Using Forward Rate Locks to Win Customers and Manage Risk

We work with hundreds of community banks across the country that utilize forward rate locks to decrease risk, increase fee income, and stave off competition from national and regional banks. If your bank is not currently offering forward rate locks (in its various forms) to borrowers, you may be interested in how to incorporate such a tool to boost your bank’s performance. A forward rate lock allows lenders to deliver a known loan rate on future borrower financing without interest rate risk for the bank. National and regional banks heavily emphasize this strategy when competing against community banks and credit unions in the hopes of a competitive differentiator. However, hundreds of community banks are now using this same strategy to retain existing clients, win new business, reduce risk, and increase fee income.

Tools for Forward Rate Locks

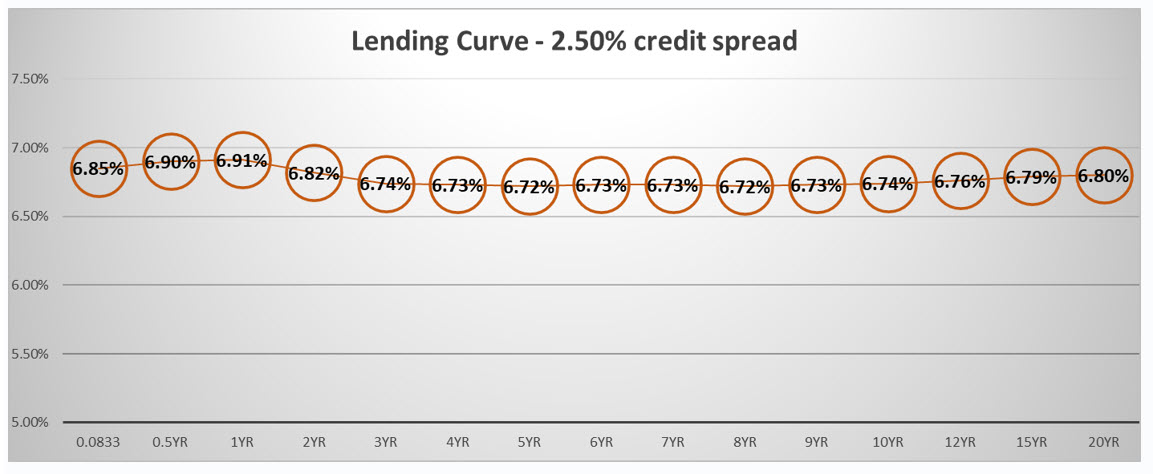

The lending curve is currently flat. As shown in the graph below, borrowers can lock fixed-rate loans from floating out to 20-years fixed at the same rate. This flat yield curve also allows lenders to use forward rate locks to creatively deliver solutions to borrowers. The coupon cost to obtain a loan in the future is almost identical to the same loan starting today. This phenomenon opens an array of options for borrowers without an increase in financing costs.

National lenders have been using forward rate locks for decades, and these instruments can take many forms. Borrowers want certainty of rate for future financing costs, and lenders want to protect themselves from interest and credit risks. The forward rate lock allows a win-win outcome for borrowers and banks.

Forward rate locks can be achieved with Treasury locks, collars, and swaptions, but the most prevalent instrument is a forward starting swap. The forward-starting swap has some significant advantages over alternatives as follows:

- It is the simplest to explain and document,

- It does not require an upfront fee,

- It is the most cost-efficient for borrowers to purchase, and

- The current flat yield curve creates no premium for forward financing versus a spot-starting loan.

Current Applications for Forward Rate Locks

Borrowers use forward rate locks for assorted reasons, including funding M&A, purchase and sale agreements, construction periods, and locking the economics of an underlying deal during the due diligence and underwriting process. Community banks that use our ARC hedging program have used forward rate locks in the following scenarios:

- Community banks use forward-term loan commitments to offer single-close construction through perm financing. This technique reduces credit risk to the borrower and can increase the profitability of the relationship by maintaining a stable, longer-term facility. But this application also prevents competition from national banks after the construction and stabilization. In summary, the advantages of a forward rate lock for construction loans is as follows:

- Simultaneously book the construction and term facility to increase return on equity (ROE).

- Mitigate credit risk through an upfront, known fixed-rate takeout facility.

- Boost non-interest income with loan and hedge fees.

- Build additional I/O periods to allow project stabilization.

- Community banks also offer forwards to poach customers from other banks. This application involves offering the customer a new loan where the initial period mirrors the pricing on the original loan at the previous bank. The bank builds a forward, which is typically the more profitable portion of the loan for the bank. This allows the customer to retain the economics of their original loan and still make the switch to a new lender. We have seen community banks offer up to 12 months of below market-rate pricing to win business with a forward rate lock that allows the community bank to earn a market-driven credit spread and boost ROE.

- Another interesting forward technique, a variation of strategy #2 above, is where community banks deploy locking in an existing customer on a new loan without refinancing the existing, below-market loan. The forward loan commitment starts after the existing loan is set to terminate. Again, the customer retains the remaining economics, but the bank builds additional terms, fees, or spread on the backend.

- Many community banks we work with use forward locks to accommodate standard closing and due diligence steps such as title, appraisal, and loan documentation. The forward lock period is typically a few weeks to a couple of months. The community bank collects a commitment fee, generates hedge fee income, and eliminates the possibility of competitors undermining the negotiated terms and pricing.

- The most interesting technique in today’s market is to forward rate lock loans by simultaneously appealing to borrower’s fear and greed and taking advantage of the flat yield curve. Today’s five-year loan commitment is 6.72% at a 2.50% spread, a 1-month forward five-year loan at the same spread is also 6.72%, a 6-month forward prices to 6.71%, and a 12-month forward prices to 6.70%. With so many fiscal and monetary unknowns, this flat yield curve creates tremendous value for borrowers who want the certainty of a known payment to service their debt. The flip side is that banks eliminate one additional unknown element of their underwriting (the P&I payment amount). The only caveat to these forward rate lock techniques and tools is that community banks must not take undue risk without compensation. At SouthState Bank, we use forward rate locks through the ARC program without taking the interest rate risk.

Conclusion

Specific borrowers will require forward rate locks, and national, regional, and community banks will accommodate those needs without taking that risk on their own balance sheets. However, the current interest rate combination of fiscal and monetary unknowns, and a flat yield curve is driving increased demand for forward rate locks. If your bank does not have an efficient tool to offer forward rate locks, we can share SouthState Bank’s proven strategy with your lending team.