5 Steps to Deliver Customer Value in Banking

The crucial factor in delivering value to your shareholders is first delivering value to your customers. Most community banks understand that simply delivering lower price or looser credit standards can deliver value to customers, but over the long-term it dilutes value to shareholders. However, the empirical data shows that the majority of banks fall into the trap of competing on price and credit structure, and neither of these competitive attributes is aligned with long-term bank success. Why is there such a disconnect between many bankers stated objective of competing on delivering value and the reality of competing on price or credit structure? One reason is that while management and employees would like to offer better value to their customers, few banks are doing the required research, the planning, and the execution to define what constitutes value for their customers and differentiating their service or their brand. We believe that delivering value to your customers is key to banking success. In this article, we will outline how to think about your bank’s services and attributes that deliver value to your customer without sacrificing price or credit quality.

What is Customer Value

The value of banking services to a customer can be calculated using a simple formula: Customer Value = Perceived Benefits – Perceived Costs. Perceived benefits include factors like quality, service, brand, and functionality. Perceived costs include the price paid, plus time and effort expended.

Why Customer Value Matters

We believe that extracting value from customers is a long-term formula for failure. But adding value to customers through your bank services creates satisfaction and repeat business and results in more business with more clients and it also increases employe satisfaction at the bank. The question for community banks is how to understand which customers can benefit from your value creation, what value these customers prioritize, and how to develop, measure and encourage the delivery of these superior values from your employees. Community banks have rigorous methods, systems, and committees to measure cash flow, net interest margin, and credit analysis, but most community banks do not spend the same resources in understanding and measuring customer value and satisfaction.

Competition creates customer expectations and the benchmark for value. Customers that have experienced superior value delivery from other banks or other businesses expect to receive the same level of value from your bank. Our job as community bankers is to exceed the industry-average value creation.

Steps to Implementing Superior Value

Superior value creation takes substantial planning, resources, thorough analysis, and an iterative process (constantly improving strategy).

The five steps to implementing superior value are outlined below:

- Identify desired results. Management must tie value to a quantifiable output. Customer value must translate to any of the following: reduced costs for the client, higher flexibility, increased market share for the client, reduced friction costs, or other defined attributes. It could also be a combination of outputs. Any desired value result (subject or objective) must be measurable.

- Segment your current and potential customers. Customer value creation is a finite and scarce resource, and a bank should not aim to provide higher value for all customers and prospects evenly. If, for example, the bank’s desired goal is to increase customer value through flexibility, then that attribute should be emphasized to clients that need such value and are willing to pay for this value. To segment customers and prospects, management must understand current profitability, capital costs, growth potential, and the bank’s product capabilities. Providing value attributes uniformly for all clients and prospects squanders resources and reduces bank profitability.

- Survey customers and potential customers. This step in the process is not as easy as it sounds and is fraught with countless obstacles and pitfalls. Luckily, much has been written about this topic and good marketers in banking or consultants can add substantial value here. Superior value is different for different client segments, and surveys will identify factors that drive customer satisfaction and determine customers’ priorities. Many organizations fall into the trap of relying exclusively on frontline employee interviews for survey data. Unfortunately, frontline employees introduce a substantial amount of bias. Employees often assume, incorrectly, that customers value certain attributes simply because those attributes have been emphasized by the bank in the past, or because employees find it easy to deliver those attributes. Banks must use multiple other survey methods such as face-to-face interviews, focus groups, mystery shopping, customer panels, email surveys, and comment cards. Surveying should not overlook past, potential, or competitors’ customers, because these customers may be where a bank should focus superior value creation to achieve its goals.

- Measure customers’ and prospects’ value expectations. This step is different from surveys. In surveys the bank listens to customers’ responses and gathers data; in measuring value expectations, the bank is attempting to understand customers’ wants, needs, expectations, and preferences based on industry standards or averages. In this step, the bank is doing a competitive analysis of its ability to create value compared to the industry. Every bank must understand how it is performing relative to competition because that is how customers will perceive your value creation. Value is a relative measure – if the average bank can obtain credit approval to commercial customers in two weeks, then customers will measure your bank against that benchmark.

- Identify your bank’s value attributes. Based on the first four steps, a community bank then needs to identify what value it can create that will attain maximum customer satisfaction at minimum cost. At this stage, a community bank will identify services that it can offer which can be delivered at a lower price, higher perceived value or differentiated from its competitors. We have identified four attributes that community banks may emphasize in providing superior value creation.

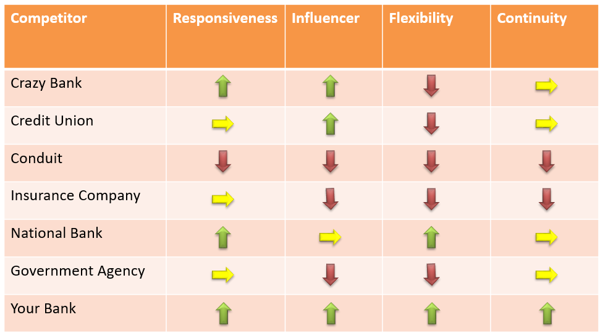

Community banks cannot be all things to all customers because of limited size, time, and resources. We believe that there are four attributes that most community banks can emphasize to effectively differentiate themselves from competitors and deliver superior value. The attributes are shown in the chart below and in our next blog we will describe how each attribute can be used to deliver superior customer value.

Conclusion

To achieve superior performance, community banks must deliver customer value to their clients. Customer value equals perceived benefits minus perceived costs. There are five crucial steps that banks must take to enhance customer value. There are four attributes that most community banks possess that can be used to differentiate their brand and deliver superior value versus their competitors in the market (more about this in our future article).