Improving Bank Profitability – Fall Performance Series Annouced

On the path to improving bank profitability, we concluded our summer performance series for a handful of community banks. Because of the demand and success of the format, we are extending this program for a “Fall Performance Series.” For banks that are consistently earning below 1% ROA, we may be able to help increase performance with proven techniques and insightful analysis. We review your bank against peers and industry benchmarks, we share with you our analysis over a 1-hour virtual meeting, we share a custom roadmap to increase performance, we describe strategies that can be easily adopted and have been proven effective at other banks, we discuss how technology, deposit and loan pricing can improve efficiency and margin, and we do not charge for this service. The feedback from our initial group of banks has been positive and additional banks have indicated an interest in participating.

Why This Format?

Consultants charge high fees and have an incentive to prolong engagement to maximize their revenue. We do neither – we do not charge a fee, and we are not positioning our advice to generate additional consulting sessions. We can fit all the pertinent information in a one-hour session, and banks are free to contact us after for additional data or clarification.

Consultants need to be sensitive to management’s existing strategies and choices. We do not aim to offend, but we do not filter our message. Some businesses and strategies are often unprofitable, and we are free to call this out – we are not concerned about being fired.

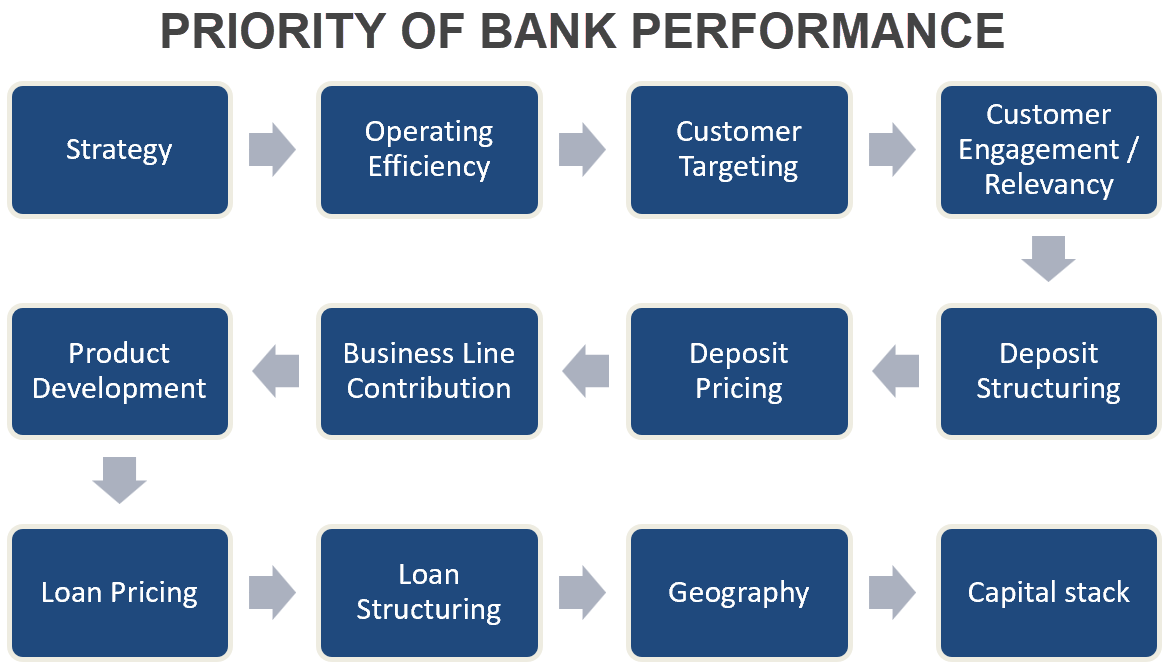

We work with over 1,400 banks around the country, so we get to see what works and what does not. We also view banks from different perspectives as we know first hand what drives franchise value and what is your biggest “bank for the buck” of effort. We use our “waterfall of bank performance” (below) and tackle each in order – strategy, efficiency, use of AI, customer segmentation/targeting, customer engagement, product offerings, business line contribution, deposits, loan pricing, ALM positioning, fee income, loan structuring, geography and capital.

It is a perspective that affords us the opportunity to get to the root of the banking business and identify what drives profits. Our goal is to help you “sell more profitable products to more profitable customers” with the goal of producing above your cost of capital and hopefully – to generate a return greater than your peers (called “alpha”).

How it Works

To start improving bank profitability, visit our landing page to request a spot and we will review your application. If we feel that we can add value to your bank, we will send you a brief questionnaire about your current business strategy. We then allow your senior team to book a one-hour strategy session beginning in October. After the one hour virtual meeting we will send you the deck we covered and any follow up information that came up in our discussions.

What We Cover

We have a template analysis that we use and superimpose your bank’s specific geography, size, business model and management competence. We typically cover the following topics:

- Client profitability – how to measure and focus on existing profitable accounts and attract new ones.

- We cover the topics that management specifically brought up in the questionnaire.

- Compare the bank to state, national and top performing peers.

- Review branch network and efficiency.

- Assess balance sheet for business lines, duration mismatch, funding sources, credit quality, and leverage ratios.

- Discuss top deposit strategies currently deployed by high performing banks.

- We then review profitability drivers such as NIM, COF, non-interest-bearing deposits, asset yield, and non-interest income.

- We then cover overhead and efficiency factors, such as salary costs, revenue/asset/income per employee, and compare these to peer groups – identifying opportunities and successes.

- We will share specific recommendations based on industry segments, relationship size, loan terms, credit quality, and profitability drivers. These recommendations almost never require infrastructure investments, additional hires or new vendors. We prefer to emphasize the myriad of recommendations that do not include additional costs or time resources.

- We explain where high performance banks succeed by using trusted advisor models and key account management.

- We usually finish with analytical examples showing how banks can elevate ROA through credit quality, loan size, term commitment, cross-sell and upsell opportunities. We also differentiate long-term balance sheet vs. collateral-dependent relationships.

Conclusion

If your bank’s senior management team is interested in booking a one-hour strategy session starting in October, please visit this link below. It appears that 2026 will bring more economic and business volatility, and community banks may be facing headwinds with a slowing economy. Our performance series may be a simple and cost-effective way to focus management to overcome expected challenges and surpass 1% ROA in 2026.