Can The Federal Reserve Afford to Raise Interest Rates?

The market is now pricing Fed Fund hikes beginning in 2022, and the proposed fiscal stimulus in the form of two separate infrastructure bills totaling $4.5T has created a new sense of optimism for FOMC members. However, the lingering concern that many bankers hold is can the country (US Department of the Treasury) afford to pay higher interest payments on the massive US debt ($21T public debt and $6T intergovernmental debt). The math is straightforward and shows that the most viable route to de-lever the US debt is to stoke inflation and raise interest rates in tandem.

What The Markets and The FOMC Are Telling Us

The Fed Funds futures market is pricing a 48% chance of interest rate hike by November of 2022 and an 83% chance of a hike by December of 2022. FOMC members have come out with the following statements in the past ten days:

- Dallas Federal Reserve President Robert Kaplan – The central bank should begin to taper its monthly purchases of Treasury bonds and mortgage-backed securities in October. “My thought is I’d rather take the foot off the accelerator soon and reduce the RPMs. What I don’t want to do is keep running at this speed for too long and then we’re going to have to take more aggressive action down the road.”

- Kansas City Fed President Esther George – After the end of tapering, “a transition from extraordinary monetary policy accommodation to more neutral settings must follow.” She went on to say “one might argue the inflation being experienced today is enough to “align” with the stated threshold for raising rates.”

- St. Louis Fed President James Bullard – referring to the current higher than anticipated inflation numbers, “This is quite the large impulse, and it is enough to have made up for some of the past misses to the downside, which was a core part of the discussion. In my mind, we should declare success on this.”

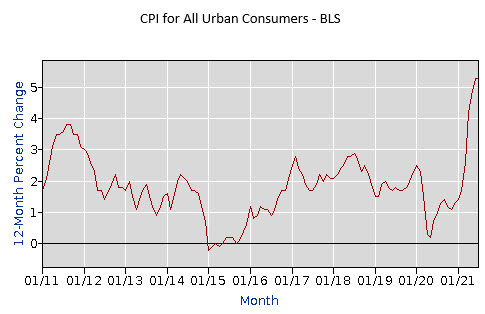

There is potentially a flawed argument that there is political and regulatory motivation to control inflation. But there may be much to gain to allow inflation to escalate and interest rates to follow in the near future. The Federal Reserve and Congress may not only tolerate inflation but seek it, and FOMC members welcome the current inflation levels. The graph below shows the 12-month CPI for the last 10 years. The current number, at 5.3%, is the largest since the early 1990s.

Why Inflation Helps Debt Management

There are many perils of inflation, from regressive redistribution of wealth, eroding purchasing power, and discouraging investments. However, inflation can also help indebted nations, especially those indebted nations that issue domestic debt in their reserve currency.

As of July 31, 2021, the US Treasury had $21.7T of marketable securities outstanding, with a weighted average coupon of 1.37% and average maturity of 5.75 years. There are three main ways for the US Treasury to lower the cost of financing this debt (outside of paying off the debt through budget surpluses or defaulting).

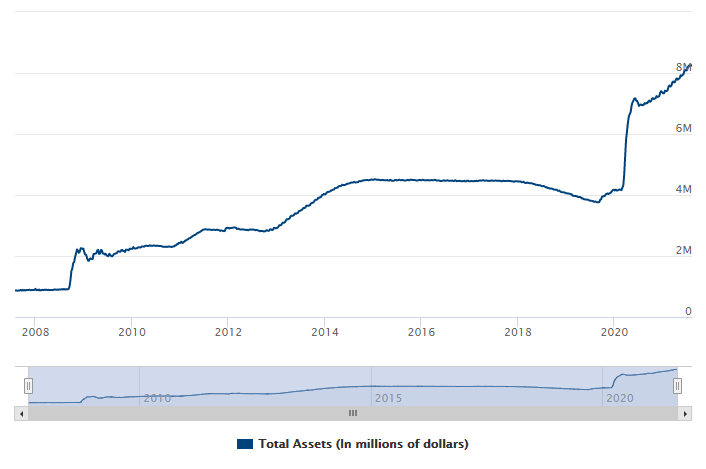

First, the US Treasury may issue debt which is then bought by the Federal Reserve. That way, interest payments on debt are paid by the US Treasury to the Federal Reserve, with that interest payment becoming neutral for current expenditures. This is one example of helicopter money that was coined by Milton Friedman, to illustrate the effects of monetary expansion. That is precisely what is happening now, and the graph below shows the Federal Reserve balance sheet ballooning to the current $8T. It is debatable, but this type of money printing cannot last for extended periods, even for reserve currency debtors, and even if other central banks continue with easy money policies.

Second, inflation decreases the cost of servicing debt. The weighted average coupon on all US government securities is 1.37%. However, that 1.37% is the nominal interest rate. The real economic payment is the nominal rate minus the inflation rate. Currently, inflation is over 5%, and over the next 5.75 years (the weighted average maturity of all debt maturities – bills, notes, and bonds), the expected inflation is 1.42%. The bizarre reality is that the current debt burden by the US Treasury is negative – the government is getting paid to borrower funds from investors. This is no different than the vast majority of commercial borrowers paying next to zero real rates to borrow in the capital markets or from their commercial banks. Therefore, all else being equal, higher inflation and interest rates will now serve to decrease, not increase, the cost of carrying US sovereign debt.

Third, the fastest way for the government to shrink the mountain of debt weighing down the US economy is to promote inflation because inflation decreases the value of principal owed in the future for repayment of US notes and bonds. The vast majority of government interest payments are fixed in nominal terms and pay principal at maturity, and inflation makes the existing debt less burdensome in real terms. Assuming a 30-year bond, raising the long-term inflation target from the current 2% to a still-modest 4% would reduce the debt by 39.6% over the life of the instrument, and raising the long-term inflation target to 6% would reduce debt by 62.4% over the life of the instrument. The US has used inflation this way before. The average inflation rate from 1946 to 1955 increased to 4.2%, reducing the debt/GDP ratio by almost 40% within a decade.

Because the average maturity of US debt securities is 5.75 years and the securities are mostly bullet repayments, we can measure the trade-off between the cost of rising interest rates (which increase coupon payments for refinancing) vs. the erosion of future dollars of debt repayment (which effectively lowers the real debt obligations). The benefit of rising inflation and interest rates is a factor of 3.5:1.0, meaning that as interest rates rise, the debt repayment obligation falls 3.5X faster than the cost of servicing the debt.

Further, as interest rates rise, the entire debt structure does not reprice. The current maturity distribution shows that 27% of all US debt will reprice in the next year, another 13% will reprice in the next 2 years, and another 10% will reprice in the next 3 years. Therefore, increasing interest rates will only marginally affect the cost of servicing current debt but will immediately make the entire stack of notes and bonds less burdensome to the US Treasury.

Application to Community Banks

Bankers cannot rely on the argument that the Federal Reserve cannot stoke inflation and raise interest rates because the US Treasury cannot afford to make higher payments. Not only is that argument flawed, but in the medium term, higher interest rates make the debt problem smaller. Therefore, community banks underwriting commercial loans today must stress test the DSCR and equity in the collateral assuming non-benign inflation. Inflation at 4% per annum should be the standard and not the stress case.