Better Loan Pricing – Correcting 5 Big Mistakes

If you want to know how you can improve your bank’s profitability, one place that you can start is better loan pricing. While chances are your bank prices most of its loans correctly, it is the fringe cases that, in aggregate, end up having a large impact on bank profitability. In this article, we look at current data to uncover where banks are “leaking profit” and give some tips on how to improve.

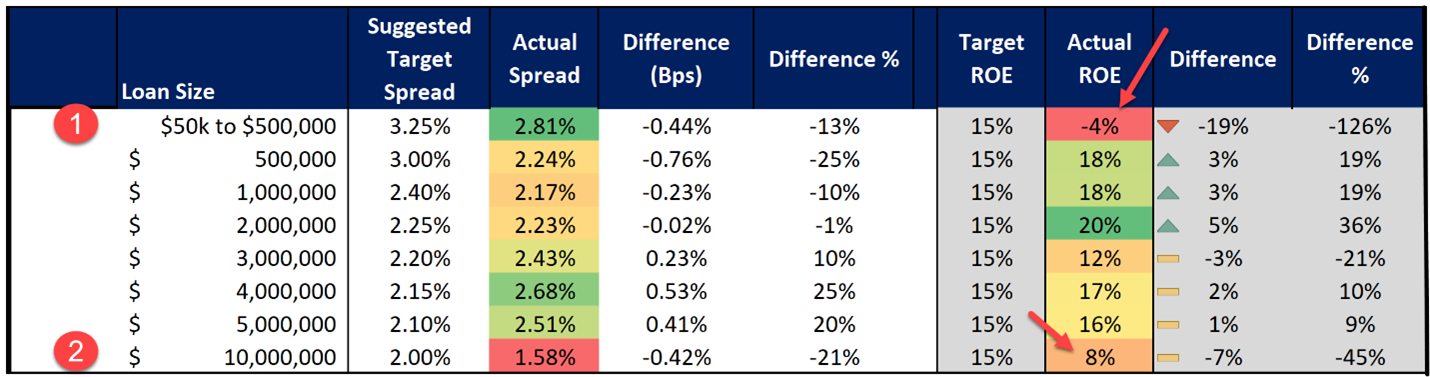

Better Loan Pricing Starts With Loan Size

The single largest mistake most banks make when it comes to loan pricing is that they underprice their smaller loans. As you can see in the data below, banks do put a premium on smaller loans, but it is not enough. Banks priced the average loan below $500,000 at a 2.81% credit spread, which is about a 40-basis point premium to the average credit spread in the market, but it is still too small a spread as it produced an average risk-adjusted return of -4%.

Loans below $500,000 can make up 30% to 60% of a community bank’s loan production, driving down the average relationship profitability. That spread, depending on the loan structure (maturity, fees, deposits, and other business), likely has to be above 3.00% in almost all cases.

On the other side of the spectrum are the larger loans. Here, competition is fierce, and it isn’t easy to get a spread north of 2.00%, which is the target average for most banks. In this case, profitability is more about structuring, and banks should strive to increase the maturity of their loan in order to give the most extended set of cash flows possible protected with a yield maintenance provision.

Alternatively, banks that dip below 2.00% in spread should be doing so for the relationship and, as such, should be able to garner profitability from other fees and lines of business. By bundling products, average return on equity can often double as not only does profit increase, but lifetime value lengthens, thereby resulting in greater lifetime profitability.

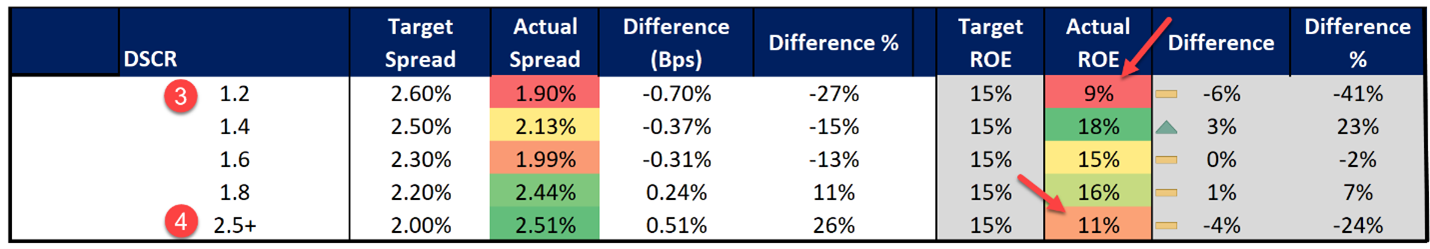

Better Loan Pricing By Credit

After pricing by loan size, the next largest mistake banks make is not pricing their lower-tiered credit enough. Last quarter, banks priced credit that generated an average of 1.2 times debt service coverage at 1.90% when it should have been closer to 2.60% to compensate for the probability of default, the loss given default, and the volatility.

In a similar fashion as loan size, it is also the other end of the spectrum where banks run into trouble on two fronts. One is that, despite having better credit, banks are getting adequate credit spread. But they are not doing enough to lock-in that borrower with other products, a longer maturity, or a longer amortization. Like more significant loan-size deals, banks will take good credit and think nothing of putting a five-year maturity on the loan.

Not only is the four- to six-year area the time of the largest credit risk, but it is also a time when banks just recouped their acquisition cost and started to make a higher profit margin on the loan. Putting a maturity in year five forces a refinancing at best and causes a borrower to go elsewhere at worst. It’s far better to lock a quality borrower in for ten or more years and build that relationship profitability over time.

Of course, the flip side of this is that banks are not aggressive enough with the spread and are losing higher-quality deals. This lost opportunity has an impact on bank profitability and needs to be tracked. Since borrowers are more price-sensitive than structure-sensitive, it is far better to provide an aggressive spread to win the business but get the loan structure and relationship you want than it is to let a quality credit go to a competitor because of price.

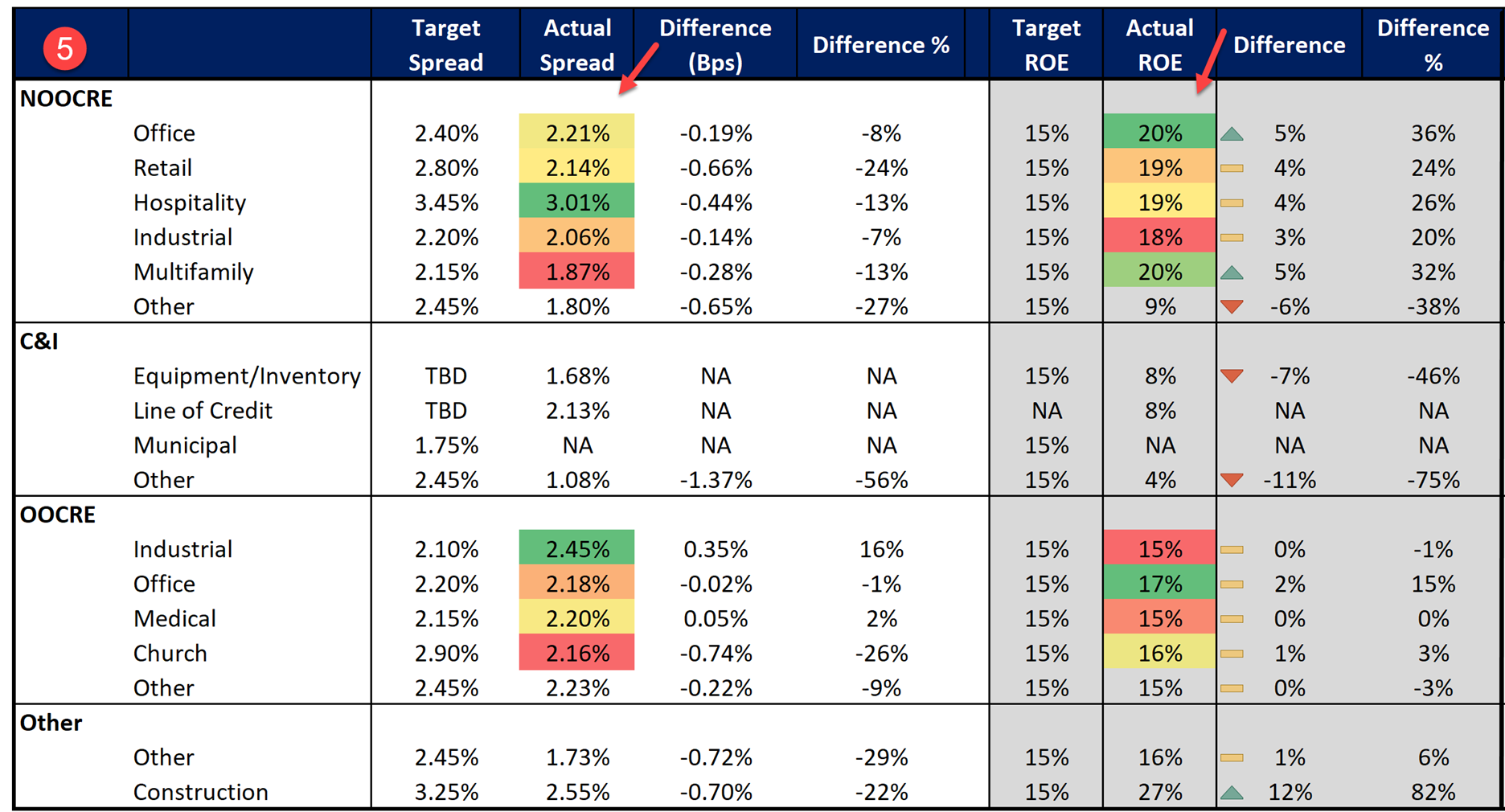

Better Loan Pricing By Sector

Last year, banks in general did a fantastic job at pricing their lending sectors correctly and getting the return on equity (ROE) that they need. This isn’t so much of a mistake as it is a plea for the industry to be mindful of how we price various sectors and subsectors to get the profitability we need to continue to attract capital.

As can be seen below, banks did a great job at pricing their riskier sectors, like hospitality and construction, in order to drive return. Conversely, when a sector was competitive, like multifamily, banks did a good job at getting the relationship and structure they needed.

Both non-owner-occupied commercial real estate (NOOCRE) and owner-occupied commercial real estate (OOCRE) produced above a 15% targeted return. Notably, banks did a commendable job at taking advantage of the dislocation in the office market. They provided loans to both the investor and the owner-occupied sector for an above-average return.

The one noted area of improvement is for the commercial & industrial (C&I) sector, where lines of credit renewals, popular in the fourth quarter, brought loan spreads and profitability down. Here banks need to be careful of whom they provide lines of credit to and use the product sparingly only to support existing relationships, particularly relationships where the bank also has a term loan in place. In this manner, the data a line of credit provides helps lower the risk of the overall relationship, making the combination of products often more profitable.

Putting This into Action

By using relationship profitability tools like Loan Command, banks can not only drive loan-level pricing more accurately but have the aggregate data like the above to be able to analyze trends, train, and improve. We have highlighted the top five areas of improvement driven by industry information from last quarter, but each bank is a little different. It is helpful to look at the data from your own bank to see where you can improve.

By practicing continued quality improvement in relationship profitability, banks can find that they can move their return to above-average since many banks don’t take the time to analyze this easily obtainable data.