When Will Your Bank Start Using Chat and Chatbots?

It is not a question of “if” it is only a question of “when” you will start deploying chat and chat automation at your bank. It should be on your radar screen for several reasons, the first of which is that it will soon be the fastest growing and the most preferred communication channel among your customers. That trend got a boost when Apple announced last week the production release of its Business Chat product. That announcement led several banks to sign up and join the ranks of Discover, Credit Suisse, Lowes, Home Depot, the Four Seasons, and others that were already using the Apple chat product. Over the weekend, we rolled chat and highlight our experience in case it helps your bank make a case for why chat should be considered.

The Flexibility of Technology and the Pandemic

One of the most underrated aspects of technology investment is the operational flexibility that it gives you. While many bankers look at the return on say, account opening, compared to the manual process, there is some optionality that account opening gives you. This value was not likely included in the return. Still, that optionality can pay off in handsomely when a change occurs, such as a pandemic, PPP, an acquisition, or a similar new situation. The ability to go into new markets is optionality that should be considered the next time an investment decision comes before the board of directors.

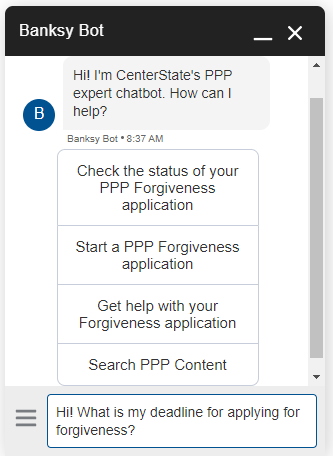

This week, we are deploying chat just to assist customers with PPP Forgiveness. This specific integration is easy to do once you have chat and only possible because we had invested in the technology. Instead of dozens of calls and emails being routed around, that makes compliance, audit, training, and quality control difficult, chat allows specific questions to be routed to bankers and automation with specific PPP Forgiveness knowledge.

The Adaptation of Chat

Chat is part of a growing effort by banks to improve their relationship and intimacy with the customer. The reality is a website or marketing brochure is a horrible place to include marketing information. For the same reason why we advocate that all banks add the ability to handle natural language search capabilities to their website, we also heavily promote adding chat for one particular purpose – understanding the customer’s intent.

Unless your bank is highly analytical and can stitch together social media and web traffic, chat helps you instantly understand your customer’s intent. Not only can banks figure out what the customer wants through chat, but the data can easily be captured to both improve customer service, but also improve content production and products. Get enough customers disappointed by your 4 pm cutoff time for deposits, and it is likely you will change your hours as you will now have quantitative evidence. While a trend before, the use of chat has only accelerated at a hyper-pace given COVID-19.

Banks can deploy their instance of chat over multiple channels such as SMS (text), on the web, through social media channels (such as Facebook Messenger, WhatsApp, WeChat and others) or via voice. Banks with seasoned chat and chatbots such as U.S. Bank, TD, and others report chat usage has more than doubled from March at the start of the pandemic.

The Cost of Chat

To get both chat and chatbots off the ground, it is a $20,000 to $150,000 investment depending on the size and integration of the install. Apple’s new business chat is free to banks as long as banks don’t mind exposing their customers to Apple ecosystem programs like Maps and Apple Pay. Other popular bank chat platforms that we have reviewed include Glia, Zendesk, ServiceNow, Facebook’s messenger, Hubspot, LiveChat, LiveAgent, and Salesforce.

If the customer experience aspect doesn’t move you, consider that to handle a problem in the branch and even in the call center is about $4.00 per interaction of fully loaded cost (keep in mind that while the cost of the call center is cheaper compared to the branch network, this costs get allocated over fewer assets/revenue compared to the branch network, so the cost of resolution is often the same for many community banks). This compares to about $0.25 per resolution through social media, email, and text channels and $0.17 per chat/chatbot resolution.

Through chat, each banker can handle about four customer interactions at once and by leveraging tools such as chatbot and pre-canned responses, can handle multiple times more with greater accuracy.

The Cost of Not Having Chat

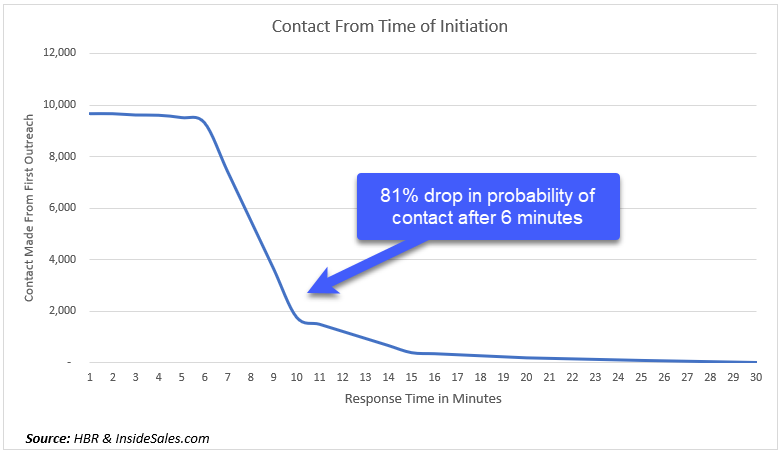

When a customer comes on the website, social media, or email, time is of the essence. As can be seen below, when a customer completes a webform or sends, and email as is the case with about 85%+ of the banks in our industry, the speed at which a bankers gets back in touch is critical as if they wait longer than six minutes, the probability of making contact drops precipitously. What is the cost of missing those sales and helping those customers?

If you doubt the above, stop reading, pretend to be a customer and test one of your bank’s digital channels – website, text, social media, or email. If you are like most banks, 93% of those attempts will get a response back in more than five minutes, and 70% will take a day or more. Can a bank claim to be about service when it takes a day or more to get back to their customers in this day and age?

Don’t Be Fooled By Customer Preference

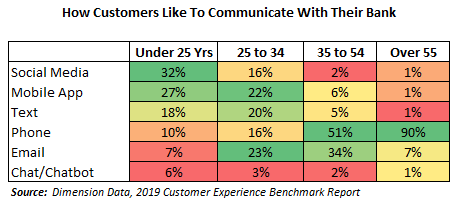

Many banks look at data like the one recently published below and conclude that only 2% of my target customer prefer to chat, so why invest in it? That is like saying no customers desire banking by sunglasses. Customers say they don’t prefer chat because they are not exposed to chat. Our customer data looked much the same way.

However, survey a bank customer that has used a leading chat product such as those found at Bank of America, Chase, Wells, Capital One, USAA, and American Express, and 25% or more will prefer chat to other available channels. As firms like Apple make chat more ubiquitous and fueled by the pandemic, we look for more than half our customers to prefer chat by next year.

The Evolution of Chat

Customer support is just the first step. Banks using the crawl-walk-run approach are encouraged to get started on their chat and chatbot journey sooner rather than later as there is much to learn here. The good news is that it can be iterative, and banks can just get basic chat onto their website and then expand with a chatbot and then expand into areas such as being transactional and having the ability to support payments, account opening, and product sales. Banks are now evolving into having the chatbot help with scheduling, financial analysis, recommendations, voice, and more.

Putting This Into Action

If you are still using email and forms on your website, online banking, and mobile applications, your bank is using technology that is almost 20 years old. You are making the customer work harder than they should, you are not capturing intent, you don’t know the sentiment, and you are not able to leverage automation to help with simple questions or to qualify customers.

Having chat and chatbots at your disposal makes your bank more flexible while lowering your cost and increasing effectiveness. While you are likely spending big dollars on digitizing loans and account opening, it is customer problem resolution and online sales that are your number one and number two issues. Far more of our customers and potential customers come to our website with a challenge or a problem they need our help on than come ready to open an account or take on a loan.

Getting chat should be on every bank’s roadmap, almost regardless of asset size. The pandemic has just accelerated the need for it as a portion of every bank’s customer base still needs human interaction but can perfectly be served with live chat.

Once they get familiar with the technology, most will also be comfortable with talking to a bot. For the bank, having a more efficient channel of communication can payoff quickly with a return on investment often within the first year. For that matter, take a particular situation such as PPP Forgiveness, and chat can payoff in weeks.