A Banker’s Primer on Defi, Blockchain and The Future of Banking – Part II

In Part 1 (HERE), we gave bankers an overview of decentralized finance and the increasing use of smart contracts in banking. Our tortured analogy was based on how children are similar to using smart contracts as they are a store of value and a message all in one bundle of joy that can move independently around (as it grows up) separate from their parents or any centralized authority. As they grow, they are governed by their core language, their DNA, analogous to a blockchain, and a language layer, such as English, that helps with usability and then transfers that information for specific use cases. In today’s article, we step through some of the details of what every banker should know about blockchains.

Blockchain Basics

As we discussed, a blockchain is a specific form and structure of code that supports a decentralized ledger that is only controlled by its code and not by a central authority such as a government, corporation, or bank. Once information is written in a block, it can never be changed and is there for all to see. Every entity on a blockchain, be it a person, a company, or another computer, is a “node” and has a copy of all or a portion of the entire blockchain. This is the distributed nature of the chain and is part of the poetry of the structure.

These properties of having identical information distributed and immutable provide some industry-altering properties. For starters, you don’t have the cost of having to maintain a centralized database. Since all the information is distributed, that database is always available and always replicated. This makes the data and associated structure much more stable. Destroy, alter or hack a node and there are many other nodes to take its place that can help rebuild that node, so system integrity is maintained. This not only makes the whole system more fault-tolerant and resilient, but it makes manipulation extremely difficult.

The other valuable property of a blockchain is transparency. Anybody can view a blockchain at any time. Now, if you want to store your online banking password, a blockchain may not be the proper application (more on this later). However, if you wanted to record a vote for President or record the title to your house, well, the blockchain exceeds all other alternatives.

Hashing on a Blockchain

At this point, it merits a brief explanation of how a blockchain achieves this stability, as these properties are critical for future bank product development. It is likely that your bank has already been pitched by a fintech regarding cryptocurrency or the use of a blockchain. If it hasn’t, it will. As such, it has become essential for bankers to know enough to ask basic questions. Bankers should understand what makes for a quality blockchain for its potential purpose. We will start with a hash.

A “hash” is a fixed string of letters and numbers that represents a block of information. For example, it could be a set of payment transactions, all the data from an invoice, concert tickets, a vaccine record, a movie, or your identity verification. No matter what the amount of information, a hash has the same format and size. Make one small change in the input, such as changing a lowercase letter to a capital, and the hash will be completely different.

A “hash algorithm” is what converts a set of inputs, such as an invoice, into a fixed string. How it does this is somewhat standardized as there are many standard hashing functions, the most popular of which is called “SHA-256.”

You have undoubtedly heard of “256-bit encryption” that uses a similar technique to secure websites, VPN applications, and information in a bank’s core system. Hashing takes that similar technique to take an “input” and produce the output, or “digest.” By design, a hashing function only works one way so that you can only make the digest from the input and not the input from the digest. Further, the hashing function will always create the same hash given the same input. If you alter the input in any way, you will always get a new digest or output string.

This is a crucial feature as if you wanted to validate the information of the invoice, you could rerun the hash algorithm and see if you get the same digest. If the digest matches, then you know a bad actor did not alter the information.

To recap, step one of looking at a blockchain is to make sure (by having it reviewed by an audit or security firm) that the hash follows commonly accepted protocols for encryption, is one-way, deterministic (produces only one digest), quick and stable.

The Keys

Since hashing, by design, can be replicated and the blockchain is visible, you must make the blockchain secure. A blockchain does this by “asymmetric cryptography” or the production of public keys and private keys. Much like your home address, anyone can find your public key, but like the key to your door, you need your physical key to get in. In this case, your private key is an encrypted 256-bit hexadecimal string that is nearly impossible to guess. Having both the public and private key not only gets you access to the data but allows you to claim ownership of that process to which the code entitles you.

Now that process contained within the blockchain could be anything. It could be a store of value like Bitcoin, but it could also be an invoice, the title to real estate, an estate plan, identity, or access to another process. Let’s go back to our invoice example.

Invoice Example

Here Company A sells a fleet of cars to Company B. Company A puts the invoice on the blockchain with net 90-day terms. Unlike a dumb paper invoice, the blockchain invoice is smart. It contains all the payment information, the title to the fleet of cars, and other instructions about the sale. The blockchain is programmed to send Company B reminders to pay while notifying the owner of the invoice of the status. Company A wants its money and sells the paper to Company C. Company C pays Company A. The invoice on the blockchain updates with the new ownership information and the new payment instructions. Should Company B not pay on time, notices and penalties will send. After a while, the collection process is automatically initiated, and the title transfers to Company C.

What used to take much manual intervention transferring the invoice information between databases and hiring various companies to help with factoring, management, and collections are now all automated and autonomous. All parties are verified, the invoice validated, and there is a record for all to see. Any party can be given rights to investigate the blockchain and see the payment history of Company B or the status of that invoice.

Turing Completeness and Composability

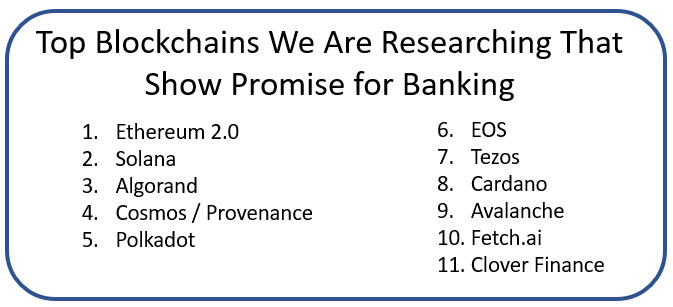

Before embarking on any blockchain product, bankers want to make sure they have the best blockchain for the job. This starts by understanding a blockchain’s “transactions per second” (TPS). For example, if a bank wants to handle high-volume payments, then a blockchain like Solana (SOL) may be ideal (which is thought to have the highest TPS of any current blockchain).

Each blockchain has its own language or set of languages that are used for programming. Some, like Ethereum, have their own language (called Solidity). Others, like Steller, use multiple common languages such as NET and C++. Some have an artificial intelligence layer such as Fetch.ai while others are limited in what they can do. When a blockchain language can’t perform a loop in its logic or is not versatile enough to handle any problem, it’s called “Non-Turing Complete.” A non-Turing Complete language is thought to be faster, safer but less versatile than a “Turing complete language.”

Another vital point to understand is that a blockchain’s code is “composable” or able to be reused. Thus, developers can use existing routines that send notices, handle KYC, handle compliance, and conduct payments when creating the above application. The robustness of code libraries and developer activity is now a key metric when evaluating the quality of a blockchain. The more development that takes place on a chain, the more diversity of applications that can be created, the faster they can be built.

When evaluating a blockchain, bankers should conduct due diligence on the size of the developer network working on the chain. Bankers can do this by either completing a web search for specific blockchain routines or monitoring popular developer communication channels such as Github, specific blockchain Slack channels, Discord, or Reddit. The more developer activity a blockchain has, the greater chance it will increase in value.

Blockchain Architecture

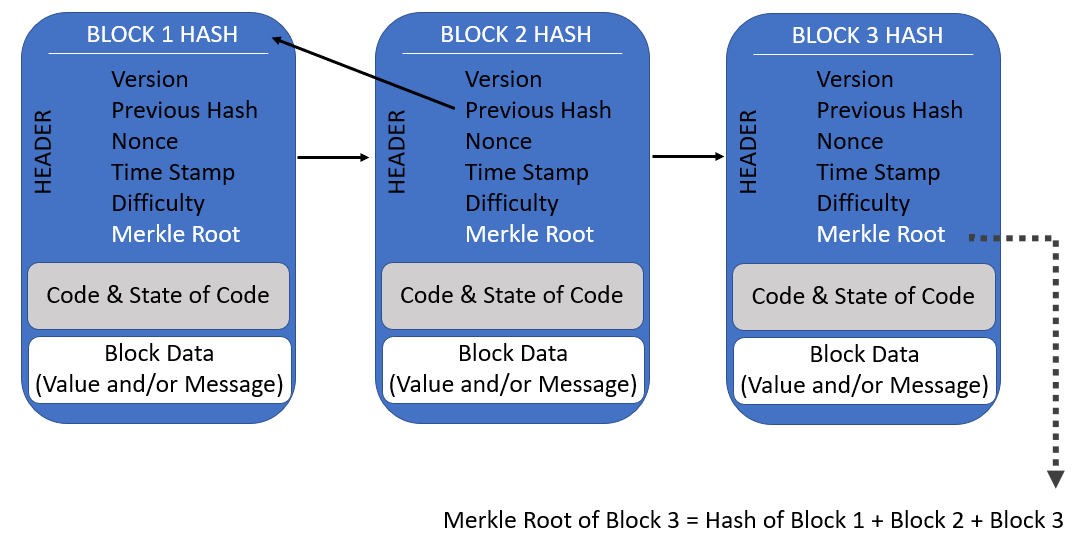

Getting back to the architecture, each block within the chain contains information about the name of the block plus what is found in the block. This is called a “header.” The header points to the previous block’s hash, thereby “chaining” each block together. The critical point to understand here is that changing the information in one block changes its hash, thus impacting all succeeding blocks. Within the “body” is the information about the transaction, document, ownership, identity, or process.

Since the last block’s hash is the sum of the previous blocks, “validators,” also called “miners,” can verify the hash, thereby determining the validity of a block.

The Consensus Mechanism

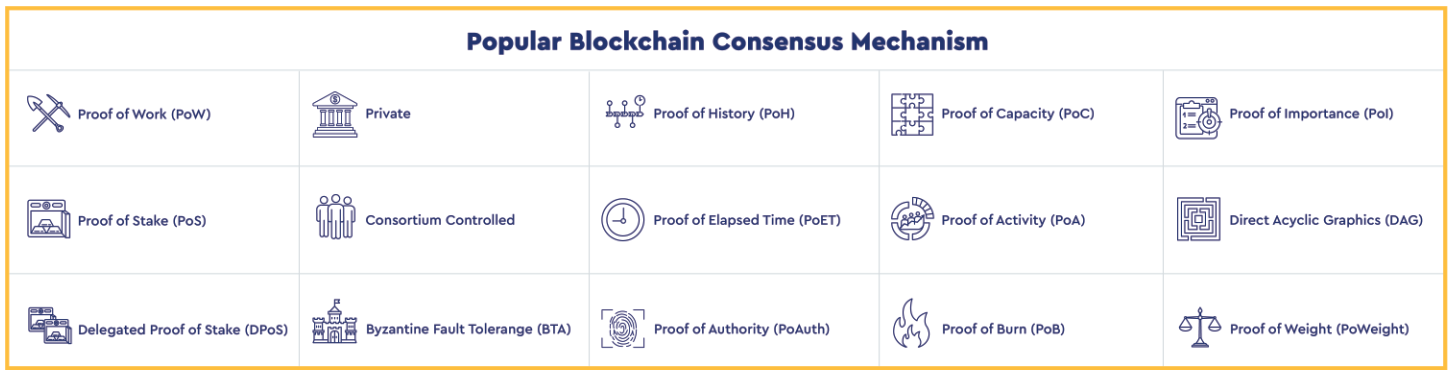

One aspect that bankers need to be concerned about is the “consensus mechanism,” or how blocks are formed and validated. This is where the power of the blockchain shines as its structure is poetic. While there are more than fifteen common consensus mechanisms (the top 15 are below), by far the most popular are “proof of work” and “proof of stake.”

Since proof of work is the classic consensus mechanism and one that is used for Bitcoin, we can start there. Once a block is created, like that invoice, it’s automatically sent to a pool of work, or “mempool,” where any validator, in exchange for value (the underlying native crypto), grabs that block and creates a valid hash.

To create a valid hash, a miner needs to generate a certain number of zeros at the start of a hash to match the required “difficulty” on the block. For example, a block with a difficulty of “4” would require a hash that results in the digest, specifically called a “nonce value” of four zeros or “0000.” A difficulty “5” would be five zeros and would take longer to figure out. Since validators can’t alter the previous block’s hash, or what is called a “Merkle Root,” the validators must start with the last block’s hash and then add to it to get the required number of zeros at the start of the hash.

A Merkle Root is a hash of all hashes that have come before it. The beauty of this scheme is that validators only have to verify the latest block’s Merkle Root to validate the entire chain.

To validate a block, the validator needs to find a new hash input that produces the digest of four zeros for a difficulty “4.” To do this, it must have the machine make random numbers until the cipher is cracked. This takes time and energy of the miner, and in exchange, they get a fee. A block is created and valid when 51% of the nodes complete the cipher to the required difficulty level.

For some blockchains, this difficulty level is fixed, and for others, such as Bitcoin, the difficulty level increases as more blocks are added to the chain.

Now, there are a couple of critical concepts for bankers to understand. The first is that the stability and security of a blockchain are based on this consensus mechanism. The idea that is part of the crypto ethos is that in place of a central authority, such as a bank, if you do the work, you earn the trust of the network and the right to handle the validation.

The second concept here is the fault tolerance of the network. If a group of validators cease to exist or not be able to complete the work, new validators would arrive to take their place, and the system would adjust. Finally, and most importantly, if one hash is altered, the hashes don’t match, and the block isn’t validated. To overcome this, a bad actor would have to control 51% of the hashes and must do all the work. Because of this structure, a properly constructed blockchain is thought to be more stable and more secure than most bank infrastructures.

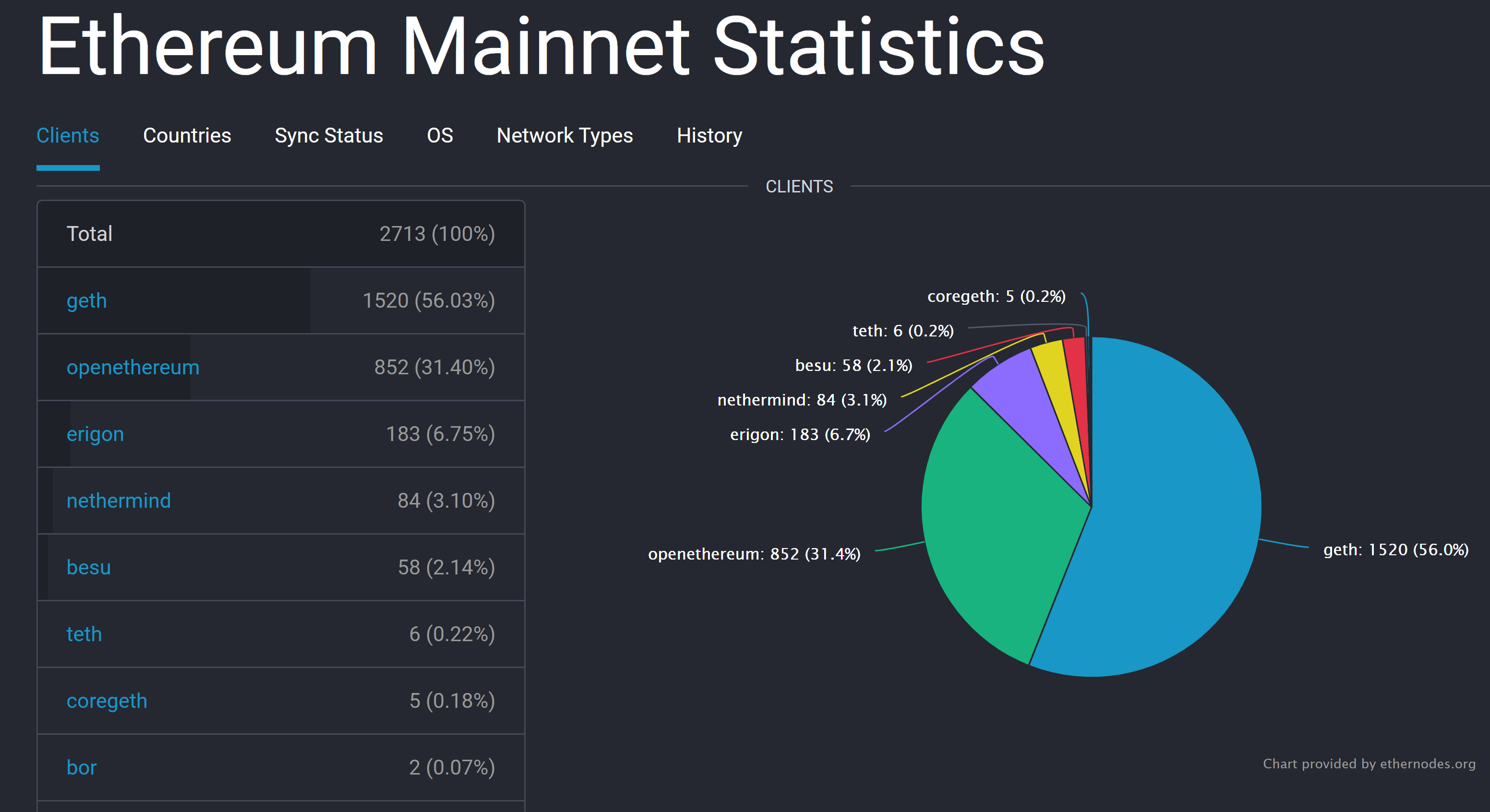

For bankers analyzing various blockchains, the number of nodes is essential. The more nodes, all things being equal, the more stable and the more secure a blockchain is. For each blockchain, there are likely a set of open-sourced tools to allow you to check the active and public nodes (some nodes are hidden) on a chain such as Ethereum’s below. Here you can see 2713 nodes are active, and you can look at the statistics to ensure these nodes are diversified as to the language used to validate (shown), location, status, operating system, and network type (home computer, hosted, etc.).

Proof of Stake

While we have talked about Proof of Work validation, the problem with that methodology is that it can be slow and it takes up a sizeable relative amount of energy. The other popular approach, one that is being adopted by the Ethereum 2.0 structure that is just starting to be released, is the Proof of Stake approach. Here, instead of a bunch of validators competing with some expending energy for no reward as they couldn’t complete the validation in time, a select number of validators are selected based on the amount of crypto they are willing to invest. The minimum might be the equivalent of a couple of hundred dollars for your average blockchain, while it could go sharply up from there.

The methodology starts with validators essentially bidding to do the work, the highest bidders chosen by the code, and then they get to validate. Some small blockchains choose 20 validators while others are in the thousands. Once the validator solves the hash, they get a fee for their trouble, and the bid amount is returned.

Once a block is validated, it is added to the chain and propagated to every node in the network. This prevents the “double-spend” risk, which is when more than one copy of an asset is created. Once 51% of the active nodes on the network confirm the new block, then all the data or transactions within that block are deemed valid.

While there are many other consensus mechanisms, some of which we may highlight in the future, PoW and PoS are by far the most popular, with the rest mainly being variations on the theme.

Understanding The Hash Rate

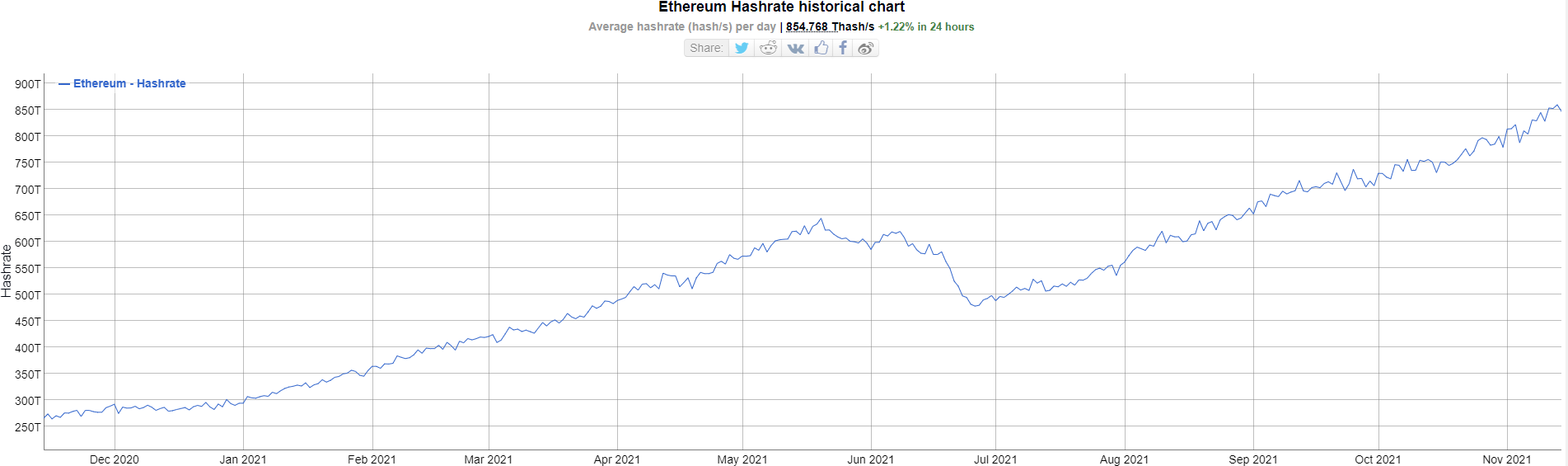

Another critical concept to understand when evaluating a blockchain is the hash rate or the activity on a chain. The more activity, all else being equal, the more future value is likely to accrue to the underlying crypto. Here too, there are many free tools available to monitor a chain’s hash rate (Ethereum example below). Bankers will want to see sufficient and growing activity on their chain.

What it Really Means To Invest in Crypto

At this point, we want to pause for a moment as we now have all the tools to evaluate an investment in a cryptocurrency. It is a common refrain among non-crypto believers that crypto investors are “gambling” and investing in an asset without intrinsic value. While partially true, it is no more accurate than any other investment. Making an investment in a cryptocurrency is making an investment in an underlying blockchain. If you know the developer activity on a chain and you know the hash rate trends, you can assume that value will follow. The more decentralized apps (“dapps”) that are created on a blockchain and used, the more value the chain and underlying crytocurrency become.

Creating a dapp is like inventing the light bulb. Investing in the underlying crypto is like investing in electricity. That is another dimension of investing that the world has never known. Not only is there additional leverage in investment, but that investment in crypto is equity in an equity-only capital stack. In many cases, like Bitcoin, the creation of that equity is known and fixed. More to the point, that crypto likely has a new level of liquidity that the world has never seen. It can be traded 24 hours a day, 365 days a year, without an exchange, without a third party, with zero carrying costs, and from any country or currency. You can’t get that potential liquidity with stocks, not in bonds; you can’t get it in gold, in real estate, or even Treasuries.

While undoubtedly there is speculation in the crypto market, the fact that investors can see the activity that leads to value is more transparent than most every public market and a tangible indicator of the underlying value. Amazon isn’t exactly giving you details of their production, and you don’t exactly know what is happening with supply and demand in the corporate bond market.

Investing in a blockchain is like investing in virtual real estate or a roadway system. A blockchain is a location to house other apps or a pathway to let apps grow. It’s little different from physical real estate. Like real estate or a roadway system, that investment is only worthless if no one uses it.

Finally, we would like to point out that crypto is often derided because it is so volatile. That volatility is a feature, not a bug. It is volatile because it is so transparent and is not manipulated by a third party such as a central bank, government, or corporation. The transparency of crypto means that any investor can get a full view of activity 24 hours a day and not just at Fed announcements or quarterly earnings.

Putting This Into Action

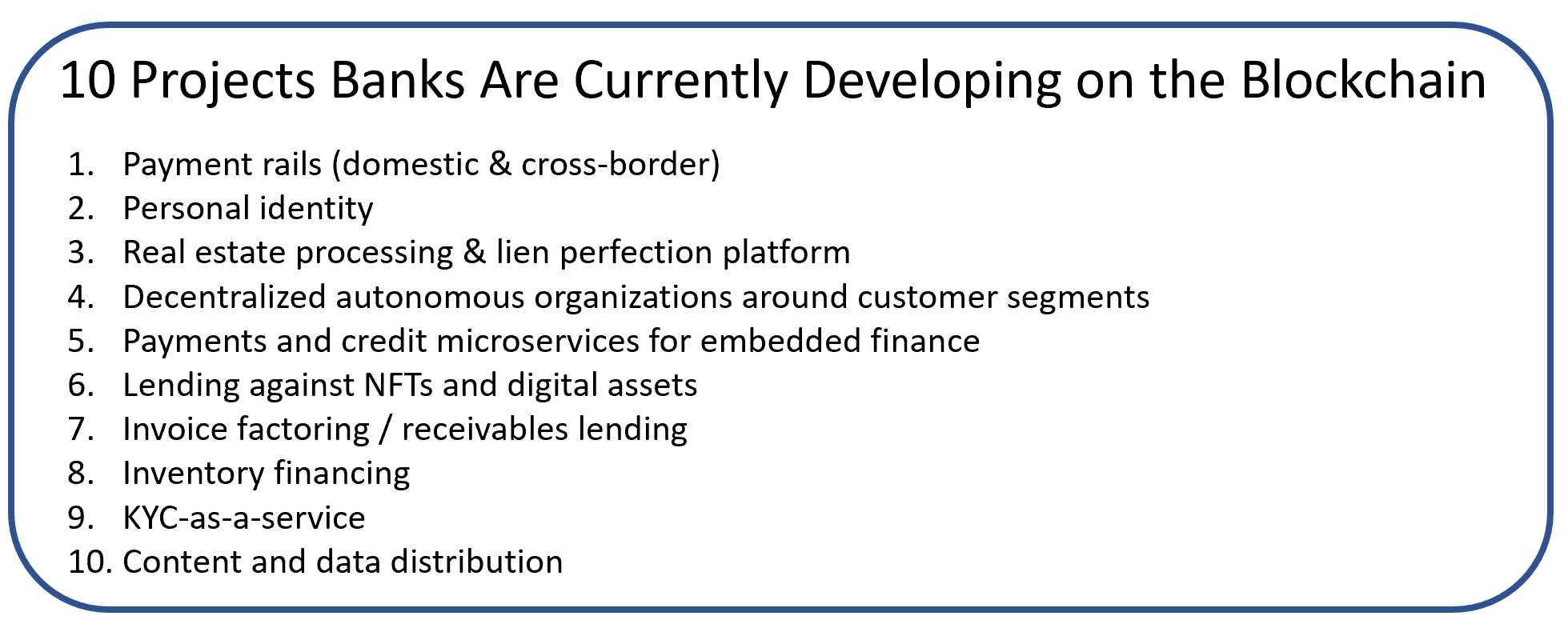

If you made it this far – congratulations as you likely know more than 80% of blockchain investors and 99% more than the average banker. This article was meant to give bankers a working knowledge of the basics of blockchain so they can start to understand what basic due diligence on a blockchain product might look like.

A blockchain, while a new concept for many, is basically a distributed database that has a series of cryptographical layers to ensure immutability and security. Because the blocks are replicated throughout the network, the chain is stable and resistant to catastrophic events such as server failures, hurricanes, or ransomware.

It is likely in the future that bankers will build products on several different blockchains for different purposes. Some blockchains, such as Cosmos, allow the connections between various chains which will likely be of great use to banks. Soon, we predict, it will be common for banks to have a “Director of Blockchain” that will manage and monitor different platforms.

The blockchain presents a whole new world of opportunities in payments, lending, finance, collateralization, trust, wealth, mortgage, deposits, and almost every aspect of banking. Having a working knowledge of cryptocurrency and the blockchain is now a fundamental skill that every banker should have.