7 Bank Marketing Tactics Proven to Increase Performance in A Pandemic

Community banks divide into two groups – those that have shifted their digital marketing to encompass the pandemic and those marketing as if it was business as usual. Do you know which type is by far the least common? That’s right, the first. Do you know which type is by far the most successful? Yep – the first. Why more banks are not adapting their marketing to show more empathy and education is a mystery. This article highlights seven tactics culled from quantitative research that banks can copy to boost their success in a pandemic and post-pandemic environment.

The Research

Based on research initially done by ad platform, Sharethough that looked at every digital ad running through their exchange to include more than 70,000 individual ads and 3,000 campaigns, we then spoke with 30+ community banks that altered their advertising during the pandemic and an interesting conclusion emerged – Even a slight acknowledgment of the pandemic improved display and video advertising performance by 55% and 10%, respectively.

Delving deeper, here are the top seven tactics and examples that resulted in marketing lift.

Tactic 7: Expertise

Financial institutions such as Edward Jones and Bank of America used native digital ads to highlight their expert advice in managing money and cash flow during an economic downturn. IBM hit a home run with their “Call for Code Starter Kit” that helped developers at banks, and other corporations leverage the artificial intelligence in Watson and other cloud tools to help with crisis communication, remote education/training, and community collaboration. Banks and other businesses, for example, can leverage “Safe Queue,” an app that could be white-labeled to allow walk-in branch customers to wait outside or in their cars and get notified when its their turn.

The tactic of targeting expertise to solve a pandemic-related problem increased click-through rates by an average of 12% and increased video completion rates by 25%.

Tactic 6: We are Still Open

With many branches and businesses closed during quarantine, advertising that you were still open, in whole or in part, was an extremely simple tactic that ended up increasing click rates by 14% and video-completion rates by 25%.

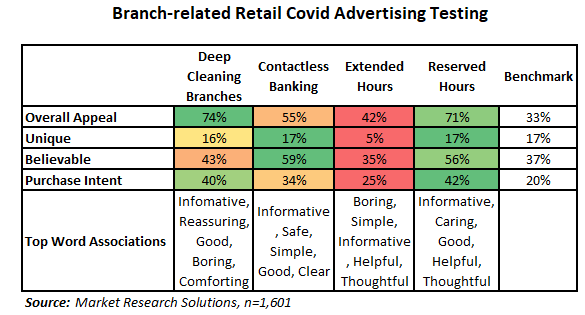

The takeaway here is that almost any advertising helped. While talking about extended hours at retail stores was a dud, promoting deep cleaning, contactless banking and especially having reserved hours scored well in testing (below).

Tactic 5: Sharing Real-Life Stories

Every bank has a testimonial of how it helped a business or retail customer during the pandemic. Why not share it? Paycheck Protection Program (PPP) testimonials abound and are perfect for a video to showcase a bank’s culture, effort, community involvement, and ethos. Foothills Bank did a webinar with one of their clients, Gabby’s Grill to let the public know of the mutual success of originating and receiving a PPP loan.

What does highlighting a real-life pandemic story get you in bank marketing? This tactic results in an average 17% higher click-through rate compared to normal advertising.

Tactic 4: Promoting Corporate Social Responsibility

Highlighting what the bank is doing to help pandemic victims or families impacted by the associated economic downturn usually resulted in not only a tear-jerking video ad but a click-through rate of 29% higher than traditional advertising and a higher than average video-completion rate of 7%.

Tactic 3: Work From Home Products and Services

Showing customers that are forced to work from home how they can benefit from using mobile banking, online ACH, or banker video chat boosted click-through rates by an impressive 53%. Banks can create a separate, curated landing page that speaks specifically of how various banking products can be especially useful to help in saving a trip to the branch. While many banks did highlight these services, most did not put a clear pandemic spin on the marketing.

Tactic 2: Using Empathetic Headlines

Creating a more sensitive headline or sub-headline allowed companies of all shapes and sizes to better connect to struggling businesses and households. While thanking essential workers and marketing “we are all in this together” was OK, some real successful headlines proved to be: “We are not going to let you fail,” “Tough times don’t last, tough people do,” and “It will take more than a pandemic to keep us from helping you.”

By using direct, empathetic headlines, advertisers increased click-through rates by 156% and video-completion rates by 149% above average.

Tactic 1: Content That Will Improve Life

Providing content on how to improve the probability of getting a loan, improving your work-from-home life, or coping with the downturn all prove to increase clicks. During the pandemic, particularly during the start, it seemed everyone was looking for quality content to help make sense of what is happening. This tactic improved click-through rates by an astonishing 363% above average, and potential customers and customers had more free time and were more apt to invest the time to learn something new. Currently, this tactic is working now more than ever as households and businesses are hungry to learn about PPP forgiveness, the next round of PPP origination, how the vaccine will impact business during the back-half of 2021, and what is ahead for the economy are all content areas that will likely triple your normal downloads and clicks.

Putting This into Action

The common theme among each of these potent bank marketing tactics is showing relevance and empathy. The most successful bank brands are getting creative in coming up with ways to resonate with their communities in these challenging times. The performance data leads to the conclusion that community banks should be advertising and advertising with a clear and empathetic message. Banks that will do will likely jump their return on marketing investments, lower their customer acquisition costs and emerge from this crisis stronger than when they went into it.