Why a 1.65% Credit Spread Makes Sense

We recently spoke to a frustrated banker who was amazed that a regional bank was trying to poach his existing customer by quoting the borrower a credit spread of 1.65%. At such a thin credit spread, how would any bank make a profit, and why was this regional bank so irrational? In this blog, we will outline how this regional bank (and many banks that use loan models, database mining, and simple forecasting tools) would consider the credit, price the risk-adjusted return, and make assumptions on future potential cross-sell and upsell business, arriving at the 1.65% credit spread.

Measuring Return

First, let’s cover some background. The loan is an owner-occupied CRE credit to a 31-year old physician. The credit facility would be a refinance with some cash-out. The borrower also needs a $100k line of credit and some ancillary banking services. Our banker was focused on how to get approval for a 1.65% credit spread to avoid losing the existing customer to the regional bank competitor. We used our RAROC relationship pricing model (Loan Command) to run the analysis.

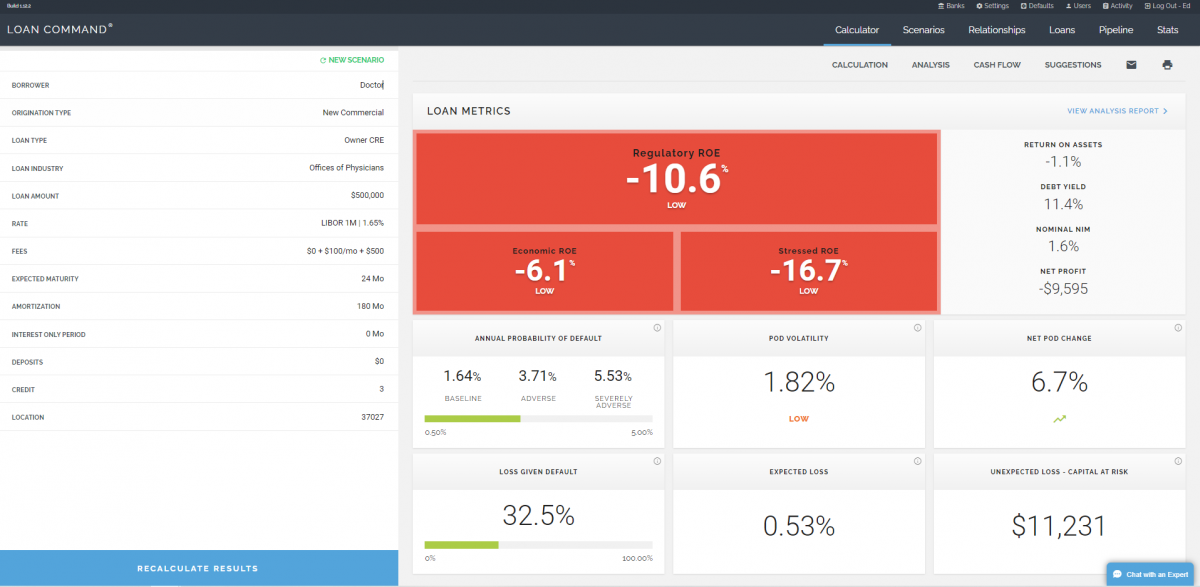

Step One: We priced the loan as our banker had proposed it to the borrower matching the 1.65% credit spread. The model output appears below and shows a negative 10.6% ROE. We priced a 15yr amortization, and two years expected life, $500 upfront loan fee, and $100 monthly wealth management fees.

At this point, when the banker saw the ROE results, he was convinced that the regional bank was irrational in pricing the credit at 1.65% over the cost of funds. But that is not how the regional bank is looking at the credit.

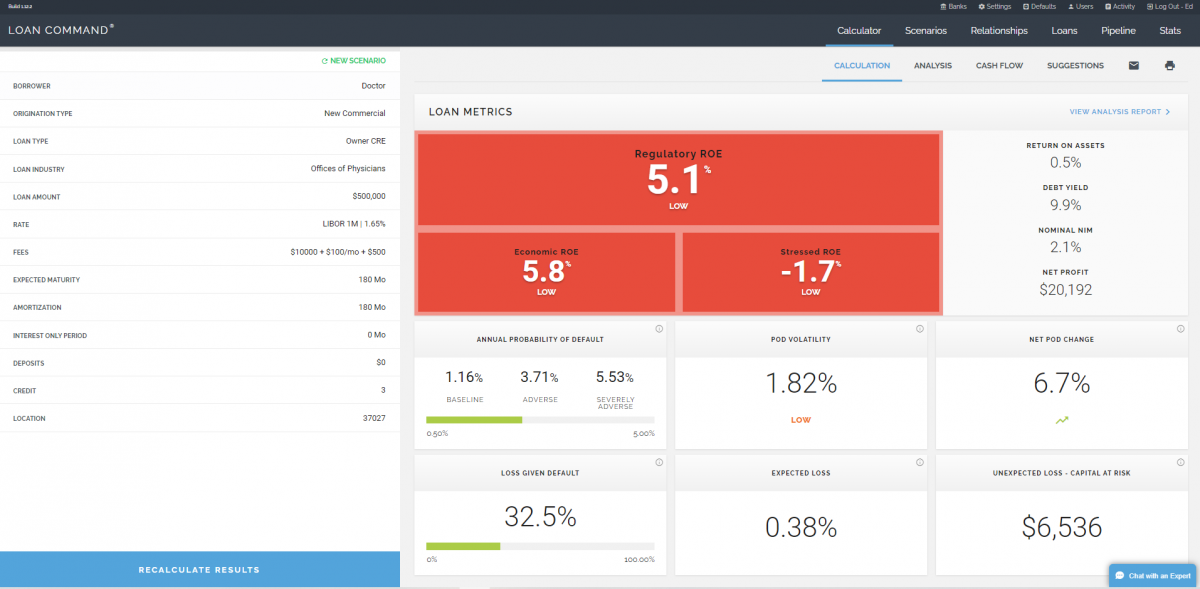

Step Two: The regional bank was offering a 15 year fully amortizing facility through their hedge program. This presents a few benefits to the bank and borrower:

- Generates $10k in upfront hedge income for the bank;

- A longer relationship and a longer stream of revenue, thereby increasing the ROE;

- Less probability of customer defection, increasing upsell, and cross-sell opportunities.

If the banker used the same structuring and pricing strategy as the regional bank, the model output appears below and shows a marginally acceptable ROE of 5.1%.

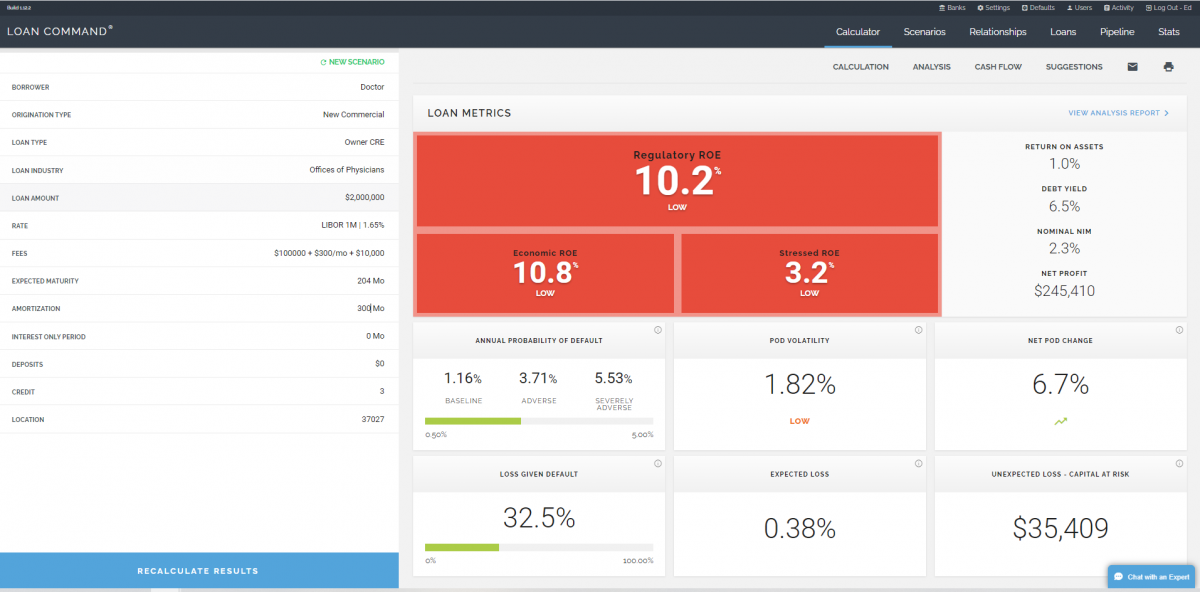

Step Three: The borrower is a 31-year-old doctor and two years out of medical school who will refinance his loan multiple times as his practice grows. Each time the doctor refinances the loan, his credit and banking needs will increase. The bank will use industry statistics for age, type of practice, and geographic location to predict with a high degree of accuracy the potential upsell that the bank can expect for the life of the doctor. The predictive model may be off for each individual doctor, but for a portfolio of credits, the predictive accuracy is high. For this kidney doctor, at age 31, in Nashville, the regional bank anticipates that they can retain the relationship for an average of 17 years and increase loan outstanding by an average of 400% over that period. Considering the average life, loan amount, cross-sell opportunities, and upselling of the credit and deposit products, that relationship is much more valuable, and the loan pricing output is shown below.

The regional bank is pricing an acceptable return on this loan, taking into consideration the upsell and cross-sell opportunities associated with the credit quality, growth potential, and banking needs of the customer.

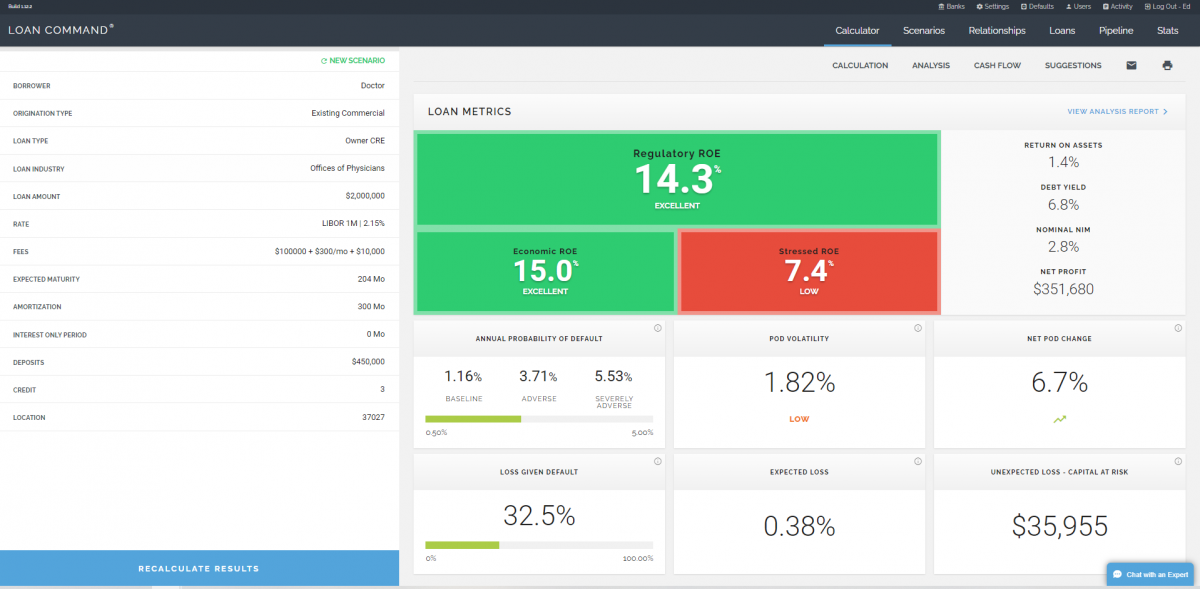

Step Four: There is one final important variable that bankers must not overlook when pricing credit. Winning a piece of banking business in a competitive bid situation is not highly profitable – after all, the winning bank is competing on value, but also on price. But with the correct structure that contains prepayment provisions, switching costs and the understanding and trust developed between lender and borrower, banks can increase pricing in a relationship because every upsell (increase in the borrower’s credit needs) is now evaluated based on the value and service the bank provides instead of a competitive bid situation. In other words, banks may win the business on price but must attempt to gain pricing power by delivering value and service. Increasing the credit spread by 50bps from 1.65% transforms an acceptable return to an excellent return as shown in the output screen below.

Key takeaways

Bankers must be able to quantify the return on capital using all of the levers of pricing (NIM and fee income) for the various products sold. But further, bankers must also be able to look forward to the type of returns that a relationship can garner. A 1.65% credit spread on a $500k loan for investor property might not make sense but to a growing medical practice with substantial cross-sell and upsell opportunities, the teaser rate of 1.65% is a very profitable long-term relationship for the bank.