Changing Commercial Loan Pricing To Manage Loan Average Life

One trick every bank lender should have up their sleeve is the ability to meet a client’s maturity and amortization targets but limit the risk of the bank by adjusting the rate on a loan. This tactic is especially germane in today’s market as certain sectors in certain cities are likely reaching the end of their safety zone. Being able to change commercial loan pricing to manage a loan’s average life is also useful for aligning risk with reward as well as helping to manage the overall duration of the commercial loan portfolio. In this article, we will take a quantitative look at this tactic and cover some case studies on how and when to apply this with the goal of making sure the customer gets what they want while the bank has a profitable loan on a risk-adjusted basis.

The Commercial Loan Portfolio Management Challenge

Let’s say a real estate investor customer wants to refinance a multifamily project and needs a seven-year loan as they feel we are nearing the top of the market, and they want to sell the property with an eye towards providing a little extra cushion in timing. Thus, while their hold period is three to four years, they want a seven-year maturity with a 25-year amortization.

The bank, on the other hand, believes the market will deteriorate in the near future and wants to be out in five years. The average price is a credit spread of 2.60% in this particular market.

As a lender, how do you keep the customer and your bank happy?

The Solution

The solution is to use step-up pricing that can be instituted with a fixed or variable rate loan. The bank proposes the following pricing structure:

Years one thru three: 2.45% spread.

Years four and five: 2.75% spread.

Years six and seven: 2.95% spread.

Since the bank wants the borrower to pay off early, the bank will not include a prepayment provision. While this hurts general profitability as the cash flow length becomes shorter, it increases the risk-adjusted profitability as the cumulative probability of default significantly decreases. The net result is that in a period of rising default probability, a shorter loan may be your more profitable loan.

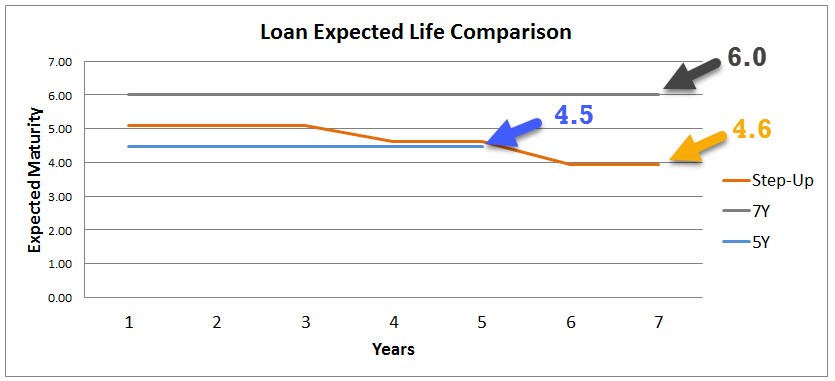

When using step-up pricing to control both credit and duration, you can see the comparison below. Absent any changes in credit and interest rates, the average life for the five-year loan is approximately 4.5 where the average life for the seven-year loan is 6.0. By instituting step-up pricing for the seven-year term, the loan falls back to an average life of 4.6, or roughly the average life of the five-year loan. In this manner, the bank has controlled both interest rate and credit risk.

The average weighted spread for the 7Y loan is 2.59%, one basis point under market. If the borrower does refinance early, then the borrower is even better off. For example, if the borrower does repay in year three, then their spread is 2.45%, versus the market’s 2.60%.

Shifting The Option In The Bank’s Favor

What happens if credit or interest rate risk doesn’t increase?

If interest rates don’t climb and/or credit risk doesn’t reset up, then the bank could be worse off as if they made a five-year loan. The step-up pricing structure may force the borrower to look elsewhere to refinance before maturity. While true, this is part of the beauty of this structure as the bank simply amends the spread and rate for the borrower at any time.

This pricing amendment can be done at any time but is best accomplished during the start of the second year, or before the borrower gets approached by other banks or starts looking around. If interest rates go down, or if credit for the loan improves, the bank proactively lowers or removes the step-up rate. This shifts the average life out and improves the profitability of the loan.

As an added benefit, a proactive lowering of pricing is usually accompanied by an increase in customer satisfaction as you are likely to impress the borrower with your bank’s attentiveness.

When Would You Use The Step-up Structure

The step-up pricing structure can be used anytime you want to control either the average life or the duration (interest rate risk measure) of a loan. This might be specific to the borrower in that you don’t have complete confidence in their ability to maintain or improve their current credit position, it could be a lack of confidence in a geography or a negative view of a future loan sector.

In today’s market, there are many optimal places to use the step-up structure. The risk for industrial lending in Memphis, Pheonix, or Dallas are all examples of areas with low capitalization rates but massive supply coming online over the next several years. Stressed office and retail lending that may be weakly cashing flowing now and may not be able to withstand a rise in rates. Structuring a step-up structure may cause the borrower to go elsewhere before the rate rise brings debt service coverage below 1.20x or if the property does improve, allow the bank to participate in an increase in future rates.

Conclusion

This is another example of how banks can get creative in loan structuring to win more business and to achieve both the goals of the borrower and the goals of the bank. If credit improves or rates don’t rise as much as expected, banks can always reduce the stepped-up rate to keep the customer. Banks need to proactively control both risk and profitability, and step-up pricing can be a valuable tool to accomplish both those goals for better commercial loan portfolio management. Also, this example underscores the point that a loan portfolio isn’t static and not only needs to be periodically reviewed for interest rate and credit changes but needs to be aggressively managed to achieve the goals of the bank.

If your bank is committed to having the most creative and sophisticated lenders in the marketplace, having knowledge of this and other tactics is mandatory in a competitive marketplace.