Your Bank Probably Has Loan Size and Risk Wrong

If you are like most banks you have your credit approval and risk process based around loan size. The assumption is that the larger the loan the more risk the bank is taking on so a greater level of risk review is needed. But, suppose the data didn’t bear that assumption out? If that assumption is wrong, then that means that your bank is probably underpricing the smaller loans, overpricing the larger loans, applying the wrong cost structure to the larger loans and misaligning risk against your capital. In this article, we present the data and a counterintuitive view of risk and reward.

The Data

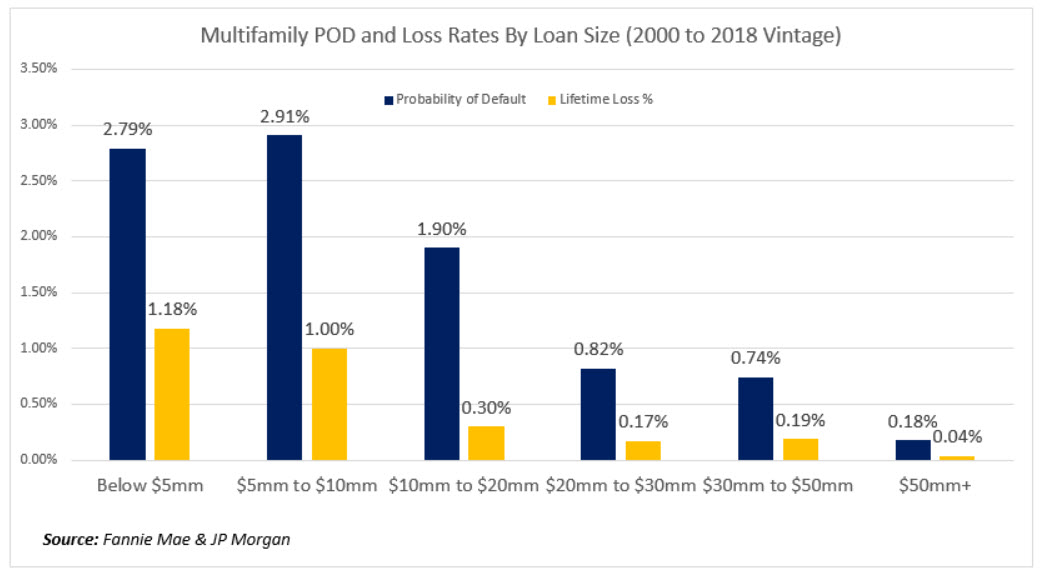

While multiple loan types exhibit the inverse correlation between loan size and default rate, multifamily is probably the best example of this trend. We take a look at Fannie Mae’s multifamily portfolio and can see that when loan size is below $10mm, the probability of default is around 2.85%. However, as loan size gets larger both the probability of default drops as does the actual loss history. For example, a $25mm loan is more than 3.5x less likely to have a payment late more than 90 days (our definition of default).

While additional due diligence and risk oversight might explain some of this, it is a minimal part as the additional due diligence resources for a $15mm multifamily loan in FNMA’s portfolio and a $30mm loan is mostly immaterial to the outcomes.

Larger projects tend to be sponsored by developers with more capital, experience, and access to talent, all of which serve to mitigate risk. More substantial projects also tend to allow the property owner to better control supply in a given area thus being better able to control rents, occupancy and thus cash flow.

The Model

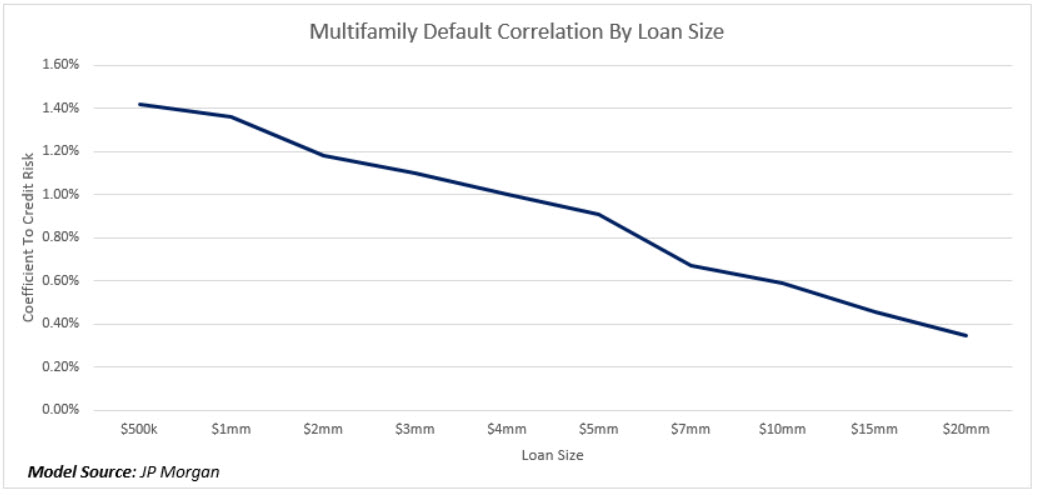

If you turn the more granular form of data into a model, you can correlate loan size and defaults together. What the model says is that below $4mm in size, a loan is more correlated to defaults and above $4mm, a loan is less likely to go into default.

In other words, the data over the past eight years indicates the opposite of what most bankers know and build their loan processes around. This relationship also helps explain the fact that in addition to larger loans being more efficient and less costly on the margin to underwrite, they also have a lower probability of default, all of which help explain tighter pricing.

Putting This Data and Model Into Action

While this data may or may not be pertinent to your underwriting, customer type, geography, and production, all things being equal, it probably is. If it is, we would say that it is perhaps better to relook at your underwriting, risk management practices and pricing with an eye towards basing your risk/underwriting, not around loan size, but around something correctly correlated to actual losses such as debt service coverage.