The Current Banking Crisis – 10 Not-So-Apparent Lessons

It turns out that confidence is more valuable than capital. While we wrote about the root cause of the failure of Silicon Valley Bank (SVB) HERE, the lessons of the current banking crisis go beyond interest rate risk management. While interest rate risk caused the most significant impact on value, several other factors contributed to the terminality of each bank that was closed. This article highlights ten not-so-evident lessons of the banking crisis that every banker must consider going forward; plus, we highlight the trends of higher forthcoming costs and an enhanced “risk-off” attitude.

10) New Ratios To Learn: This current round of bank failures has ushered in a set of new ratios to use or recalibrate to.

- Loan-to-Deposit Benchmarks: A low loan-to-deposit (LTD) ratio usually denotes a less sensitive liability base and a higher-quality bank. SVB’s 43% LTD used to be talked about with reverence. That notion proved false, and the quality of that metric has forever changed. Now, customers and analysts will pay more attention to loans plus securities-to-deposits as a ratio. This new ratio will tell depositors and analysts what the potential wholesale liquidity need could be. Higher cash holdings will now be a demarcation of credit quality.

- Percentage of Uninsured Deposits: At the time of failure, SVB had approximately 88% of their deposits above the FDIC-insured $250k limit and ran at 95% at the end of last year. Roku revealed it had almost $500mm in deposits at SVB. This is compared to about 40% at most banks. Having that large of uninsured deposits dramatically reduces the duration of those deposits. While many banks had a deposit beta around the 45% level for year-end, SVB’s beta was at 63%. Higher-balanced customers tend to be more interest rate sensitive.

- Funding Capacity as a % of Uninsured Deposits: Calculating a bank’s total liquidity lines as a percentage of uninsured deposits is now in vogue. Customers and analysts will look for this ratio to be over 100% so that borrowings can meet any uninsured runoff.

- AOCI and HTM after-tax Loss Adjustment to CET1: It is unclear how this exact ratio will settle out in the industry, but the concept is to adjust a bank’s common tier 1 equity to risk-weighted assets (CET1) by subtracting any accumulated other comprehensive income (AOCI) (unrealized gains or losses) and any losses in a bank’s held-to-maturity (HTM) investment portfolio. The ratio would provide a bank’s current core capital position to risk-adjusted assets. Some form of this ratio will likely be applied to the national and regional banks, which means larger community banks will also be judged by this ratio.

9) Brand Matters: SVB had one of the best brands in banking. Watching the banking crisis unfold, thousands of customers came to the bank’s defense. You did not see this kind of support during the failure of Washington Mutual, and you didn’t see it with Silvergate or Signature Bank. Unfortunately, in this case, the brand couldn’t overcome the sizable liquidity risk on the balance sheet. However, we note that had the banking crisis been less severe, this bank’s brand would have helped extend the duration of its liabilities.

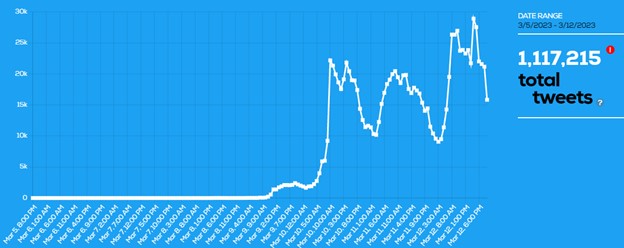

8) Deposit Impact of Social Media: SVB’s customer base and followers were highly active on Twitter and other social media properties. A Tweetbinder report below shows that the brand generated more than a million tweets, about 65% of which were negative. This is substantially more traffic on the order of at least five times than what a normal distressed bank would receive. The more active your customer base and “friends of the bank” are on social media, the shorter you can expect your deposit duration when sentiment turns negative. First Republic Bank is fighting for its life right now as a result.

7) Investment Portfolio Sales & Restructuring to Support Capital: While many bankers have been concerned about the unrealized losses in their investment portfolio, this concern was realized by SVB when they had to sell their portfolio and recapitalize. The immediate tactic for many banks will be to use the drop in rates to reduce their investment holdings and increase their liquidity. Many banks will park this liquidity in cash or short-term securities in an attempt to get ahead of higher required capital ratios that are likely forthcoming from regulators. In the future, look for banks to pay more attention to the duration, convexity, and liquidity of their investment portfolio as well as the portfolio’s size relative to total assets.

6) Bank Term Funding Program (BTFP) & Collateral Management: This newly introduced liquidity facility will now be common knowledge for all bank executives and finance personnel. While the details can be found HERE, and the FAQs can be downloaded bank-term-funding-program-faqs, the TL;DR synopsis is that the facility allows banks to borrow against their investment portfolio at par value for up to one year. Bank borrowers will receive 100% of the face value of the securities without a haircut at a rate of the one-year overnight index swap rate plus 10bps (currently set at 4.50%). The facility not only allows greater liquidity for the investment portfolio but allows bankers to borrow against any losses. Previously, if banks were able to borrow against these securities, it would be at 98% of the market value or less, depending on the investment type. The BTFP now presents bankers with one of the best tools of additional contingent liquidity plus borrowing capacity to include in the ratios mentioned above, plus cover any potential run on uninsured deposits.

The larger issue here is that banks need to do a better job at collateral management in general. Most banks are materially under-pledged in terms of the loans available for borrowing. From now on, bankers need to develop expertise around managing and optimizing their collateral, as every drop of liquidity now counts. In some cases, loans can be pledged at multiple facilities, such as the Federal Home Loan System, the Discount Window, or for lines of credit. Bankers need to know which path is the fastest, the cheapest, and/or the way to gain the most liquidity, as not all haircuts/discounts are the same.

5) The Lower Impact of Deposit Inflows: Traditionally, a distressed bank can count on a material amount of deposit inflows due to more proactive marketing, more brand recognition, and the bank raising deposit rates. These inflows help mitigate a run-in-progress. The behavior of deposits for a bank under a regulatory order and pre-failure period was recently famously quantified by Martin, Puri, and Ufier of the FDIC last year HERE. These inflows have a first-order impact and are part of a distressed bank’s playbook. Unfortunately, the speed at which SVB’s outflows occurred never gave the Bank a chance to launch a counter-deposit gathering campaign. Going forward, few bankers can count on their ability to counter-market a failure-in-progress.

4) Digital Velocity, New Products, and a Lobbying Effort: SVB had one of the highest penetrations of digital usage in banking. Access to wires via mobile and online banking apps has sped up money movement. When it came to withdrawing funds, SVB had a record $42B leave the bank in about five hours. That is $4.2B per hour or more than $1mm per second. To put this in perspective, Washington Mutual was heretofore considered the fastest bank run, in terms of outflow velocity, at $8B over several days. As banks move more of their customer base to digital platforms and real-time payments, they can expect the need to hold more liquidity and have shorter liability durations.

To combat this speed, banks must get innovative to offer greater protection for uninsured deposits. This may be in the form of reciprocal deposit programs, money market sweeps, private deposit insurance, or Treasury-backed deposits where the customer’s deposits are secured, and the customer can borrow against those securities.

In addition, look for more active bank lobbying efforts to increase FDIC insurance coverage, put state coverage in place like in Massachusetts, and/or have the return of private deposit insurance.

In general, banks will be focusing more on deposits. Managing deposits takes a dedicated team under a Chief Deposit Officer. Banks will focus more on mix, slowing customer churn, relationship packages, new product development, and fee alignment. Look for more formal education teaching bankers how to talk to customers about FDIC insurance, bank safety, and liquidity concerns. Unfortunately, the recent turmoil resonates with the most profitable customers at banks, making customer management critical

3) Deposit Rates & Re-Education: We recently wrote about “relasticity” for deposits HERE. Recent events have increased and made customers more sensitive to safety, service, and convenience instead of rate. The result is greater negative relasticity. This means looking for lower deposit rates and fewer interest rate-sensitive depositors in the future. Smart banks will take this opportunity to launch a marketing campaign around their safety, service, and convenience to gather better-performing deposits.

Part of this effort is a concerted program to re-educate your front lines. This includes intelligently talking about the current banking stress, discussing how deposit insurance works, and how to expand coverage through proper titling.

Look for deposit betas to slow because of this “flight-to-safety” and slower Fed increases. High deposit rates will now be a sign of weakness.

2) Customer Concentrations Matter: About a dozen customers of SVB had outsized influence on almost their entire customer base. Well-known venture capitalists were able to influence other venture capitalists, which all controlled their portfolio companies. Banks often ignore this risk, particularly those with limited geographical footprints where community members talk. SVB showed what happens when this risk is realized.

1) Manage Customers as Part of the Crisis Plan: Every bank needs not just a banking crisis communication plan but a proactive plan to educate and manage customers. This should be a standard operating procedure at every bank. Every bank should train and conduct tabletops exercises on crisis management down to customer outreach. As we called around last Sunday, only a few banks had directed staff to reach out to their customers, yet every bank was on the brink of a potential run. Too many banks did not assign “response teams” to manage the news flow and events over the weekend. Had the Treasury not stepped in with the Bank Term Funding Facility, Monday would have looked a lot different.

In the future, banks will leverage data and personalization to inform customers of their specific risks and provide needed information based on the customer’s relationship and product use. Banks learned this week that generalized communication about their strength, counter-intuitively, resulted in a sign of weakness. The communications team was, and will continue to be, challenged during this crisis to strike the right balance.

Better Understanding These Banking Crisis Changes

As this banking crisis unfolds and more details emerge, look for more lessons to follow, and like with every banking crisis, expect new liquidity and deposit management regulations. Further, look for the Fed to reassess its hawkish “hiking” position. The combination of potentially more stimulus and slower or no rate hikes potentially risks exacerbating inflation or companion stagflation. Both scenarios now need a higher probability of occurrence as banks forecast their financial performance, budgets, and strategic planning.

In the next several weeks, look for more content from us, including a webinar that will go into more detail about some of the above. We will be discussing many of these topics at our 2023 Bank Management Conference coming up on July 6-8. Every public bank is at risk of being caught in an equity sell-off that will catch the media’s attention, be amplified on social media, and will cause depositors to question the stability of the bank. Bankers must now be ready to combat these events with their own defensive and offensive plans.

Keep an eye out this weekend for more industry announcements.