Using A Commercial Step-Up Loan to Increase NIM and Fees

Community banks are striving to increase loan yield and maintain their cost of funding (COF). Unfortunately, pressure on COF is expected to remain, and loans will reprice slower than expected as borrowers with below-market rates will wait until the last maturity day to refinance their credits. We have created and used a novel structure to take advantage of the inverted yield curve to allow community banks to increase net interest margin (NIM) and fee income on these existing fixed-rate loans. This strategy is called a “step-up” loan, and it allows community banks to increase loan yield on existing credits that have up to three years to maturity (even though the borrower retains their existing fixed rate), and it permits the community bank to generate additional fee income on existing loan commitments (no new funding is required). We created this “step-up” loan structure using our ARC program.

Net Interest Margin Trends

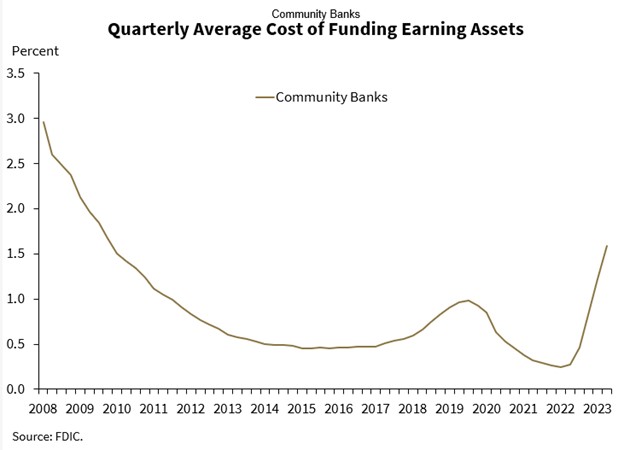

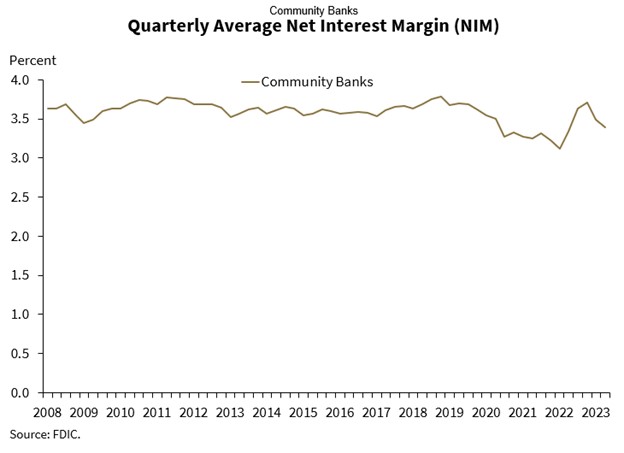

Community banks’ (under $10B in assets) COF is increasing, and NIM is decreasing, as shown in the two graphs below, and this pressure is expected to continue through 2024.

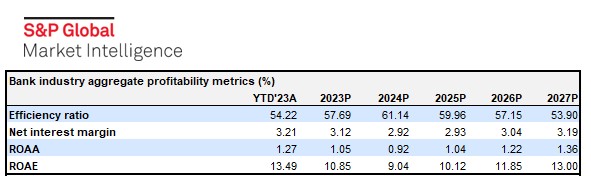

S&P Global expects this NIM compression to last through 2025 (see table below) as COF remains under pressure and fixed-rate loans reprice slower than historical averages.

The Step-Up Loan Structure

Community banks are saddled with below-market-rate fixed-rate loans booked between 2020 and 2022, with yields between 4.00% and 6.50%. Community banks would like these loans to be repriced to market, but borrowers are intent on retaining their low rates for as long as possible.

The step-up loan structure allows a bank to refinance loans up to 3 years before maturity. The structure will convert the existing loan into two fixed-rate payment streams for the borrower, as follows:

- The borrower’s existing fixed rate is retained for the contractual maturity;

- The borrower’s fixed rate after the existing commitment period is priced fixed based on today’s forward curve.

The bank’s yield is converted into two adjustable-rate payment streams, as follows:

- For the period to the initial contractual maturity date, the bank earns an adjustable rate equal to term SOFR plus a credit spread, which is solved based on the borrower’s existing fixed rate, and because of the inversion of the yield curve, the bank will always earn a higher yield than the existing fixed rate (currently between 80 and 100bps); and

- After the initial contractual maturity date, a rate equal to term SOFR plus a market-driven credit spread negotiated by the bank with the borrower.

The benefits of refinancing for the bank are as follows: an increase in immediate loan yield (because of the currently inverted yield curve), generating new fee income, stabilizing borrowers’ future financing costs, preventing loss of valued customers, and extending relationship commitment terms for cross-sell opportunities. The benefits of refinancing for the borrower are as follows: retain existing terms and pricing, lock in future financing costs (at a preferential rate because of the inverted yield curve), and obtain a more competitive credit spread.

Step-Up Loan Structure Example

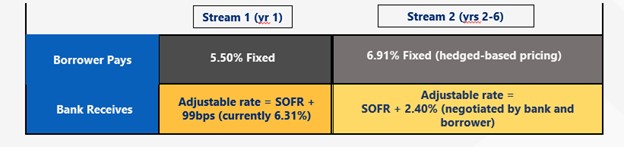

Assume a $1mm loan with one year remaining on a three-year initial commitment priced at a 5.50% fixed rate. Using the “step-up” structure, the bank refinances this loan into a 6-year hedged loan where the borrower retains 5.50% fixed for one year, and the last five years are priced at the hedge rate plus the bank’s desired credit spread.

Using this example, the borrower refinances into a 6-year fixed rate priced at 5.50% for the first year and 6.91% fixed for the next five years (based on SOFR + 2.40% credit spread and standard ARC fee for the bank).

The bank now has two floating rate streams: 1) one year at SOFR + 99bps (currently 6.31%), and 81bps higher than the borrower’s payment of 5.50%, and 2) five years at SOFR + 2.40% (assuming that is the correct credit spread for the borrower/relationship ROE). The bank also generates a 1.30% hedge fee ($13k).

The graph below shows the borrower’s payments and the bank’s yield for payment streams one and two.

Conclusion

The step-up structure can be a powerful tool for community banks for existing, below-market, fixed-rate loans where the bank wants to retain the client for a longer commitment. This tool works for important and profitable relationship credits, except for the NIM hit caused by a low fixed-rate loan coupon. Not only does this strategy generate higher NIM, additional fee income, less repricing risk for the borrower, and longer commitment-term, but it also does not require additional funding as the loan is already with the bank.

If you would like to learn more about how to price and document the “step-up” loan, please sign up for a 30-minute webinar on December 13th at 2 pm ET by clicking below.