A Case Study of Assumable Commercial Loans

With regard to commercial real estate, an assumable commercial loan allows a buyer of the property to take over the seller’s existing mortgage, keeping the basic economics of the loan in place. The basic economics of the loan include rate, term, prepayment provisions, and other key features. However, the basic economics may be adjusted to suit the new borrower and lender to make them indifferent to these adjustments. In talking to many community bankers across the country we see very few commercial mortgages that permit assumability, and many lenders question the benefit of such provisions in their loan documents. In contrast, we close a handful of assumable loans each month through our ARC program, and in this article, we will highlight a case study and explain how assumable loans create win-win scenarios for lenders and borrowers.

Case Study for Assumable Commercial Loans

In 2017 a community bank made a $4.8mm, 10-year ARC loan to a new client secured by commercial real estate. The loan was priced at 2.00% credit margin, the bank earned 20bps loan fee, and $51k hedge fee. There was expectation of other business (deposits and other credits – which materialized over the next eight years). In October of this year the borrower decided to sell the commercial property in a 1031 exchange, but the new property has yet to be identified. The purchaser of the property was unknown to the bank but was introduced by the existing borrower (who attested to the bank’s superior service and products). The bank was able to underwrite the new borrower for the property and while the existing loan had a balance of $3.8mm with two years to maturity, the new borrower needed $3mm in loan proceeds (at 49% LTV) and was interested in extending the term of the loan to seven years. The initial loan was priced in a lower rate environment (all-in fixed rate of 4.27%). The new borrower was thrilled to obtain a below market rate – with adjustment to a seven-year term, and $3mm balance, the new borrower obtained a 5.48% rate. The previous borrower had a positive prepayment premium of just over $100k and obtained this value through an upward adjustment in the sales price.

The bank expanded its network by adding a new customer on real estate collateral well known to the bank, with a lower LTV, and low fixed rate (both aspects helping to maintain credit quality and showing a 1.49X DSCR based on existing rent roll). The bank also made an additional $32k in hedge fee income on the loan extension. The new borrower is expected to generate additional cross-sell opportunities. The initial borrower will remain a customer and will come back to the bank when the 1031 property is identified (proceeds of the sale are residing with the bank).

The bank is retaining the same credit spread for the new borrower as with the initial borrower (2.00%), but the bank was able to decrease LTV, increase DSCR, and generate additional fee income and pick up a new customer that was introduced through an existing client referral. The bank maintains most of the loan balances on an adjustable loan with less credit risk.

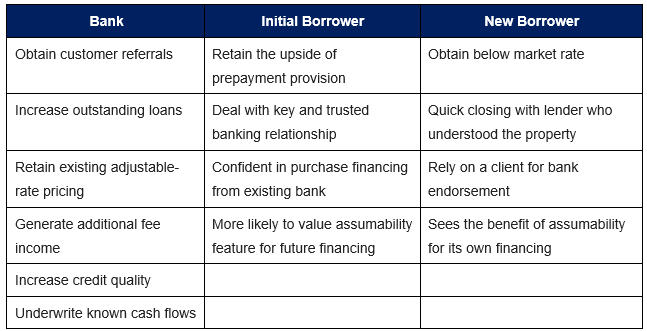

The table below outlines the benefits to each party.

Conclusion

While every lending scenario will have its specific aspects, assumability that is at the option of the lender is valuable where interest rate risk is eliminated and the prepayment provision is symmetrical to provide the ability to transfer economics from one borrower to the next. Banking is the business of keeping loans and not making loans. In the long run, and over interest rate cycles, having commercial assumable loans afford banks the ability to retain more clients and more loan balances, while, often, increasing cross-sell opportunities and lowering transaction costs for borrowers. The key to the assumable loan is interest rate risk mitigation, prepayment provision symmetry, and identifying the right borrowers – borrowers who are growing their business and are proponents of the bank and its ability to create value for client so that existing customers can become your extended sales team.