Increasing Customer Cumulative Lifetime Value Through Lending

In a previous article (HERE), we discussed how a portfolio of commercial loans with various expected average lives resulted in different net present value (NPV) of income over a ten-year period. Our analysis shows that an average community bank can expect $9.7mm NPV of income (about 1% ROA) on a $100mm loan portfolio when the average loan life is seven years, versus only $5mm NPV of income (about 0.50% ROA) on the same portfolio where the average loan life is 2.3 years (both portfolios measured over a ten-year life). In this article, we will review how community banks can use marketing, product mix, and sales strategies to increase the cumulative lifetime value of customers to increase the return on assets and equity (ROA and ROE, respectively). These strategies are imperative to lower a bank’s efficiency ratio and enhance performance. Even sophisticated loan pricing models often do not adequately track, predict, or measure average loan life.

How To Increase Commercial Cumulative Lifetime Value

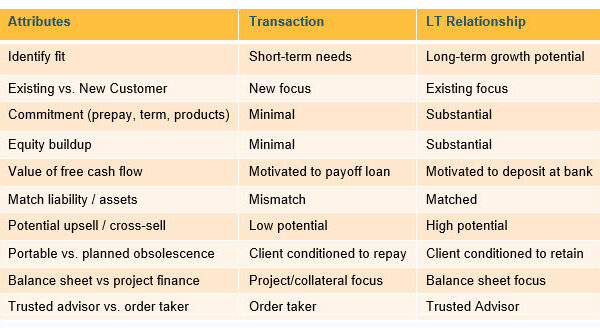

We identify 10 distinct variables that are responsible for extending the average expected life of a commercial loan. We have written about some of these in the past, and some have become more evident from our analysis on loan portfolio profitability. These variables can be contrasted between those that result in transactions (short-term client engagements) and those that result in long-term relationships and, thereby, extend average loan life and increase bank performance. The table below summarizes our findings.

1. Identifying the Right Customer Fit at Inception

Community banks must be honest about their target relationship account. Not every business should be a customer. A bank with a $5mm in-house lending limit cannot provide long-term growth potential to a corporation with $100mm in credit needs. That corporation may take a small pocket finance opportunity with a community bank, but that is throwing a bone that will not flourish into a relationship. Likewise, a local borrower with only one credit requirement and who is close to retirement age may not be a relationship candidate for a large and expanding community bank. Both previous examples do not preclude the community bank from making a loan, but both represent a transaction and not a relationship. Community banks must identify clients that present the right opportunity given that bank’s product suite, growth potential, and their commercial lenders’ expertise.

2. Existing Customers Are More Profitable Than New Customers

New customers drain bank resources with acquisition, processing, and onboarding costs. New customers are also not as well known to the bank as existing customers (increasing credit risk), and these new customers typically have existing banking relationships elsewhere, thereby decreasing the share of wallet for the new bank relationship. Therefore, the goal of relationship banking is to keep and grow the relationship for as long as possible. Longer loan commitments lead to more relationship opportunities which leads to a jump in cumulative lifetime value. If your commercial lending team is incented strictly for new bookings, the result may well be transaction business with short expected average loan life.

3. Extend Commitment Terms

Commitment terms are tricky to define, because they can vary substantially. However, certain products (example, treasury management), loan features (example, strong prepayment provisions), or contractual life of a commercial mortgage can all extend the expected life of a relationship. Short contractual commitments or repricing triggers (business or real estate loans with less than 3-year terms) have shorter lives. There are assorted reasons why borrowers may need commercial loans for two or three years. However, shorter commitments lead to lower switching costs for borrowers, more opportunity for competitive loan bids in the future, and shorter client relationships.

4. Building Equity Value to Increase Cumulative Lifetime Value

Principal reduction and equity buildup increase the probability of longer-term relationships and further extend their lives. Bank products should support this equity creation. As loans season, the borrower continues to make principal payments increasing the equity in the collateral. Using mortgage-style amortization results in little buildup in equity in the first few years. However, by year seven, on a 25-year mortgage, a long-term relationship has reduced principal balance by over 9%, and by year 15 over 28%. Longer-term loans increase collateral cushion, reduce credit risk, and provide more flexibility for modifications in the event of credit stress.

5. Longer Contractual Terms Means Less Competition

Longer contractual loan commitments influence how borrowers choose to deploy free cash flow. Commercial loans do not tend to prepay equally over time. Borrowers accelerate prepayments and switch banks more readily as credit commitments approach 12 to 24 months to maturity. If the initial loan term is three years, the bank is in competition with the market for that customer within one or two years of originating that three-year loan commitment. Borrowers are much more likely to prepay a loan with free cash flow if that loan has one to three years to maturity – the borrower needs to substitute that loan soon and sees little value to retain the credit availability. But borrowers are more reluctant to prepay a commercial loan with five or more years remaining on a commitment (assuming credit spreads are priced to market). Borrowers value the long tail remaining on the credit facility and try to avoid the burden of switching costs. Therefore, short-term commitments convert relationship clients into transaction clients by inducing borrowers to prepay the loan with free cash flow, instead of depositing that free cash flow with the bank – this leads to high loan churn and it puts community banks in competition for the client’s business more often than necessary.

6. Help Borrowers with Asset Liability Management

Borrowers are prudent to match duration of assets (business, equipment, or real estate) and liabilities (credit). A good match eliminates refinance risk and reduces the probability of default. Typically, when borrowers use short-term liabilities to finance long-term assets, they are expressing one of two probable views: 1) they are trying to time the market for cheaper entry points (which is not a winning strategy because borrowers cannot outwit the market, and will be right about 50% of the time), or 2) they intend to refinance the asset with the next best loan offer. Banks that self-select borrowers who are willing to match assets and liabilities will realize longer average loan life on commercial mortgages and business loans.

7. More Bank Products Mean a Longer Customer Life

For the average industry, upselling and cross-selling can increase revenue anywhere between 10% to 50% and add a few percentage points to ROE. But in banking, those numbers are markedly different. Upselling and cross-selling can increase revenue by more than 100% and add 10 or more percentage points to ROE. Almost equally important is that the more products a bank has to a customer, the higher their expected retention will be which means the higher cumulative lifetime value. The biggest cross-sells for a commercial mortgage are deposits and treasury management services. However, the cross-sell timeline for these products can be as long as three to seven years. The returns can be substantial for a community bank, but only if the time to cross-sell and upsell are adequate.

8. The Fine Print in Lending Matters

Commercial loans with designed flexibility can lead to longer cumulative lifetime value. Unfortunately, some banks offer loans with built-in or planned obsolescence – making those loans shorter and less valuable to borrowers. Many commercial loans are structured to be called by the lender with any of the following: borrower change, collateral change, modification to term, cash out financing, change to business model, or business expansion. Conversely, we see many community banks that permit these changes (subject to credit underwriting) without requiring the credit to be prepaid. This strategy increases average loan life and enhances the client’s affinity to the bank.

9. Balance Sheet Financing is More Valuable Than Collateral Financing

The difference between balance sheet financing versus collateral financing is profound in increasing value to both lender and borrower. On a typical collateral-financed loan, the loan is callable when the borrower sells the collateral, asks for modification of the security, the term, or the pricing. On the other hand, for balance sheet financing, the bank makes the loan based on the strength of the borrower’s balance sheet and business model (the loan can still be secured by collateral). This balance sheet financing can be retained by the borrower with changes to collateral, term, pricing, even borrower entity if the bank can underwrite the credit. Balance sheet loans lead to longer relationships and more profit for the bank. We have seen many community banks move to offering balance sheet financing to their strongest, more sophisticated, and profitable clients.

10. Be An Effective Trusted Advisor to Increase Cumulative Lifetime Value

The quality of a relationship manager’s relationship, matters. This is an unheralded aspect of relationship managers. A strong relationship with a client can add years of annual lifetime value to the equation. This means that banks not only need to retain and keep happy the relationship manager, but give them the technology, knowledge and support to further grow relationships.

Relationship banking is typically defined as a model focused on a consultative banking approach. Bankers provide advice based on the customer’s particular situation and needs, as those needs change and evolve over the customer’s lifetime and as the market changes. The bank is compensated by selling products, services, and especially insightful and targeted advice. To provide insightful and meaningful advice, the relationship manager must understand credit underwriting, business cash flow analysis, liquidity management, business risk management, acquisition financing, and how various banking products can decrease a client’s risk or increase profitability.

Most importantly, the relationship manager must have the time to devote their skills to their book of business. We believe that not all lenders at a bank are able to effectively deliver a consultative banking approach. Those lenders that can, should oversee a manageable book of business to provide the service to extend and solidify a long-term relationship. These consultative bankers can manage no more than 20 to 40 complex relationships. The bankers that are not yet ready to fulfil the role of a relationship consultant can manage a much larger number of transactional business accounts and provide a more reactive service to these clients.

Conclusion

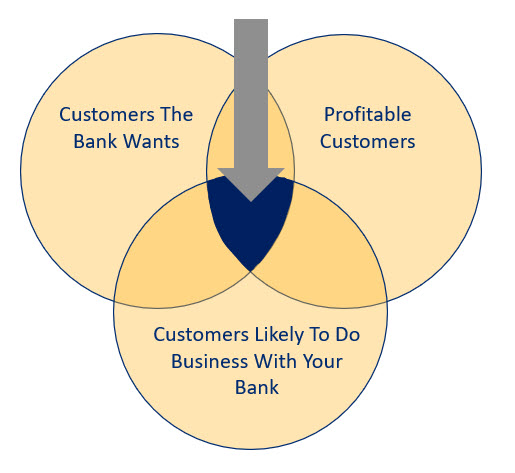

Increasing each customer’s cumulative lifetime value is a major driver of bank profitability. Community bankers can influence marketing, product mix, and sales behavior to convert transactions to long-term relationships, thereby extending average expected loan life and increasing portfolio profitability. Because even sophisticated loan pricing models do not adequately measure expected loan life, community bankers must understand and manage these ten variables to maximize long-term relationship and optimize bank performance.