If the Fed is Uncertain, How Will Bankers Get it Right?

As of May 2025, the Federal Open Market Committee (FOMC) maintained the federal funds rate at a target range of 4.25% to 4.5%. This decision not to move reflects the Fed’s cautious approach amid rising risks of both inflation and unemployment, influenced by recent tariff policies. Fed Chair Jerome Powell emphasized the heightened uncertainty, stating, “It’s not at all clear what the appropriate response for monetary policy is at this time.” Essentially, the Fed stated that projections indicate significant uncertainty in economic forecasts, and the range in short-term interest rates has increased, highlighting the challenges in predicting future rate movements. The market largely expected this Fed decision and the reasoning. However, what does it mean for community banks, their base case rate view, and risk management practices?

Tariff Policies and Economic Impact

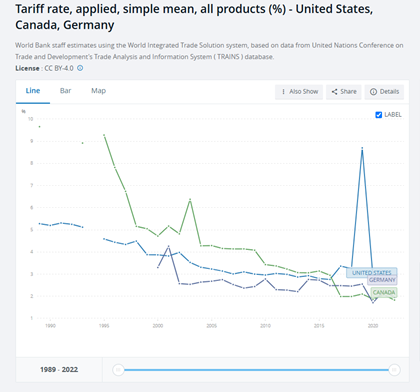

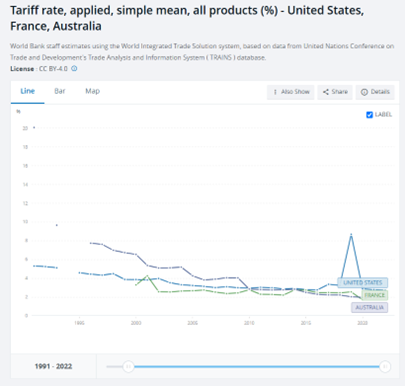

Recent tariff implementations have added layers of uncertainty and complexity to the economic outlook. There is no logical reason to follow the stated policy tariff level, by country, by industry, and by product since it changes so rapidly day to day (and sometimes faster). What is clear is that 10% tariffs should be viewed as the minimum. This represents a significant increase in existing tariff levels. The World Bank Group calculates the world-wide simple mean tariff level at a little over 4%. For context, the historical tariff levels between the US and four trading partners are shown in the two graphs below. The graph shows that the current mean tariff levels on all products for these trading partners are roughly the same at around three to four percent.

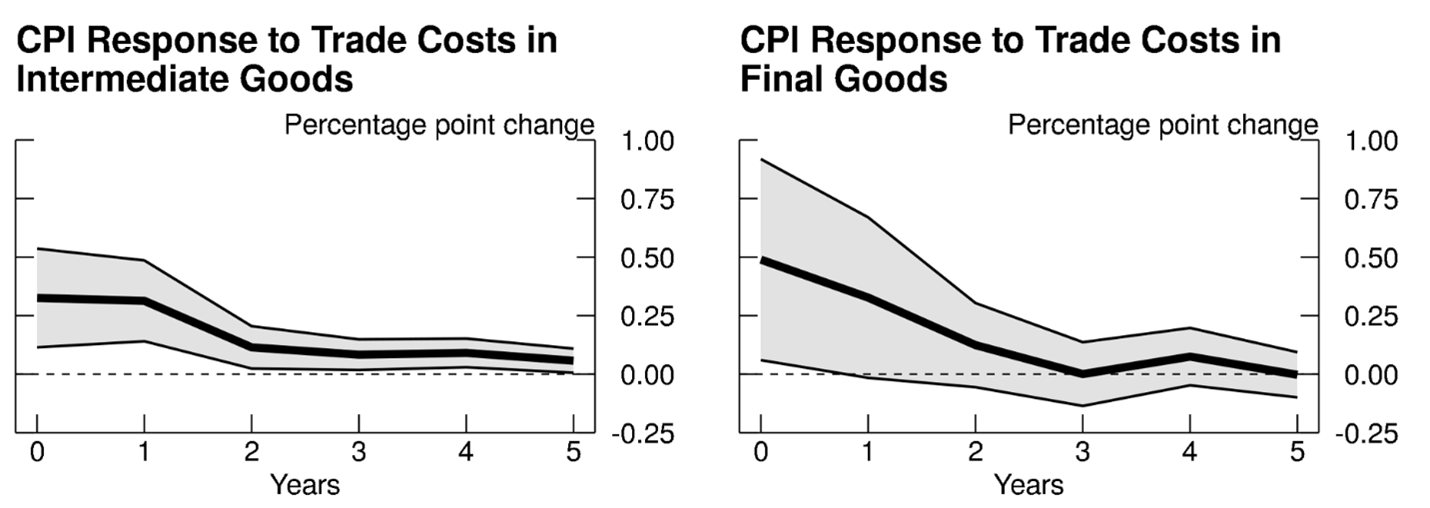

Therefore, an enacted policy that increases existing tariff levels on imports is likely to increase inflation and decrease employment. In a 2025 study (here), the Federal Reserve calculated the possible effect of tariffs on inflation. In summary, 10 percent tariff rates are expected to increase CPI by 0.8% and the impact takes up to three to five years to stabilize. The graph below from that study is a good summary of this relationship and is based on a 10% tariff increase. However, the authors state that the impact of tariffs is not linear on CPI, employment and GDP, and higher tariffs result in higher consequences disproportionately.

How Should Community Banks React

If the FOMC is no longer operating with a forward-leaning posture, and instead is adopting a reactive stance, then there is little hope for market participants to correctly gauge the future path of interest rates. Yet the futures market does that for a living. The forward market must buy and sell forward starting interest rates regardless of whether the Fed knows not how the future will evolve.

Despite the Fed’s messaging that it will react to future events without commitment, the futures markets and economists continue to speculate on policy paths. But the variability around the mean is getting wider – from as many as three 25-basis-point cuts by the end of 2025 to zero. Futures traders are playing a probabilistic game with incomplete data because they need to make a market.

The lesson for bankers is straightforward: if traders can misread the Fed, banks certainly should not build their balance sheet strategies around rate predictions. Misreading the Fed’s intentions can be costly – particularly if it exposes the institution to interest rate risk, liquidity risk, and credit risk.

A scenario where inflation remains high, and the Fed delays rate cuts or increases interest rates could compress net interest margins (NIMs) and raise funding costs, or worse if the curve rises and inverts. One possible disastrous scenario for banks is that in response to higher inflation and higher unemployment (stagflation), the Fed could reintroduce yield curve control – keeping short term rates higher to dampen inflation and buying long-term treasuries to spur economic growth and employment. For lenders, this would mean low long-term rates combined with high funding costs – a toxic combination for spreads.

But greater uncertainty can create opportunities for well-managed banks. Those that emphasize risk management over speculation are better positioned to serve clients, gain market share, and maintain profitability.

Given the prevailing uncertainties, bankers should prioritize risk management over speculative interest rate forecasts. Key strategies should include:

- Enhancing Credit Quality: Focusing on higher-quality assets can mitigate potential losses in volatile markets. Those banks that are now looking to book higher yielding assets may be negatively selected by lower quality credits. Using risk adjusted return calculations are key.

- Managing Duration: Adjusting the duration of assets can help manage interest rate risk. For those banks with higher deposit betas, assets duration should be shortened to avoid NIM compression. Diversifying interest rate exposure by keeping loan duration short, but security duration longer can be a viable strategy for many community banks.

- Maintaining Liquidity: Ensuring adequate liquidity positions banks to respond effectively to unforeseen economic shifts. Community banks should position for relationships that are meaningful, profitable, and bring DDA balances.

By emphasizing these risk management practices, banks can navigate the uncertain economic environment more effectively, safeguarding their financial stability and resilience.

Conclusion

If the Fed doesn’t know where rates are headed, and neither does Wall Street, therefore, bankers and borrowers should not pretend to know. Our role as bankers should be to manage risk for our bank and our clients (who also should not be speculating on the future path of interest rates). In an era marked by economic unpredictability, particularly concerning the Fed’s interest rate trajectory, bankers are best served by focusing on comprehensive risk management strategies.