Why Banks Need To Develop Their Own Customer-Facing Technology

The build or buy decision should be a constant question in most bank’s decision making, and unfortunately, most banks default to the “buy.” In some cases, this is appropriate, but in many, it is not. In this article, we look at the two major overriding reasons of why your bank may want to hire and build out a development team in order to deliver a more customized banking experience to your customers. If you think your bank is too small, then read on.

One Reason To Develop Your Own Customer Interface

The one major reason that is unfortunately overlooked of why you should consider pulling more of your customer-facing technology in-house is that banking is increasingly in the software development business. Your central value proposition is likely about service, and “service” increasingly means handling the customer’s needs via a mobile application.

If your value proposition is going to continue to be about service and you believe that more and more of your customers will access your bank through electronic channels, then it stands to reason that in order to create a differentiated strategy, by definition, your mobile, in particular, needs to be able to execute on that strategy. If you are 100% reliant on your core provider, then your strategy is that of the core provider, which is really no strategy since many other banks will have the same platform.

Looked at another way – if you don’t control your customer technology, then you will be prevented from delivering the service level that makes your bank special. Over time, banks that can deliver their value proposition in a more efficient manner than their competition will win the most customers. This will fuel their growth which will also translate to a higher equity value. Since their equity multiple will be higher than the bank that doesn’t have the customer growth and profitability, they will have a higher probability of acquiring banks that have inferior customer-facing technology. Soon the banks that are not making the appropriate technology investments will be gobbled up both because they have higher operating costs but also because they have slower customer growth.

The Second Biggest Reason To Develop Your Own Technology that Is Almost 100% Overlooked

There is another, more nuanced, reason to develop your own customer-facing technology that is hardly ever discussed and unknown to banks that don’t handle any development. By being able to control your technology, you change the narrative with your customers when it comes to feedback. If you can’t change anything in your software platform, then there is really no discussion to have. There is no use in garnering feedback if you can’t change anything as it will only frustrate both the employees and customers if nothing gets changed after the feedback.

However, if you can make customized changes, then customers will project onto your technology their hopes and dreams in ways you cannot duplicate in a normal focus group. As anyone that has done a technology-driven focus group will attest, customers usually spend the first 30 minutes warming up to the process and being very literal about your technology. After that, most customers will start telling you all about their other problems, hopes, and dreams. You often hear, “what if you could do X,” “could you offer this product,” or, “It would be great if you could do Y.” These moments are gold when it comes to designing a remarkable customer experience and moments that you would miss if you did not use technology as a narrative bridge to the discussion.

But We Are Too Small To Develop Our Own Software

If you think your bank isn’t large enough to hire developers, consider the math. Three full-stack developers will handle most of your basic needs for online banking and mobile app development and would likely cost you around $500k per year depending on what part of the country you are in (to include benefits, incidentals, expenses, etc.).

Now consider that that cost is about half the annual operating cost of your average branch. That branch likely is a differentiating factor for only about 2,500 customers at most. Those three developers can set your bank apart for your entire customer base, both now and in the future.

Parting Thoughts

While your bank may not be able to gain the scale of a large bank in technology, it can still gain operating leverage compared to the current analog processes. There is an infinite number of products and processes that have yet to be converted to a digital delivery. Financial services are still in the very early stages of digital transformation, and now is the time to take action.

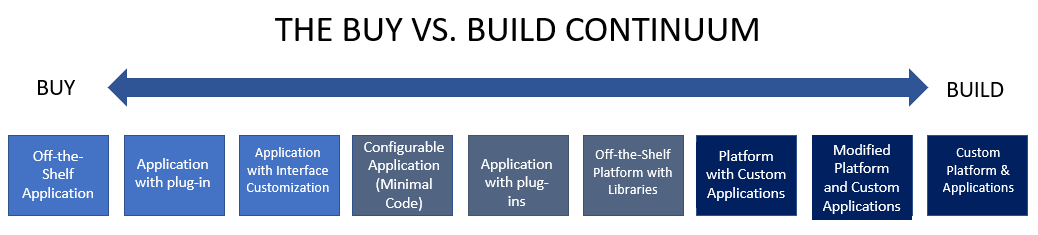

Further, developing a single application or developing a platform to create multiple applications doesn’t have to be developed 100% from scratch. Off-the-shelf platforms can speed development up, particularly if you can take their standard applications and customize it for your needs.

Being able to customize your technology allows you to translate your current customer service, product attributes, marketing and delivery to your customer’s phone, tablet and computer. Being able to make changes to your technology allows you to have a deeper, more meaningful conversation with your customers in order to continually fuel innovation. You obviously don’t have to build all your technology, but having the ability to at least customize the last mile of connection plus having the ability to create supplements to off-the-shelf technology can serve to provide a strategic advantage to your bank that will keep you growing well into the future.