A Case Study for Building Commercial Relationships

If your bank is interested in banking more profitable commercial relationships – those customers with multiple bank products, where the bank holds over 50% of bank wallet, provides long-term sticky banking services and recognizes over 20% return on equity (ROE) – then the case study described in this article will be of interest to you. We highlight how a community bank won a commercial real estate (CRE) mortgage against multiple competitors, solidifying an existing relationship, extending term to cross-sell treasury management, booking a highly profitable loan, lowering P&I payments to increase credit quality, and generating substantial amount of fee income.

Background

While a bank would always like to bank depository relationships before lending relationships, often times the fastest way to acquire a customer or extend a customer’s lifetime value is through an extension of credit. Because a bank wants a long-term relationship, it makes sense to extend a long-term loan.

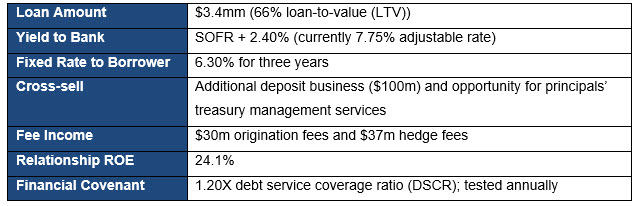

To set the stage for building commercial relationships, lets walk through a case study. The customer is well known to the bank with multiple commercial deposit accounts (checking, money market, and certificates of deposits (CDs)), and an existing $3.5mm non-owner occupied commercial real estate (NOOCRE) loan. The community bank was competing for another loan opportunity and wanted to cross-sell multiple services such as accounts for the principals and treasury management. The principals were purchasing another NOOCRE industrial property for approximately $5.2mm. The loan was structured as shown below:

How to Build Profitable Commercial Relationships

Because of the inversion of the yield curve, bank was able to use a loan hedging program to lower the borrower’s rate from an in-house fixed rate of 7.50% to 6.30% hedged rate. Not only did that save the borrower approximately $33k in annual P&I payments, but it also increased DSCR from 1.17X to 1.31X. The result was a lower rate to the borrower, higher yield for the bank, and lower credit risk on the project. The project would not meet the bank’s required 1.20X DSCR covenant with the bank’s in-house fixed rate of 7.50%.

The bank also generated substantial amount of fee income. While the origination fee is amortized and recognized over the life of the loan ($10m/yr.), the hedge fee of $37m is recognized upfront (1.1% of the loan amount). The bank was also able to obtain additional deposits, but most importantly, the bank now has at least three more years to cross-sell treasury management services to the principals of the project. Treasury management creates stickier relationships, increases valuable low-cost deposits, but takes years to sell.

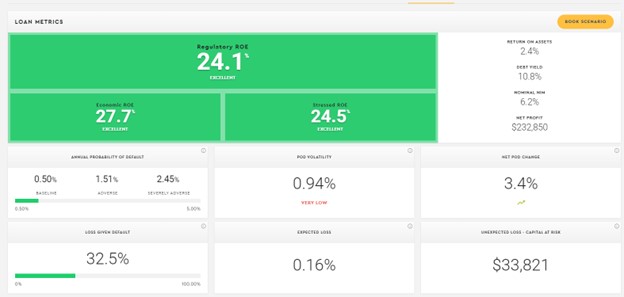

The bank’s fixed rate was about 30bps higher than a competing offer, however, the prepayment provision and portability of the loan made the difference for this winning bid (more on this below). Longer commitments with the correct prepayment provision are a two-way relationship play – both the lender and borrower agree to be bound with business dealings over a longer period, and some of the most profitable and sticky bank services take a long time to sell – treasury management is a prime example. This loan opportunity was a segue for the bank to sell treasury management to multiple businesses managed by the principals. The output below shows the risk-adjusted-return-on-equity of the loan and additional cross-sell opportunities on incremental business (this ROE does not include the existing business the bank has with this relationship account).

Customer Pushbacks and Banking Counters

Bankers need to ask the following questions: 1) Why would the bank be interested in using a loan hedge at this point of the interest rate cycle? and 2) Why would the borrower be interested in using a loan hedge instead of an on-balance sheet fixed-rate loan?

The bank expressed the following thoughts on the use of the hedge program:

- While the Federal Reserve is indicating a reduction in short-term rates as early as September of this year, that forecast might change. Further the bank’s starting yield is 1.45% higher than the borrower’s coupon (that is six 25bps rate reductions before the bank’s yield reaches the borrower’s payment). The bank is also recognizing substantial amount of fee income. The economics are compelling.

- The hedged loan allows for a lower starting rate to the borrower, resulting in better DSCR (eliminating a policy exception).

- The bank would like a longer relationship and runway for more cross-sell opportunities with the principals. However, the bank understands that the borrower’s business model is to buy and reposition properties, increase values, then sell or 1031 exchange. The hedge loan provides the flexibility for the borrower to substitute collateral or sell the property and take the remaining term to existing or new projects – when this happens the loan may be upsized, or extended, resulting in more earning assets, additional fees, and more cross-sell opportunities. By using this structure, the Bank ensures its building long-term commercial relationships.

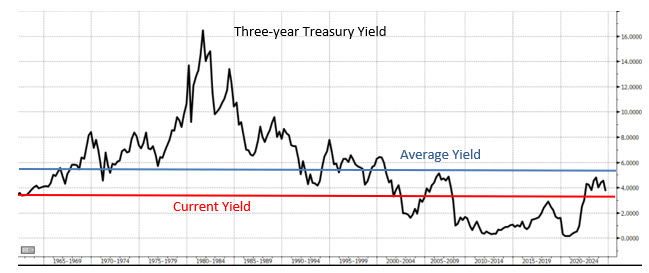

- While the Federal Reserve may be close to cutting short-term rates, long-term rates have approached their bottom compared to historical levels. The graph below shows the three-year Treasury yield over the last 50 years. The average three-year Treasury yield over the period is 5.26%, the current level of 3.71% is low in comparison (including the levels seen during the great financial crises and the pandemic). If we exclude the high inflation periods of the ‘70’s and ‘80’s and exclude the periods of the great financial crises and the pandemic, the average three-year Treasury yield was 5.63%. Why would the bank want to put a low fixed rate yielding loan on its balance sheet when the current threeyield Treasury rate is the lowest of any historical period outside of an economic crisis?

The borrower identified the following advantages in using a hedge to fix its loan rate:

- The rate was 1.20% lower on the hedged loan versus the in-house fixed (6.30% vs. 7.50%).

- The borrower understands that the Fed Funds rate may be lowered soon, but its financing needs are fixed rate, and not adjustable, given its low DSCR cushion. Therefore, the Federal Reserve lowering rates in the near future would not help the borrower, especially because the market has already priced in the lower future short-term rates when pricing the three-year hedge rate.

- The borrower is in the business of buying, improving or repositioning properties, then selling or using 1031 exchange to upsize the loan. Unlike the in-house loan, the hedged loan allows for carrying the loan to substituted collateral on existing or newly acquired properties. This was a selling feature that compelled the borrower to go with the bank instead of slightly cheaper offer from another bank. The other bank’s in-house loan would not permit any collateral substitution, portability, or 1031 exchanges. This is an example where value and services overcome lower costs.

Conclusion

If your bank does not have the ability to accommodate a commercial real estate mortgage through a hedge program, now is an opportune time to consider investigating if such a tool makes sense for your bank and your customer base. Having this option can be critical for building profitable commercial relationships. If you want to learn more about our program, click here.