Loan Structuring with an Inverted Yield Curve

The yield curve is currently inverted, and the FOMC may take a pause at its next meeting in June. Uncertainty about the evolution of the economy and the path of future interest rates and the unusual inverted yield curve shape affords a prime opportunity for bankers to provide sound, trusted advice to clients. This is the time for bankers to offer loan structuring solutions to help customers solve business problems, mitigate risk, and manage balance sheets and cash flows. Borrowers are currently desperately seeking a trusted advisor to help guide them through this period of uncertainty. With the debt ceiling uncertainty, an undecided Fed Reserve, and concern about credit quality, this is a perfect opportunity for community bankers to be trusted financial advisors.

Loan Structuring With The Current Yield Curve

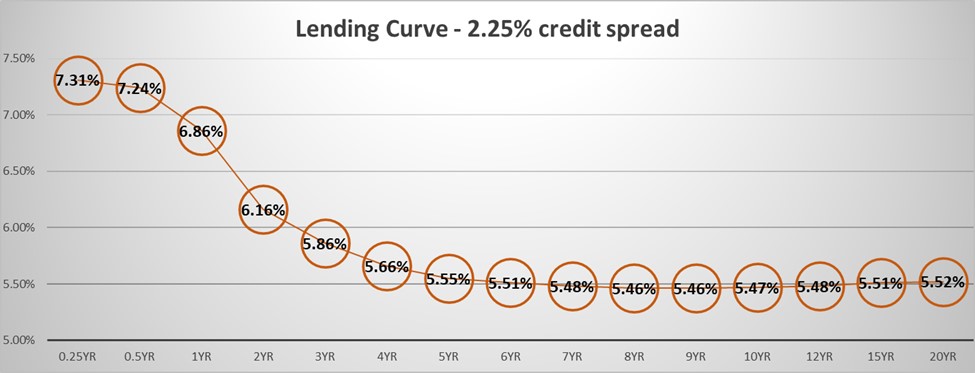

The graph below shows the lending curve from three months to 20 years and demonstrates the average commercial loan rates for different repricing terms. The graph uses the average credit spread (2.25%) to achieve a 15% ROE for a bankable loan, $1mm size, with cross-sell opportunity and an overall relationship.

There are a few key elements to consider for bankers when loan structuring from the graph above:

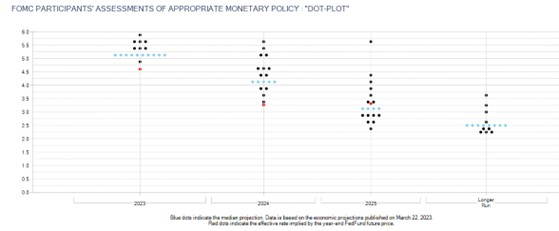

- The short end of the curve (floating rates) is higher than any other point on the curve. We expect this phenomenon to remain over the next few months as the Fed is unlikely to decrease short-term rates in the near future. The latest Dot Plot below (from March) shows the FOMC members’ expected Fed Funds rate to remain at its current level at the end of 2023.

- Short-term fixed-rate loans are not attractive to borrowers because longer-term commitments are up to 1.85% cheaper. No one can predict if this differential holds, but the yield curve inversion will likely remain unless the Fed starts aggressively cutting short-term interest rates.

- Banks that can offer loans further on the curve, and eliminate their interest rate risk, hold the advantage. Banks that are reluctant to commit to fixed rates beyond two or three years are at a disadvantage.

- Differentiating your bank by offering longer-term fixed-rate loans can lead to benefits that are unique in an inverted yield curve environment. These include the following: enhance credit quality by eliminating repricing risk, lengthen and deepen relationships, differentiate from the competition, and increase your borrower’s profitability by decreasing loan payments. However, managing the bank’s interest rate risk with longer-duration loans is necessary.

Banker As Trusted Advisor

Below are the common topics that bankers should discuss with borrowers.

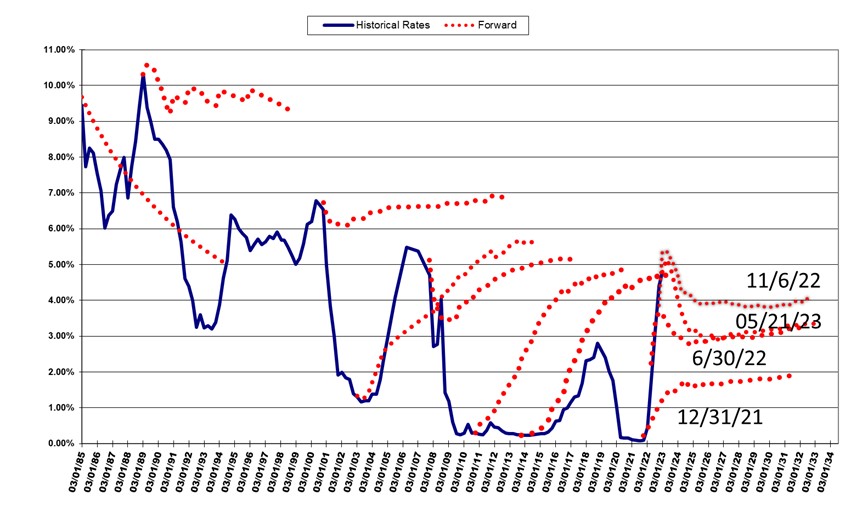

- When to refinance my debt: Borrowers have seen years of near-zero interest rates, and some have falsely concluded that such an environment is normal. Bankers need to remind customers that near zero or negative real interest rates are not normal and that today’s 10-year treasury yield is low by historical standards outside a financial crisis and a pandemic. Bankers should be able to share the graph below and demonstrate empirically the current low level of interest rates, especially when adjusted for inflation.

- Where will rates be in the future: No one can predict the future path of interest rates. Lenders need to appear knowledgeable and do not want to come across as not having an opinion – because everyone seems to express at least one. The reality is that no one knows the future path of interest rates. For example, below is a graph showing in the blue line where short-term rates have been from 1985 to the present (Prime, LIBOR, or Fed Funds are 99% correlated). In the dotted red line are forward rates at specific periods (the last four red lines are labeled and highlight how quickly the market keeps changing its mind). The market is generally wrong but is wildly off during inflection points and further out in time – the futures market may be a good predictor for the next few months but is woefully wrong beyond a year. But lenders do not need to predict interest rates to be valuable to their clients. Instead, lenders need to analyze a customer’s balance sheet, cash flow, and business model to structure products that insulate customers from adverse outcomes, regardless of what interest rates may do in the future. The lender’s primary focus should be eliminating the borrower’s financing and credit risk.

- Why not wait for the Fed to start lowering rates to refinance: Lenders need to remind borrowers that the Fed lowers rates in a recession. It is risky for borrowers to purposefully wait for a recession for better credit terms. Currently, absolute and relative interest rates are low, and credit spreads are still at historical lows – waiting for a recession is unwise. Lenders can remind borrowers that in a recession, liquidity is scarce, business cash flow is compromised, and credit spreads widen.

- The best asset/liability for borrowers: Borrowers should seek loan structuring that matches their asset-liability position. Bankers must provide the proper structure, payment terms, conditions, and maturities for the specific borrower and their personal situation and business needs. Many borrowers do not know if their loan correctly matches their cash flows and if the liability and assets are appropriately matched for their business, and this is the most significant value-add that lenders can provide. For example, real estate and stable cash flow businesses are longer-term assets with net operating income (NOI) or earnings before interest, taxes, depreciation, and amortization (EBITDA) that is insensitive to interest rate movement. Therefore, fixed-rate for longer terms may be the best fit for these borrowers.

- What flexibility should borrowers expect for future restructuring or collateral substitution: We see how many banks offer credit products that are relationship driven rather than transactional. For example, with a relationship-driven credit facility, a borrower will commit to some term for a credit facility, and if needs change during the course of the term – for example, loan size changes, collateral substitution is required, a related entity wants to assume the credit, the bank will allow the economic terms of the initial credit to remain – subject to credit underwriting. This built-in feature (that we ourselves use at SouthState Bank) offers credit products that provide built-in future flexibility to allow borrowers to lock in pricing today and a structure that is tied to the borrower’s balance sheet instead of a piece of collateral that may be bought and sold multiple times in the course of a loan commitment term.

Conclusion

The current business environment is a perfect opportunity for community bankers to demonstrate how they are trusted advisors to their clients buy helping borrowers with loan structuring. Lenders do not need to predict the future, but they should be able to help borrowers manage risk and reduce financing costs. By analyzing the borrower’s balance sheet, cash flow, and liquidity positions, lenders can structure solutions that help borrowers both reduce business risk and increase profitability.