Why Your Bank Needs A Digital Lead Gen Strategy

Unfortunately, in 2020, most bank websites are nothing more than brochure-ware. That is a problem as not only can a bank’s website be its most efficient source leads, but it should also be the best source of conversions (leads that turn into new accounts and loans). While there are several hundred banks that do handle online lead gen well, it is even rarer to have a bank generate leads from its mobile app. This is also a problem as some banks are now generating the bulk of their digital leads from mobile, not to mention the bulk of their conversions. In this article, we highlight a case study and talk about some best practices for banks.

The Cost of Generating Leads

As a rule of thumb, through traditional channels, a qualified retail lead costs a banker about $34 dollars, while a qualified commercial lead costs a banker in excess of $515 depending on the product. This is cold calling, list management, branch and calling time in addition to marketing expenses. This is all to find out that a customer has an interest in a product.

Now compare that to digital where an internally generated retail lead costs $7 and a commercial lead about $38 to include content generation, marketing, and management. That significantly cheaper cost structure stems from the fact that not only are digital assets cheaper to produce but also far more leverageable. A profitable branch is likely working about 400 retail and commercial leads at a time, where a good bank website or mobile app is closer to 20,000.

The Bank of America Case Study

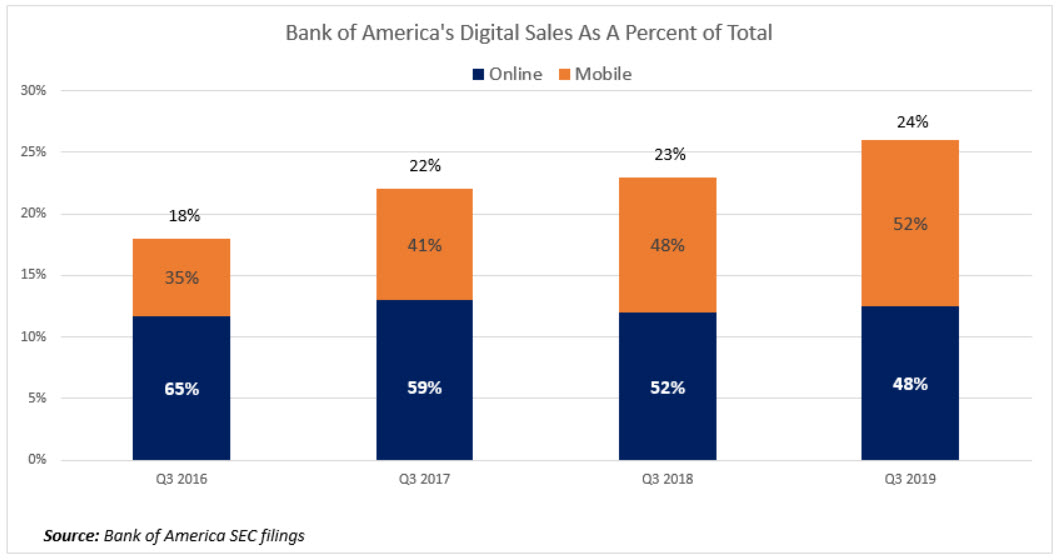

One of the leaders in digital sales for banking is Bank of America (graphic below). In 2019, approximately 24% of its sales came from their digital channels. Of that, 52% came from mobile channels. As more and more customers use mobile banking, it goes to follow that more and more customers will inquire about various products while on the mobile app.

What it Takes To Generate Digital Leads

For starters, it takes customers utilizing your digital assets. If a low percent of your customers are not using online or mobile banking, then that is a bigger problem. To generate leads, you need digital assets that satisfy not the customer base you have now, but the customer base you want in the future. Your easiest product leads come from your existing customers, so you need to find customers that appreciate electronic banking and then provide them a suitable customer experience.

Next, you need engaging digital marketing on your website and mobile platforms. If you look at your website traffic and 95% or more of your traffic comes from customers trying to log in for online banking, then that is an indication that no one cares about your website. Blogs, white papers, case studies, calculators, checklists, quizzes, and similar all serve to engage the potential customer. Increase traffic to your online and mobile channels, and the hard part is done.

Third, you need to have some basic technology to handle a sales funnel. This starts with a compelling call to action such as “click here to find out more” and ends with a successful onboarding of the customer. In between, you should have the ability to follow up with the customer, provide the customer with more information, track the customer’s level of interest, and close the sales. The more automated you can make the process, the better without hurting effectiveness.

For some banks, this is nothing more than an online/mobile form that alerts the banker that then generates a call. For more sophisticated banks, it is an automated process that includes additional electronic content, interactive emails/text, auto-scheduling, and personal follow-up. No matter what the process the goal is to be getting your digital assets to be working for you 24/7 a day.

Your people are your most valuable asset so it makes sense to get them focused on closing qualified leads instead of spending their time on less productive activities such as cold calling and list management. Relook at your website, and mobile properties and make sure you have a steady stream of offers and content plus the process to capture and manage interest, and you should be able to increase your new account opening percentage as well as your loan interest. Taking your sites from brochure-ware to a lead generating machine is likely one of the best investments you can make for your bank in 2020.