What You Learn By Ranking Your Loans

We estimate that roughly 10% to 15% of community banks use a loan pricing model and fewer use a risk-adjusted return-on-capital (RAROC) loan pricing version. Most bankers are aware of loan pricing models but choose not to use them for the following reasons: 1) The cost of acquisition and implementation, 2) A lack of time or expertise to implement and calibrate, 3) A basic distrust of a black box, and 4) Concluding that a model is not needed as the bank has succeeded to-date without one. All these reasons may have merit. However, one of the most important executive managers’ tasks is capital allocation – which loans to book and which to forgo, and ordinal ranking your loans is key to this decision. Without a RAROC loan pricing model and ordinal ranking, capital allocation becomes a guessing game.

What is Ordinal Ranking

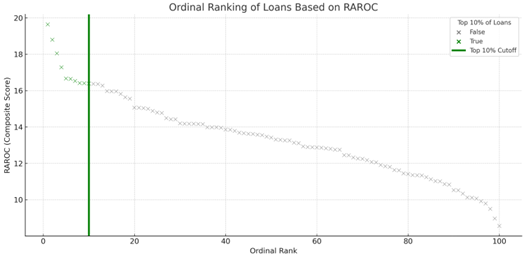

Ordinal ranking means placing loans in order from highest to lowest RAROC. This is critical because a community bank cannot book all the loans available to it in its market. Instead, community banks must rely on relative positioning with the highest return loans (regardless of margin) as the most attractive to the bank. For example, assume that a community bank strategy calls for $100mm in new loan bookings for the year, and the bank will see $1Bn in loan opportunities in the market for the year. The universe of loans will be mapped to differentiated returns so ideally the top 10% will be booked. The graph below shows how ordinal ranking may work for a community bank. The 10% of loans to the left of the green line represent the loans most attractive to the bank given its capital constraints.

Once loans are ordinally ranked by RAROC, a bank can apply a cutoff (the percentage will vary based on desired growth level, capital availability and opportunities in the market). This ensures that only the most efficient use of capital gets approved, improving portfolio quality and aggregate return. Most community bank pipelines exceeds their capital capacity. Further, bankers need to broaden their definition of loan pipelines to include loans that could be available to the bank if pricing terms become more flexible. For example, banks that have minimum credit spreads should consider clients who can command lower priced loans, since RAROC may be higher despite lower credit spreads.

Ordinal ranking also makes credit decisioning more adaptive. In declining credit markets, the bank may be able to raise credit spreads or choose stronger credits which will command a lower credit spread. The cutoff (10%, as an example) can be modified depending on capital availability, credit quality in the market, or pricing power of the bank. Ordinal ranking adds flexibility that enables better alignment with macroeconomic trends, capital availability, and strategic focus.

A loan pricing model does not provide a “go/no-go” decision. A loan pricing model allows executives to compare all asset returns on a common calculation (RAROC) and then allocate capital to the highest return. One frequent question that we hear from bankers is that the comprehensive future pipeline cannot be known with certainty – this is true. However, banks that run RAROC for years see the market available returns through different credit cycles, geographies and loan categories. Managers develop an understanding of which loans will fall into their desired cutoff even when they have not been presented with all possible loan opportunities beforehand.

Conclusion

By using RAROC as a basis for ordinal loan ranking, banks can make smarter, more risk-sensitive lending decisions. Adding a percentile-based cutoff provides a disciplined way to filter the most profitable and capital-efficient loans. This approach not only enhances financial performance but also strengthens the bank’s ability to manage risk and deploy capital strategically. For banks that believe that the market dictates pricing and not a model, keep in mind two key factors:

- Most of the competition (85% of the banking industry by loan volume) are non-community banks, where almost 100% of these lenders are using RAROC and some form of ordinal ranking for capital allocation. Without similar tools a bank has a higher probability of inadvertently booking loans outside of its cutoff level.

- The primary benefit of a pricing model is not making go/no-go decisions. RAROC output is just one crucial factor for banks to consider in allocating scarce capital. Not making the suboptimal ROE loan is as big a benefit to a bank as booking the loan that makes the ROE hurdle.

For those banks that have not yet embraced a loan pricing model, for whatever reason, in our future article we will discuss common but not necessarily intuitive concepts that will help with loan pricing decisions and ordinal ranking even without RAROC outputs.