Why Its Time For A Hedge Program At Your Bank

Between low-interest rates, the concerning rise in COVID-19 cases, and tough competition for quality commercial loans, community banking is a tough business. While there has been a nominal deterioration in credit quality thus far, a deterioration in the business environment related to the pandemic and lack of fiscal stimulus may change that. Net interest margins at community banks are declining, and the trend is likely to continue through 2021. S&P Global forecasts that community bank NIM will decrease to 3.42% for 2020 from 3.67% actual in 2019. Many community banks are overcoming some of these industry challenges with the strategic use of commercial loan hedging programs. We want to highlight some of the reasons community banks have embraced commercial loan hedging and discuss the strategies these banks use to achieve better financial performance.

Appealing to Basic Human Behavior

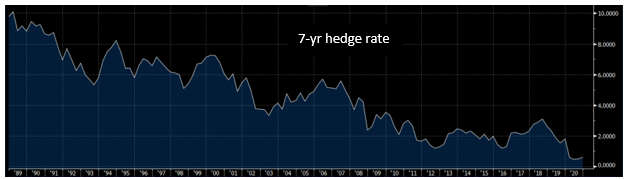

Fear and greed are the two greatest forces that drive human behavior. Fear and greed are the most powerful emotions that drive people to take action. In today’s interest rate environment, community banks can market to these two emotions in a simple way. The graph below shows the seven-year hedge rate from 1987 to the present. This rate represents the cost of funding for a seven-year commercial loan before adding credit spreads. The graph would look similar for ten, 15, or 20-year terms.

Properly positioned, banks can motivate borrowers by both fear and greed to take a longer-term, fixed-rate financing options. Borrowers are fearful that interest rates are more likely to increase in the future from such low levels and are motivated to lock their financing costs today. Borrowers are also greedy in taking as much financing as their businesses will support (and banks will approve). The cost of borrowing after-tax, after inflation, and after deprecation costs results in cash borrowing costs that approach zero percent. This low-interest rate market creates emphatically compelling reasons for borrowers to lock borrowing costs for as long as possible today to both save money and not take a chance should interest rates rise over the next few years and that future refinancing may be more expensive.

Refinancing Threat

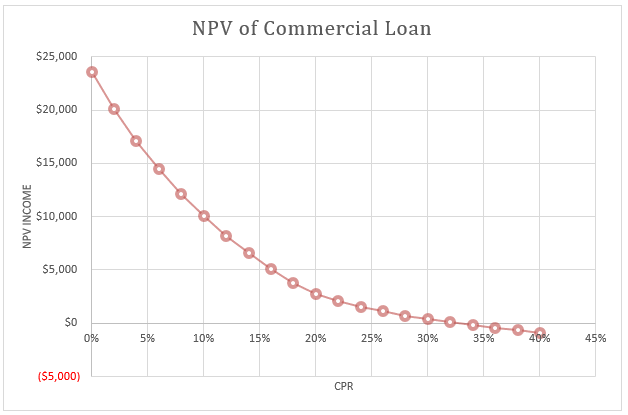

Some bankers point out that a hedging program is not for all commercial customers and that some customers will frequently refinance their debt as they sell or exchange their businesses and real estate portfolios. That is precisely how community banks are taking advantage of hedging programs. Community banks strategically identify borrowers who can use long-term money because studies show that borrowers with short-term borrowing needs are typically not profitable bank customers. The graph below shows the net present value (NPV) of income on a $1mm commercial loan priced at a 3.5% coupon, based on varying prepayment speeds of the loan (using conditional prepayment rates, or CPR). The prepayment speed is akin to the average expected life of that credit facility. What the data shows is that banks earn a much higher return if the loan stays on the balance sheet longer, and the bank can earn more interest income and cross-sell opportunities.

Community banks that use hedge programs are strategically identifying more profitable customers and then applying a platform to match those customers’ needs.

Fee Income

When interest income is challenged, a commercial loan hedging program is a smart way to add non-interest income to a community bank’s business model. Fee income from a commercial loan can be a substantial source of revenue. Last week we saw a community bank earn $51k in hedge fee income on a $2.2mm commercial loan. Further, that hedge fee income can be recognized upfront and does not need to be amortized over the life of the loan for GAAP. Most importantly, the borrower does not pay the fee upfront out-of-pocket, instead, the borrower pays a marginally higher rate for the life of the loan, and the hedge counterparty monetizes that spread to pay the community bank the hedge fee when the loan closes. In a challenging banking environment, any source of non-interest income is a welcome benefit for community banks.

Differentiation is Key

Having the ability to offer five to 20-year fixed-rate lending options is a benefit to almost all community banks, and a hedging program is an easy way to offer such an option for commercial customers. However, one benefit of this option is that it may not be right for all borrowers, and community banks are quick to pivot their product offering to a conventional and non-hedged commercial option if the borrower is better suited to another structure. In other words, even if the hedge alternative is not chosen, just having the option can be a differentiator to help win business. The ability to offer multiple choices thwarts competition from larger banks and government institutions (like Farm Credit). The community bank is still ahead by retaining a customer even if the hedge option is not the right fit in that specific circumstance.

Key Takeaway

We see substantial benefits to community banks incorporating a hedging program for their commercial customers. Especially in today’s challenging business, it is beneficial for community banks to have more options to drive new business, generate more fee income, retain customers longer and offer more creative lending alternatives for their clients.