7 Cross-Functional Teams Banks Need For Better Strategy

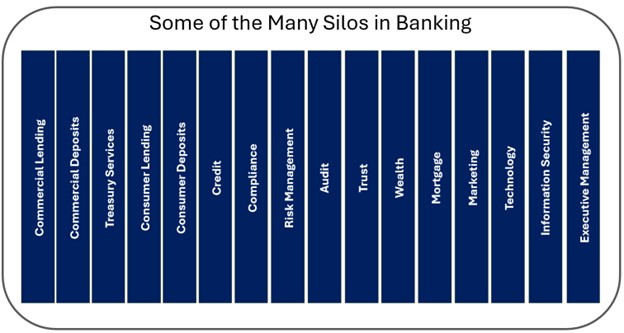

Your bank is likely full of silos. Deposits rarely coordinate with Loans, Loans seldom talk to Mortgage, Risk is often on the outside looking in, and no one talks to Marketing until it is too late. These silos frequently prevent executing a single strategy, hinder communication, and interfere with collaboration. As a result, banks often struggle with culture, the customer experience, and, most importantly – strategy. There is an easy fix, and it starts with having cross-functional teams in charge of enterprise strategy. In this article, we break down the concept and highlight, in order, six cross-functional teams your bank needs as it grows.

The Many Silos of Banking

While your bank is likely familiar with cross-functional teams composed of stakeholders from various departments, chances are they are primarily associated with projects and not strategy or management.

You were small and in a single location when you were a $300 million bank. Culture, communication, and collaboration were easy. However, as you grow past $1 billion, everything, from culture to sales, becomes more complicated. You are spread out in different geographies and have hired people with diverse backgrounds, and the management team can’t all fit into a single conference room. People do not know what they don’t know, and you end up with different vendor choices, underutilized technology, various customer experiences, and incongruent end-to-end processes. Worst of all, a long-term strategy becomes hard to articulate as there is no global “owner” for an effort to ensure accountability and a vision for the past five years.

How to Fix Silos

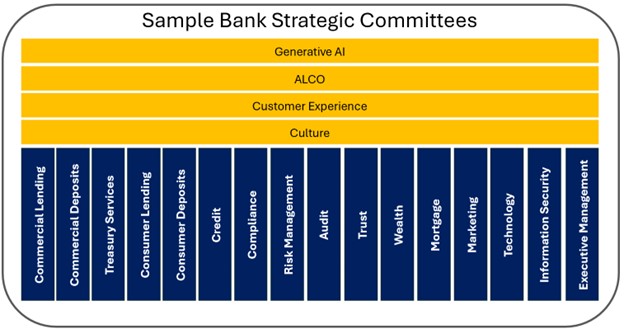

While there are many ways to fix silos, one improvement is to create cross-functional teams that are responsible for enterprise strategy. These working groups or formal committees meet weekly, monthly, quarterly, or as needed to collaborate. The flow of these meetings roughly follows the “Planning P” cycle (HERE). Each silo provides color on their metrics that provide situational awareness of current operations; they report what they are planning on doing, and they highlight the needed resources or information that is required to meet their current objective. Then each silo collaborates to achieve their vision.

Project budgets can live at this enterprise level to be dispersed to the business line, at the business line, but coordinated with this enterprise layer or a hybrid of both. During annual strategy meetings, these cross-functional teams speak to the enterprise business objectives and strategy and then let each business line report on their piece.

This structure improves communication while making strategy a year-round effort. Having vertical layers responsible for execution and horizontal layers responsible for strategy provides coordination that is missing at most banks. These horizontal layers aid in communication and bring strategy to the forefront.

A bank’s capital is of a long-term nature, and so should a strategic planning horizon. Strategies like switching out your core system, pursuing different markets, refining the customer experience, or building a solid culture are ongoing efforts that never end.

These strategic committees must ensure that a ten-year horizon is envisioned and that the vision lasts past the career span of key executives. Building a strategic committee ensures continuity in the execution of the vision and that the vision survives a single executive.

Below are some sample cross-functional strategy teams, who should chair them, and the appropriate asset-sized bank that should have them, which we recommend.

-

Culture (Employee Experience)

Target Asset Size: $0+

Chair: Human Resources

Every bank should start on Day One with at least this working group responsible for the employee experience. This is your most important committee in the bank. While many banks treat this as the sole domain of human resources, it’s not. Culture is so important that feedback from all sections of the bank is required.

Many banks develop a culture around their CEO at the start of their maturity, which may or may not be what you want. Having a cross-functional team responsible for culture allows a bank to be purposeful in developing its vision, objectives, and values.

Tactically, this group helps bring an enterprise-wide view to assist human resources in efforts around employee acquisition, retention, onboarding, diversity, inclusion, and development.

-

Customer Experience

Target Asset Size: $300mm+

Chair: Marketing

A customer experience group is another committee that is never too early to start and is the second most important committee a bank can have. Too often, bankers think from the point of view of the bank and not the customer. This group sets the standard for the customer experience throughout the bank and ensures that each customer touchpoint supports the bank’s overall strategy. This group is responsible for establishing an enterprise customer relationship management platform, building clean customer data, onboarding, and helping the organization with product development, customer appreciation, and user experience.

-

ALCO/Pricing

Target Asset Size: $0+

Chair: Finance

While every bank needs this committee at inception, it starts to become vital once one person can no longer price and structure every loan and deposit. This is somewhere around $300mm in asset size. The group sets the methodology and targets for profitability, liquidity, optionality, and interest rate management.

This is the group that decides the pricing position and strategy of the bank (HERE).

-

Efficiency

Target Asset Size: $1B+

Chair: Operations

Once you start approaching $1B in asset size, banks start to get inefficient and more bureaucratic. As such, banks would serve themselves well by setting up a cross-functional team to solve enterprise problems and improve efficiency. While this group can leverage technology, the bread and butter of this effort are normally around process improvement throughout the organization. Banks have a myriad of antiquated legacy processes and rules that need to be relooked at and reimagined to reduce the “time-on-task” (HERE).

The goal of this team should be to improve efficiency by 5% each year.

-

Generative AI

Target Asset Size: $1B+

Chair: Technology or a Business Line

While a bank may have an AI Governance Committee, it needs a team to look at the strategic applications of generative AI (Gen AI) throughout the organization. Gen AI is important to have a separate team focusing on the application as it permeates everything we do in banking. It pays to have a strategy around how your bank should use it and a timetable for when you want to enable critical areas of the bank with gen AI, such as Credit and Customer Support.

This group needs to set the pathway for their bank to become a gen AI-enabled bank. This includes deciding the priorities of gen AI installation, the platforms, the needed talent, the required resources, and the overarching business goals.

-

Payments

Target Asset Size: $1B+

Chair: Business Line

If your bank just wants to be defensive on payments, then you might want to skip this working group. However, if your bank wants to use payments to acquire payment-heavy customers, then your bank needs a strategy around the effort since payments are rapidly changing and complicated.

Payments touch almost every line of business in the bank, including retail, commercial, mortgage, wealth, and specialty lines. In addition, payments, such as loan processing, have a large impact on bank operations. To juggle the strategic direction of check, ACH, wire, debit, credit, Zelle, FedNow, The Clearing House, and others – a payment strategy is required.

This group should be focused on resource allocation, pricing, the user experience, and the prioritization of cannibalization, given the rise of instant payments, requests for payment, and pay-by-bank.

-

Enterprise Platforms

Target Asset Size: $5B+

Chair: Technology

Leveraging enterprise platforms takes a village. Figuring out the best platform to handle the myriads of workflow processes takes a separate cross-functional group that can weigh in on the best platform to handle to-be-built applications. Further, a strategy needs to be developed around the use and rate of growth of platforms like Salesforce, HubSpot, ServiceNow, Workday, Microsoft, core processors, and others.

Much of this strategy is beyond the purview of just technology. Salesforce, for example, is an all-encompassing platform that can handle 400+ different use cases in banking. Many banks pass on Salesforce because it requires at least an administrator, a business analyst, and a developer. While this may seem like a prohibited expense for many smaller banks, what is not considered is how many other people a flexible platform, like Salesforce, can save. In addition to savings operations, admin, and support personnel, Salesforce can dramatically save by consolidating platforms.

While IT can manage these platforms from an operational point of view, they may not be the right group to manage the enterprise business decisions that come with the platform as they are unlikely to see the entire view of the organization. Executive management must make a proactive decision on how much to trust and rely on these enterprise platforms.

Many banks have found themselves jammed up with their core providers and have assumed the product, pricing, and channel strategy of their core providers. To learn from this lesson, banks need to take a long-term view of the planning horizon and understand the strategic value of each of these platforms.

The Path to Workforce Pixelation

Utilizing cross-functional strategy teams is a step towards the evolution of “workforce pixelation,” which is the breaking apart of departments into smaller operational teams. We are not sure it will ever take hold in banking. Still, banks may need to restructure themselves into a flatter organization composed of teams that specialize in specific tasks such as onboarding, bank secrecy act, identity, payments, etc.

Having a composable workforce is the ultimate way to end silos and unlock agility. Once a bank gets over $10B, it’s almost impossible for every banker to see a complete picture of resources, vision, and capabilities within an organization. In a pixelated workforce, banks can quickly scale teams, and the workforce becomes more fluid. A team handling account onboarding can work on a project for retail deposits for a couple of months and then switch to handling the onboarding of mortgage clients. Teams can be tapped to execute a mission regardless of their role or department. This would make a bank more efficient and agile so that it may be future-proofed for change.

Putting This into Action

Silo mentality is a function of management and organizational construction. Often, bank departments set goals that benefit their division but conflict with the goals of another. On the dark side, department managers accomplish specific goals that incentivize siloed information or technologies and create resistance to sharing it across teams.

In order to break down the silo mentality, department managers must have the vision that information, talent, and knowledge must flow freely across the entire organization. These cross-functional teams ensure that strategy is a 365-day-per-year effort and that a unified vision is supported. These teams also help build culture and help seed knowledge across departments.

Having cross-functional strategy teams also helps encourage trust, create empowerment, and break managers out of the “my department” mentality and into the “our organization” mentality. It moves the importance of the organization’s mission before the department’s needs.

Many banks need to rewire their views of their organization. Banks need to think differently about product development and strategy speed. Banks must think profoundly AND broadly about AI, payments, and automation efforts.