Why Digital Deposit Marketing Should Get More of Your Resources

In the last quarter, the money market world has changed, which has important implications for banks. Not only is it less competition, but the influence that money market funds have on banks is substantial, and so it means less pressure on rates. Less pricing influence means less deposit price sensitivity, which not only means rates are lower for banks, but marketing dollars go much farther. In this article, we look at some structural changes in the market and why now may be one of the best times in history to gather deposits.

The State of Money Market Mutual Funds

A couple of weeks ago, Fidelity Funds announced the liquidation of two of its prime institutional money funds. Early last month, Northern Trust announced the shuttering of its prime institutional money fund. To place these moves in context, both funds are relatively small representing only about 5% of the prime institutional market (and a much smaller percentage of the total money market mutual fund industry) and both funds produced yields below 0.15% compared to some of the competition that is in the 0.35% range, but both fund families are well respected in financial services, and the announcements are likely to portend a broader movement.

Prime funds, as you might recall, have the ability to invest in short-term corporate debt such as commercial paper and has the ability to invest out to about 13 months (but most all funds have a weighted average maturity of under 60 days). Those combinations of attributes are what allows these funds to give banks the most competition when it comes to competing for certificates of deposits and money market funds.

However, in a flat yield curve, a period of relatively high volatility and potential credit stress, prime funds attributes work against them. Smaller funds are susceptible to sudden investor withdrawals, which could put pressure on their liquidity so that they breach regulatory liquidity guidelines – a reportable event. To mitigate this risk, these funds hold more uninvested cash, which in turn hurts performance. At present, prime institutional fund managers are holding a near-record 50%+ of liquidity (on average) compared to the 42% back in the first quarter of 2020.

In addition to market pressures, there is the threat of more money fund regulation, which is further threatening to add to the cost of running these funds. While large asset managers like JP Morgan, Schwab, and Bank of America, have both the capital and the liquidity to deal with these issues, many fund complexes don’t. This all adds up to every fund company rethinking their money market mutual fund products with many either choosing to get out of the business or cut back on marketing since more inflows mean either more costly liquidity or more credit risk exposure at a time when it is a risk-off environment.

It Is Also Tax Time

The discussion of money market mutual fund stress is timely as this week is also the deferred July 15 tax date. While this will have a profound impact on the Treasury’s General Account, money market participants are wondering how much cash could be withdrawn from money funds to support tax payments. Seasoned bankers will tell you where retail accounts normally draw their tax liability for their checking, while corporate taxes are normally drawn from money market funds. This year, we estimate corporations will be withdrawing about $60B from these funds this season. This will result in added pressure on these funds.

What This Means for Your Bank

As money market mutual fund competition recede, these means a couple of things for your bank. For starters monitoring fund closings and advertising to your treasury management customers is a no-brainer action step. Banks can run the ABA numbers to these funds against their historic ACH or wire transactions to know exactly which corporate customers are using funds that are slated to be shut down. A commercial client that has a past history of investing in funds slated to be shut down are highly susceptible to a marketing reminder that your bank is either the perfect “safe haven” to store the excess liquidity until the market comes back or, if you are an aggressive ratepayer, then a pitch about your competitive alternatives.

For that matter, most large commercial customers are likely to have some investment in some money market mutual fund somewhere, and many have not relooked at exactly how bad the returns are at some of these funds. While we are focusing on prime funds here, we point out that many government funds are paying below many banks pay on their commercial interest checking accounts.

Remind your current customers or even your prospective retail and commercial customers of the current risk of these funds are likely to garner substantial deposits.

Advertising Sensitivity – Sense of Purpose

With more eyes on screens, digital advertising for items like “saving money during Covid-19,” “saving more money,” “savings account,” “financial security,” “emergency funds,” “financial planning,” and similar, are growing in popularity. These terms are up 20%+ or more, with many of these terms up more than double from January.

Email opens, and clicks about deposits are up as well. Typically, a basic deposit promotion for a health savings account, retirement, or emergency funds savings might get a 9.5% open rate. Now, that same campaign is getting a 25.5% open rate. Click-thru rates are also up 12% or more.

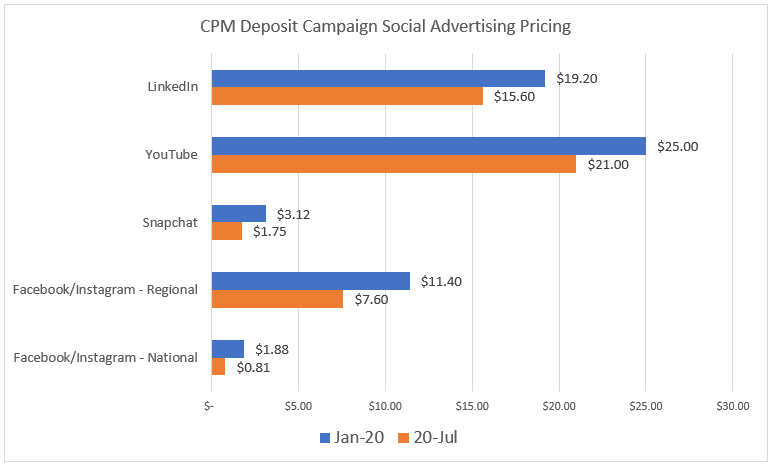

On the other side of the coin is the cost of advertising. While advertising rates have recently come off their lows, they are still down a substantial amount compared to where they were at the start of the year.

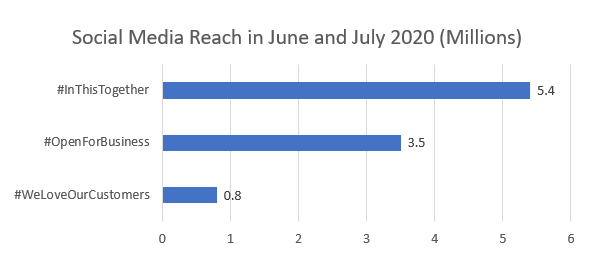

Further helping is the passion and energy around some topics. Run a promotion to support small businesses on social media and use the top related trending tags such as #OpenforBusiness and increase both your reach and engagement. To be clear, not only are these tags popular but all three of the below hashtags, for example, are incredibly positive to help a bank with its brand.

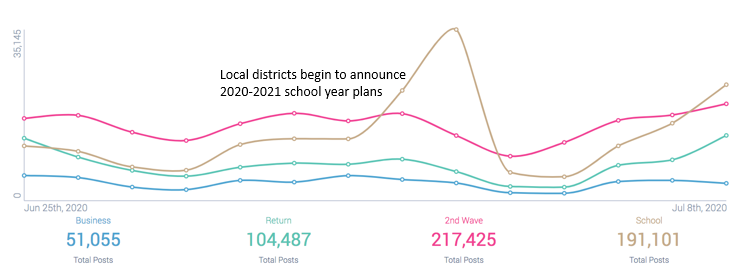

In addition to any deposit promotions around supporting small business, returning to work, the second wave of the pandemic, and reopening, going back to school is a sharply trending topic (below). Banks can tap into the trend. Running a deposit promotion where your bank donates school supplies, Zoom training, or personal protection equipment to teachers is a clear winner.

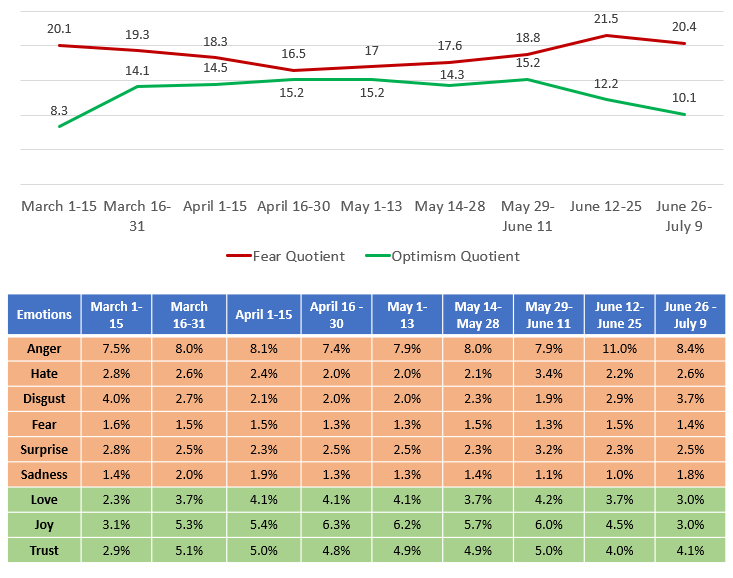

Finally, sentiment on digital channels is back to being sharply polarized as the gap between positive and negative posts have worsened -10.3 on the index (below) or almost a two to one ratio. While not great for the mental well being of the public, for marketers, as long as they are careful, it provides ample fuel for the digital marketing efforts of banks. Banks can amplify positive trends while countering negative trends, all the while extending not only their reach but the passion behind the sentiment. If done, right it is this passion that will hopefully result in more clicks and then more conversions to deposit balances and fees.

Putting This Into Action

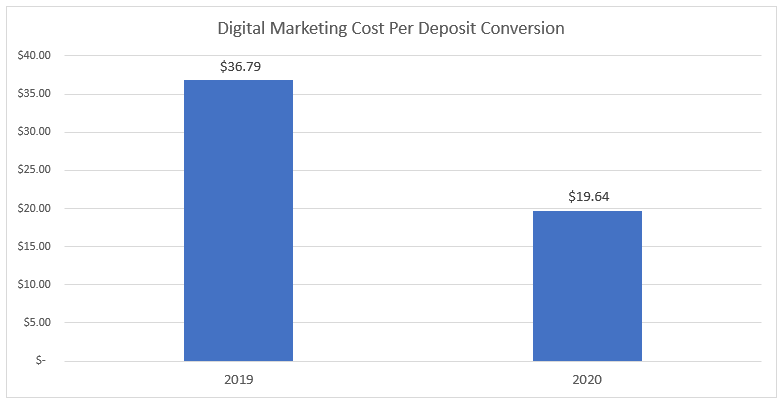

All this adds up to some of the lowest cost-per-deposit-conversion this industry has seen in recent memory. What was an average of $36.79 is now $19.64 (below0, or almost a 50% drop in acquisition costs. Between the problems with money market funds, passion around certain trending topics, or need to engage with brands that align to the individual ore business’ purpose, digital engagement is increasing at a time when costs are relatively low. While your bank may not need deposits now, it will in the future, and the time to grab these customers is now before rates go back up.

Banks may never be in this sweet spot of deposit marketing again, and now is the time to take advantage of this confluence of trends to grow your bank.