Measuring Relevance For A Sustainable High-Performance Bank

When it comes to bank performance, there are lots of metrics to manage. The two that we would submit are the most important, are risk-adjusted return on capital (RAROC) and customer relevancy. While we have spoken at length about managing loans, deposits and customers around RAROC, in this article we focus on measuring relevance.

Producing a RAROC above your cost of capital needs to be balanced with creating a bank that impresses your customers so much that they engage with you and talk about you. Too often, banks focus on operational efficiency, digital interfaces, or regulatory compliance while overlooking one of the most critical measures: how much customers truly value the bank’s relationship and services.

We believe relevance can and should be measured, optimized, and systematically improved. Here’s how banks can move from guessing about customer loyalty to building an intentional, data-driven engine that keeps their brand essential to the people they serve.

Measuring Relevance – Anchoring Around a Clear Metric

When it comes to measuring relevance, traditional measures like Net Promoter Score (NPS) or satisfaction surveys often lag too far behind. By the time customer attrition rises or deposit balances slip away, the damage is already done. These measures also suffer from inaccuracy and gaming. Ask how likely a customer might recommend you and they might give you a high score, but the reality is that they rarely actually recommend you. We have also seen bankers almost bully customers into a high satisfaction ranking.

Instead, banks should adopt a leading and more accurate indicator.

Ask customers, “How would you feel if you could no longer bank with us?”

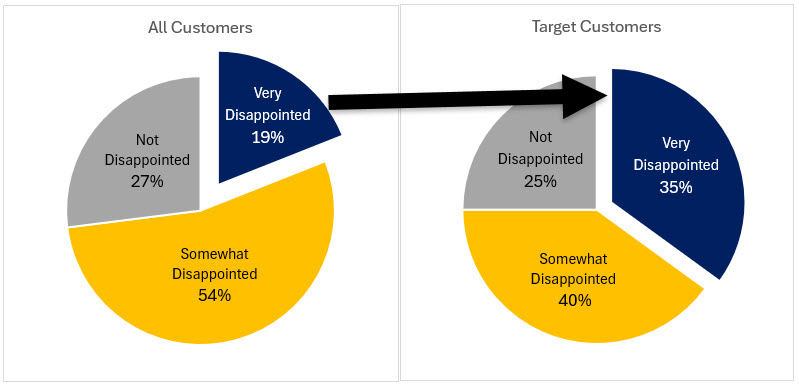

Track the percentage who respond, “Very disappointed” as they will unlock a clear path forward.

A common benchmark shows that banks with over 40% of customers saying they would be “very disappointed” tend to have higher primary bank status, greater share of wallet, and lower attrition rates. Banks scoring under that threshold risk being seen as replaceable utilities, not valued partners.

Segment and Focus on Your Highest-Expectation Customers

In banking, not every customer relationship drives strategic value equally. When you grow a bank, you tend to attract all kinds of customers — especially if your bank has ever marketed rate or easy credit. Many of these customers don’t value relationships but value a transaction. This often misaligns a bank if the bank’s objective is to build a long-term relationship. Customers that come to your bank because of a cheap loan or high-priced deposit don’t have a need for a bank but have a need for a product. It is no surprise that the bulk of a bank’s customers are unprofitable (HERE).

Bank management often tries to segment their customer base with preconceived notions of who they think their bank is for. The problem with this approach is that it might be wrong and even if it is correct, it won’t teach a bank anything new.

A specific set of survey questions might be:

- How would you feel if you could no longer bank with us? A) Very disappointed B) Somewhat disappointed C) Not disappointed

- What type of customers do you think would most benefit from our bank?

- What is the main benefit you receive from our bank?

- How can we improve our bank for you?

After the survey results are collected, focus on the “very disappointed” group when measuring relevance. Bankers can use their responses as an aperture to be laser focused on a customer segment with a data set that can speak for itself and can lead bank management to the promised land of excelling in both relevancy and profitability.

As a result of focusing on core customers, the “Very Disappointed” group increased the percentage (below).

To recap, instead of trying to be everything to everyone, segment your base to identify customers for whom you are already essential.

To do this:

- Survey customers who have meaningful engagement (e.g., active in digital banking, multiple products, or use advisory services).

- Group them by how disappointed they would be without your bank.

- Profile those who say “very disappointed” — they are your high-expectation customers (HXC).

Building detailed personas around these HXCs — their financial needs, goals, frustrations, and preferences — helps sharpen the bank’s focus on where it can win. For example, HXCs are often relationship-driven business owners and affluent families who value personalized advice, seamless service, and proactive problem-solving. From these customers, we hear repeatedly – “I don’t have time to understand banking, I want a bank that understands my needs and banks for me.”

Making Strategic Decisions

Next to focusing on every customer instead of specific customers that value relationship banking, another common problem is to build products that everyone wants. This feeds into thinking everyone is your customer.

Instead of building products that many people want in small amounts or desire infrequently, it is better to build a product that a small number of customers want in large amounts. In this manner, relevancy is designed in.

For example, many banks require loan customers to have a depository relationship. While this is a solid tactic, when it comes to customer relevancy these customers may not be the target if your bank is trying to be relevant for deposits. It is better to focus on those customers that came to you because they liked your account package or products such as instant payments. It is these customers where you want to focus.

Turning Feedback into Action to Grow Your Core Customers

Simply identifying your strongest supporters isn’t enough. The next step is understanding:

- Why do our most loyal customers love us?

- What prevents others from feeling the same way?

Analyzing feedback reveals two critical areas:

- Loyal customers rave about the responsiveness of their bankers and the ease of managing their money across channels.

- Those less enthusiastic may cite slow service on complex requests, account problems and lack of proactive communication.

Rather than chasing the loudest complaints from disengaged customers, it is better to focus your tactics on two dimensions:

- Enhancing what your loyalists love (e.g., expand concierge services, improve self-service tools, provide faster payments insights, help analyze cash flow, support other business needs, etc.).

- Fixing small but critical gaps that hold “somewhat satisfied” customers from becoming true advocates (e.g., faster turnaround for lending decisions, more personalized alerts, introduction of a digital wallet, etc.).

Build a Relevance Roadmap: Strengthen Loyalty and Eliminate Friction

To truly become irreplaceable, your strategy should split into two tracks:

- Double down on what customers love.

Examples include:

- Expanding financial advisory capabilities

- Offering more relationship perks tied to loyalty

- Enhancing mobile and digital self-service features

- Get better at anticipating banking needs

- Remove friction and address unmet needs

Examples include:

- Streamlining account opening, account maintenance and loan processes

- Providing tax support

- Introducing personalized insights into digital channels

- Proactively reaching out during key life moments (e.g., business growth, retirement planning) to be proactive with financial leadership support

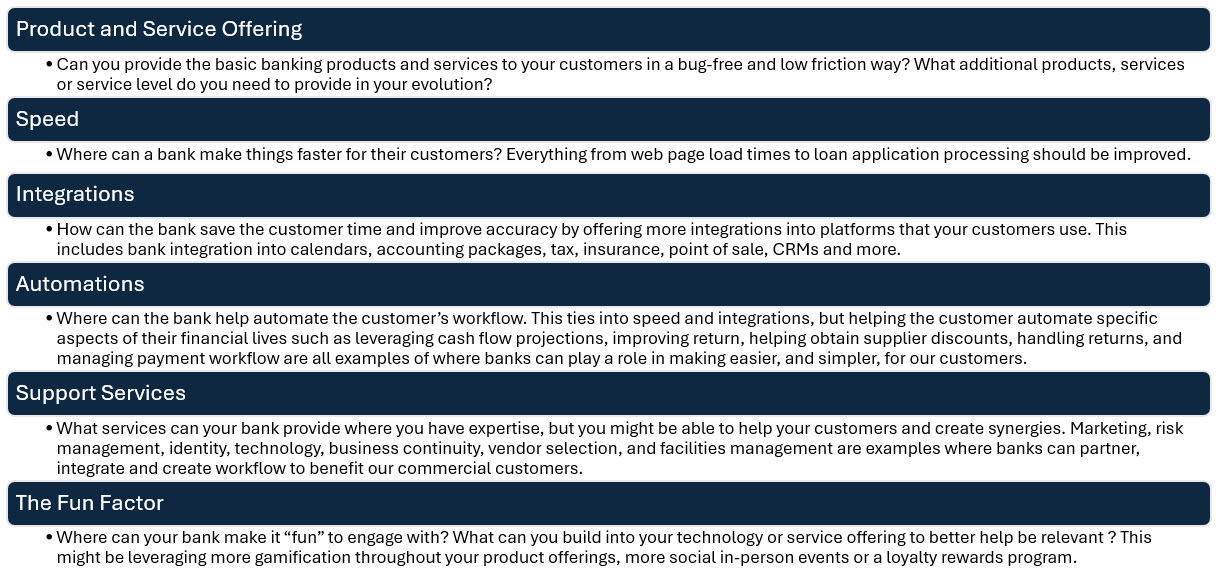

Below are the six dimensions in which banks can look to become more relevant and engaging to their customers.

We recommend banks use a simple cost/impact matrix to prioritize improvements — choosing quick wins that deliver the biggest boosts to customer perception early.

Make Customer Relevance Your Primary Success Metric

Staying relevant isn’t a one-time project; it must become a core discipline.

Track the “very disappointed” percentage at least quarterly. Watch for patterns by customer segment, region, or business line. Rally your teams around improving it, just like any critical KPI.

Customer relevance can be one of the most visible metrics banks track across business lines and can guide how banks prioritize technology investments, product innovations, and employee training.

Conclusion: Staying Essential in the Next Era of Banking

In a time of commoditized rates, digital competition, and rising customer expectations, banks that stay highly relevant will thrive. Those that don’t risk being quietly replaced.

By anchoring around measuring relevance, focusing on high-expectation customers, acting on meaningful feedback, and committing to a disciplined roadmap, banks can ensure they remain an essential part of their customers’ financial lives for decades to come.

Relevance isn’t static. It’s built — one relationship, one experience, and one insight at a time.