Scalability in Banking and Digital Transformation Example

Banking is woefully inefficient. There is a myriad of manual processes that take place everyday in banking driving up unit economics and causing the average bank to operate with a 77+% efficiency ratio. To be competitive in the future, banks need to be operating at an efficiency ratio of below 40%. Part of the issue is that while bankers are good at focusing on cost controls, many are weak at designing business models and workflow that scale. It is rare that a banker ever tracks unit economics let alone aware of the scalability function of a business line. In this article, we give a practical example of how scalability in banking works and how to use it to your strategic advantage.

Case Study: SBA Lending – The Traditional Approach

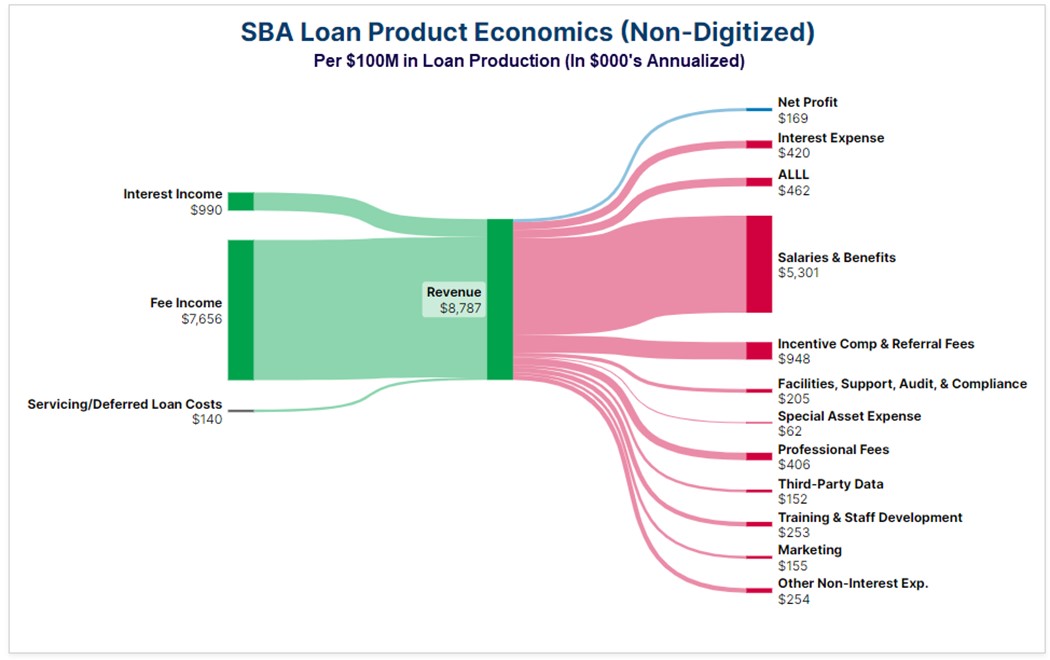

Small Business Administration (SBA) loan production is the perfect example of a business line that screams for digitization. Below are the typical economics for a traditional SBA production operation at a bank presented per $100 million of annual loan production in this current year.

Here, a bank would originate approximately 80 loans, sell the guaranteed portion for an average of an 8.7% premium contributing to the bulk of the profitability, receive interest income of the non-guaranteed portion at a rate to average Prime + 3% and derive a small net servicing profit. Out of the revenue, comes your typical expenses so a bank drives about $166k of risk-adjusted operating profit for every $100M of notional origination.

These economics result in about an 17% risk-adjusted return on equity (ROE), or a 1.4% return on asset figure. The operating margin is about 2% and the unit cost of production is approximately $112,000 which is the main problem with the business model.

Of course, times are slower these days due to higher rates (but about to pick up with the recent Fed rate cut), so the typical bank currently has excess capacity which is a nice way of saying that most banks are overstaffed. The key concept here to understand is that while most business schools would categorize labor as a variable expense, the reality is for a bank, human capital charges are largely fixed as banks are slow to fire people. The defense for this is that production could increase with potentially falling rates so banks need to maintain operational flexibility and SBA lending is a specialized lending niche that takes more training and skill compared to your average lender. Hiring and training is a slow and difficult process in the SBA world, so banks often decide to operate with lower profitability for the short-term to maintain their long-term strategic advantage.

SBA Lending – The Digitized Comparison

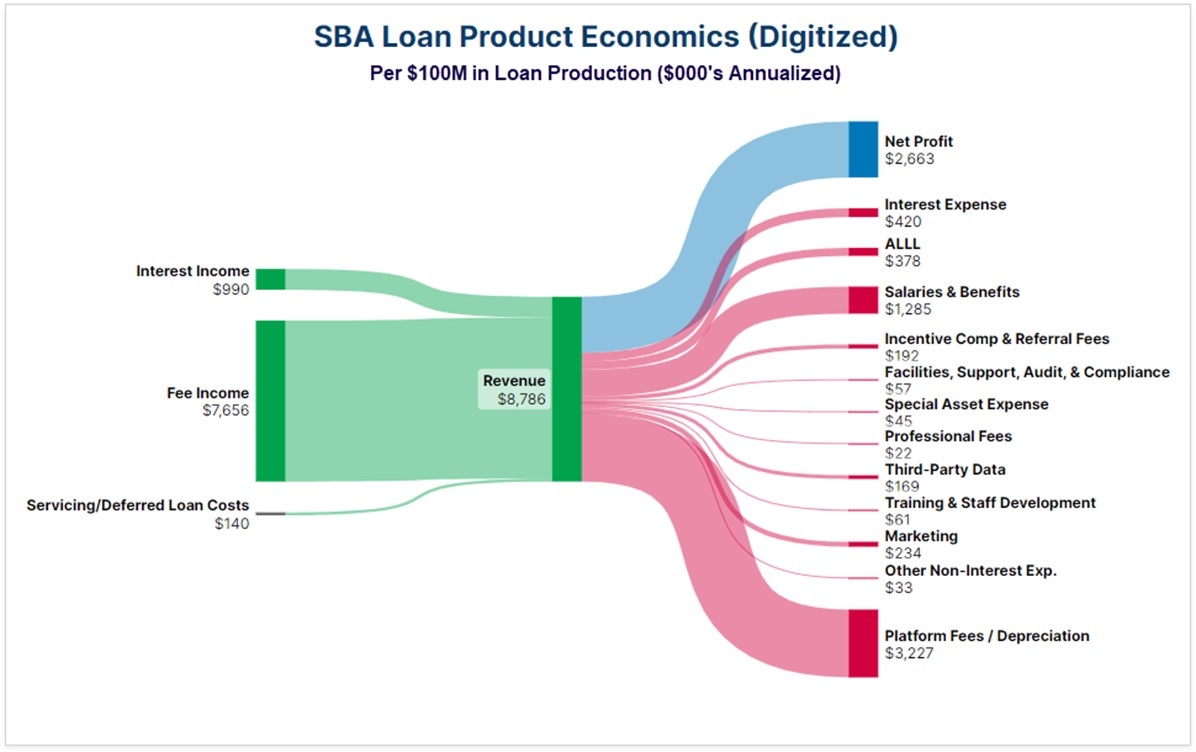

To contrast traditional SBA lending, let’s look at similar economics for a digitized line whereby the customer utilizes an online or mobile platform and both lenders and credit personal have the workflow digitized for efficiency. This is an example of scalability in banking. The average bank that has done this, see similar economics as below.

Here you see the business model and cost structure slightly different. We held production and revenue constant for the sake of cost comparison.

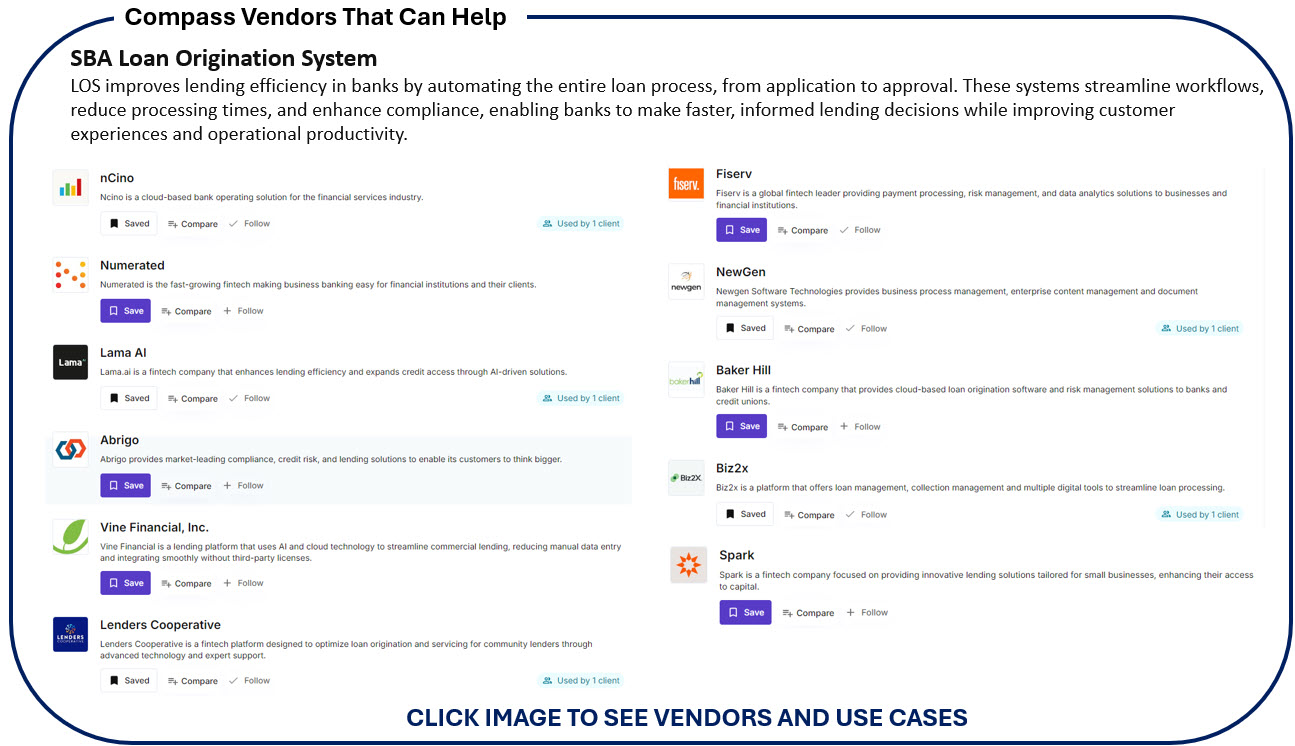

The digitized business model operates with about a third fewer bankers resulting in lower labor costs. Marketing expense is increased due to more efficient digital marketing and as a result incentive compensation is lower as fewer bankers are needed mto handle applications, credit and origination management. In the place of labor cost, you see platform fees where banks can either build their own platform (not common) or use one of a dozen providers (examples below).

One important point to understand is many vendors will charge a per loan platform fee resulting in a much more flexible cost structure. As such, when production slows like it has done now, unit economics are preserved.

The above model produces a 277% ROE, a 22% ROA, operates at a profit margin of 30% and has a loan unit cost of approximately $21,000 per loan, or more than 80% less the traditional SBA business model.

Another interesting aspect to this model is because of the lower unit expenses, banks can afford to process smaller loans which increases diversification, increases the guarantee premium, requires slightly lower credit charges and results in greater CRA attribution. This model also offers banks greater flexibility so that they can not only scale both up and down but can leverage the technology to handle related business lines such as USDA or Farm Credit production.

The Misguided Notions of Digital Transformation

Part of the issue of the inefficiencies in banking stems from a confluence of misguided notions when it comes to digital transformation. When bankers do want to improve efficiency, they think along a single business line instead of a function. Banks will tend to transform consumer lending instead of tackling all of lending or all of onboarding. Instead of building components such as identity, know-your-customer, or account self-service that can be used across the enterprise, bankers rely on a vendor or create a process that handles a business line silo. While banks may reduce their cost for that business line, they limit their ability to scale across the organization.

The other issue is one of strategy. Most bankers want to be relationship bankers instead of focusing on transactional efficiency. Bankers also love to service every type of customer from consumer to small business to mid-sized company. To compound this problem even more, bankers attempt to deliver an “omni-channel experience” which means serving the customer in the channel they choose – mobile, online, social media, embedded, phone, or branch. Trying to be all things to all people across all channels is downright expensive and is difficult to sustain for even the largest bank, let alone one with $1B of assets.

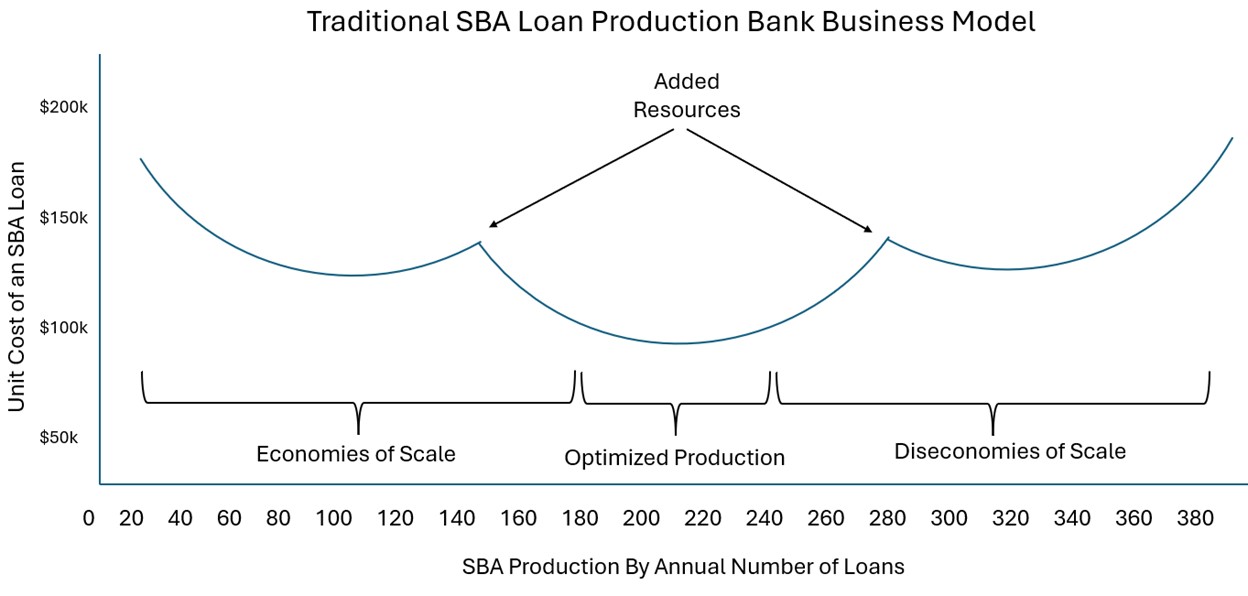

In our SBA lending example, its common to have some process improvement and add resources to lower credit production cost and improve unit profit of each bank product. What normally happens is that you get a series of “scale-lets” as depicted below. Each scale-let has a portion where you gain economies of scale and lower your unit cost, reach an optimized point, and then become less efficient as you suffer diseconomies of scale. To solve capacity issues, bankers need to add more people handling underwriting, compliance and operations to then move to the next scale-let.

Scale-lets can be visualized together so that in the long-term bankers often suffer diseconomies of scale permanently until they add technology to the process. This helps explain, why banking processes like branching, checks, drive-throughs, and ATM can only be so efficient and as a result, will be vastly curtailed in the future. Technology will see to it that new processes and products are created to replace each banking product that us nearing its limit on unit cost reduction improvement.

Improving the Banking Business Model to Achieve Scalability in Banking

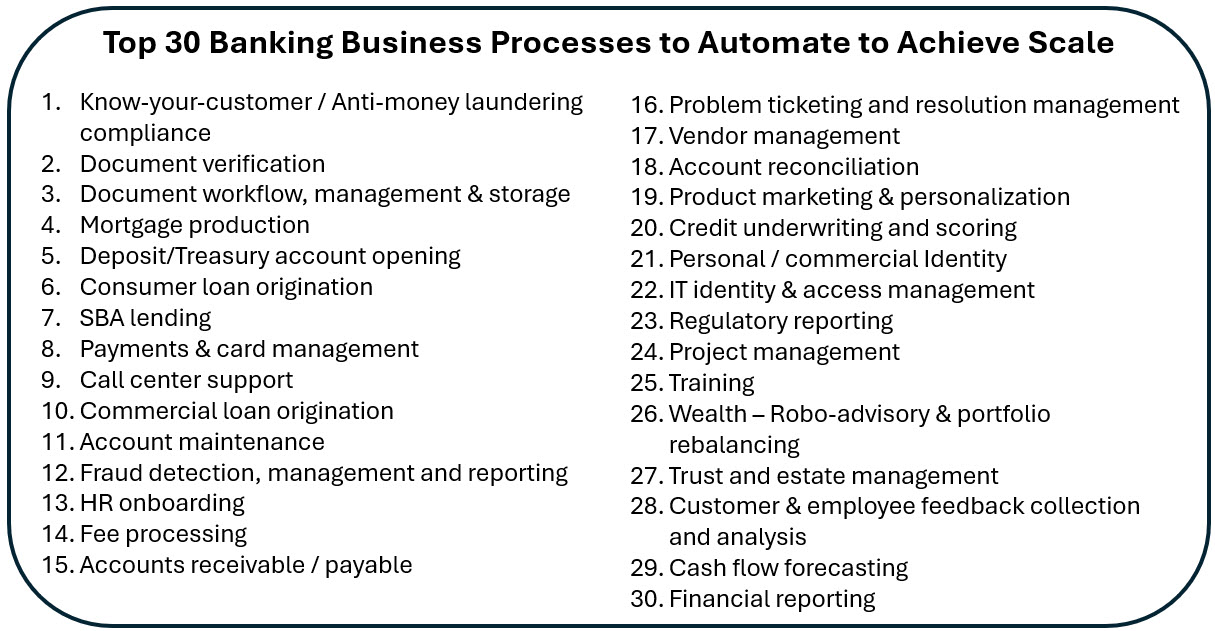

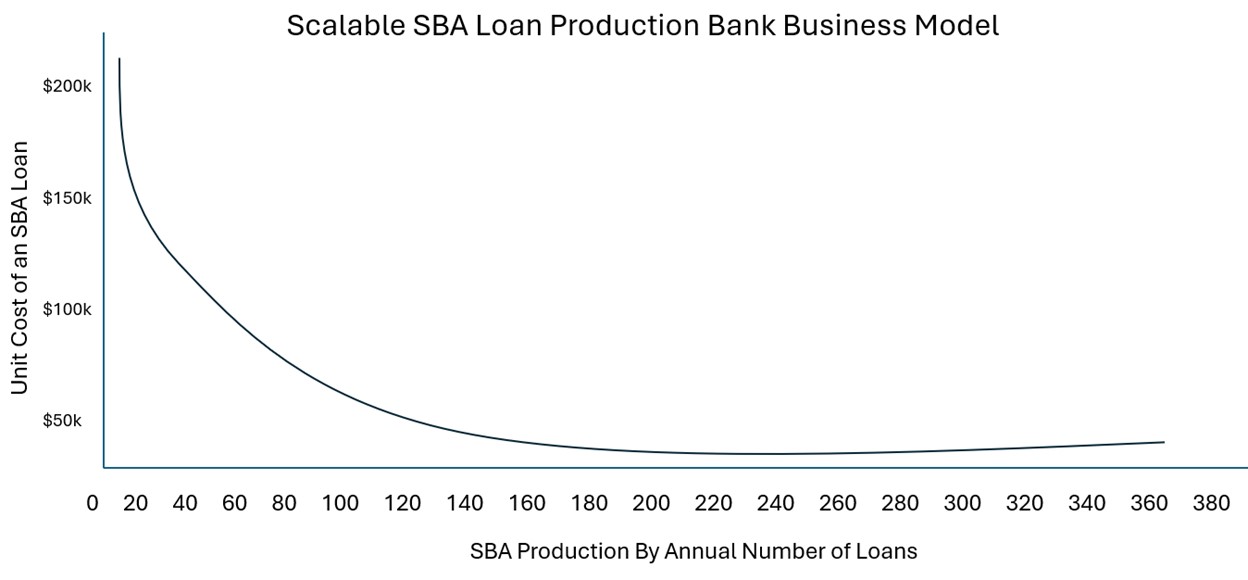

By contrast to the traditional SBA lending model, moving loan origination and servicing online and mobile has some clear advantages the first of which is achieving scalability in banking. Any product where a bank has heavy volume in such as mortgage lending or consumer lending, are ideal candidates for automation prioritization. SBA lending, because of its complicated rules and procedures is also a perfect candidate for digital transformation.

For banks that have done this, or will do this for SBA lending, their business model moves from the above graphically depectived business model to the graphic below. Here, unit costs drop sharply after implementation based on the number of loans and diseconomies of scale are slight. Most bank production platforms have the capacity to handle tens of thousands of loans per year. As such, putting a flexible platform in place that can also grow with your bank is a strategic imperative. This will not only increase unit profitability now but will provide more operational flexibility well into the future. Do these enough times with various bank processes and your bank will be in an ideal position for M&A.

12 Indicators of Product Management Scale Measurement

Managing scalability in banking at the product level is another reason banks need more product managers (our latest article HERE). You can’t manage what you cannot measure.

As you prioritize strategic initiatives for next year, consider what enterprise business processes could be ripe for transformation. It is likely that your bank is in various stages of many of our Top 25 list detailed above. This is the time to take another look at each of your strategic initiatives and reprioritize based on enterprise scalability.

If you have not done so already, we also suggest considering adding the following scale key performance indicators to your product management to better understand the scale of the product, service or process. Here are some of our favorites, in order of impact:

- Unit cost and profit: How much does it cost to originate, book, manage, and service each bank product on the margin both now and if business doubles. Bankers should create a business model, so they understand where and when to add resources as they grow.

- Present Capacity Utilization: Without adding any more resources, what is the current throughput capacity of a banking product or service. This applies to both origination and portfolio management.

- Throughput: Measures the rate that a process can be completed within a predetermined time. For example, how many SBA loans can be processed per week.

- Capacity Investment Points & Volume Flexibility: When is the next throughput limit when you need to add more resources. The more room you have here, the more scalable the process. How fast can you add capacity – that is, how much volume can you increase within a set period of time if required?

- Cost Capacity: What is the dollar amount and ROI of making that next capacity investment?

- Breakeven Analysis: What is the production increase needed to pay for the cost of that next capacity investment?

- Bottleneck Analysis: Where in your current process are you the most inefficient or the slowest? Why do you have the disruption? Every product has a bottleneck, and you have to make sure you know where yours is.

- Cycle Time: What is the total time required to complete a process such as account onboarding or SBA loan booking?

- On-Time Delivery: What percentage of activity or production meets your stated desired cycle time?

- Work-in-Progress (WIP): What are the units in each stage of production?

- Capacity Growth Rate: Your bank measures production but it should also consider measuring how fast your capacity grows.

- Innovation Rate: This is the amount of dollars you invest in a given process as a precent of total revenue.

How to Take Action To Achieve Scalability in Banking

Consider some of the concepts and metrics detailed in this article and start to have a conversation about how to scale your bank better. Executive management should create opportunities for discussing capacity constraints and future required capacity investments to better manage a bank’s future efficiency.

Creating business lines that scale not only offer superior economics, but greater operational flexibility to make the bank more resilient. Creating microservices of automated business processes also allows banks to pivot faster or take advantage of new markets or innovating around new products.

To achieve better scalability in banking, the entire bank model needs to be digitized and banks are about 10 years through a 30-year process. Unfortunately, many banks are doing this on a business line basis and not looking at the bank wholistically enough to make sure they digitize a function before automating business line processes. Managing scalability and capacity management is often a new skill for bankers to add to their skill set in order to improve the efficiency of their product line and the bank.