9 Steps to Kill Checks and Check Processing

Sometime soon, one of the banks reading this will likely be the last bank to handle paper checks. Last week’s announcement that Target, one of the nation’s largest retailers, will not take personal checks past July 15th has made bankers take notice. Target joins Whole Foods, Aldi, and Lululemon as major retailers that have found that checks eat up too much margin. In the next several years, checks will reach a tipping point where retailers and banks can no longer afford to process them. In this article, we detail a playbook that banks can start executing immediately to mitigate this risk.

Check Processing is Archaic and Dangerous

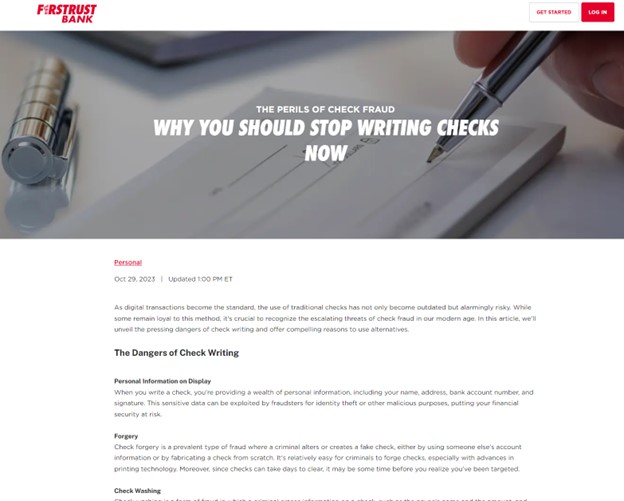

Paper checks are costly, inefficient, and risky. Check processing requires physical handling, multiple steps, and mailing. The settlement of a check takes days to weeks, all the while a person’s name, address, account number, and signature are out there for all to see. According to a 2022 Association for Financial Professionals report, 66% of organizations experience check fraud.

Paper checks are inconvenient, slow, and prone to errors for customers. Check processing incurs fees for both the issuer and the recipient, such as check printing, postage, and deposit charges. On average, it costs a business $4 to $25 per check to handle check processing or about $25,000 per year.

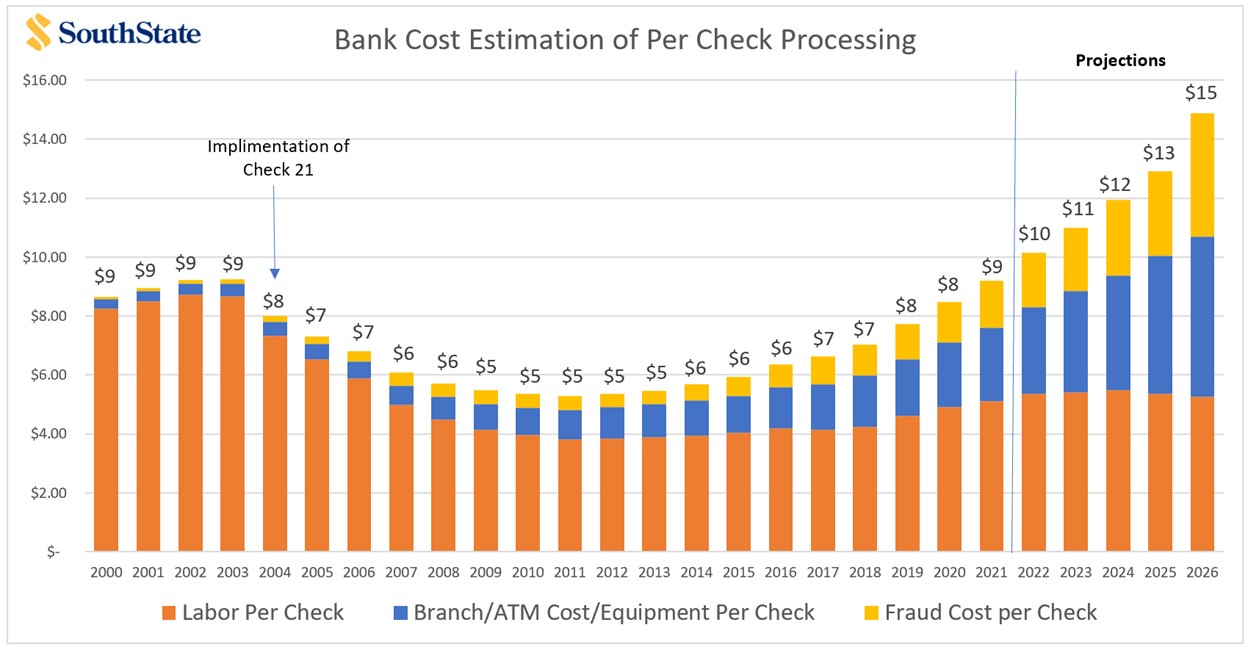

In our last deep dive into the cost of checks for banks (HERE), we estimate that checks will end up costing banks about $12 per check (below) in 2024 when you add up branch costs, operational processing, and fraud. As check volume decreases, incremental check processing will skyrocket to the point of being untenable to handle check processing.

More Electronic Payments

According to a 2020 report by McKinsey, digital payments could generate $210 billion in annual revenue for banks by 2025 and increase customer satisfaction and loyalty. All digital payments are faster, cheaper, and more secure than paper checks. They can be done online, through mobile apps, or at the point of sale. Even if merchants must pay 3% for credit card processing, it is still likely cheaper than the manual handling of check processing, the associated fraud, and the problems of insufficient funds.

Being able to send, receive, and request payments through The Clearing House or FedNow will ultimately cannibalize most all payment forms as it is the cheapest and most efficient payment channel available. The ability to automate payments, attach more information to a payment than any other payment channel, settle instantly 24/5/365, and use a secure network makes instant payments the clear long-term winner. Combine these attributes with lower fraud occurrence and the fact that households and businesses no longer need to reconcile (balance) their accounts, and instant payments are sounding the death knell for checks. As more banks utilize instant payment send capabilities, leverage request-for-payment (RFP), integrate payments into enterprise resource planning (ERP) systems, and build products on top of the instant payment channel, look for more and more businesses to stop accepting checks.

Some banks are trying to hasten the requiem for check processing. Here are 10 steps that banks are taking to speed up the demise of checks in order to not be the last bank to process paper checks.

9. Set Strategy: As we discussed in our previous article, every management team should have a strategic discussion around the systemic changes associated with the future of checks. Getting a proposed timeline and roadmap is critical to the proper allocation of resources. Doing away with checks entails the loss of large operational functions at the bank plus material revenue streams like non-sufficient funds (NSF) fees. Stopping check processing is a monumental decision and needs to be planned with increasing granularity as each year passes. Since payments are one of the major drivers of non-interest-bearing balances, and these deposit balances are a significant driver to profitability, there are few more pressing strategic decisions a bank can make.

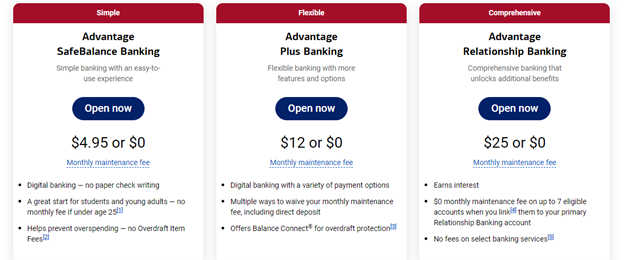

8. Product Rebranding: Check volume is declining at almost every bank, and already, most accounts have more non-check items being processed than checks. Further, many banks, like Chase, no longer provide checks with their lower-tier accounts. As such, it is no longer a checking account but a “transaction account.” While a seemingly innocuous point, making the change sooner rather than later sends an important marketing signal. Bank of America talks about having a “Banking account” and barely mentions checks in their account lineup (below).

7. Transaction Account Product Design: Along with rebranding, deemphasizing checks in your transaction account lineup will likely reduce your bank’s cost and cause a restructuring in bundle design. Having a base account with no checks at all, charging for check supply, and charging for check processing should be considered in an account redesign. By creating friction and disincentives for using paper checks, banks will see the adoption of digital channels quickly increase and net cost gets reduced.

6. Instant Payments: Ultimately, every bank will need to send, receive, and be able to handle request-for-payments if it wants to compete for a business transaction account. Having a product manager on your payments channel and having a long-term plan for instant payments will be critical to every bank’s survival. Instant payments will cannibalize checks, wires, cash, and ultimately, ACH and cards. Given the return on investment for a commercial transaction account, this is an easy investment decision.

5. Set KPIs: Establishing key performance indicators (KPIs) will help your teams understand the level of success they are having at reducing check volume. Tracking check volume by dollar and number plus check fraud should form the basis of the KPIs. Other banks may want to get more granular and track the number of NSFs, researched, stop payment, and other check processing metrics. While your bank likely reports this data already, being able to produce a dashboard with checks and other payment channels will be increasingly important.

4. Develop Messaging: Moving away from checks is paradigm-shifting for those over 40 years old, whether employees or customers. Developing messaging points early will help get everyone philosophically onboard and supporting a check processing phase-out initiative. Creating internal and external campaigns around themes such as speed, convenience, security, cost reduction, reliability, and sustainability are winners.

3. Develop a Marketing Plan: Educate customers about the benefits and features of digital payments, such as speed, convenience, security, and cost savings. This can be done through various channels, such as the branch, webpages, email, social media, webinars, podcasts, or blogs. Banks can also use testimonials, case studies, or demonstrations to showcase how digital payments work and how they can improve customers’ lives. Banks that get Visa or Mastercard support dollars can use some of this money to drive debit card payments away from checks. Providing incentives and rewards for using digital payments, such as discounts, cash back, points, or free services, can also help. Banks can also leverage gamification, personalization, or nudges to motivate customers to use digital payments more frequently and consistently. For example, banks can offer customers badges, levels, or goals to achieve when they use digital payments or send them personalized messages or reminders to use digital payments for certain transactions. Banks should consider leveraging behavioral economics, such as loss aversion, social proof, or scarcity, to discourage customers from using paper checks.

2. Targeting Customers and Industries: Personalized marketing and sales efforts should be made (and included in the marketing plan) to target those customers with a high volume of check transactions. Many businesses have not thought about the cost of checks, and this is the perfect time to take a leadership role and help be a trusted financial advisor. Industries such as healthcare, the trades, non-profits, municipalities, commercial real estate managers, schools, insurance companies, and others often do the bulk of their business by check. Targeting these high-check industries and moving them over to instant payments or ACH will help dramatically reduce check volume. In line with the Pareto principle, 80% of a bank’s checks come from approximately 20% of its customers.

1. Product Innovation: Specific to our point on needing a product manager for payments (HERE), banks need to invest more effort in enhancing their product and services around payments. This may include better identity verification (such as biometrics), pay-by-bank functionality, merchant QR codes, cash flow analytics, notifications, and other attributes. Banks can work with their bill pay, lockbox, or third-party provider to automate sending instant payments in place of the approximate 35% of payments that still go by paper checks. Here, banks can gain instant payment advantages without handling the product themselves.

Putting This Into Action

By adopting these strategies and tactics, banks can help their customers transition away from paper checks and embrace the digital payment revolution. As more businesses like Target move away from checks, it is only a matter of time before a bank starts charging for check processing. Once it does, volume will drop precipitously until checks become too costly to process.

The time to start planning this is now, as banks can immediately effect change. Actively moving customers to electronic channels, particularly instant payments, will be cheaper for all parties and improve the customer experience.