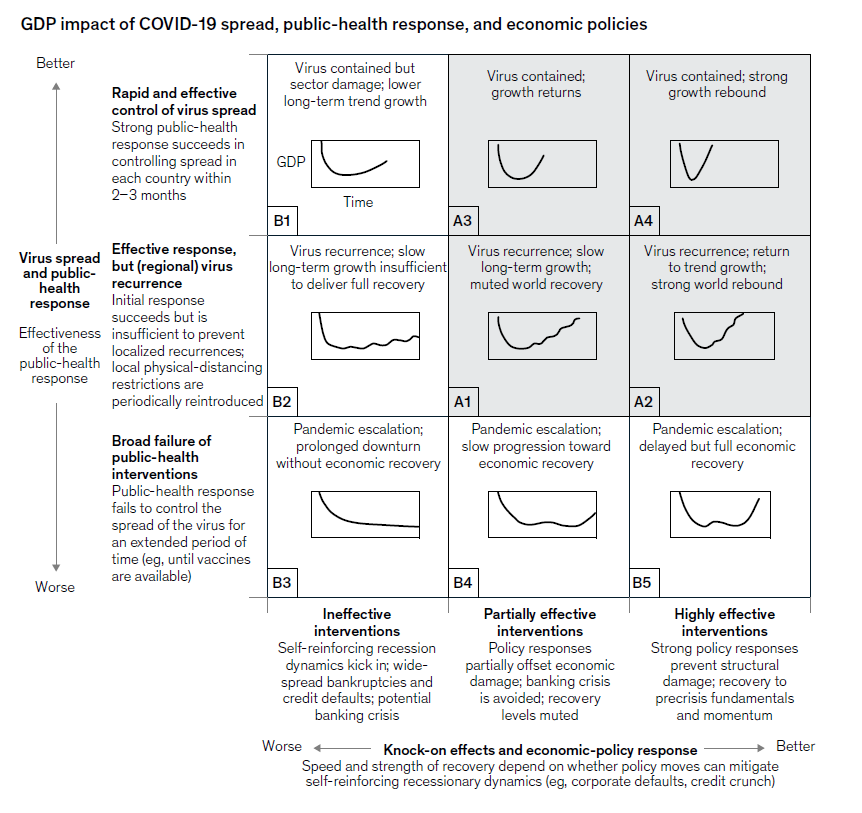

McKinsey & Company devised a scenario framework to describe nine potential economic outcomes based on various public health responses, as shown in the graph below.

Many analysts are making the argument that only countries that can control the spread of the virus can realize an outcome shown in the first row of the graph above. Without firmly controlling the virus, most countries are likely to realize results in the second row of the graph above (barring an effective vaccine). Conversely, a continued spread of the virus caused by broad public health policy failure leads to outcomes shown in the third row of the graph above – resulting in self-reinforcing recessionary cycles, corporate defaults, financial system stress, and profound structural damage to the economy.

The data currently suggests that the impact on the economy of not getting the virus under control is not linear. Every month of delay in restarting the economy results in two months of recovery to return economic output to pre-crisis levels. However, empirical evidence is also showing that consumer behavior and level of comfort is the most critical factor determining spending decisions, and propensity to re-engage in daily routines. Therefore, the desired policy response must lead to consumers feeling comfortable about their health when re-engaging in normal day-to-day activities.

The recent McKinsey Covid-19 consumer survey found that only 30% of consumers feel safer when government restrictions are lifted, but 75% of consumers feel more comfortable re-engaging when they see people wearing masks when in groups, 65% of consumers feel more comfortable when new cases in their area are declining, and 56% feel more comfortable when public-health leaders state that it is safe to re-engage.

Conclusion

It is only by getting the virus under control can the public feel confident about re-engaging in normal business activity, and only then can economic activity be restored. Nationally, it only takes about three months from enactment to achieve the full effects of public health policy. Several countries have already restored confidence and achieved economic activity at or near the pre-crisis level. The question for bankers (and voters generally) is which candidate is better able to enact a robust public health policy that prevents further structural damage to the economy and creates public confidence that leads consumers to re-engage in normal daily activities. Historically, the president’s policies have had only a small to moderate impact on the economy, but the importance of this election appears to be different.