Why Some Banks Are More Profitable Than Others – The Nonlinear Customer Equation

Why do some banks grind it out and struggle to produce a 9% return on equity (“ROE”), while other banks such as Bank of America and Chase produce 20% plus ROE for the same business segment? One answer is that banks that produce an above-average ROE either have a more profitable customer segment focus, more profitable products, or a more profitable business model. While we have covered the first two in previous blogs, today, we highlight an aspect of a more profitable model known in bank profitability circles as the “non-linear customer equation.”

The Non-Linear Customer Equation

If one customer equals a transaction, then by adding either customers or transactions, revenue increases in linear fashion. This is good, but it is not optimal.

In comparison, by adding customers that are relationship-oriented, marketing them on a proactive basis, and cross-selling them profitable products, customer profitability can grow in an exponential or non-linear fashion. This is highly desirable.

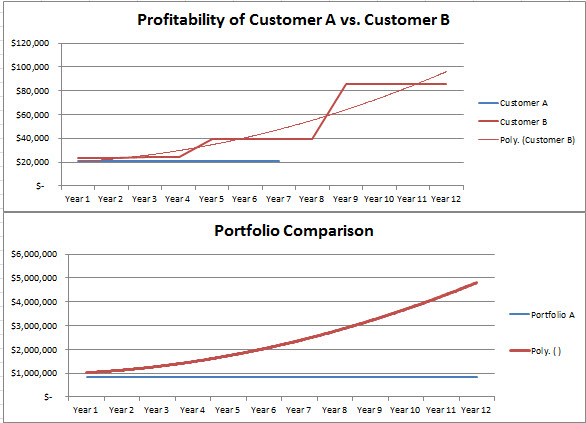

This can be seen graphically in the charts below, where we have taken two commercial customers and charted their profitability. Because profitability tends to grow in stair-step fashion, we have taken the liberty of smoothing the line to better illustrate the exponential growth of Customer B. We then have extrapolated each customer’s profitability and assumed we had 50 of these customers in order to show the dollar difference of what having a customer portfolio composed entirely of one type of customer or another.

In case you think this is a theoretical discussion, consider that almost everyday, banks need to decide on loan pricing. Before you turn down that loan priced at a 2.20% margin, first consider the overall potential profitability.

While not always the case, it turns out that the borrower with the higher net worth and more dynamic business tends to utilize many more products, has more referrals, and have larger loan/deposit balances. As such, while their single loan profitability may be relatively less (as it is compared to Customer B), the larger balances, lower risk, larger deposits, more products, and stay around longer often make up for any loss in margin. In short, that more desirable client is desirable by larger banks because of their potential for non-linear growth. Banks that focus on margin and the transaction are often shortsighted as it relates to lifetime customer profitability.

This makes sense that if you say you are a “relationship bank” but don’t measure your profitability on a relationship basis, then chances are you will act more like a transactional bank.

Getting The Right Products

Of course, banks need to place themselves in a position to target those higher lifetime value customers and then have the products to turn them into profit generators. This is our second takeaway – once banks are focused on customers that can produce non-linear growth, they must make sure they have the cash management and debt products to support that growth.

Putting This Into Action

If you are struggling to produce over a 9% return on equity, look at your customer composition. You may find that your customer portfolio looks a lot like the portfolio made up of customer A-types. If this is true, consider adding resources – marketing and sales – to go after a mix of customers that skews to the higher-value customer.

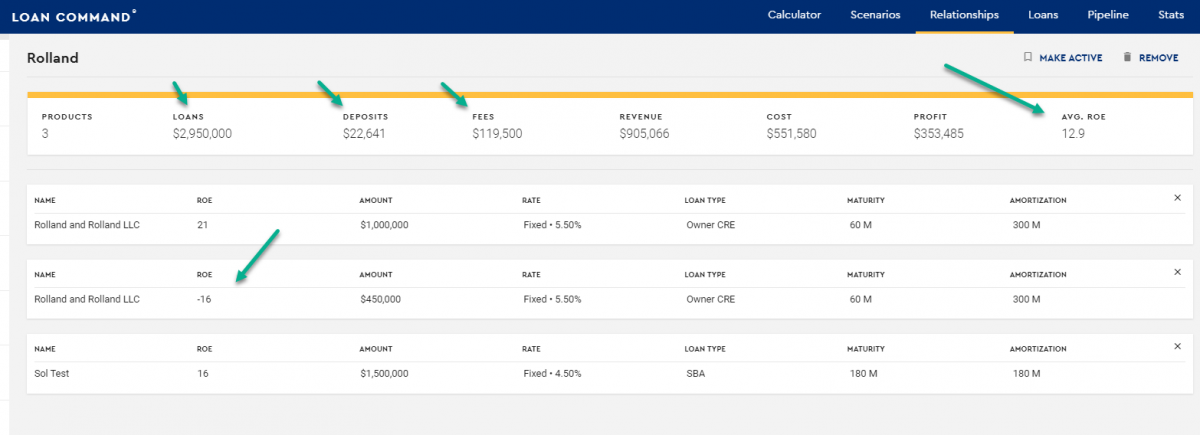

If you want to see how some of your customers look on a risk-adjusted return basis for the entire relationship, try out our Loan Command profitability model for free for 45 days and with no obligation. Run your customers through to get a sense of their profitability. As you can see in the sample below, the total relationship is what matters. While one loan product is a -16% risk-adjusted return, the value of the other loans, deposits, and fees come out to a 13% return – the current relationship target for many banks these days.

You can choose to grind it out but know some of your competitors have their business model refined to produce exponential growth.