5 Skills We Learned In a Recent Remote Selling and Coaching Training

In a recent training, the recording of which is below, our Bank participated in an intro class on how to get better at remote selling and coaching put on by Jack Hubbard of St. Meyer & Hubbard. Given the pandemic and the fact that we believe remote selling is here to stay, we found it was a critical gap in our selling skill set that we wanted to fill. This training stepped us through the technical aspects of getting your sound and lighting right (Skill 1) as well as providing us some tips that are dramatically overlooked. In this article, we highlight some of these tips as well as make the training available to our readers.

Why Remote Selling Is Different

When you are in person, you can command a room. You can modulate your voice, you can physically position your body to underscore points such as moving around a room or leaning in, and you can make gestures that attract attention. With remote selling, you don’t have that luxury. However, what you do have is the ability to better manage the process and to command the room in a different manner. To compensate, Jack teaches us to use important engagement techniques.

Structuring Your Presentations – Telling Stories

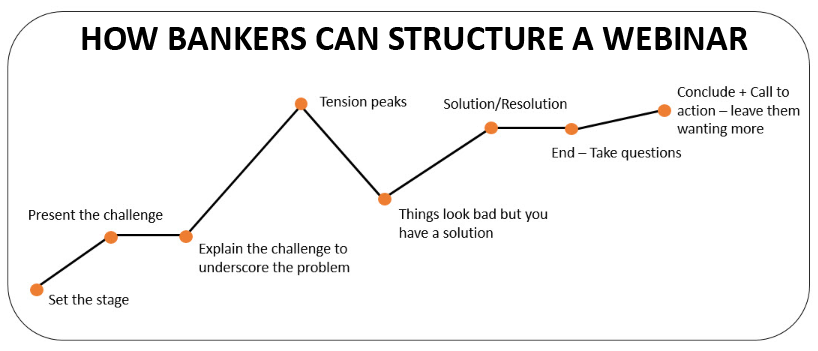

Next to audio and lighting, Jack teaches bankers not only how to tell stories but how to tell stories within a story. For example, based on Jack’s teachings, we often try to plan out a borrower presentation beforehand and use the standard story arc that we have become used to from movies and books. This looks something like the below where we might highlight a challenge for a small business and how our expertise, network, and capital can help them.

One key aspect here is that we like to present the solution, take questions, and THEN conclude. This allows us to conclude with a big finish and with the sentiment that with our partnership, we can achieve great things together. Contrasts that with where you conclude, take questions, and have a flat finish.

Better Than Note Taking

The third major way that St. Meyer & Hubbard has improved our approach is the next level of note-taking. We use an automated note-taking program (Outter.ai) that not only takes notes during our calls but improves with every minute of use. Further, at Jack’s urging, we also ask permission and then record our webinar calls with customers and potential customers. The note-taking gives us a rough transcription of the call, and we can go back over the recording during the sales call debrief to see if we missed any tone shifts or sentiment changes.

This method gives us a highly efficient way to then produce a very accurate call summary to reflect back to the customer and one that gets loaded into our CRM system in order to be able to pass the meeting information on to the rest of the account team.

If that isn’t revolutionary enough, we can then use the recording to have our management, team members, and St. Meyer & Hubbard review and help us improve our calls. Given the complete transcript with time notations on it (automatically generated), sales coaches can just focus on key parts with near-perfect fidelity. From a sales coaching perspective, this approach is vastly more efficient and almost as effective as being on the call in-person. Instead of two or three sales calls per day, the coach can review 10+ calls in a day.

Whiteboarding

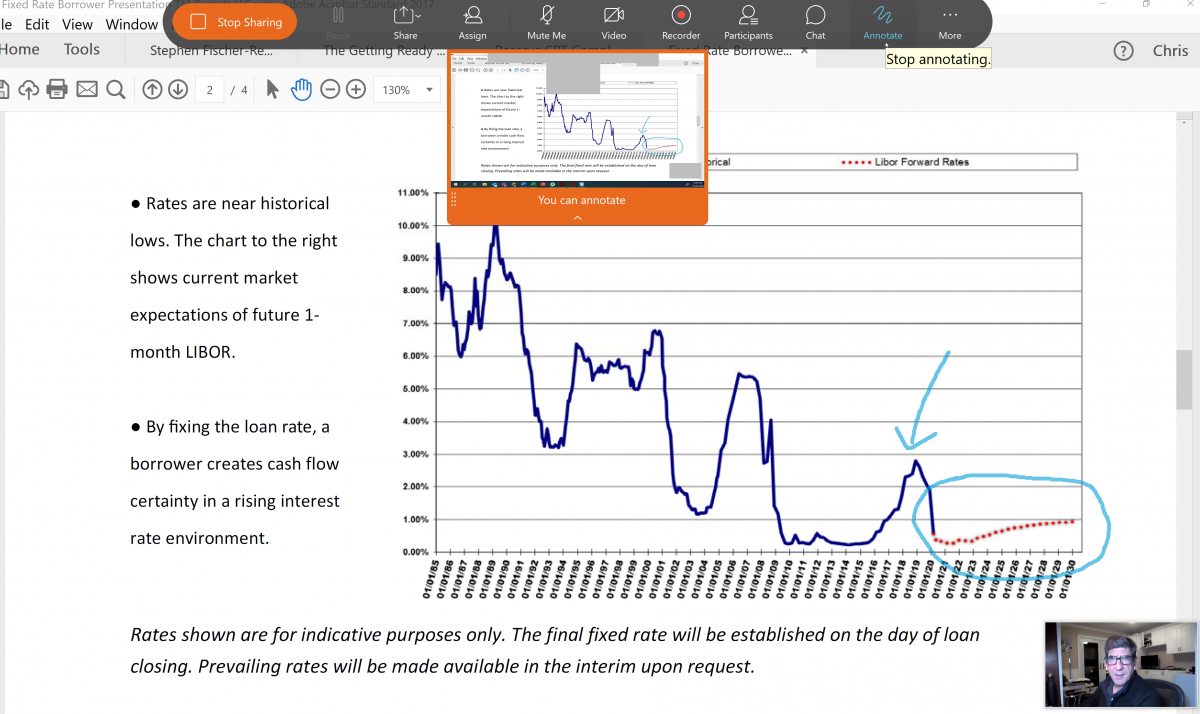

The fourth major lesson we learned was to make greater use of the whiteboard feature on Zoom/WebEx. It is difficult not to be engaged when someone is drawing something in real-time right in front of you, so we often encourage frequent use of whiteboarding or annotating term sheets, graphs or numbers to make the boring more exciting. One of our favorite and most common moves are to provide a graph of the history of fixed-rates, show what the forward curve says, and then highlight the fact (below) that our current rate environment could be the perfect time to refinance their loan into a longer-term fixed-rate structure.

This move is not only engaging but allows the customer to gain perspective on the history of rates much better than if you said – “rates are low.”

Delivering Value At Every Turn

Like us, Jack is a big fan of content marketing. While we are active users of content for marketing in order to generate leads or move prospects through the funnel, Jack has encouraged us to use content more in both setting the meeting and in the follow-up. Economic information about a particular community or city, for example, is often hard to find, but since community banks are plugged into the state and local universities, they often have ready access.

While business owners might be focused on their industry and pay attention to general economic trends, they might not pay attention to interest rates or more regional economic data. Bankers can use these interest rate or regional economic reports as either a piece of content to set up a virtual meeting or as a follow-up to a meeting.

You can deliver the meeting notes and follow up right after, but then surprise the customer or prospect with an economic report a couple of weeks later as a way to create an additional touchpoint.

An Avalance of Other Advice

Below is the webinar recording that is just the tip of the proverbial iceberg. As Jack points out, professional education has taken a turn for the better in the pandemic age as now we can shift when we listen to classes and spread them out in order to pay maximum attention. Pre-pandemic, our administrative cost was greater as we traveled around teaching our teams for eight hours a day. That is a lot for even the most hardened professional to pay attention and retain the information. Now, bankers don’t have to give up a day and spread lectures out for one to two hours a day.

For many more tips, including one of our favorites, “Turkey Feathering,” listen to Jack below and improve how you sell remotely as well as how you coach.