Predicting Bank Performance with Declining Rates

Most community bankers we talk believe they will get a boost to bank performance with declining short-term rates. The thinking is that a lower Fed Funds rate will mitigate credit risk, spur loan demand and potentially soften competition for deposits, leading to wider NIM and more profitability. Unfortunately, the empirical evidence shows otherwise. While the directional response of net interest margin (NIM) and return (either return on assets (ROA) or return on equity (ROE)) to changes in interest rates is ambiguous, what is clear is that industry NIM and profitability declines when interest rates decrease. In this article we will quickly highlight the relationship between NIM and ROA/ROE and look at studies and historical trends of NIM in declining interest rate environments.

Relationship between NIM and ROA/ROE

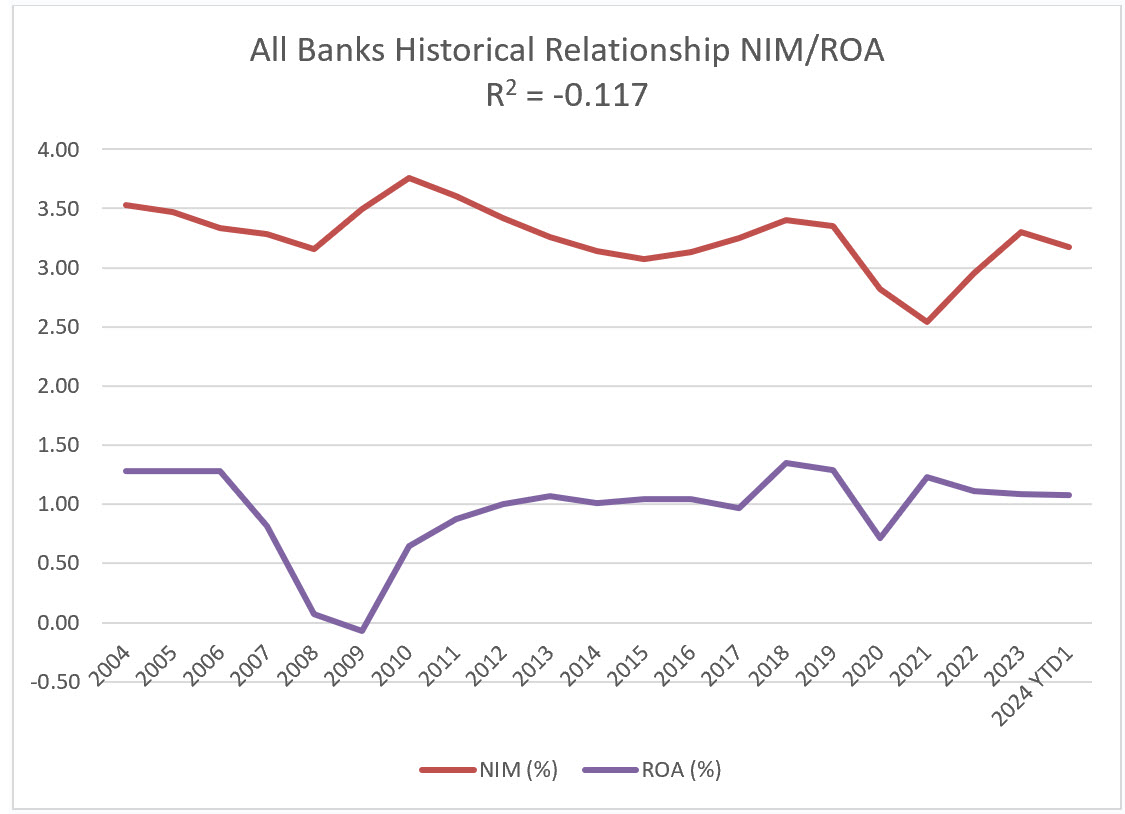

We have published numerous articles explaining why at specific banks no relationship exists between NIM and performance as measured by ROA/ROE (lates one here). Further, there is no relationship between NIM and performance for the industry as a whole – the last 20 years of NIM and ROA is shown in the graph below and the correlation coefficient is negative 0.117 (a low inverse relationship between NIM and ROA).

Theoretically, if all variables stay the same, an increase in a bank’s NIM will lead to an increase in a ROA/ROE. In the competitive world of banking (retail, commercial, corporate) all else is not equal. However, if short-term rates change (as they are now expected to decline) what will happen to NIM? A change in market interest rates seems to be an example where a bank’s NIM may change, and all other variables remain the same.

Bank Performance with Declining Rates and NIM

There are several factors that influence the relationship between declining interest rates and NIM. The germane ones are as follows:

- Asset versus liability sensitivity to declining short-term interest rates: this factor is driven not only by the contractual maturity distribution of assets and liabilities but also by effective maturities (the result of asset and liability prepayments).

- Historically short-term interest rates have decreased because the Federal Reserve is managing slowing economic activity. During economic contractions nonaccrual loans increase and NIM decreases. Further, during economic slowdowns, banks tend to lend less, and this leads to lower yields and lower NIM.

- It is a simplification to look at short-term interest rates (the portion of the curve that the Fed controls) and NIM. In reality, longer term assets, and to some extent liabilities, price not on Fed Funds rate but along various portions of the yield curve. The yield curve reflects the market expectation of future rates, and those rates already have future expected short-term rates included in the calculus.

- The magnitude and duration of declining short-term interest rates also plays a role in influencing a specific bank’s NIM.

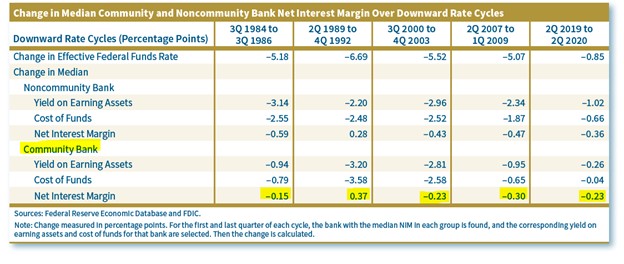

A recent published FDIC research paper looked at the historic relationship between NIM and short-term interest rates (here). The authors studied all rate cycles since 1984 and change in median bank NIM during rising and falling cycles. The authors considered how the change in NIM varied with community banks vs. noncommunity banks, and how asset portfolio distribution influenced NIM.

The authors came to the following conclusions:

- NIM for the entire banking industry has trended down since 1984.

- During decreasing interest rate cycles NIM has contracted for the industry.

- During decreasing interest rate cycles NIM contracts faster than it expands during increasing interest rate cycles.

- NIM change was smaller for community banks than noncommunity banks in both increasing and decreasing interest rate cycles.

- Community banks experienced a NIM decline in four of the last five decreasing interest rate cycles as shown in the graph below (highlights added).

Actionable Items

There are a few key takeaways from the FDIC paper (both expressly mentioned and implied). The key points are as follows:

- Fee income is a strong mitigant to the adverse impact of declining NIM in a decreasing interest rate cycle. Noncommunity banks have historically demonstrated more noninterest income. It is imperative for community banks to generate more noninterest income, especially in a declining interest rate cycle.

- Asset maturities play a vital role in NIM behavior in declining interest rate cycles. The authors considered maturity structures of bank balance sheets to determine how NIM responds to change in short-term interest rates. While banks with more fixed rate assets in three years or more repricing may gain a NIM advantage when interest rates decline, that same balance sheet composition hurts banks when interest rates increase. Unfortunately, it is hard to forecast future Fed Funds beyond a short period. In the long run, banks with higher share of long-term assets underperform the industry.

- Prepayment volumes change the dynamic of NIM in unexpected ways. In a decreasing interest rate cycle, fixed-rate assets prepay, and in an increasing interest rate cycle, fixed-rate assets extend. Both behaviors have hurt community bank performance. Prepayment protection is vital for both long-term assets and liabilities.

- Community banks hold a higher percentage of long-term assets to total assets than noncommunity banks. This may be a result of business models, and the lack of interest rate hedging capability at community banks.

- The authors identify another area of concern for the banking industry – excess deposits of over $3.3T from the pandemic have not been fully removed from the banking system. If those deposits continue to leave the banking industry, NIM may contract more than expected in the next decreasing interest rate cycle.

Conclusion

Bank performance with declining rates will be more nuanced than most bankers expect. While community banks’ cost of funding has historically been very closely tied to short-term interest rates, that relationship is not perfect. We would expect that during the next decreasing interest rate cycle that community banks would experience some NIM contraction, some banks will also witness more non-accrual loans, all leading to lower ROA/ROE. Banks that can generate more fee income, attract or retain DDA balances, include strong prepayment provisions on loans, and manage credit issues will continue to outperform the industry.