Bank’s Post-Pandemic Balance Sheet Playbook

Bankers can be forgiven for not anticipating the start of the pandemic. However, bankers must now be planning their business to capitalize on the transition from a pandemic to an endemic environment. There is convincing evidence that the global economy will transition to an endemic phase after the omicron variant subsides – but caveats abound. The endemic stage will occur at different times for different parts of the country, but it is now essential for community banks to plan for this transition.

The Evidence

Stocks that win in an economic reopening have stormed back, and those stocks that outperform in lockdowns and pandemics are tanking (primarily tech companies). A rally in commodities is adding further evidence that consumption is rebounding. The percentage of the sovereign with negative nominal yield is declining to pre-pandemic levels (declining to $9Tn from $20Tn at its peak). The travel and leisure indexes are starting to approach pre-pandemic levels (even though passenger airline indexes are still down 30% from pre-pandemic highs). Inflation-adjusted Treasury yields have rebounded from record lows and indicate that monetary policy is ending as the economy breaks free of the pandemic.

There are calls in countries worldwide to treat Covid as endemic and push for a return to normal life. Parts of the world have already moved in that direction – notably South Africa and London, England. In South Africa, the omicron death rate topped at 15% of the delta wave. Given the lower severity of this strain, other countries will likely label Covid as another endemic virus.

The Consequences

The expectation of the end of the pandemic will lead to the Federal Reserve raising short-term interest rates and possibly reducing its balance sheet. Regardless of how fast the Fed moves to tighten financial conditions, inflation is expected to remain elevated, at least in the short term. Real interest rates, not nominal rates, will be much more critical than in the past. If inflation stays elevated at recent CPI and PCE levels, interest rates will have a long climb, and four quarter-point rate hikes in 2022 appear insufficient. Real yields approaching zero would become a genuine concern for the economy, but that is 600 basis points away in the Fed Funds rate.

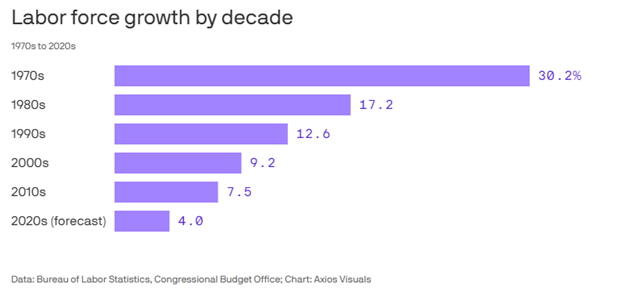

We will likely continue to see pressure on inflation as the labor shortage is expected to continue despite the end of the pandemic. The graph below shows labor force growth for each decade from 1970 to 2020 (forecast). The summary is that the demographics are causing fewer people to enter the workforce, and the massive baby boom retirement is causing a significant departure of labor. The Congressional Budget Office is forecasting that the US labor force will grow 0.2% a year from 2024 to 2031. This lack of employees will be a significant factor driving up inflation.

If interest rates and inflation are rising, how should banks position for this change? We reviewed what Warren Buffett said about rising rates and the impact on businesses. “Interest rates are like gravity to valuations”, but “nobody can predict where interest rates will go”. He also stated, “The value of every business, the value of a farm, the value of an apartment, the value of any economic asset is 100% sensitive to interest rates. The higher interest rates are, the less the present value is going to be.”

How Community Banks Should Respond

In a rising interest rate and higher inflation environment, community banks should follow certain principles and strategies. Generally, higher interest rates decrease the value of the collateral and diminish the debt service coverage ratio. Banks should also expect liquidity to diminish and interest paid on savings and CD accounts to increase.

The top 10 principles that community banks should consider as the result of rising interest rates and higher inflation are as follows:

- Capital-intensive businesses perform poorly in a rising interest rate environment. The cost of owning assets becomes more expensive, and returns diminish. Real estate is a capital-intensive business, and banks should be cautious in identifying less leveraged projects.

- Cash flow becomes even more important when interest rates rise. At today’s average cap rates, DSCR must be over 1.5X to withstand a 200bps increase in rates before cash flow cannot support debt payments. The old banking adage that cash flow is king will become even more germane.

- Brands and intellectual property will become more valuable as capital-intensive businesses become less valuable. Businesses that do not have to invest great sums in retaining brand loyalty will be more profitable in a rising interest rate environment.

- Historically, the following sectors have performed well in a higher inflation environment: energy, consumer staples, industrials, and financials. The following sectors have performed poorly in that same environment: IT, mortgages (real estate), telecoms, and consumer discretionary.

- As interest rates rise, deposits will again become valuable and create franchise value for most community banks. Those banks with non-interest-bearing accounts and a high concentration of business DDAs will fare best.

- A proper mix of liabilities will become necessary. Banks that show discipline about pricing CDs, savings accounts, and MMA will earn higher returns than competitors.

- As interest rates rise, community banks need to be more focused on picking winning relationships. When real interest rates paid by borrowers are a negative 2-4% (adjusted for inflation, tax, and depreciation), most businesses can survive. However, we may see real interest rates in positive territory in the next few years, and picking sustainable and profitable business models will become more crucial for bankers.

- Change is always difficult to navigate, and rising interest rates will put a strain on some community banks. Being able to manage ALCO, balance deposit mixes, and find profitable relationships will be essential for banks in competitive geographies (which is almost every market in the country).

- This anticipated change in the interest rate environment puts pressure on banks to create and deliver new products desired by customers. As interest rates rise, existing deposit products and lending products will not address customers’ needs, and product innovation will be a challenge for some community banks.

- Community banks should expect to pay more to retain and attract talent. Early in 2021, many national banks, including BofA, Citi, JPMorgan, UBS, and Morgan Stanley, announced increased salaries for entry-level and corporate banking positions. Later in 2021, many regional banks followed suit. In 2022 community banks will feel the same pressure to raise pay to retain good lenders and managers.

Conclusion

Change is a force that disrupts business models. The onset of the pandemic was disruptive for many families and businesses. The end of the pandemic will be much more welcomed by many but will create some challenges for community banks. Community banks must start planning for the future end of the pandemic and how best to position their business for optimal performance.