10 Resource Saving Tactics While Finalizing PPPFA Workflow

This week is the first week banks could potentially take Paycheck Protection Program Forgiveness applications. However, most banks are holding off as we do not have a final application, due out this week. WHEN you release your process merits some analysis, and in this article, we discuss 10 important considerations to decide on as you finalize your process.

When to Start Your Process

This one is a tricky one as you need to first determine the flexibility of your process. The more flexible you are, the sooner you can release, start taking applications, and the sooner you can spread the workload. For banks that are creating their own automation, this becomes a bit trickier as the longer you wait, it is likely that your customer experience will be better and your process more efficient. While most banks were targeting the release for July 1, in line with Form 941 availability, now many banks are thinking mid-July as that is that appears to be the balance between speed to market and getting the process flow refined. This is especially true, considering we have not seen the final process or application. When the Paycheck Protection Program Flexibility Act was signed into law, a majority of small businesses opted for the 24-week Covered Period as opposed to the eight-week period. This longer period is providing banks more time to refine their PPP Forgiveness process.

Finalizing the Variance

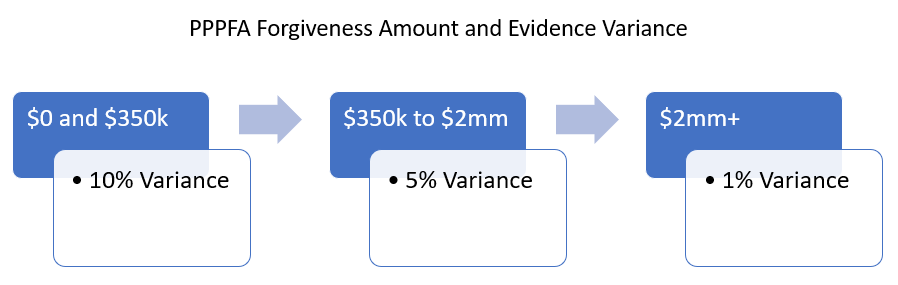

Perhaps one of the more quantitative questions to finalize for banks is deciding on the variance of submitted forgiveness amount compared to supportable evidence. If a customer claims (and certifies) a forgiveness amount of $115,000, but your bankers could only support $112,500, what happens? Do you spend resources going back and forth with the customer? Accept the customer’s higher amount? Just submit the lower amount?

The answer lies in the cost and level of required resources, the time that you estimate it will take you for a resolution, and the need to have the forgiveness application supported (or the probability of an SBA audit depending on how you want to view it). For most banks, if they do the math, they come up with a chart like the below:

If you don’t install a variance, then count on spending an addition 45 minutes per application on 30% of your total applications. For that matter, banks may want to establish different review processes depending on the size of the loan. Deciding where to spend your resources – loan size, complexity, or risk can help efficiency and speed the process along. As you determine categories of review, it then becomes easy to have a variance built into each workflow.

Before we leave this point, banks also need to document, and time stamp, this variance in case a future audit does occur. This should be built into a bank’s process.

Time Stamp For A Complete Application

Some banks we have spoken with are overlooking creating a timestamp for all completed applications. While most banks time stamp when the application is handed in, many banks are not time stamping when the bank deems the application complete. This is critical because it is this completed application that starts the 60-day SBA clock for processing.

Forgiveness Denial Documentation

While an adverse action notice is not required for the forgiveness process, it has become the best practice to notify the customer, have a dispute resolution workflow and be able to document the activity. As we get close to the release of the forgiveness process, banks are focusing their energy here to make sure they have this critical piece right.

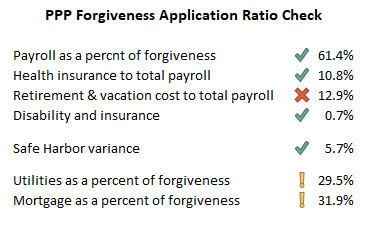

Ratio Analysis

Given that a bank likely has to go through so many applications during what essentially amounts to three waves (See our revised PPPFA Staffing Model), being able to look at ratios of specific metrics can help with determining outliers, detect fraud and better allocate review resources. Below are some of the more popular ones that can help the bank determine where to allocate resources.

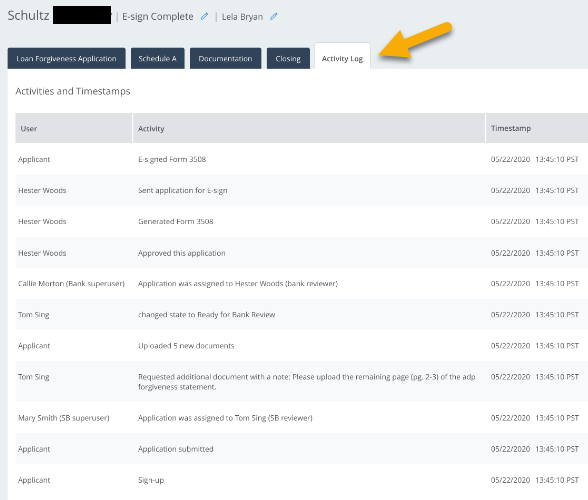

Quality Assurance Review and Audit Log

Speaking of audit, since the forgiveness process is more complicated than the origination process, banks should prepare to document some level of activity associated with the application process in order to support continuous process improvement as well as reduce risk. When the application is accepted, complete, reviewed, approved by the bank, documented, approved by the SBA, and boarded are the bare minimum of activity that should be recorded. Many banks are going far beyond that and recording when documents are obtained, conversations with the customer, internal review, and more (example below).

For that matter, banks should decide ahead of time what loans get a second review. Does a second review analyze the complete application or just check work? Deciding who will do a second review, what that process looks like, and how this secondary review process is documented, are all questions banks should decide now. Many banks are choosing to have a second review of all loans over $2mm to include an analysis of the “necessity of the loan.” Other banks are doing amounts over $1mm, and sill other banks are doing $2mm loans plus complex loans.

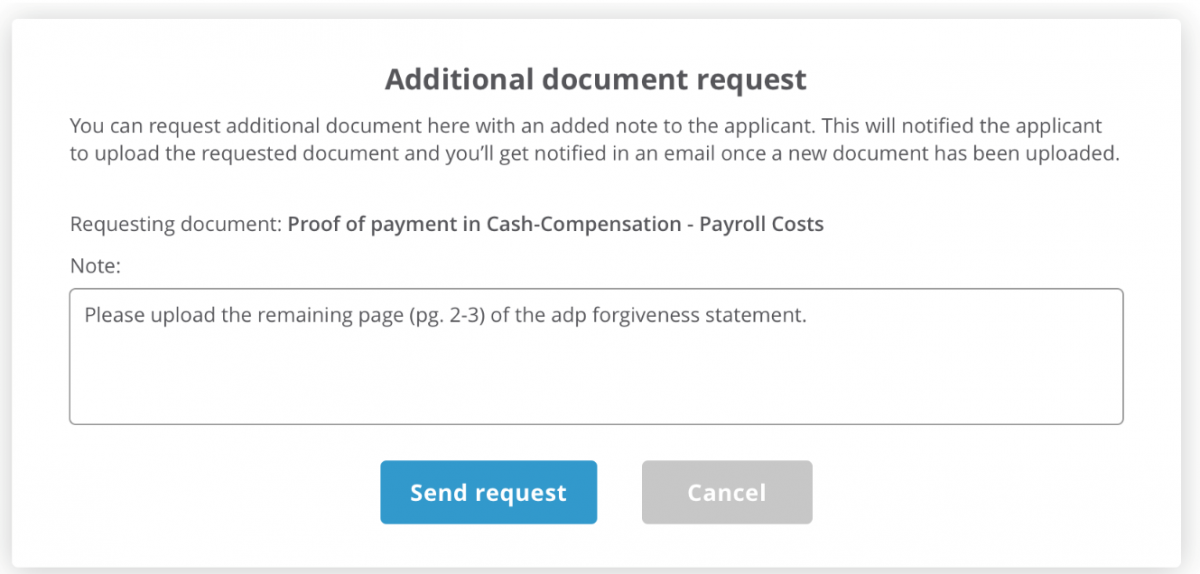

Finally, banks need to decide how to capture customer communication. Will all customer communication take place on the technology platform (see example below), through emails of each relationship manager, emails of PPP reviewers, through a centralized email, or via phone/text? Being able to monitor and capture customer communication for audit and quality assurance purposes could be helpful.

Accountability and Process Ownership

While seemingly a minor point, because the PPP Forgiveness process is so complicated and will now go on for more than a year, banks need to be crystal clear on who owns the process and how often the process is reviewed for improvement. Some banks are doing this weekly, while others are doing this monthly. The PPP process, in general, falls somewhere with the SBA group, credit, loan documentation, senior management, compliance, project management, and lending. During PPP origination, many bank problems arose because they were not clear on who was running the process, how decisions got made, and who is ultimately accountable.

Establishing accountability and a process review cadence upfront can help the bank quickly solve problems at a faster rate than without a formalized process.

Marketing and Ancillary Schedules

By now, hopefully, you are well into your PPP Forgiveness marketing plan and keeping customers updated as to all the changes that are taking place. Some banks are creating additional calculators and schedule to distribute now to speed approval. For example, for PPP borrowers with more than two properties, banks are asking the borrower to complete a schedule to list each mortgage/lease and then include the starting date, term, the current applicable rent/interest payment, applicable payment adjustments, and the percent used for the business. This will save bankers a material amount of time instead of having to dig through each mortgage/lease and try to determine the cost of living escalators, terms, plus figuring out if 100% of the property is used for the business.

Banks are also creating additional schedules for utility payments as well.

Document and Process Organization

While most banks are organizing their workflows around PPP forgiveness sections, such as all payroll documents in one section, mortgage/lease document reviews in another, other banks are organizing by monthly cash flow. The advantage to the later is the more efficient ability to tie back to financial system reporting. For example, using this structure, a bank could reconcile April payments vs. reconciling payroll for all 24 weeks. There is no right answer here, but our point is that just because the PPP forgiveness application is organized by section, doesn’t mean that is how a bank should review.

Whatever method is chosen, the next two weeks are likely the time to finalize the structure.

Reporting

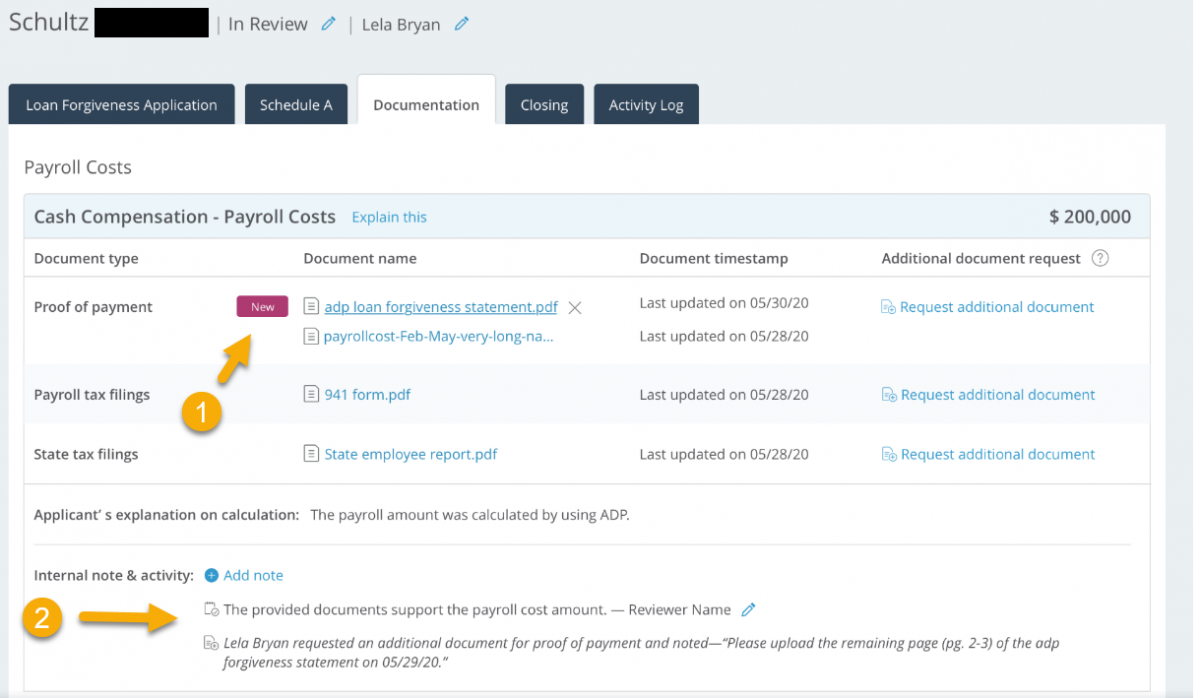

Many banks are nearing the completion of the process and finalizing what reports and metrics are needed to be tracked. Obviously, reporting around stage management is required, but what about some of the other items that could help workflow. For example, how will reviewers get noticed of corrected applications or new documents submitted? Good technology will flag new information (Item #1 below), alert the reviewer, and then allow for a report created of all new applications that need to be reviewed because of new information.

In addition, it is helpful for someone to review a report of the notes of problem applications (Item #2 above) so that marketing departments can understand how to better message customers to reduce problem applications.

Management and processors should finalize this week what reports will be needed and when so that they can be ready to roll those capabilities out in the next month.

Putting This Into Action

As we get closer, banks are scrambling to put the finishing touches on their process and platforms. After talking to thousands of customers, hundreds of banks, and more than two dozen industry experts, we have partnered with SmartBiz to create a platform that all banks can leverage. If you would like to learn more, contact your CenterState Bank business development officer or sign up to get the details and register to view a demo.