8 Takeaways From JPM’s Shareholder Letter

While we look at many annual reports, the two CEO missives that we never miss are Berkshire Hathaway’s and JP Morgan Chase’s (JPM) shareholder letter. We feel that as community bankers, we can learn much from Jamie Dimon (Chairman and CEO of JPM) and from Warren Buffet. Recently, JP Morgan Chase released its 64-page 2021 shareholder letter and 340-page annual report. As usual, it was full of insight that every community banker should consider. We do not opine or care so much about JPM-specific performance and leave that to the equity analysts. Our focus is on information that pertains to the community banking industry.

1) The Fed May Hike More Than Expected

JPM’s shareholder letter had 21 mentions of inflation and inflationary pressures. Jamie Dimon believes that the Fed may hike rates more than the market expects and has indicated that the strongest inflation in 40 years may prompt officials to rethink the pace of the hiking cycle. He also stated that the Fed’s move from quantitative easing to quantitative tightening will trigger a significant change in the flow of funds, which drain liquidity from banks.

2) Leadership Matters

America is facing challenges at every turn: “a pandemic, unprecedented government actions, a strong recovery after a sharp, deep global recession, a highly polarized U.S. election, high inflation, a war in Ukraine, and economic sanctions against Russia.” These exceptional global challenges require problem-solving by strong American leaders. However, because of dysfunctional politics, we have prevented our best, brightest, and most talented to want to work in government.

3) Community Focused

Despite JPM enormous size ($3.7T in assets and almost $500B market cap), Dimon emphasizes in multiple ways that the bank’s focus is on the communities in which it operates. The bank aims to be a responsible citizen at the local level in every community where it lends and takes deposits. He goes on to say that Americans have lost trust in the ability of large institutions like the federal government, national media, and big banks to understand or care about their needs. JPM is using local branches to meet the needs of the community. The bank is emphasizing its services to people who live and work in the local communities – the bank hires locally so that people who work at JPM care about servicing their neighbors.

4) Employee Focused

In almost every JPM’s shareholder letter, people are emphasized. The basis of JPM’s success is clearly its people in Dimon’s eyes. They are the ones that serve customers and communities, build the technology, make strategic decisions, manage the risks, determine investments and drive innovation. Dimon points out that the bank’s employees are its most valuable asset and that asset does not appear on the balance sheet. The bank spends $39B in compensation and benefits on 270,000+ employees, and about $1.5B is directed to medical costs for employees and their families.

5) Pandemic Changes

Dimon believes that the pandemic for the most part accelerated ongoing trends. While working from home will become more permanent in business, for JPM about 50% of the employees will work at a company location full time. This includes retail bank branches, check processers, vaults, sales and trading, critical operations and facilities, security, medical, management, and many others. Approximately 40% of employees will work using a hybrid model, and this flexibility will vary by job type. The remaining 10% may work full-time from home in very specific roles. This flexibility will decrease the need for office space for many businesses.

6) Commercial Banking Profit Drivers in JPM’s Shareholder Letter

Total 2021 bank revenue was $122B, and loans outstanding were just over $1T. Much of the JPM’s business lines do not compete with the community bank’s business model, however, JPM’s middle market banking and commercial real estate banking (part of the commercial banking business) compete squarely with community banks. Middle market banking covers small and midsized companies, local governments, and nonprofit clients – this should sound familiar to community bankers. Commercial real estate banking covers investors, developers, and owners of multifamily, office, retail, industrial, and affordable housing properties.

Commercial banking, which competes with community bank businesses, generated $10B in revenue in 2021, with an ROE of 21% – not too shabby. Of note is that of the $10B in revenue in commercial banking, almost 40% was noninterest revenue. Noninterest income is a large driver of profitability for JPM and is a substantial driver of the 21% ROE for the bank. The other major driver of commercial banking profitability is a 40% efficiency ratio. We believe that the bank’s stated emphasis on larger and longer relationships drives this low efficiency ratio.

7) Real Estate Focus

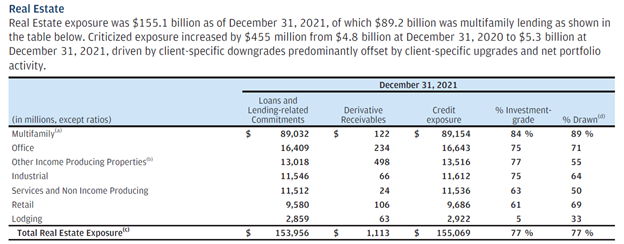

The bank’s real estate comprises the largest percentage of loans at the bank (at $155B or about 16% of total loans). The industry exposures in real estate are shown in the table below.

The bank holds the #1 market share for multifamily lending. The key takeaways in the data above are the high percentage of investment-grade credits (at 77%) and the high percentage of loans drawn (also at 77%). However, the US net interest margin (NIM) at JPM was 1.86% in 2021.

8) Management Lessons at JPM

Great management and leadership are critical to any organization’s long-term success – whether it is a country or a company. In JPM’s shareholder letter, Dimon states that “People are happier and more motivated when they have a passion or moral purpose intertwined in their work. Retaining your best talent is essential. In addition to being treated with enormous respect, what people want most is a challenging job with meaningful work.” Again, Dimon emphasis the importance of bank culture and its role in performance.

To read the whole letter, you can go HERE.