What Alerts Do For Bank Products

When designing products, choosing vendors or trying to solve usage challenges, understanding the importance of alerts and notifications is critical to success. Alerts are important now and will be even more essential for the modern banker to understand in the future as banking morphs into a collection of mobile apps and wearables. While we have written about what it can do for specific products such as health savings accounts, in this article, we want to talk about the applicability across all products.

Before we continue, it is helpful to define what we mean by alerts. While alerts take many forms, in this post, we are specifically focused on automated notifications to include email, push notifications on mobile or online, text messages, and in-app notifications.

The Balance of Alerts

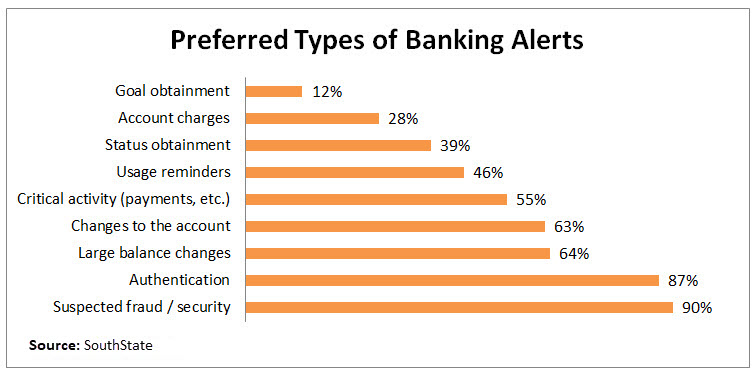

Pull generic data on alerts and you will find the results mixed. Many users when dealing with non-banking applications such as Groupon and others find alerts annoying. However, when it comes to a person’s or company’s finances, our research shows that more than 83% of users not only appreciate an alert but use alerts as a pivot point of engagement that ends up benefiting both the user and the bank. Below is a graphic of just some of the more popular alerts we polled potential customers (retail and commercial) that they said they either use or would like.

There are of course many other types of alerts depending on the product and application. However, the important point here is that since banks occupy a position of trust, we not only have more leeway in staying under the user’s threshold of notification tolerance, but alerts are usually a desirable aspect of the product.

What Alerts Do to Profitability

In most cases we studied, alerts increase the usage of any product. Create alerts for remote deposit capture and usage will increase. For some banking products, such a personal financial management and bill pay, abandonment can be 80% within three months of being introduced to the product.

In general, bank customers that receive notifications are far more engaged than users that are not. In a study by Localytics, alerts resulted in greater retention (above graphic) and 53% more monthly sessions compared to users that don’t have alerts.

Similar to our findings regarding health savings accounts, sending reminders and notifications also result in higher balances when dealing with deposit products.

Putting This into Action

The net result of this research is that alerts equal increased current profitability and greater lifetime value. The next time you are designing a product, map out where alerts fall in the customer journey and what form they will take.

When looking to purchase a new product, be sure to understand the role that alerts play and the level that alerts can be personalized. The more personalized the alerts are (within compliance limits) we found the greater the acceptance and value.

Automated notifications are a relatively new product attribute for many bankers, but one that has far-reaching implications. Experiment within your bank to find out how to best leverage alerts for a given product and it can spell the difference between failure and success.