Why Banks Are Loosening CRE Underwriting Standards During A Pandemic

It may seem counter-intuitive, but many banks are loosening CRE underwriting standards instead of continuing to tighten them. With a new presidential administration, it is likely that we will face more stringent pandemic mitigations in the near future. While this is likely good for public health, it increases the short-term risk for commercial real estate (CRE). Offsetting this risk is the possibility of a vaccine and therapeutics. In prior articles, we discussed how much banks had to tighten their underwriting and increase their reserves at the start of the pandemic to maintain a constant risk level. Now we do the same, but with a slightly different approach. In this article, we back into the required loan-to-value (LTV) and debt service coverage ratio (DSCR) needed to maintain a constant level of risk aligned with bank’s current 1.40% allowance for loan and lease loss (ALLL) reserve level. What we find may surprise you.

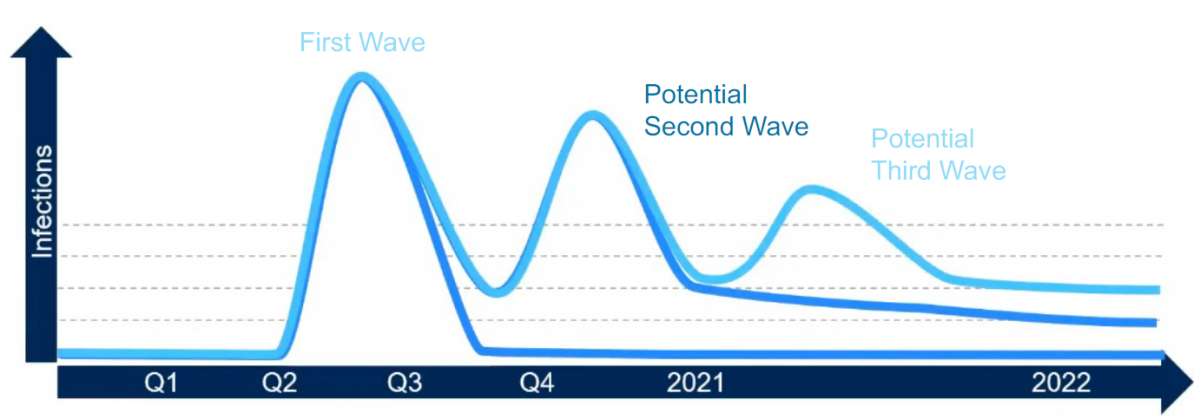

The Second and Third Pandemic Wave

At the start of the pandemic, we predicted that COVID-19 cases would likely come in two, probably three waves (below). It appears now that we are halfway through the front slope of the second wave of COVID-19 cases that will peak during early 2021. We then assumed that while we will get a vaccine by mid-next year, there were will deep confusion over which vaccine to take, its efficacy, and the health risks of the side effects. As such, we project that the US population will be slow to move to an effective vaccine, and the third wave of COVID-19 will impact society, causing yet another round of mask-tightening and social distancing.

As each wave hits, cash flow gets reduced, and credit risk increases for specific CRE subsectors. Hospitality is the easiest to understand. Harder to predict is what happens with office, retail, and even multifamily. Using the above assumptions, we look at what loan-to-value (LTV) and debt service coverage ratios (DSCR) are needed to target a 1.10% expected loss number.

Collateral and Cash Flow Targets

At the start of the pandemic, we didn’t know how bad credit was going to get. As such, banks immediately restricted certain lines of business, such as hospitality, retail, and others. Because of this uncertainty, banks tighten underwriting standards as it had no history of how properties and companies would react during a pandemic.

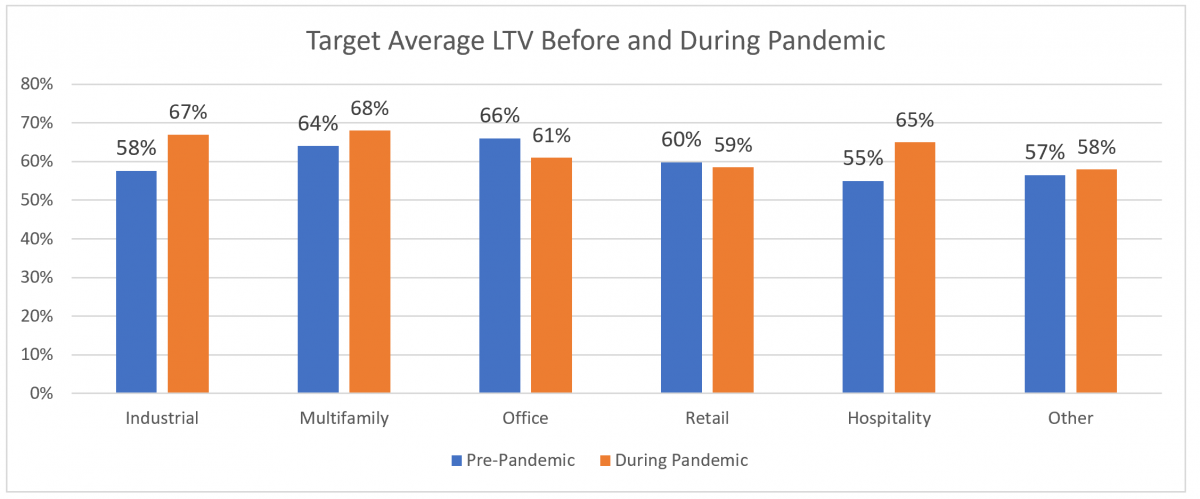

Now, seven months into Covid-19 restrictions, we now have a fair idea of what is happening with credit and could occur in the future. At the start of the pandemic, we required lower LTVs and higher DSCRs to compensate for the risk. Now, for the most part, it is the opposite. Properties and businesses likely have already suffered the worst impact of the pandemic, so the future looks better, or at least equal to the dark, cash flow restricted days of April and May. As such, we can take the current position of many properties and owner-occupied businesses and loosen underwriting standards from where we sit today.

With cash flow already constrained for some properties and industries, collateral valuations are materially down from January levels. As such, the quality of cash flow is deemed higher for most subsectors than it was back at the start of the Pandemic in March.

Here is the breakdown by sector:

Industrial: Industrial investment and owner-occupied businesses have been performing above average and have even improved during the pandemic due to the demand from e-commerce companies, distribution facilities, and data companies. As such, cash flow for this sector has mostly increased from 1Q to 3Q and it has been easy for banks to increase the average LTV ratio and decrease the DSCR.

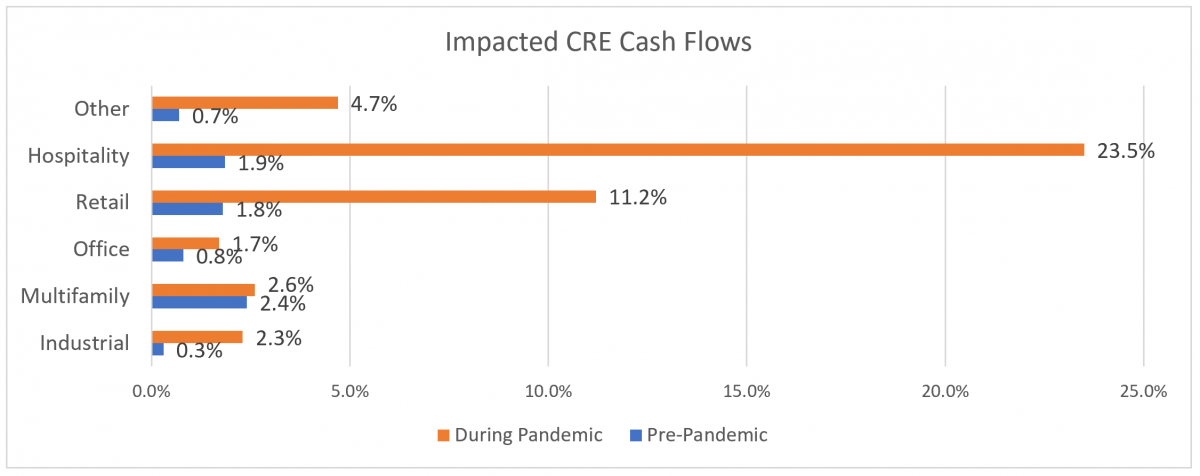

Multifamily: While multifamily has taken a slight hit due to missed rent payments by five to ten percent of tenants, it has held up reasonably well. Impacted cash flows, that is, cash flows that are impacted either due to non-payment for 30 days, in forbearance or restructured, moved from a begin 2.4% to 2.6% as of last month (below). Depending on the tenant mix, it is likely that most properties have suffered their most significantly reduced cash flow and reduced property valuations. While this varies from area to area, likely banks can increase their average LTV and decrease their DSCR (but just slightly). Look for more stimulus and a better outlook by Spring.

Office: Of all the sectors, office gives us the most heartburn. We understand what is happening in hospitality and retail, but office causes us long-run concerns as it is unclear the percentage of tenants that will ultimately not roll over their lease and what that means for area rents. As such, even though impacted cash flows have more than doubled and valuations are off some 15%+ in many areas, this is one sector where banks still need to be cautious. Due to the still-rising probability of defaults and loss given defaults, banks should tighten underwriting, increase ALLL, or a combination of both.

Retail: Unlike office, retail has taken a significant hit in cash flows and valuations. If a retail borrower has made it through to this point and still has sufficient cash flow coverage to meet covenants and underwriting standards it is likely worthly of your bank’s capital commitment. For this sector, banks should hold underwriting steady and still keep their same LTV and DSCR targets. This would keep expected loss rates at about equal to pre-pandemic levels.

Hospitality: While hospitality could get worse, it will likely start to get a little better. The sector hit its low point in July and has improved from there. While the future doesn’t look great, properties that are cash flowing and have new valuations after July are likely undervalued. While these properties are few and far between in this market, should banks find them, underwriting can be loosened up slightly from the third quarter.

Other: Speciality properties can be a mixed bag, so it is always hard to speculate with any accuracy in the future. In general, it is probably too soon to reduce underwriting standards as it remains to be seen how some of these pandemic trends play out. The lack of clarity and greater potential volatility means greater risk ahead. Each bank will have to take their own specialty mix into account. Mobile home, campgrounds, and RV parks are all improving and performing relatively well, while amusement properties have taken a large hit. Each one of these subsectors is an area that underwriting can likely be loosened. Self-storage is holding stable, and underwriting levels can probably be maintained.

Putting This Into Action

CRE has figured out how to outmaneuver the pandemic better than most credit analysts thought. While we are far from out of the woods, likely the biggest underwriting challenge will be for most sectors is how to survive at these reduced levels. Latent stresses will continue to hurt the office sector and maybe multifamily, but most have put the worst behind them and will benefit from pent up demand.

National banks have increased their ALLL reserve levels to around 2%, while community banks have kept theirs relatively low at 1.40%. This is the time to take a sharp look at your portfolio and decide where does your market goes from here. Since the onset of the pandemic, sector risk, volatility, and geographical risk have all increased and are now largely baked into underwriting and pricing. The key to banking success will be to find areas where collateral value and debt service coverage has largely remained intact and then target those borrowers with looser underwriting standards and aggressive pricing.