ROE Contribution – Commercial Hedged Loans

We compared community bank profitability on hedged commercial loans to those same banks’ reported return. The goal of our analysis was to investigate if community banks can improve their performance by utilizing a hedging program. We want to caution readers that our analysis may not extend to all banks, borrowers, or regions, but the results are strikingly convincing that banks that use hedging can improve performance as measured by return on assets (ROA) or return on equity (ROE).

The Study

In our study, we measured the risk-adjusted return on assets and equity for nine community banks ranging in asset size from $350mm to just under $8.5B. The nine community banks in our study all allowed us to measure their hedged loan performance through our RAROC (risk-adjusted return on capital) model on the condition of not disclosing the banks or individual commercial loans.

We were able to measure the RAROC for approximately $501mm hedged loans (154 loans in total) to understand why these banks used loan-level hedging to book this portfolio of loans. All of these banks are utilizing RAROC models to measure risk adjusted return. We then compared the RAROC on these hedged loans with the banks’ general financial performance and based on our RAROC modeling attributed which factors benefited or detracted from ROE as influenced by loan level hedging instruments.

Results of Hedged Loans

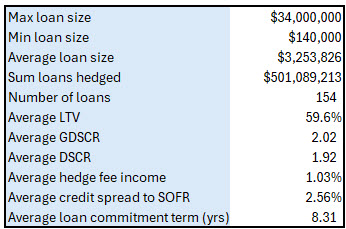

The composition of our study is shown in the table below.

The hedged loan size ranged from $140k to $34mm, with an average loan size of $3.25mm ($1.78mm median). We saw that even the lower sized hedged loans had an impressive return for the banks (for reasons discussed below). The $501mm in hedged loans had an average of just under 60% LTV and 1.92X DSCR. These loans were comparatively higher credit quality for the group of 9 banks. The estimated, at inception, average DSCR and LTV for the industry is 1.30X and 70%, respectively.

The average loan size ($3.25mm mean and $1.78mm median) is substantially higher than industry average. Most community bank’s average loan size ranges from $300k to $800k depending on region and business model, and we estimate the industry average at approximately $400k.

The average hedge fee income was 1.03% of the loan size and ranged from nil to 2.53%. This income is recognized by banks in the period it is received. The average credit spread of the hedged loans was 2.56% (and ranged from 1.53% to 3.50%). The loan at 1.53% credit spread delivered an above average ROE of 25.1% because of substantial deposit business. The average hedged loan deposit spread of 2.53% is approximately 20bps below the industry average.

Finally, the average hedged loan commitment term was 8.31 years. This is substantially longer than industry average by more than 5 years. The shortest hedged loan commitment term was 2.91 years and the longest was 20.26 years. These loans terms were self-selecting in that the average borrower was motivated to obtain longer fixed-rate financing to match project cash flow, to match a holding period, or minimize other risks.

Insight into Hedged Loans

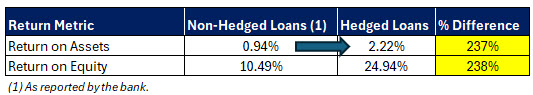

We compared the risk adjusted return of the hedged loan portfolio for each bank, to that bank’s year-end reported ROA/ROE. The results appear in the table below.

For each bank, the portfolio of hedged loans exceeded that bank’s reported ROA/ROE. On average the hedged loans RAROC was 2.22% ROA and 24.94% ROE – this is more than double the group of banks’ reported performance. These hedged loans created value for these nine banks as measured by RAROC. The hedged loans benefited from longer term, increased loan size, improved credit quality, and fee income.

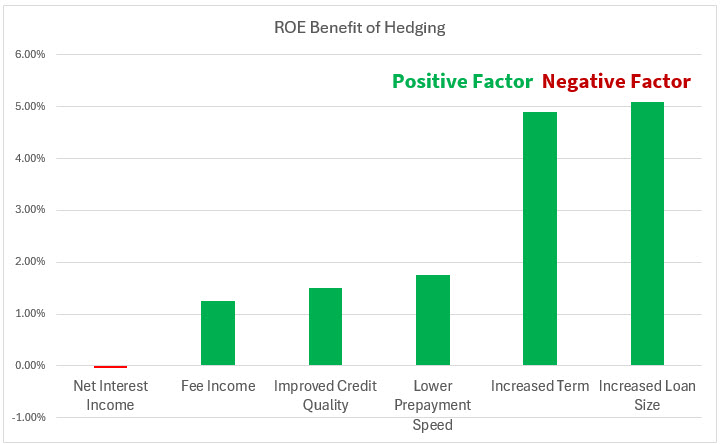

We measured the benefit of hedging compared to the average bank’s ROE based on NIM, fee income, credit quality, lower repayment speed, increased commitment term and increased loan size. Our conclusions appear below.

While hedged loans had slightly lower NIM (thus lowering the ROE on this portfolio), every other factor associated with these hedged loans contributed to the ROA/ROE return for these nine banks. The biggest drivers of ROE performance were increased loan size, followed by increased loan commitment term (accounting for 66% of performance increase for hedged loans). One driver for ROE performance we could not measure was the ongoing cross-sell opportunity that longer-term loans may offer to community banks. This would require a longitudinal study to investigate if over time banks can improve performance by cross-selling higher valued products such as deposits, treasury management and other fee businesses.

Conclusion

The results of this analysis should be of interest to all community bankers. There are real and direct benefits for community banks to use loan-level hedging to generate additional performance, retain more coveted clients, and attract higher credit quality borrowers. Our study shows that the vast majority of a community bank’s most profitable commercial borrower customers are composed of larger, longer, more stable, and higher credit quality clients.