Bank Earnings Call Questions – Get Ready for These

Now that 1Q is in the books, if you are a public bank, you may have an earnings call coming up in some form. We want to better prepare you and get you ready for bank earnings call questions. To do that, we wrote a Python script to analyze a representative sample of earnings call transcripts for regional and mid-sized banks over the past several years. We looked at every question and then categorized them. We then looked at trends and used the data to project the probability of a given question being asked by an analyst or shareholder on the next earnings call.

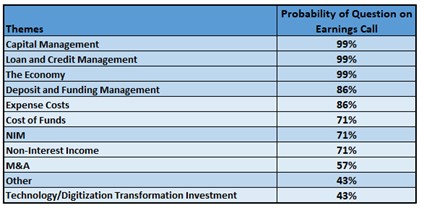

The Probability of Bank Earnings Call Questions

For any given earnings call, you will likely get 17 questions. The data indicates that, in all probability, you will most definitely get a question about capital management, mostly around buybacks, credit, reserves, and the economy, mostly around what the bank is seeing in their market. M&A, by contrast, is also near 99% for acquisitive banks but less than 30% for non-acquisitive banks.

Most Common Questions

We categorized the above data for ease of use, but we can get more granular in the questions. For example, some of the ones with the highest probability:

Deposits

No surprise, the highest probability of a question and the bulk of the questions will be around deposit management. The data indicates that the most likely question that you will receive will be around your expected deposit beta for the next quarter. We had our machine-learned script formulate the exact wording of a common question based on popular word choices and syntax and came up with this question:

High Probability Question: “Given your net interest income outlook, what are you assuming for deposit betas as rates fall.”

The next highest probability question you will get concerns your deposit costs and the impact of the yield curve on your deposit factors. This question carries a 51% probability. Again, we asked the machine to project a single question in this category, and it came up with the one below.

High Probability Question: “Your guidance calls for the low single-digit deposit growth. What are your expectations of where this net growth is coming from? Which products will be driving this and what do you think your incremental funding cost will be this year? “

Credit

Next to deposit management, credit is the next set of high-probability questions and the second-largest bulk of questions. Here, there is an 86% probability that a large bank will be asked a question about the quarter’s charge-offs. Next to charge-offs, there is a 77% probability around what the reserve levels and delinquency trends will be in the future. Also, it is no surprise that real estate concerns is trending up. There is a 56% probability that you will be asked about commercial real estate performance, most likely around office and multifamily exposure. Specifically, a popular projected question (based on trends from last quarter) will be around where your management believes oversupply will start to hurt real estate performance.

High Probability Question: “What kind of reserves do you see moving forward? “

Capital & Risk Management

The larger the bank you are, the more likely you will be asked about capital levels. The odds are high for regional banks, nearing 100%, that you will get a question around common equity Tier 1 (CET1), other Basel III capital standards, and/or your Dodd-Frank Act Stress Test (DFAST) findings. Questions for all banks around the accumulated other comprehensive income (AOCI) were popular last year but have since died off in the last several quarters. As such, the probability of getting an AOCI question this quarter is projected to be less than 30%.

High Probability Question: “Where do you project your CET1ratio by year-end? “

Further Research

For those bankers who prefer to avoid being stumped, it is worth knowing that a little more than half the time, the management team gets a question that they cannot answer and must get back to the shareholder or analyst. These questions primarily revolve around details for a particular business line.

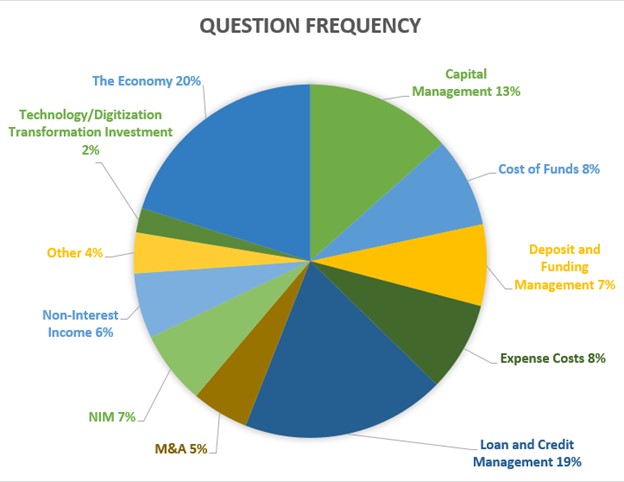

Questions as a Percent of Total

On aggregate, questions about the general market or economy make up about 20% of all questions asked, followed by questions about loans or credit. Below is a breakdown by category of the universe of historical questions from our sample.

Earnings Call Timing

In a confirmation of a Havard Business School study published in 2013 (HERE), we also ran sentiment analysis on bank earning call transcripts. We found that negative sentiment did increase and was correlated to calls later in the day. While the average number of questions was reduced late in the day, the questions were more pointed (and more focused on beta and credit), and the answers were less succinct with less positive word choices. The takeaway here is that early calls are best for all stakeholders.

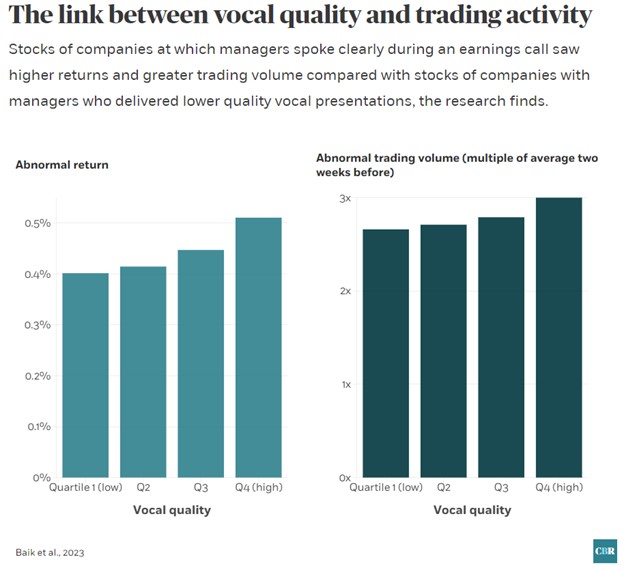

A similar analysis was published by the Chicago Booth Business School last year (HERE) based on research by Baik, Kim, Kim, and Yoon. They analyzed 29,000 earnings calls covering 2,000 companies. They found that vocal tone, quality, and diction matter to stock performance. Executives who mumbled, mispronounced, used lazy diction, or were hard to understand produced lower equity performance (below) than executives with higher vocal quality and delivery.

Putting This into Action

Having a feel for the probability of questions and the percentage of questions can help your management team prep for earnings calls by knowing what information to rehearse or at least have at your fingertips. Having your bank earnings call the first thing in the morning is also a solid tactic. Instead of scheduling the call at the same time as you did last quarter (what usually happens), move it to the morning for better vocal clarity and better performance.