Understanding The Capital Structure – Better Real Estate Loan Advisory

The capital structure of a business refers to the mix of debt and equity used to finance the company’s assets and operations. The simplest forms of financing for a business are equity and debt, although there are many hybrids. Equity represents the most expensive form of financing. Because debt is legally first to be paid, has a finite term, and typically requires some form of covenants or reporting, debt is cheaper than equity. Senior secured debt is the cheapest form of financing. An essential question for community banks is this: what is the borrower’s motivation in choosing a capital structure when financing real estate investments?

WACC and The Ultimate Capital Structure

The main objectives for debt financing for a real estate asset are to decrease the weighted average cost of capital (WACC) and increase return on equity. At high levels of leverage (typically over 40-50%), the risk-return profile for equity holders becomes highly asymmetric. The downside for equity investors is never more than 100% of their equity, but the upside reward can be multiples of the initial equity investment in the real estate.

So what is the optimal capital structure for real estate financing? Higher debt results in lower WACC but involves a trade-off because higher leverage increases the risk for all capital providers (including equity) and increases the potential costs of financial distress (including legal, court, receivership, governmental and regulatory costs). Unfortunately for bankers, many elements in the current lending environment are motivating borrowers and lenders to shift the current optimal capital structure to 100% debt and 0% equity. The reasons for this shift are as follows:

First, most real estate projects are viewed by lenders as a mature industry that generates reliable and positive cash flows. This has historically allowed borrowers to increase leverage substantially from 75% to 90% LTV in many cases. Because of this, borrowers often prefer more debt in their capital structure.

Second, real estate is one of the most capital-intensive businesses in our economy. The hard assets of real estate allow lenders and regulators to rely on appraisals to substantiate secondary form of repayment for debt. This further increases lenders’ comfort in extending higher leverage.

Third, many real estate projects have long-term leases resulting in little cyclicality. Lenders will accept higher leverage if cash flow is not substantially impacted in down cycles.

Fourth, debt is cheaper than equity, and a borrower’s objective is to decrease WACC. However, the classic work of Nobel Prize-winning economists Modigliani and Miller showed that increased debt also increases the cost of the remaining equity equally so that the value of the assets or business does not increase.

In other words, increasing debt (with its lower cost) increases the cost of the remaining equity by the same dollar amount, resulting in the same WACC. Except that Modigliani and Miller also proved that when interest paid on debt is tax-deductible to the equity holder, debt financing does increase the value of the asset to the owner. Therefore, the ability to deduct interest paid on debt from income taxes enhances the company’s value and will lead owners to maximize debt financing. If unmitigated by lenders, this “debt tax shield” will entice borrowers to a capital structure of 100% debt and 0% equity.

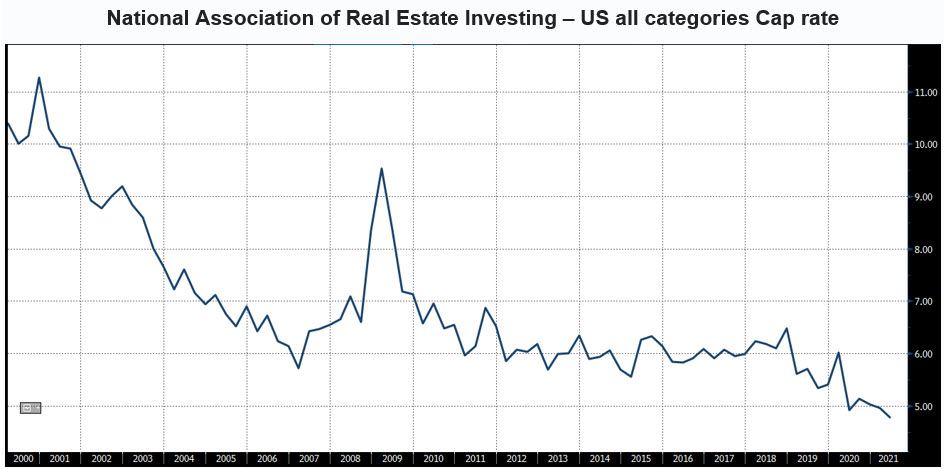

Fifth, an increase in debt results in higher financial distress or bankruptcy costs. However, if the market (lenders and borrowers) believe that central banks will exercise put options in the event of severe downturns, then the bankruptcy costs are calculated as nil. This put option is exactly what central banks exercised during the great recession and during Covid. Central banks continue, inadvertently or not, to exercise this put option today – whether it is needed or not is a topic of debate. This is the reason for Cap rates for all US properties to hit an all-time low of 4.77%, as shown in the graph below.

Sixth, borrowing is more attractive if interest rates are low, and it becomes even less costly to borrow when interest rates are low and inflation is high – which is itself a rare occurrence and is present in today’s market. Borrowing costs on bank debt have historically averaged 50bps to 300bps over US Treasuries. However, in today’s market, those same spreads, when adjusted for inflation, result in near-zero or, in some cases, sub-zero real interest cost of debt (real interest rate is the nominal rate minus expected inflation).

Conclusion

The value-enhancing effects of leverage from tax-deductibility of interest, the lack of perceived default risk, and an unusual occurrence of the negative real cost of borrowing are causing market complacency for borrowers and lenders, leading many to accept what has been historically unreasonable leverage on real estate. Borrowers are currently having success in moving lenders closer to 100% debt on real estate financing and bankers need to be aware of this risk. Advising on the proper capital structure will serve to keep both the borrower and the bank safe.