5 New Year’s Resolutions For Any Sized Bank That You Must Get Right in 2023

A potential economic slowdown, slower rate rises, an inverted yield curve, and deposit stress likely make 2023 a trying year compared to 2022. Banks will need to balance these short-term challenges with longer-term strategic goals. For any banker looking for clarity, we present five New Year’s resolutions, no matter your size, that provide a roadmap to accomplish both the short and long-term objectives of a top-performing bank.

Why “Growth” is Not on The List

Noticeably absent from the list below is growth. The irony here is that more than half the banks we recently surveyed had some goal and metric around asset growth. While there is nothing wrong with growth, the problem is that most banks are not prepared to grow. Because many banks are now producing below their cost of capital, growth further exacerbates their issues and drives them out of business (likely through a sale) faster.

In addition, with the threat of a recession and dramatically increasing cost of funds, there is a solid argument to be made that banks should be shrinking rather than growing. While the current growth rate needs to be left to each bank based on their capital cost, market, and risk tolerance, the general guide is that growth should be in the 3% to 5% range for this year.

That said, smart banks will make growth a byproduct and ensure they have all their other processes right. In addition, they may consider focusing on these five critical areas:

1. Improve Operating Leverage

Improving efficiency is like “losing weight” and “working out more.” It will likely always be on your New Year’s resolution list; it is just a question of where.

In the past, you have seen us rank customer relevance and total experience as a top priority for banks – not in 2023. Without the windfall of profit accrued to banks in 2022 because of faster-than-expected rate increases, banks will need to be better allocators of capital. Financial pressure will be greater, and bank margins will be higher. This combination means that banks will need to focus on the quality of their earnings.

To improve the quality of their earnings, banks need their number one focus to be on making their operations more efficient. A more efficient platform means more profit will be driven to the bottom line, and a more significant number of acquisitions should be more accretive faster.

As such, every bank should have one to three major projects that radically reduce their cost structure and allows for greater scale. The goal should be to reduce your efficiency ratio below 40%. Projects of this scope could include – moving to a real-time core system, digitizing loan production, expanding mobile account opening, or consolidating business process platforms to a Salesforce, Service Now, Workday, or similar.

In addition to these technology-oriented improvements, there are also a variety of process improvements that many banks can make that are cost-free. Moving all customers to digital statements, restructuring compliance reviews and employee onboarding are just some of the more popular efforts that banks are undertaking in 2023.

Regardless of your choice, improving the efficiency in which you generate profits by 10% or more should be at the top of your list.

2. Customer Engagement, Relevance, and Total Experience

Like improving operating leverage, some derivation of improving customer engagement, relevance, and the total experience of your customers and employees should always be on every banker’s list of New Year’s resolutions.

For bankers unfamiliar with total experience and time-on-task, we encourage you to review our 7 Rules HERE. Every banker should have at least one goal for 2023 that makes them more relevant to their customers and/or improves both the customer and employee experience.

To the extent projects improve operating leverage and the total experience, so much the better. Popular projects for 2023 include online loan and deposit onboarding utilizing third-party data to speed the process, compliance-as-a-service, payments, card controls, service case management, leveraging data for customer insights, and providing open banking APIs to customers.

3. Deposit Focus – Limit Cost of Funds increases, dampen customer rate sensitivity and keep beta below 40%

Now that deposits are back to generating more value than loans, every bank is refocused on keeping deposit volume high, beta low, and cost of funds benign. This is tough to do in a rising rate environment, particularly one where the Fed is withdrawing liquidity. Bankers have never seen this confluence of events, and as a result, it is creating new challenges.

Inexperienced bankers will be focused on just keeping the cost of funds low. In contrast, experienced bankers will be worried about volume, beta, and training both the customer AND employee to be more rate sensitive. When offering a higher money market or CD rate, the direct damage done to cost of funds is often the least of a bank’s worries. Raising rates impacts volume and sensitivity of the entire balance sheet (through cannibalization). Worst of all, it trains the customer to expect higher rates and the employee to solve problems in the future with rate. The result is often a higher cost of funds now, not to mention higher future rate sensitivity.

While we will discuss how to raise deposit rates in the future, the New Year’s resolution should be to find other ways to raise deposits without resorting to rate increases. Mostly, this means getting innovative with deposit and payment products. Building out the ever-important treasury management suite, targeting deposit-rich customer segments, and creating new savings products are all examples of how banks can build deposit balances at low cost, low-rate sensitivity, and high deposit convexity.

4. Lending Focus – Interest Rate Sensitivity and Credit Accuracy

Remember all those five-year fixed-rate loans you booked at 4%? Yeah, that was a mistake. Those loans are now worth $0.85 on the dollar from interest rate risk alone, and if it resets at the end of that five-year period, you likely lost another $0.10 on the dollar due to higher credit risk. That is 25% of the loan’s value lost in a year which is more than your reserves and likely stressful to your capital position.

Since inflation still needs to be under control, banks should resolve to avoid making the same mistake. Keeping loan duration short should be the theme until bankers are convinced rates are going down. Inflation took a long time to raise its ugly head, and it will likely be more persistent than the market, and many pundits believe. Bankers that bet on a rate drop at the end of this year may be in for a surprise.

Then there is credit. Higher rates and a slowing economy mean banks need to be more accurate in their probability of defaults and loss given defaults. Your relationship profitability model and credit model should be dynamic enough to adjust. Banks need to spend more resources to ensure their credit view is accurate. If you look back over any recession, it is the two years prior when banks make 80% of their lending mistakes. Now is that period.

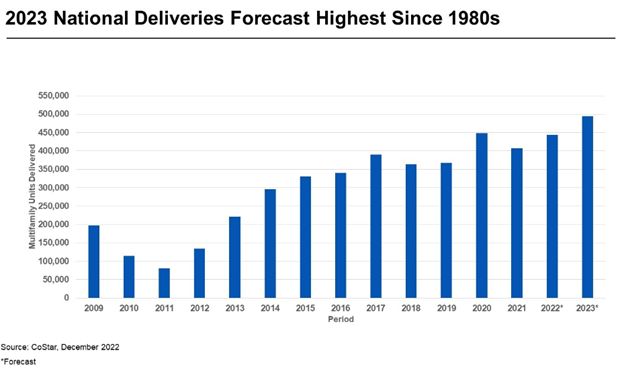

Many banks, for example, are still hyper-competitive in multifamily lending. This would be a mistake as we have a record half million new units hitting the market due to the construction boom of last year (below). This means that supply will outpace demand, likely sending vacancy rates higher by another 1% (on top of the 1% increase we saw last year). This also means that rent growth will go negative in many markets. Despite a 30% increase in expected losses in markets like Dallas, Atlanta, D.C., Charlotte, Houston, Phoenix, New York, Austin, Denver, Orlando, Miami, and Nashville, many banks have not adjusted pricing or their credit appetite.

Sectors like office, retail, and hospitality, are even worse. For 2023, banks need to prioritize interest rate risk management and credit accuracy as a top priority.

5. Develop a more innovative process

Despite all the talk about innovation, banks remain slow with their time to market for new products. Many banks have yet to structure vendor management reviews, new product approval, and development with efficiency in mind. Getting a pilot approved takes as long as getting a new product approved at a majority of banks.

In addition to not having a truncated process for product testing, most banks run their approval processes in a linear fashion. First, you analyze the product, then vendor reviews, then approvals, then legal, etc. In addition to an annotated process for beta tests and pilots, banks need to restructure their approval process so that many tasks run in a parallel fashion. Bank product innovation should be measured in weeks, not months.

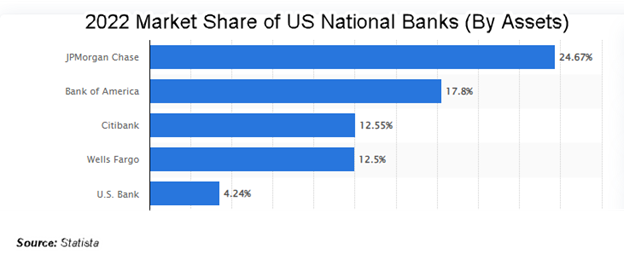

Why is this so important? The answer is that because operating leverage and customer relevance are now so important, banks can no longer compete on rate and the abundance of credit. Many community banks have an inherent strategic advantage in bringing a new product to market faster than a national bank, yet they squander their position. As a result, national banks are eroding the customer base of the community bank. Consider that in 2021, Chase and Bank of America controlled approximately 33.9% of the banking market, according to Statista Research. In 2022, that number is now approximately 42.5%. That market share has come mainly from regional and community banks.

Conclusion

These five New Year’s resolutions should be considered for any bank looking to improve performance for 2023 and beyond. It should be noted that each resolution focuses on improving the process at each bank instead of focusing on outcomes.

For banks looking for more strategic and tactical assistance, stay tuned for our 2023 Survey Results and Strategic Roadmap to be published at the end of this month.